Jacksonville's housing market has an ideal environment for investors, especially for turnkey real estate investments. Jacksonville is Florida's biggest city and the largest city by area in the contiguous United States. It serves as the county seat of Duval County. The housing market in Jacksonville (Duval County) experienced some noteworthy changes in February.

The median sales price has experienced a substantial increase of 9.8%, reaching $345,990. This uptrend in median sales price underscores the appreciation of property values in the area.

Furthermore, while the median sales price has risen, the percentage of the original list price received has slightly decreased by 0.4%, standing at 96.8%. However, it's worth noting that 13.7% of properties have been sold over the list price, indicating a competitive market where buyers are willing to pay a premium for desirable properties.

The months supply of inventory is a critical metric that gauges the balance between supply and demand in the housing market. In Duval County, FL, the MSI has increased by 58.4% to 3.8 months.

Historically, a six-month supply of inventory is associated with moderate price appreciation. However, with a lower MSI, prices tend to rise more rapidly due to increased competition among buyers. Therefore, the current MSI of 3.8 months suggests a market that remains favorable for sellers, albeit with a slightly more balanced supply-demand dynamic.

Current Jacksonville Housing Market Trends

NEFAR (Northeast Florida Association of REALTORS®) offers three categories of market statistics reports. Their monthly market reports provide an in-depth summary of NEFAR's entire market area in addition to area-level breakout reports for numerous submarkets. Below is the latest market report for Duval County containing data for the 13 regions for February 2024.

- New Listings were up 42.3% from last year.

- Closed Sales were up 13.4% from last year.

- The Median Sales Price rose by 9.8% to $345,990.

- The percentage of the original list price received was 96.8 percent, down 0.4 percent from the previous year.

- The percentage of properties sold over the list price was 13.7 percent.

- Median Days on the Market was 33, down by 36.5%.

- The inventory of available homes increased by 46.9 percent.

- Months Supply of Inventory increased by 58.4% to 3.8 months.

- Months Supply of Inventory (MSI) is a calculation that quantifies the relationship between supply and demand in a housing market.

- Historically, six months of supply is associated with moderate price appreciation, and a lower level of months' supply tends to push prices up more rapidly.

The current housing market trends in Duval County, FL, paint a picture of a dynamic and competitive environment. With significant increases in new listings, closed sales, and median sales prices, the market appears to be thriving. However, factors such as days on the market and inventory levels indicate a balanced landscape, providing opportunities for both buyers and sellers.

Jacksonville Rental Market Trends

As of March 2024, the median rent for all bedroom counts and property types in Jacksonville, FL is $1,549. This is -21% lower than the national average. Rent prices for all bedroom counts and property types in Jacksonville, FL have decreased by 4% in the last month and have decreased by 11% in the last year.

The monthly rent for an apartment in Jacksonville, FL is $1,435. A 1-bedroom apartment in Jacksonville, FL costs about $1,277 on average, while a 2-bedroom apartment is $1,456. Houses for rent in Jacksonville, FL are more expensive, with an average monthly cost of $1,755.

