Cincinnati, the third-largest city in Ohio, is experiencing a housing market that has been on the rise in recent years. With a growing economy and affordable housing options, Cincinnati is attracting a lot of attention from buyers and investors. Given the increase in active inventory and a sustained median sales price, the Cincinnati housing market appears to favor both buyers and sellers.

Buyers benefit from more options, while sellers enjoy the stability reflected in the median sales price. It's a balanced market that requires expertise and adaptability from REALTORS® to provide optimal service to clients.

Cincinnati Housing Market Trends in 2024

The Cincinnati real estate market has commenced 2024 with a promising balance, as revealed by the latest data released by the REALTOR® Alliance of Greater Cincinnati. Despite facing challenges posed by market conditions, the housing market in the Cincinnati area has demonstrated resilience, serving as a beacon for both buyers and sellers alike.

In January, the housing market in Cincinnati exhibited a notable trend in home sales, reflecting ongoing adjustments in response to broader economic shifts. While specific figures regarding sales volume, listing durations, and median sale prices offer insights into market dynamics, the overarching sentiment remains one of cautious optimism.

Tracy Dunne, President of the REALTOR® Alliance of Greater Cincinnati, emphasized the significance of the January sales data, stating, “As we commence 2024, the Cincinnati real estate market portrays signs of balance and resilience. Our members have reported sustained interest from buyers, coupled with a healthy inventory from sellers. This equilibrium is crucial for maintaining a vibrant market that benefits our community. We are steadfast in our commitment to supporting our members and the public through insightful data, professional development, and a dedication to excellence in all facets of real estate in Greater Cincinnati.”

The January 2024 report underscores the importance of local market knowledge and professional guidance in navigating the intricacies of buying or selling a home. The REALTOR® Alliance of Greater Cincinnati serves as a pivotal resource for real estate professionals and the public alike, offering up-to-date information, education, and advocacy to nurture a robust and accessible housing market.

Key Highlights from the January 2024 Report:

1. Balanced Market: The Cincinnati real estate market demonstrates a balance between buyer demand and seller inventory, fostering a healthy environment for transactions.

2. Sustained Interest: Buyers continue to show sustained interest in properties within the Cincinnati area, indicating confidence in the market's stability.

3. Healthy Inventory: Sellers are contributing to the market with a healthy level of inventory, providing ample options for prospective buyers.

4. Community Benefits: A vibrant real estate market benefits the community as a whole, driving economic activity and enhancing overall quality of life.

Looking Ahead:

As the year progresses, the Cincinnati housing market is poised to experience further developments and opportunities. By remaining vigilant and adaptive to changing conditions, both buyers and sellers can capitalize on favorable market conditions.

The REALTOR® Alliance of Greater Cincinnati remains committed to providing invaluable support and resources to facilitate successful real estate transactions. Through collaboration and dedication to excellence, the Cincinnati area continues to thrive as a dynamic hub for real estate activity.

