The real estate market today is a topic of much debate among experts. While there is no consensus on whether the historically tight housing market will loosen or not, it is evident that the market has cooled significantly from its previous highs. The housing market today is still a seller's market.

Home prices are rising, inventory is low, and mortgage rates are increasing. This makes it a challenging time to buy a home, but there are still opportunities for buyers who are prepared. In this post, we will discuss whether the real estate market is slowing down or going to crash.

Is the Housing Market Slowing Down or Going to Crash?

Despite initial concerns of a housing market crash comparable to the Great Depression due to the pandemic, the market has remained stable. However, there are key factors to consider, such as rising home prices and potential declines in home sales due to supply-demand imbalances.

The impact of higher mortgage rates and recession fears has contributed to the market's cooling from its peak earlier this year. Nevertheless, there are other factors that may influence the market's pace and favorability for both buyers and sellers. The market is gradually shifting away from being heavily skewed towards sellers, moving towards more balanced conditions. Buyers are still showing interest, maintaining some level of competition, particularly for attractively priced homes.

- The housing market is expected to continue to cool down in the coming months, as rising mortgage rates and inflation make it more expensive to buy a home.

- However, home prices are still expected to rise, albeit at a slower pace.

- The housing market is expected to remain a seller's market for the foreseeable future, as demand for homes continues to outstrip supply.

While real estate firms generally do not predict a financial or foreclosure crisis on the scale of 2008, they do anticipate a return to more typical housing fundamentals. This moderation may be driven by increasing salaries and declining home prices. As the correction takes place, the housing market is expected to reach a more reasonable valuation and avoid being overvalued.

Mortgage rates will likely play a significant role in determining the decline in home values. Interest rates have a substantial impact on the real estate market, influencing mortgage payments, housing demand, and prices. Although home prices are still experiencing growth, the rate of increase has slowed compared to earlier in the year. Despite this, buyer interest remains high, resulting in a somewhat competitive market, especially for homes that are priced attractively and possess desirable features.

ALSO READ: Current Real Estate Housing Market Trends in 2024

However, concerns persist regarding the housing market, particularly regarding the shortage of housing supply and rising interest rates. The shortage of supply has been a primary driver of home price growth, but the increasing interest rates are discouraging potential sellers and new construction. As a result, there is limited hope for an improvement in the housing supply and the establishment of a sustainable market that would benefit from increased inventory.

The significant increase in mortgage rates since last year has further exacerbated the already expensive housing market, making it even less affordable. Home prices saw a meteoric rise during the pandemic, driven by factors such as high demand, low supply, and record-low mortgage rates. However, the sudden surge in mortgage rates has slowed the market's growth and affordability, posing challenges for buyers looking to enter the market.

As we explore the latest housing market predictions and forecasts for 2024, it becomes evident that the market's trajectory remains uncertain. Factors such as interest rates, supply-demand dynamics, and affordability will continue to shape the housing market. Staying informed about these predictions will be crucial for prospective buyers, sellers, and industry professionals navigating the ever-evolving housing landscape.

