Cleveland, Ohio is one of the most popular cities in the United States, known for its rich history, culture, and economy. Its location along the southern shore of Lake Erie makes it a great place to live for those who love the outdoors, while its diverse population and strong job market make it a hub for businesses and entrepreneurs. The Cleveland housing market has seen its fair share of changes and challenges over the past year, reflecting a mix of local and national influences.

The market is witnessing robust growth, with increasing home prices and a competitive yet balanced environment. Considering the data and current trends, Cleveland's housing market leans towards being a seller's market. With homes selling faster and some properties receiving multiple offers, sellers have an advantage in negotiations. However, buyers can still find opportunities, especially in neighborhoods where prices are more competitive.

Cleveland Housing Market Trends in 2024

According to data by Redfin, in February 2024, the Cleveland housing market witnessed a slight downturn in home prices, experiencing a decrease of 4.3% compared to the previous year. Despite this decline, the median price for homes in Cleveland stood at a modest $110K, making it an attractive option for potential homebuyers.

Current Market Trends

On average, homes in Cleveland are selling faster than they did last year, spending approximately 34 days on the market compared to 52 days previously. This reduction in days on the market indicates a growing demand for housing in the area. In February 2024, there were 331 homes sold, marking a notable increase from the 311 homes sold during the same period the previous year.

However, it's essential to note that Cleveland's median sale price is considerably lower, approximately 70% below the national average. Despite this significant difference, the market remains somewhat competitive, with homes typically selling in 37 days.

Interestingly, some homes in Cleveland receive multiple offers, indicating pockets of high demand within the market. On average, homes sell for about 4% below the list price, but hot homes can command prices approximately 2% above the list price, selling in as little as 9 days.

Market Dynamics and Migration Trends

When analyzing migration and relocation trends, data from January to March 2024 reveals that 21% of Cleveland homebuyers searched to move out of the area, while 79% preferred to stay within the metropolitan area. Despite some outward migration, there is a significant portion of homebuyers opting to remain within Cleveland.

Regarding incoming migration, approximately 0.69% of homebuyers from across the nation are searching to move into Cleveland from outside metropolitan areas. Notably, New York homebuyers top the list of those looking to relocate to Cleveland, followed by individuals from Wheeling and Los Angeles.

Looking ahead, the future market outlook for Cleveland appears promising, albeit with some challenges. While the current market demonstrates resilience with homes selling relatively quickly, there are concerns about maintaining affordability in the face of rising demand.

Cleveland Housing Market Forecast for 2024 and 2025

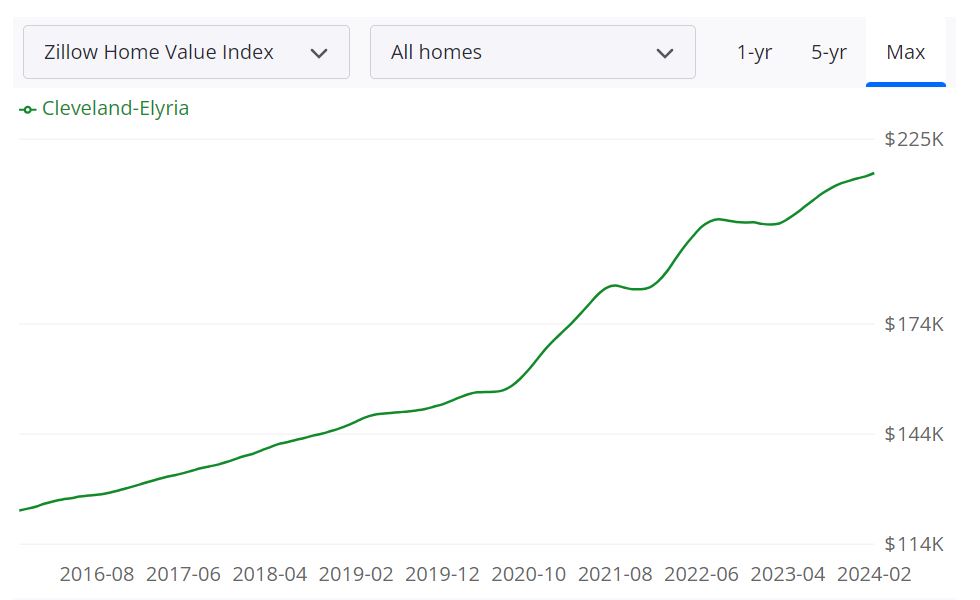

What are the Cleveland real estate market predictions? According to Zillow, the average home value in the Cleveland-Elyria area stands at $215,913, reflecting a 6.9% increase over the past year. Additionally, homes in this area typically go pending within approximately 13 days.