Cincinnati Housing Market Forecast 2024 and 2025

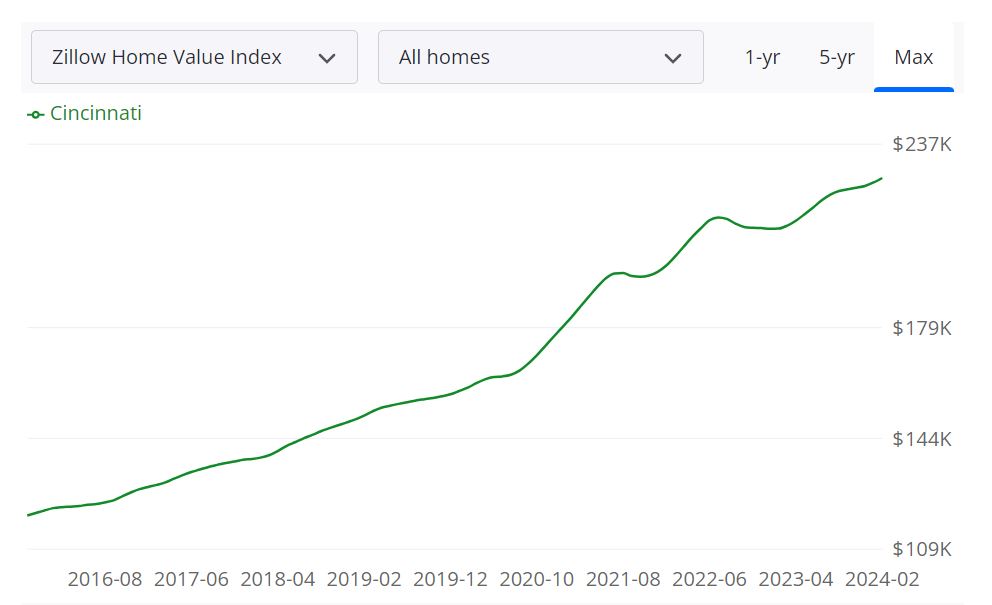

According to Zillow, the Cincinnati housing market has demonstrated resilience and growth, with the average home value reaching $227,078, marking a 7.6% increase over the past year. Homes in Cincinnati typically go pending in approximately 11 days, showcasing the market's vitality. To understand the market dynamics comprehensively, it's essential to delve into various housing metrics.

Housing Metrics Explained

For Sale Inventory: As of February 29, 2024, the Cincinnati market had 858 properties listed for sale, indicating the availability of housing options for potential buyers.

New Listings: On the same date, there were 325 new listings, reflecting ongoing activity and fresh inventory entering the market.

Median Sale to List Ratio: In January 2024, the median sale to list ratio stood at 0.994, highlighting the equilibrium between listing prices and actual sale prices.

Median Sale Price: As of January 31, 2024, the median sale price for homes in Cincinnati was $206,667, serving as a benchmark for property valuations.

Median List Price: On February 29, 2024, the median list price was $246,617, providing insights into sellers' expectations in the market.

Percent of Sales Over/Under List Price: In January 2024, 31.3% of sales were over list price, while 49.7% were under list price, indicating variations in negotiation dynamics.

Cincinnati MSA Housing Market Forecast

The Cincinnati Metropolitan Statistical Area (MSA), encompassing various counties in Ohio, has shown promising growth prospects. With a forecasted increase of 1.5% by February 2025, as projected on 31-05-2024, the region is poised for continued expansion.

The MSA includes Cincinnati and its surrounding counties, serving as an economic and demographic hub for the region. Counties such as Hamilton, Butler, Warren, and Clermont contribute to the MSA's robust housing market.

The Cincinnati MSA boasts a substantial housing market, characterized by diverse offerings and steady demand. With a population of over two million residents, the region's housing sector plays a pivotal role in the local economy.

Is Cincinnati a Buyer's or Seller's Housing Market?

In the current Cincinnati housing market, conditions lean towards sellers. With a relatively low inventory of 858 properties for sale and a high percentage of sales occurring above list price (31.3% in January 2024), sellers have the upper hand in negotiations. Buyers may face stiff competition and may need to act quickly to secure desired properties.

Are Home Prices Dropping in Cincinnati?

As of the latest data available, there is no indication of home prices dropping in Cincinnati. On the contrary, the median sale price stood at $206,667 in January 2024, reflecting a stable market with consistent demand. However, market conditions can fluctuate, and it's essential to monitor trends closely.

Will the Cincinnati Housing Market Crash?

While predicting market crashes is inherently challenging, there are no imminent signs of a housing market crash in Cincinnati. The market has shown resilience and steady growth, supported by factors such as a robust economy, favorable interest rates, and steady demand. However, it's crucial for stakeholders to remain vigilant and adapt to any shifts in market dynamics.

Is Now a Good Time to Buy a House in Cincinnati?

For prospective homebuyers in Cincinnati, now can be a favorable time to enter the market, albeit with careful consideration. While competition may be fierce, interest rates remain relatively low as compared to last year, enhancing affordability for buyers. Additionally, investing in real estate in a growing market like Cincinnati can offer long-term benefits, provided buyers conduct thorough research and make informed decisions.