Housing Market Predictions for 2024

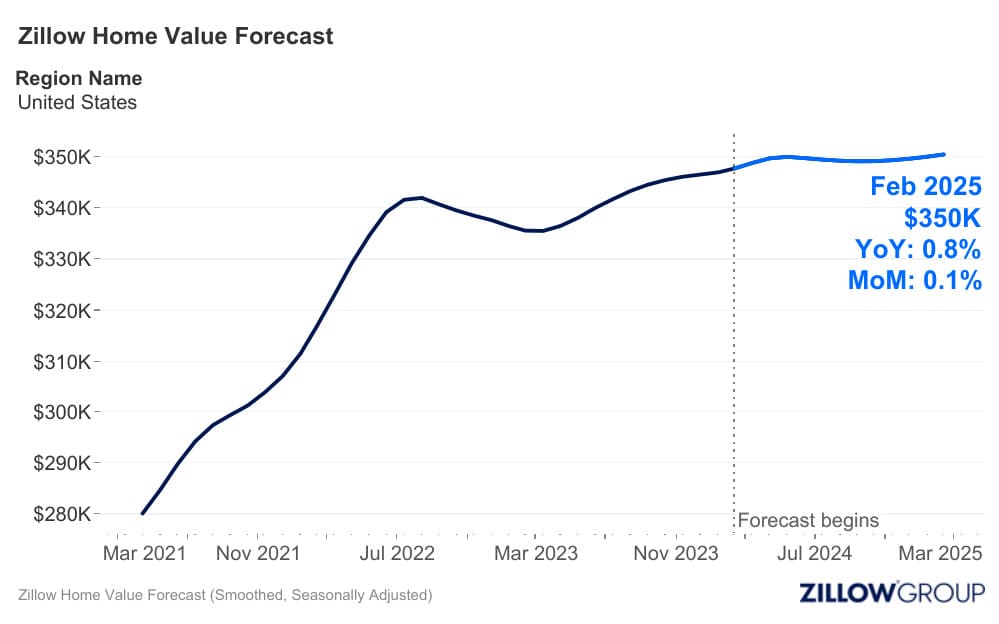

According to Zillow's Home Value and Home Sales Forecast for February 2024, the outlook suggests a 0.9% growth in home values over the course of the year. However, these projections come with a twist. Initially, Zillow anticipated a more robust 4% growth in home values. Yet, recent developments, particularly a surge in new for-sale listings, have prompted a revision in these expectations. With a substantial influx of inventory hitting the market, the competitive pressure that typically drives home values upward has eased.

Similarly, Zillow's expectations for home sales have been adjusted downwards. The primary culprit behind this adjustment is the sustained elevation of mortgage rates, which has put a damper on housing demand and subsequently, sales volume. Zillow now predicts approximately 4.06 million existing home sales in 2024. This figure is slightly lower than the previous year's total of 4.09 million and falls short of the initial forecast of 4.14 million.

Factors at Play

The surge in new listings witnessed in February hasn't yet translated into a corresponding increase in sales activity. While this may change in the coming weeks and months, it highlights a current trend where the market appears to be experiencing a degree of imbalance. The influx of listings hasn't been met with an equivalent surge in buyer demand, leading to a temporary stagnation in sales.

Impact of Mortgage Rates

One of the key influencers in the housing market's trajectory is the trajectory of mortgage rates. With rates remaining elevated, the cost of borrowing has increased, thereby deterring some potential buyers from entering the market. This phenomenon has contributed to the moderation in both home values and sales volume.

Looking Ahead

While the current landscape may seem challenging for both buyers and sellers alike, it's essential to maintain a long-term perspective. Markets are inherently cyclical, and what we're experiencing now may not necessarily persist indefinitely. As economic conditions evolve and external factors come into play, the housing market is likely to adjust accordingly.

Moreover, amidst the current challenges lie opportunities. For buyers, the easing of competitive pressures could translate into more favorable terms and negotiating power. Sellers, on the other hand, may need to adjust their expectations but can still capitalize on the inherent value of their properties.

Top 10 MSAs Where Home Prices Will Grow by Feb 2025

When it comes to forecasting the growth of home prices across various Metropolitan Statistical Areas (MSAs), it's essential to consider a multitude of factors shaping the real estate landscape. Based on the data provided, here are the top 10 MSAs where home prices are projected to experience significant growth by February 2025:

- Thomaston, Georgia (GA): With a modest start at 0.3% growth by March 31, 2024, Thomaston is expected to see a substantial surge, reaching an impressive 6.9% growth by February 28, 2025. This remarkable acceleration indicates a thriving real estate market in the area.

- Kalispell, Montana (MT): Starting at 0.8% growth, Kalispell is poised to experience steady appreciation, reaching a notable 6.4% growth by February 2025. The scenic beauty and quality of life in Kalispell likely contribute to its attractiveness to homebuyers.

- Steamboat Springs, Colorado (CO): This picturesque Colorado town begins with a 0.5% growth rate and is expected to see home prices rise to 6.1% by February 2025. Steamboat Springs' appeal as a recreational destination may be a driving force behind its projected growth.

- Clewiston, Florida (FL): Despite starting with a modest 0.4% growth, Clewiston's home prices are forecasted to rise to 5.9% by February 2025. The allure of Florida's warm climate and diverse economy likely contribute to this upward trend.