1.1% 1-Year Market Forecast

The 1-year market forecast as of February 28, 2024, indicates a 1.1% projected change in the housing market, suggesting potential shifts in demand and pricing over the coming year.

Key Housing Metrics:

- For Sale Inventory: As of February 29, 2024, there are 4,170 properties listed for sale in the Cleveland-Elyria area.

- New Listings: During the same period, 1,422 new listings entered the market, indicating ongoing activity and supply.

- Median Sale to List Ratio: The median sale to list ratio, calculated as of January 31, 2024, is 0.991. This metric provides insight into the relationship between listing prices and actual sale prices.

- Median Sale Price: As of January 31, 2024, the median sale price for homes in the Cleveland-Elyria area is $170,900.

- Median List Price: The median list price, recorded as of February 29, 2024, is $199,933. This figure indicates the midpoint of all listed property prices.

- Percent of Sales Over/Under List Price: In January 31, 2024, 32.7% of sales were recorded over list price, while 53.5% were under list price. These percentages illustrate the negotiation dynamics within the market.

Understanding the Cleveland-Elyria Housing Market:

The Cleveland-Elyria metropolitan statistical area (MSA) encompasses several counties and represents a substantial portion of Ohio's housing market. With 4,170 properties currently listed for sale, it's evident that the market offers a diverse range of options for potential buyers and investors.

As individuals contemplate entering the housing market, whether as buyers, sellers, or investors, understanding these metrics becomes paramount. The median sale to list ratio and percent of sales over/under list price shed light on the negotiation dynamics and competitiveness within the market.

Are Home Prices Dropping in Cleveland?

As of the most recent data available, home prices in the Cleveland-Elyria area have shown resilience, with a 6.9% increase over the past year. While fluctuations may occur in localized markets or specific property types, the overall trend suggests stability and moderate growth.

With 4,170 properties currently listed for sale and a median sale price of $170,900, buyers have a significant inventory to choose from. However, the median list price of $199,933 suggests that sellers are still aiming for competitive prices. Additionally, with 32.7% of sales recorded over list price, there's evidence of demand outpacing supply in certain segments of the market.

Factors such as economic conditions, interest rates, and housing supply can influence price movements. However, with consistent demand and relatively steady inventory levels, significant price drops are less likely in the near term.

Will the Cleveland Housing Market Crash?

Forecasting a housing market crash requires careful consideration of numerous economic and market indicators, along with potential external factors. While no market is immune to fluctuations, the Cleveland housing market exhibits characteristics of stability and resilience.

The 1-year market forecast of 1.1% suggests a moderate change, indicating a relatively balanced market outlook. Additionally, the diverse range of industries in the region and steady population growth contribute to the market's stability.

However, unforeseen events or economic shifts could impact market dynamics. It's essential for buyers, sellers, and investors to stay informed and monitor market trends closely.

Is Now a Good Time to Buy a House in Cleveland?

Deciding whether it's the right time to buy a house involves considering personal circumstances, financial readiness, and market conditions. In the Cleveland housing market, several factors indicate favorable conditions for potential buyers.

With a median sale price of $170,900 and a 1-year market forecast showing modest growth, buyers may find opportunities to enter the market at relatively stable prices. Additionally, historically low mortgage rates and a diverse inventory offer choices for buyers seeking their ideal home.

However, individual circumstances such as job stability, financial preparedness, and long-term housing goals should also factor into the decision-making process. Consulting with real estate professionals and financial advisors can provide valuable insights tailored to specific needs and objectives.