Cincinnati Real Estate Investment Overview

Cincinnati is a bustling city located in the southwest corner of Ohio, known for its strong economy, diverse culture, and affordable cost of living. The Cincinnati real estate market has seen steady growth in recent years, with home values increasing by 6.3% over the past year, according to Zillow.

Investors interested in the Cincinnati real estate market can benefit from the area's diverse range of neighborhoods, from the upscale and trendy Over-the-Rhine district to the more affordable suburban areas like Paddock Hills and Winton Place. The city's thriving economy, with a strong job market and low unemployment rates, makes it an attractive option for those seeking to relocate or invest.

Here are the top reasons why Cincinnati's MSA real estate market may be a smart investment:

Strong Economic Growth:

Cincinnati's economy has been growing steadily, with a low unemployment rate of 3.6% and a diverse range of industries, including healthcare, education, finance, and manufacturing. According to the Bureau of Economic Analysis, Cincinnati's gross domestic product (GDP) has grown by 6.5% from 2016 to 2021, outpacing the national average of 4.6%. This economic growth has led to a strong demand for housing, making Cincinnati an attractive market for real estate investors.

Affordable Housing Market:

Cincinnati's housing market is relatively affordable compared to other major metropolitan areas in the United States. According to Zillow, the average home value in Cincinnati is $227,078, which is below the national median value. This affordability, combined with the city's strong economy and low cost of living, makes it an attractive option for young professionals and families.

Strong Rental Market:

Cincinnati has a strong rental market, with a vacancy rate of only 3.6% and average rent prices of $1,128 per month, according to RentCafe. Additionally, Cincinnati is home to several major universities, including the University of Cincinnati and Xavier University, which provide a consistent stream of rental demand from students and faculty.

Growing Population:

Cincinnati's population has been growing steadily over the past decade, with a population of over 2.1 million people in the metropolitan statistical area (MSA) in 2021. According to the U.S. Census Bureau, the population of the Cincinnati MSA is projected to increase by 3.1% from 2020 to 2030. This growing population, combined with a strong economy and affordable housing market, makes Cincinnati a prime location for real estate investment.

Infrastructure and Transportation:

Cincinnati has a well-developed transportation infrastructure, including a major airport, several major highways, and a robust public transportation system. Additionally, the city has invested heavily in infrastructure projects, such as the Cincinnati Bell Connector streetcar, which connects several neighborhoods in the city. This infrastructure and transportation network make it easier for residents to commute and access amenities, which further increases the demand for real estate in the area.

Stable Real Estate Market:

Cincinnati's real estate market has remained stable over the past decade, with steady appreciation rates and low volatility. According to Zillow, the Cincinnati housing market has appreciated by 4.6% over the past year, which is in line with the national average. This stability makes Cincinnati an attractive option for real estate investors who are looking for a steady return on their investment.

Growing Tech Industry:

Cincinnati's tech industry has been growing rapidly in recent years, with several tech startups and established companies calling the city home. According to CBRE's Tech Talent Report, Cincinnati ranks 27th out of 50 U.S. cities for tech talent, with a 13.1% growth rate in tech jobs from 2015 to 2020. This growing tech industry provides a stable source of employment and further drives the demand for housing in the city.

In conclusion, Cincinnati's strong economy, the affordable housing market, strong rental market, growing population, infrastructure and transportation network, stable real estate market, and growing tech industry make it an attractive location for real estate investors. Whether you're looking to buy and hold rental properties or flip houses for a quick profit, Cincinnati's real estate market offers plenty of opportunities for savvy investors.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Cincinnati.

Consult with one of the investment counselors who can help build you a custom portfolio of Cincinnati turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Cincinnati.

REFERENCES

- https://www.cabr.org/category/homesales

- https://www.zillow.com/Cincinnati-oh/home-values

- https://www.neighborhoodscout.com/oh/cincinnati/real-estate

- https://www.realtor.com/realestateandhomes-search/Cincinnati_OH/overview