- Mountain Home, Idaho (ID): Beginning at 0.8% growth, Mountain Home is expected to see a steady increase, reaching 5.7% growth by February 2025. The state's affordability and outdoor recreational opportunities may attract homebuyers to this area.

- Butte, Montana (MT): Starting with a 0.6% growth rate, Butte is projected to experience a notable uptick, reaching 5.5% growth by February 2025. Montana's natural beauty and lower cost of living may contribute to the demand for homes in this region.

- Price, Utah (UT): With a strong start at 1% growth, Price is anticipated to maintain its momentum, reaching 5.5% growth by February 2025. Utah's economic growth and outdoor recreational opportunities may attract buyers to this area.

- Jackson, Wyoming (WY): Beginning with a 0.5% growth rate, Jackson is expected to see home prices rise to 5.4% by February 2025. Wyoming's natural beauty and favorable tax environment may contribute to the attractiveness of Jackson as a real estate investment destination.

- Toccoa, Georgia (GA): Starting at 0.5% growth, Toccoa is forecasted to experience a steady increase, reaching 5.3% growth by February 2025. Georgia's diverse economy and relatively affordable housing may appeal to homebuyers in this region.

- Knoxville, Tennessee (TN): Beginning with a 0.5% growth rate, Knoxville is projected to see home prices appreciate to 5.1% by February 2025. Tennessee's low cost of living and vibrant cultural scene may contribute to the demand for homes in Knoxville.

Alternate Views on Predictions

While Zillow's optimism is palpable, it's important to note that not all experts share the same sentiment. For instance, Morgan Stanley foresees a different trajectory for U.S. home prices in 2024. Their perspective suggests that home prices will experience a decline during this period, offering potential relief for prospective buyers.

Despite the differing opinions, one thing remains clear: the U.S. housing market is in a state of flux, influenced by factors such as inventory levels, mortgage rates, and economic conditions. As the months roll on, it will be fascinating to see how these predictions unfold and whether the market continues its upward trajectory or experiences the anticipated corrections.

