Duluth, Minnesota, a city nestled on the shores of Lake Superior with a population exceeding 86,000 people, is witnessing a robust and competitive housing market. The demand for homes is high, but the inventory is limited, consequently driving up home prices.

The competitive housing market in Duluth can be attributed to several factors. The city's desirable location, nestled by Lake Superior, and its plethora of amenities including scenic beauty, outdoor recreational opportunities, and a vibrant arts and culture scene make it an attractive place to live. Moreover, Duluth boasts a strong economy with major employers like the University of Minnesota Duluth, Essentia Health, and St. Luke's Hospital.

Several notable trends shape the current housing landscape in Duluth:

- Homes within the $300,000-$400,000 price range are highly sought-after and sell swiftly.

- Single-family homes are in higher demand compared to multi-family homes.

- Homes boasting desirable features such as lake views, large yards, and updated kitchens and bathrooms tend to command higher prices.

- Specific neighborhoods like Skyline Parkway, the East End, and the West End are particularly competitive within the Duluth housing market.

How is the Duluth Housing Market Doing Currently?

Based on data from realtor.com®, Duluth, MN currently exhibits characteristics of a seller's market as of February 2024, suggesting a higher demand for homes compared to the available inventory. The median days on market for homes in Duluth is 22 days, indicating a relatively swift pace of transactions.

On a broader timeline, the trend for median days on market in Duluth has shown a downward trajectory, both compared to the previous month and the preceding year. This suggests a sense of urgency among buyers and a favorable environment for sellers.

Median Listing and Sold Prices

The median listing home price in Duluth, MN stood at $284.9K in February 2024, marking a -4.2% year-over-year decrease. Similarly, the median listing home price per square foot was $180. Meanwhile, the median sold price for homes in Duluth was $225.5K, indicating the prevailing market value.

Sale-to-List Price Ratio

The sale-to-list price ratio in Duluth, MN is 100%, signifying that homes are generally selling close to their asking prices. This ratio serves as an indicator of market competitiveness and seller's leverage.

Future Outlook

Looking ahead, several factors may shape the housing market landscape in Duluth, MN. Economic indicators, including employment rates and interest rates, will likely influence buyer sentiment and purchasing power. Additionally, developments in housing supply, such as new construction projects or inventory fluctuations, could impact market dynamics.

Moreover, external factors like demographic shifts and lifestyle preferences may contribute to evolving housing demands and preferences. Understanding these trends and staying informed about market updates will be essential for individuals considering buying or selling property in Duluth.

Duluth Housing Market Forecast for 2024 and 2025

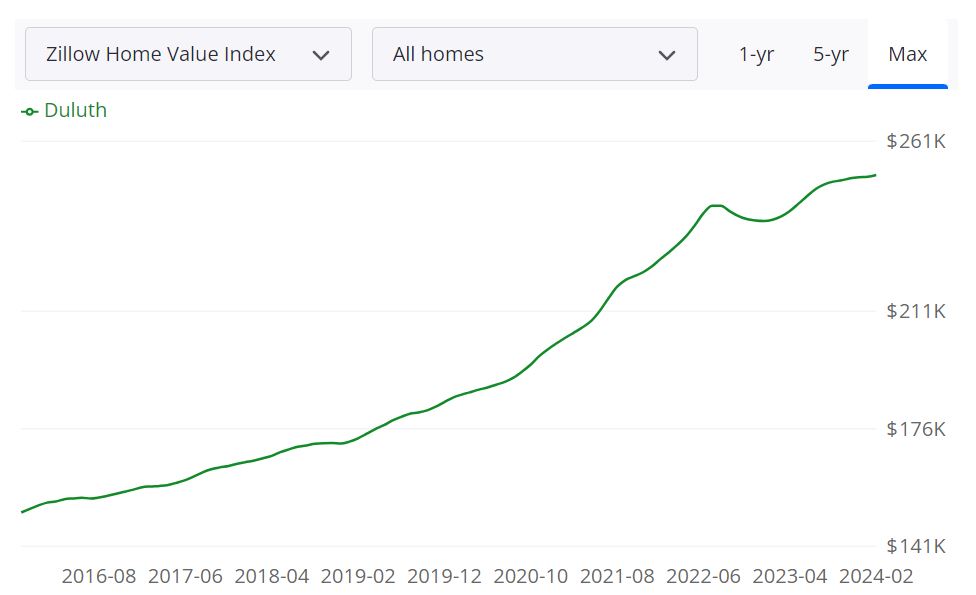

According to Zillow, in the bustling Duluth housing market, the average home value stands at $251,827, reflecting a 5.6% increase over the past year. Homes typically go pending in approximately 12 days, indicating a brisk market activity. These figures, sourced from Zillow, provide a snapshot of the current state of affairs in Duluth's real estate.

Key Housing Metrics Explained:

- For Sale Inventory: As of February 29, 2024, there are 85 properties available for sale, offering a range of options for potential buyers.

- New Listings: Over the same period, 39 new listings have entered the market, contributing to its vitality.

- Median Sale to List Ratio: This ratio, standing at 0.995 as of January 31, 2024, indicates that homes typically sell very close to their listed prices.

- Median Sale Price: As of January 31, 2024, the median sale price is $236,233, reflecting the value of properties within the market.