Jacksonville Housing Market Forecast for 2024 and 2025

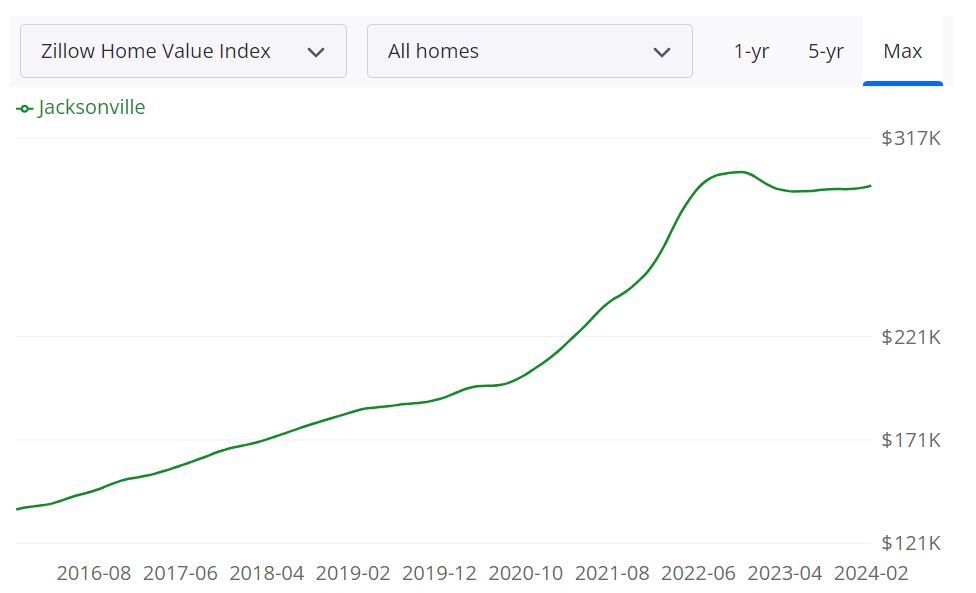

What are the Jacksonville real estate market predictions? The Jacksonville housing market, as per data sourced from Zillow, reveals an average home value of $294,450, reflecting a marginal 0.2% decline over the past year. Homes in Jacksonville tend to go pending within approximately 35 days, showcasing a steady pace of transactions.

Housing Inventory

As of February 29, 2024, Jacksonville boasts a 3,802 for-sale inventory, indicating a diverse range of options available for prospective buyers. Moreover, 1,078 new listings entered the market during the same period, adding to the city's housing supply.

Median Sale and List Prices

The median sale price for homes in Jacksonville stood at $259,483 as of January 31, 2024, while the median list price, indicating the current market trend, was $297,933 as of February 29, 2024. This disparity suggests potential negotiation opportunities for both buyers and sellers.

Sale to List Ratio and Market Dynamics

With a median sale to list ratio of 0.981 (as of January 31, 2024), the market reflects a balance between listed prices and actual sale values. Notably, 16.9% of sales occurred over the list price, while 63.2% were below the list price, indicating varying degrees of negotiation flexibility within the Jacksonville housing landscape.

Jacksonville MSA Housing Market Forecast

The Metropolitan Statistical Area (MSA) of Jacksonville encompasses various counties, including Duval, Clay, St. Johns, Nassau, and Baker. With a forecasted growth rate of 0.3% by March 31, 2024, followed by 0.5% by May 31, 2024, and a significant surge of 1.8% by February 28, 2025, the Jacksonville MSA housing market presents a promising trajectory, potentially attracting both local and out-of-state investors.

Is Jacksonville a Buyer's or Seller's Housing Market?

Currently, the Jacksonville housing market appears to offer opportunities for both buyers and sellers. While the average home value has experienced a slight decline over the past year, indicating a potential advantage for buyers, the market's balanced sale to list ratio suggests a fair playing field for both parties. Ultimately, factors such as inventory levels, negotiation flexibility, and prevailing economic conditions contribute to determining whether it leans more towards a buyer's or seller's market at any given time.

Are Home Prices Dropping in Jacksonville?

Despite the marginal 0.2% decrease in average home value over the past year, it's essential to consider this within the broader context of the Jacksonville housing market. While fluctuations may occur, the market has shown resilience and maintained stability, with fluctuations often reflective of localized factors and broader economic trends. Therefore, while specific segments or neighborhoods may experience price adjustments, it's not indicative of an overall downward trend in home prices across Jacksonville.

Will the Jacksonville Housing Market Crash?

Forecasting a housing market crash involves assessing a myriad of economic, financial, and socio-political factors, making it a complex and speculative endeavor. Currently, indicators suggest stability and moderate growth within the Jacksonville housing market, with forecasted growth rates signaling optimism. However, it's crucial to monitor market dynamics, such as inventory levels, interest rates, and employment trends, to mitigate potential risks and ensure the market's resilience against external shocks.