Cleveland Real Estate Investment Overview

Should you buy investment property in Cleveland? Looking for a home in Cleveland? These up-to-date Cleveland real estate statistics and trends will help you make smart investing decisions. You need to drill deeper into local trends if you want to know what the Cleveland market holds for the year ahead. We have already discussed the Cleveland housing market trends & forecasts for answers on why to put resources into this sizzling market. Cleveland is home to just under 400,000 people. The larger metropolitan area is home to roughly two million people.

That makes the Cleveland real estate market the 32nd largest in the country. If you include the Cleveland-Akron-Canton metro area, there are three and a half million people in the “combined statistical area”, making it the 15th largest metropolitan area in the United States. This century-old city was once a major manufacturing center. It is reinventing itself as a medical and BioMed hub. Home prices in Cleveland have been trending up 8.6% year-over-year.

As per the data from the real estate company called Neigborhoodscout.com, single-family detached homes are the single most common housing type in Cleveland, accounting for 46.56% of the city's housing units. Other types of housing that are prevalent in Cleveland include duplexes, homes converted to apartments or other small apartment buildings ( 26.01%), large apartment complexes or high-rise apartments ( 20.51%), and a few row houses and other attached homes ( 6.23%).

Just four miles from Downtown Cleveland, the University Circle has long been a diverse and appealing mix of single-family homes and apartments. This area of the city has the flavor of a quaint college campus. Given that area amenities are within walking distance, there is a lot of foot and bike traffic, which lends to its charm. The area is one of the largest employment centers in the entire state. People in Cleveland primarily live in small (one, two, or no-bedroom) single-family detached homes.

Here are the top reasons to invest in Cleveland real estate.

- Top 10 Job Market for New College Graduates (CNN)

- Presence by 70% of Fortune 500 comp.

- More than 400 bioscience companies.

- Two new Amazon distribution centers.

- Over 120,000 healthcare professionals.

- Home to 27 area colleges & universities.

- Home to four professional sports teams.

Positive Demographic Trends

Cleveland’s population is stable at around 400,000 residents. It is doing a decent job of retaining its young people. Why is that something to bring up when discussing the Cleveland housing market? Because it is right next to Detroit, a city that has been shedding people for decades. The Cleveland real estate market is thus bolstered by steady to slow growth, though specific neighborhoods are seeing spikes in their valuations as new employers and attractions move in.

The Bright Future of Good-Paying Research Jobs

Cleveland has invested in healthcare and bio-science business accelerators like Bio-Enterprise and the Global Center for Health Innovation. They expect institutions like this to lead to new healthcare advancements provided first in Cleveland and in the hope that discovered drugs and technology will be manufactured in Cleveland. Investors can find affordable investment properties for development and either sale or rental to people working at these facilities. Cleveland’s Health-Tech Corridor is a prime place for high-tech companies, while the Cleveland real estate market is booming around these businesses.

Downtown Brownfield Re-Development

Cleveland is intentionally redeveloping several brownfield industrial sites to create multi-use properties. For example, the Terminal Tower is being turned into a combination shopping and entertainment district. The Cleveland Gateway project is going to turn 65 acres into a densely populated urban neighborhood, mixing multi-family housing with trails, a marina, and an urban park. If you can’t invest directly in this redevelopment project, note that single-family and multifamily housing stock around the new units will go up in value as new infrastructure is built.

Significant redevelopment is occurring along the thoroughfare running from East 55th Street to East 105th Street. Given that it is right off Interstate 490 and connects with downtown streets like Quincy and Chester Avenue, this is an excellent place to buy a property that is going to go up in value. When you know that better streets and traffic management along with improved public transit will go into an area, it is a safe bet for investing in the Cleveland real estate market.

The nucleus is another downtown redevelopment project that seeks to bring mixed-use real estate to depressed areas. The nucleus is centered around two million square feet of retail, residential, and office space, though there will be around 500 residential units. If you want to invest in the Cleveland real estate market, consider buying and rehabbing housing for those who will work in NuCleus but couldn’t get one of the apartments or condos.

University Circle & The Western Rim

University Circle is one of the hottest neighborhoods in Cleveland. It is seeing a wave of high-end condos and apartments. If you can find single-family rentals or multi-family housing in the vicinity, snap it up. These are among the most desirable properties in the Cleveland housing market. We know that when they were willing to turn a former Children’s Museum into an apartment building.