Housing Market Predictions Until January 2025

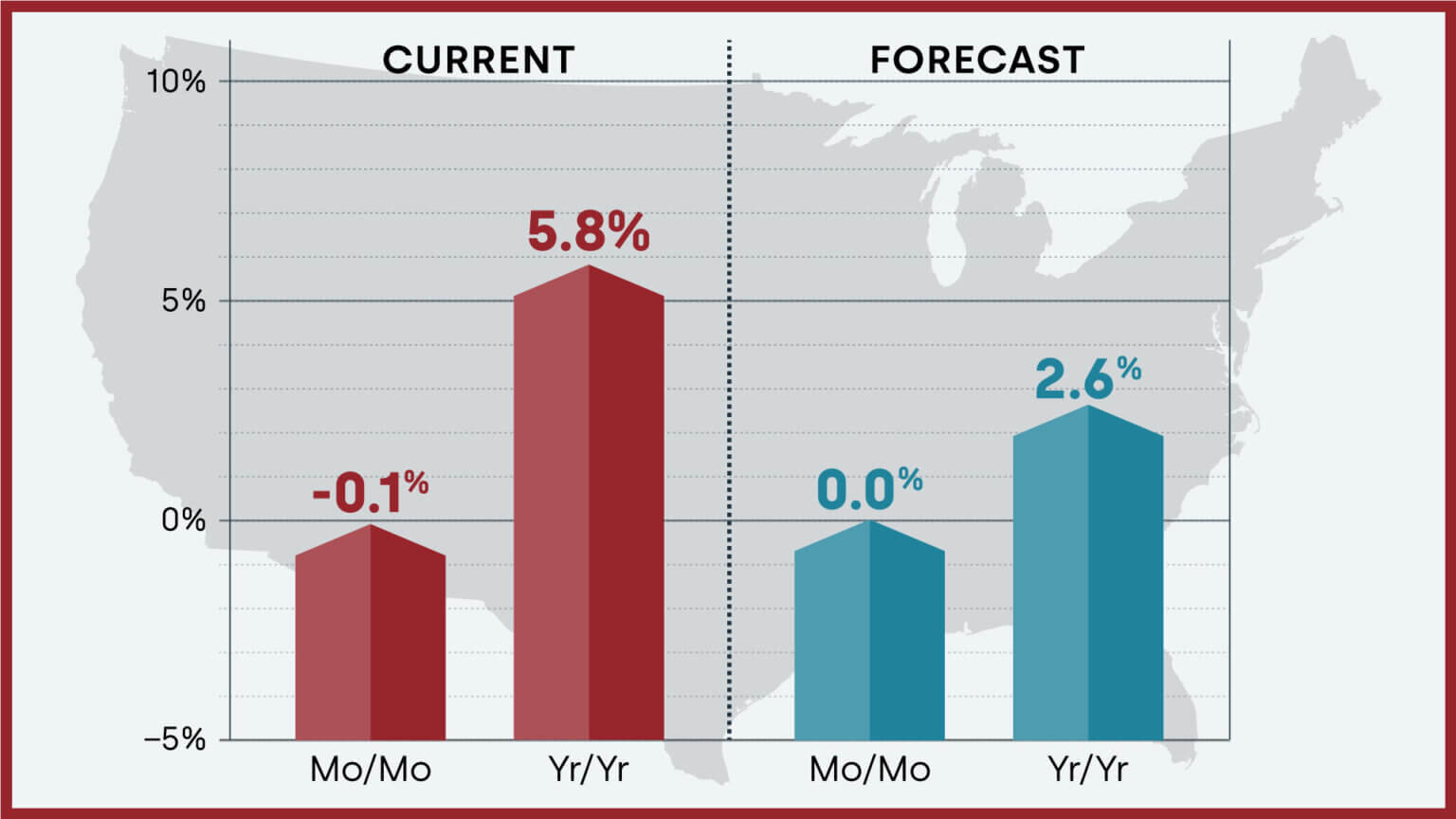

According to the latest data from CoreLogic, home prices across the United States have shown significant fluctuations. Year over year, including distressed sales, home prices surged by 5.8% in January 2024 compared to the same period in 2023. However, on a month-over-month basis, there was a slight decline of -0.1% in January 2024 compared to December 2023. It's worth noting that revisions with public records data are standard practice to ensure accuracy in the analysis.

Projections and Forecasts

The CoreLogic HPI Forecast predicts a stable trend, indicating that home prices are expected to remain unchanged from January 2024 to February 2024. However, a year-over-year increase of 2.6% is anticipated from January 2024 to January 2025. Despite the recent surge in home price gains, growth is forecasted to slow down in the upcoming months, with an estimated rate of 2.6% by early 2025. This deceleration is attributed to various factors, including higher mortgage rates and inventory shortages.

The housing market continues to grapple with challenges related to affordability, particularly in regions where wages are comparatively lower. Higher mortgage rates and inventory shortages exacerbate this issue. Although homeownership remains a priority for many, younger Americans face hurdles in entering the market due to these affordability constraints.

Despite affordability concerns, there's a notable trend among millennials, who represent over half of home purchase applications between 2020 and 2023. Conversely, baby boomers, leveraging their substantial financial reserves, often purchase homes outright with cash. This trend further intensifies challenges for other potential buyers.

Regional variations in home price dynamics are evident, with certain states experiencing more significant increases. For instance, Rhode Island, New Jersey, and Connecticut recorded year-over-year increases of 13.2%, 11.6%, and 11%, respectively, in January 2024.

Top Housing Markets at Risk of Home Price Decline

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that Spokane-Spokane Valley, WA (70%-plus probability) is at a very high risk of a decline in home prices over the next 12 months. Other areas at very high risk for price declines include Palm Bay-Melbourne-Titusville, FL; Salt Lake City, UT; Ocala, FL; and Ogden-Clearfield, UT.

These projections highlight the vulnerability of certain markets to potential **home price** crashes, emphasizing the importance of careful analysis and risk management strategies for homeowners, investors, and other stakeholders.

In short, the US housing market continues to navigate through a period of transition marked by fluctuating home prices and evolving buyer demographics. While certain regions exhibit robust growth, others face challenges posed by affordability constraints and market uncertainties. Understanding these trends is crucial for stakeholders to make informed decisions in the dynamic real estate landscape.

References

- https://www.realtor.com/research/

- https://www.nar.realtor/research-and-statistics/housing-statistics/

- https://www.corelogic.com/intelligence/u-s-home-price-insights/

- https://www.zillow.com/research/daily-market-pulse-26666/