Is Now a Good Time to Buy a House in Jacksonville?

For prospective homebuyers contemplating entering the Jacksonville housing market, several factors warrant consideration. With a balanced market offering negotiation opportunities and a diverse inventory, coupled with favorable interest rates as compared to last year, now could be an opportune time to explore homeownership. However, individual circumstances, including financial readiness, long-term housing goals, and market conditions, should inform the decision-making process.

Jacksonville Real Estate Investment Overview

Now that you know where Jacksonville is, you probably want to know why we’re recommending it to real estate investors. Is Jacksonville a Good Place Real Estate Investment? You need to drill deeper into local trends if you want to know what the market holds for the year ahead. We have already discussed the Jacksonville housing market forecast for answers on why to put resources into this market. Purchasing an investment property in Jacksonville real estate is a little different from shopping for your car or primary residence.

While you still want to get the most for your money, if you are looking to make a profit, you don’t want to buy the most expensive property on the Jacksonville real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, a turnkey investment property in Jacksonville that you might move into or sell at retirement in the future! Either way, knowing your profit potential and purpose is the first thing to consider.

Jacksonville is the 50th most walkable large city in the US. It has minimal public transportation and does not have many bike lanes. The most walkable Jacksonville neighborhoods are Downtown, Riverside, and San Marco. Jacksonville has a mixture of owner-occupied and renter-occupied housing units. It is a big rental property market.

According to Neighborhoodscout.com, a real estate data provider, three and four-bedroom single-family detached homes are the most common housing units in Jacksonville. Other types of housing that are prevalent in Jacksonville include large apartment complexes, duplexes, rowhouses, and homes converted to apartments. Let’s learn more about Jacksonville and find out why one should invest in this affordable and sizzling real estate market. These things make Jacksonville real estate market stand out when it comes to choosing a place to invest in 2022 and beyond.

A Growing Population

Without people, there’s no real estate. As the population grows, more people need a place to live. This means that over the long term, population growth drives increased demand for housing, and therefore a strong property market. Population growth also affects the property market by impacting the economy. At the same time, the supply of housing influences housing prices. When the supply does not meet the demand, property prices rise.

Steady population growth in Jacksonville, FL offers the perfect market for real estate investments. Jacksonville is the largest city in the state of Florida and the largest city by area in the contiguous U.S. With a 2020 population of 1,064,658, it is the largest city in Florida and the 12th largest city in the United States. Jacksonville is currently growing at a rate of 1.22% annually and its population has increased by 12.12% since the most recent census, which recorded a population of 949,611 in 2020. Spanning over 875 miles, Jacksonville has a population density of 1,424 people per square mile.

Jacksonville Metro Area Population Trends

- The current metro area population of Jacksonville in 2022 is 1,314,000, a 1.31% increase from 2021.

- The metro area population of Jacksonville in 2021 was 1,297,000, a 1.33% increase from 2020.

- The metro area population of Jacksonville in 2020 was 1,280,000, a 1.35% increase from 2019.

- The metro area population of Jacksonville in 2019 was 1,263,000, a 1.53% increase from 2018.

Long-Term Returns On Real Estate

Unlike stocks, real estate protects your money and offers long-term returns. Real estate in Jacksonville is getting tight thanks to its immense popularity and continuous growth. The inventory is dipping and there is a good chance to get property now at reasonable costs. This may be on ascent soon, so if there’s a better time to grab the opportunity in Jacksonville real estate market; it is now.

Jacksonville consistently features in the rundown for real urban communities with a low cost of living. Housing, especially in a few territories, is stunningly affordable compared with the numerous different urban areas on the East Coast. The cost of living isn't just lower than the U.S. national average, but at the same time, it's lower than the Florida average.