The Western Rim of Cleveland hasn’t been overlooked in the rush to redevelop downtown and the Biotech corridor. Projects worth an estimated 350 million dollars have been proposed or are actually under construction between West 25th and West 117th streets. A business incubator has been proposed for the Western Rim. The Cleveland housing market on the west side should see significant growth as new businesses pop up here. The luxury rentals built in the Near West Side are probably only the start of this area’s resurgence.

The Redeveloped Lakeshore

Cleveland sits on the southern shore of Lake Erie. Cleveland is redeveloping its long waterfront district. The fifty-year plan has already resulted in mixed-use development between West 3rd and East 18th streets. Redevelopment includes rehabilitating waterfront infrastructure like bridges, canals, and “made land”. Reinvented lakeside trails create desirable areas that will command a premium on the Cleveland real estate market. Euclid has already demonstrated this with their lakefront project and main waterfront park. Newly opened areas like the one created by the demolition of the FirstEnergy coal fire plant are to be seen as opportunities to reinvent the Cleveland real estate market.

A New Lease on Life for Old Buildings

The Cleveland housing market is so hot that they’re turning old commercial buildings into new residential spaces. A classic example of this is the former Huntington Bank Building; it is currently known as the 925 Building. The commercial building will be transformed into a mixed-use building with office space, retail space, a Hilton hotel, and 600 apartments.

Catering to the New Medical Talent

While there are Americans who worship Canada’s single-payer healthcare system, the reality is that millions of Canadians come to the United States each year. Some were denied care by their government, while many simply don’t want to wait months for a procedure, so they choose to pay cash at U.S. hospitals. Cleveland is building medical facilities to cater to these medical tourists. And these doctors, nurses and medical specialists are buying homes close to work, whether it is at the world-renowned Cleveland Clinic or the hospital down the street.

Another variation of this strategy is buying property in the Cleveland housing market that caters to medical school students. Case Western Reserve University and the Cleveland Clinic Lerner College of Medicine see many students from around the world who come to the area for one to five years to attend before leaving to practice elsewhere. (The Lerner College is a five-year tuition-free medical school).

Here are the 10 highest appreciation neighborhoods in Cleveland since 2000 (List by Neigborhoodscout.com).

- Central South

- Central Southwest

- Central East

- Central

- Downtown South

- Ohio City South

- Clark Fulton North

- Ohio City

- Tremont North

- Tremont

References

Market Data, Trends & Statistics

https://www.zillow.com/home-values/24115/cleveland-oh/

https://www.redfin.com/city/4145/OH/Cleveland/housing-market

https://www.neighborhoodscout.com/oh/cleveland/real-estate

http://www.freddiemac.com/research/indices/house-price-index.page

https://www.realtor.com/realestateandhomes-search/Cleveland_OH/overview

https://www.movoto.com/guide/cleveland-oh/cleveland-real-estate-market-trends

Lerner College

https://atlantisglobal.org/blog/2017/11/21/get-paid-in-medical-school-my-journey-to-the-cleveland-clinic-lerner-college-of-medicine

Brownfields / urban redevelopment

https://www.calthorpe.com/content/cleveland-gateway-redevelopment-plan

The Opportunity Corridor

http://www.freshwatercleveland.com/features/SevenProjects022317.aspx

University Circle

http://www.freshwatercleveland.com/features/SevenProjects022317.aspx

Waterfront

http://planning.city.cleveland.oh.us/lakefront/cpc.html

https://www.cleveland.com/architecture/index.ssf/2017/11/euclid_close_to_building_lakef.html

http://www.news-herald.com/lifestyle/20170602/clevelands-lakefront-parks-are-stable-flourishing

The Western Rim

http://www.crainscleveland.com/article/20170507/news/170509850/clevelands-western-rim-embarks-development-boom

Biomedical hubs and hospitals

http://www.theglobalcenter.com/about-us

https://newsroom.clevelandclinic.org/2018/07/11/luye-medical-collaborates-with-cleveland-clinic-to-pioneer-value-based-healthcare-in-china