- Median List Price: Concurrently, the median list price stands at $255,783 as of February 29, 2024, showcasing sellers' expectations.

- Percent of Sales over/under List Price: Notable statistics include 34.4% of sales over list price and 44.4% under list price as of January 31, 2024, illustrating the negotiation dynamics prevalent in the market.

Duluth MSA Housing Market Forecast:

In broader terms, the Duluth Metropolitan Statistical Area (MSA) encompasses a cluster of counties, with Duluth, MN serving as its core. This MSA forecast, derived from data up to February 29, 2024, projects a modest yet steady 0.3% increase by March 31, 2024, followed by a more pronounced 0.9% uptick by May 31, 2024, and a sustained 0.7% growth rate by February 28, 2025.

Defined by the U.S. Census Bureau, an MSA delineates regions characterized by significant social and economic ties to a central urban area. In the case of Duluth, MN, the MSA comprises several counties, forming an economic and demographic unit. Its housing market, with its diverse array of properties and neighborhoods, contributes substantially to the region's economic vitality and social fabric.

Is Duluth a Buyer's or Seller's Housing Market?

In the current Duluth housing market, the balance between buyers and sellers leans towards the seller's side. With a low inventory of available homes and a high demand from buyers, sellers have the advantage of setting competitive prices and receiving multiple offers. However, buyers can still find opportunities, especially with the assistance of knowledgeable real estate agents who can help navigate the market.

Are Home Prices Dropping in Duluth?

Despite occasional fluctuations, the overall trend in Duluth home prices has been one of appreciation. As evidenced by data from Zillow, the median sale price and median list price have shown consistent growth over time. While individual neighborhoods or property types may experience temporary dips, the market as a whole remains resilient.

Will the Duluth Housing Market Crash?

Forecasting a housing market crash involves numerous factors and is inherently challenging. However, based on current data and market indicators, there are no imminent signs of a crash in the Duluth housing market. The steady appreciation in home values, coupled with healthy demand and relatively stable economic conditions, suggests a resilient market. Nonetheless, it's essential for buyers and sellers alike to stay informed and exercise caution.

Is Now a Good Time to Buy a House in Duluth?

For prospective homebuyers, the decision to purchase a house depends on various factors, including personal financial circumstances, lifestyle preferences, and long-term goals. While the Duluth housing market presents challenges such as limited inventory and competitive bidding, it also offers opportunities for those prepared to act decisively. With low mortgage rates as compared to last year and favorable lending conditions, many experts consider it a good time to buy a house, particularly for those planning to settle in the area for the foreseeable future.

Is Duluth a Good Place to Invest in Real Estate? An In-Depth Analysis for Investors

Duluth, a city perched on the shores of Lake Superior with a population of over 86,000 people, offers a compelling case for real estate investment. Analyzing various factors, we present a detailed assessment to guide potential investors in making informed decisions.

1. Market Stability and Growth

The Duluth housing market has displayed stability and consistent growth. This growth trend provides a sense of security for investors regarding the potential appreciation of their real estate assets.

2. Demand and Competitive Landscape

Duluth currently experiences strong demand and a competitive real estate landscape. The average time for homes to go pending in around 12 days emphasizes the high demand for properties. Additionally, the median sale to list ratio indicates that homes are often selling slightly above the listed prices, highlighting the competitive nature of the market.

3. Diverse Neighborhoods and Appeal

Duluth is a city with 28 diverse neighborhoods, each offering a unique appeal. From the scenic beauty of locations like Skyline Parkway to the affordability of neighborhoods like Cody, there's a broad spectrum of choices for investors. This diversity allows for tailored investment strategies based on preferences, budget, and investment goals.

4. Economic Resilience and Major Employers

The city boasts a strong and diverse economy, supported by major employers such as the University of Minnesota Duluth, Essentia Health, and St. Luke's Hospital. Economic resilience contributes to a stable real estate market, attracting potential tenants and ensuring a continuous demand for housing.

5. Attractive Location and Amenities

Duluth's location on the shores of Lake Superior, offering scenic beauty and abundant outdoor recreational opportunities, adds to its attractiveness. The city's vibrant arts and culture scene further enhances its desirability. These factors contribute to a strong appeal for individuals looking for a place to live, thereby enhancing the rental potential and overall investment viability.

6. Considerations for Investors

Investors should carefully consider the following when evaluating the potential of Duluth as an investment location:

- Rental Yield and Property Management: Assess the potential rental yield in various neighborhoods and consider the ease of property management.

- Market Trends: Stay updated with market trends, demand-supply dynamics, and regulatory changes to adapt investment strategies accordingly.

- Financial Analysis: Conduct a thorough financial analysis, considering property prices, financing options, maintenance costs, and potential returns on investment.

- Risk Assessment: Evaluate the risks associated with the real estate market, economic factors, and the potential impact on investment.

Overall, Duluth presents an attractive investment opportunity in real estate. However, like any investment decision, conducting thorough research, considering market dynamics, and aligning investments with personal financial goals is essential.

Sources:

- https://www.zillow.com/home-values/51758/duluth-mn/

- https://www.realtor.com/realestateandhomes-search/Duluth_MN/overview

- https://www.redfin.com/city/6333/GA/Duluth/housing-market