Ever since the recession, home prices in the country have generally reduced. This may be normal in other areas, but if you get in a tropical coastal region, you are lucky. In Jacksonville, people are investing just under a hundred thousand dollars to buy and revamp a property. This amount is only two-thirds of the revamping costs as well as the national median. There is hardly a probability that you’ll lose when you buy property at lower prices than the replacement cost, which is what is currently going on in Jacksonville real estate market.

The Future of Jacksonville Looks Bright

In Jacksonville, the availability of jobs is set to increase by 42% in the next ten years. A wise move by investors in the Jacksonville real estate market would be to buy properties now to take advantage of that growth and rising housing need. More jobs in Jacksonville means more people would like to live in this city and therefore, they need good housing facilities.

Given the same employment prospects, most people will go for a better way of life. A warm, green radiant urban community is more attractive than a cold grey city. And that is what Jacksonville, FL offers. Plus, with regards to the most alluring regions in the US, the Florida Coast is best of all and Jacksonville is no exception.

In rental markets with numerous single grown-ups, rent turnover is generally high. In this way, property investors are likely to work more with renters and buyers with families since these people secure long-term leases. Jacksonville is one such city that pulls in and keeps families complete with top-notch schools, recreational facilities, high-tech transport, and other resources for the residents.

Economic Growth

Jacksonville's economy is completely diversified and just continues developing. Jacksonville is home to numerous fortune 500 organizations and different businesses which give employment to the present and future. This implies individuals can hold their rents and home loans under wraps. Neither the state of Florida nor the city of Jacksonville has an income tax imposed. Furthermore, with a low-level corporate tax rate of just 5.5% (on or after 1/1/2022) in the state of Florida, you can see why it’s attractive to businesses.

Florida's economy is expected to grow at a rate faster than the nation’s overall. There are also strong indicators of low property vacancies, rising rents, and single-family rental unit developments in Jacksonville. These factors are known to attract real estate investors into a city. There are more than 500 neighborhoods within the area of Jacksonville. As with much of Florida, tourism is also important to the Jacksonville economy, particularly related to golf. The greater Jacksonville area can realistically aspire to become the “highest performing economy in the country” over the next five years, according to an Elevate Northeast Florida report.

Supply and Demand

As said earlier, the Jacksonville populace is growing. However, the real estate stock is plunging. This an unmistakable sign that demand, may, in one way or another supersede supply in Jacksonville real estate market. The rate of building homes and properties here has dependably been low over the years which has created a supply vacuum in the city. Security is one major factor influencing real estate and property development at any place and at any time.

If the place you choose to invest is brimming with crimes and catastrophic events, you wager you're not going to get a decent market for your property. At the turn of the millennium, Jacksonville's Duval county held the title of “murder capital” of Florida and did so for 11 years. Since then, crime has gone down, and Jacksonville is no longer the top offender in the state.

The good news is the point at which you contrast Jacksonville with different urban areas that are of similar size, the crime rate normalizes and it hovers near the average for every single other area of comparative size. In Jacksonville, the crimes have gone down. In 2021, Jacksonville's homicide total dropped 30 percent. Despite all the difficult news in 2021, there was a positive trend in Jacksonville — the city’s homicide numbers went significantly down for the first time in years. According to News4JAX data, homicides dropped by 28% from 2020 to 2021, while the number of people shot was down 22%.

The Beach Factor

Who doesn't love beaches? No matter where you live in Jacksonville you're likely not much more than a hop and a skip from miles of beaches. Residents in most areas of the city can reach the beach in less than an hour, depending on traffic. This is one of the pros of living in Jacksonville, FL. The city of Jacksonville operates the biggest urban stop framework in the United States, with 262 assigned parks and more than 80,000 acres of land. Every one of the parks brings its particular characteristics, from the quiet tranquility of the different parks in Riverside to the rich history of Downtown's Hemming Plaza, the city's first park.

Where To Invest In The Jacksonville Real Estate Market?

We took this data from Neighborhoodscout.com, to find out some of the best neighborhoods where you can invest in Jacksonville real estate.

1. Riverside

Riverside is an urban neighborhood (based on population density) located in Jacksonville, Florida. Riverside real estate is primarily made up of small (studio to two bedroom) to medium-sized (three or four bedroom) single-family homes and small apartment buildings. Most of the residential real estate is renter occupied

Riverside's median real estate price is $434,894, which is more expensive than 57.0% of the neighborhoods in Florida and 61.7% of the neighborhoods in the U.S. The average rental price in Riverside is currently $1,717, based on NeighborhoodScout's exclusive analysis. Rents here are currently lower in price than in 79.7% of Florida neighborhoods.

2. Isle of Palms

Isle of Palms is a suburban neighborhood (based on population density) located in Jacksonville, Florida. Isle of Palms real estate is primarily made up of medium sized (three or four bedroom) to small (studio to two bedroom) single-family homes and apartment complexes/high-rise apartments. Most of the residential real estate is occupied by a mixture of owners and renters.

Isle of Palms' median real estate price is $726,109, which is more expensive than 88.4% of the neighborhoods in Florida and 85.8% of the neighborhoods in the U.S. The average rental price in Isle of Palms is currently $1,971, based on NeighborhoodScout's exclusive analysis. Rents here are currently lower in price than in 66.0% of Florida neighborhoods.

3. Jacksonville North Beach

North Beach is an urban neighborhood (based on population density) located in Jacksonville, Florida. It is primarily made up of small (studio to two bedroom) to medium sized (three or four bedroom) apartment complexes/high-rise apartments and single-family homes. Most of the residential real estate is occupied by a mixture of owners and renters

North Beach median real estate price is $305,997, which is more expensive than 39.8% of the neighborhoods in Florida and 51.0% of the neighborhoods in the U.S. The average rental price in North Beach is currently $1,973. Rents here are currently lower in price than 65.9% of Florida neighborhoods.

4. East Mayport / Mayport

East Mayport / Mayport is a suburban neighborhood (based on population density) located in Jacksonville, Florida. This is a coastal neighborhood (i.e., is on the ocean, a bay, or inlet). It is primarily made up of medium sized (three or four bedroom) to large (four, five or more bedroom) townhomes and single-family homes. Most of the residential real estate is renter occupied.

East Mayport / Mayport median real estate price is $233,260, which is less expensive than 76.2% of Florida neighborhoods and 62.3% of all U.S. neighborhoods. The average rental price in East Mayport / Mayport is currently $2,940, based on NeighborhoodScout's exclusive analysis. The average rental cost in this neighborhood is higher than 80.1% of the neighborhoods in Florida.

Buying Your First Investment Property in Jacksonville

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability. Consult with one of the investment counselors who can help build you a custom portfolio of turnkey cash-flow rental properties in the various growth markets across the United States.

All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching top real estate growth markets and structuring complete turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

References

Latest Market Trends & Forecasts

https://www.nefar.com/market-stats

https://www.zillow.com/jacksonville-fl/home-values/

https://www.neighborhoodscout.com/fl/jacksonville/real-estate

https://www.redfin.com/city/8907/FL/Jacksonville/housing-market/

https://www.zumper.com/rent-research/jacksonville-fl

https://www.realtor.com/realestateandhomes-search/Jacksonville_FL/overview

Population

https://www.jacksonville.com/news/20190530/jacksonville-growth-no-7-nationally-census-estimates-say

Reasons to invest in Jacksonville

http://www.jaxinvestments.com/why-jacksonville

https://www.tripsavvy.com/pros-of-living-in-jacksonville-2021375

http://www.jwbrealestatecapital.com/jacksonville-fl-perfect-investment-properties

https://www.realpro.com/our-blog/post/jacksonville-floridas-hottest-property-investment-market

https://www.forbes.com/sites/samanthasharf/2018/02/01/full-list-where-to-invest-in-housing-in-2018/#5f7abada627e