With the current dynamics in the Minneapolis housing market, it's essential to assess whether it leans more towards a buyer's or seller's market. Despite the increase in inventory, other indicators such as rising median and average sales prices, along with a higher percentage of the original list price received, suggest that sellers still have significant leverage.

Additionally, the reduction in days on market until sale indicates robust buyer demand, further tilting the balance in favor of sellers. However, buyers also benefit from the expanded inventory, providing them with more options to explore. Ultimately, while the market may offer advantages to both buyers and sellers, the prevailing conditions suggest that it remains primarily a seller's market.

ALSO READ: Minnesota Housing Market: Prices & Forecast

Minneapolis Housing Market Trends (City Data)

The Minneapolis housing market has witnessed significant shifts in the past year, reflecting both challenges and opportunities for buyers and sellers alike. According to data from Minneapolis Area Realtors®, February 2024 revealed intriguing trends in various aspects of the housing market.

New Listings and Closed Sales

In February 2024, the number of new listings surged by an impressive 35.6% compared to the same period in 2023. This influx of listings suggests a growing interest from homeowners in putting their properties on the market. However, closed sales experienced a slight decline of 2.6% during the same timeframe, indicating potential challenges in converting listings into successful transactions.

Median and Average Sales Prices

Despite fluctuations in market activity, both median and average sales prices demonstrated resilience. The median sales price rose by 3.7% year-over-year, reaching $298,750 in February 2024. Similarly, the average sales price surged by 20.3%, reaching $412,024. These figures underscore the continued demand for housing in Minneapolis, contributing to steady price appreciation.

Price Per Square Foot and List Price

The price per square foot also experienced a notable increase of 6.0% year-over-year, reflecting the value attributed to residential properties in the area. Additionally, sellers benefited from a higher percentage of the original list price received, with an uptick of 1.7% compared to the previous year. These metrics indicate a favorable environment for sellers, with properties commanding strong offers relative to their listing prices.

Days on Market and Inventory

One of the most significant changes observed in the Minneapolis housing market is the reduction in days on market until sale. Properties spent 16.9% less time on the market in February 2024 compared to the previous year, indicating accelerated sales processes and heightened buyer activity. However, the inventory of homes for sale also increased by 18.7%, leading to a higher months' supply of inventory, which rose by 40.0%. This increase in inventory suggests a more balanced market, providing buyers with a broader selection of properties to choose from.

Implications for Buyers and Sellers

For prospective buyers, the Minneapolis housing market offers both opportunities and challenges. While increased inventory provides more options, competitive pricing and reduced time on the market necessitate swift decision-making. Buyers should carefully assess their priorities and financial capabilities to make informed purchasing decisions in this dynamic environment.

On the other hand, sellers stand to benefit from favorable conditions, including rising sales prices and a higher percentage of the original list price received. Strategic pricing and effective marketing are crucial for sellers to capitalize on the current market dynamics and maximize their returns.

Twin Cities Area Housing Market Trends

Minneapolis–Saint Paul is a major metropolitan area and is commonly known as the Twin Cities after its two largest cities—Minneapolis and Saint Paul. They’re separated by the Mississippi River. The waterfront is home to many cultural landmarks and coveted waterfront real estate.

Let us also discuss the recent housing statistics in Minneapolis–St. Paul–Bloomington MN-WI metropolitan area released by the MINNEAPOLIS AREA REALTORS. The area is commonly known as the Twin Cities after its two largest cities, Minneapolis, the most populous city in the state, and its neighbor to the east, Saint Paul, the state capital.

Overview of Market Activity

In February 2024, the Twin Cities region saw a significant increase in new listings, with a staggering 34.5% jump compared to the same period in 2023. This surge in new listings indicates a growing interest in the housing market, perhaps driven by favorable economic conditions and increased demand for housing.

Despite the surge in new listings, the number of closed sales experienced a modest increase year-over-year. This suggests that while there is ample inventory available, buyers are still navigating the market cautiously, possibly due to factors such as affordability concerns or competition from other buyers.

Price Trends

One of the most crucial aspects of the housing market is price trends, and the data shows some interesting developments in this regard. The median sales price in February 2024 experienced a modest increase compared to the previous year, reaching $357,700. Similarly, the average sales price saw a increase, indicating a healthy appreciation in property values.

When examining the price per square foot, we observe a consistent upward trend, with a increase year-over-year. This metric is particularly important for buyers and sellers alike as it provides a more granular understanding of property values based on size.

Market Dynamics

Despite the increase in prices, buyers continue to enjoy favorable negotiation power, as evidenced by the 97.5% of the original list price received on average. However, sellers should be mindful of the slightly longer days on market until sale, which saw a decrease compared to the previous year. This indicates that while properties are selling relatively quickly, buyers are taking a bit more time to make their decisions.

Inventory levels also saw a notable increase, reaching 6,665 homes for sale in February 2024. This increase in inventory provides buyers with more options to choose from, potentially alleviating some of the pressure caused by low inventory levels in previous years.

Future Outlook

As we look ahead, it's essential to consider the broader economic and social factors that may impact the Twin Cities housing market. Factors such as job growth, interest rates, and demographic shifts can all influence housing demand and prices.

Additionally, while the current data paints a picture of a robust housing market, it's essential to remain vigilant and adaptable in the face of potential challenges. Whether you're a buyer looking for your dream home or a seller aiming to maximize your property's value, staying informed and working with knowledgeable real estate professionals is key to success in navigating the Twin Cities housing market.

Saint Paul Housing Market Trends (Describes City's Housing Stats)

Despite recent fluctuations, the overall trend in Saint Paul's housing market appears positive, with steady appreciation in property values and increased market activity.

Overview of Market Activity

In February 2024, Saint Paul saw a 34.8% increase in new listings compared to the same period in 2023. This surge in new listings indicates a growing interest in the Saint Paul housing market, which could be attributed to various factors such as economic growth and population influx.

Despite the increase in new listings, the number of closed sales experienced a 7.2% decrease year-over-year. This could be due to factors like changing buyer preferences or market conditions affecting purchasing decisions.

Price Trends

The median sales price in February 2024 showed a healthy 7.8% increase compared to the previous year, reaching $275,000. This indicates a positive trend in property values, which may attract both buyers and sellers to the market.

Similarly, the average sales price saw a 2.4% increase year-over-year, reflecting a general appreciation in property values across Saint Paul. This is good news for homeowners looking to sell their properties for a favorable price.

Market Dynamics

Buyers in Saint Paul continue to enjoy favorable negotiation power, as evidenced by the 98.2% of the original list price received on average. This suggests that sellers may need to be flexible with their pricing strategies to attract buyers in a competitive market.

The average days on market until sale decreased by 16.9% compared to the previous year, indicating that properties are selling faster in Saint Paul. This could be attributed to factors such as high demand or effective marketing strategies by sellers.

Inventory levels also saw an increase, with 13.2% more homes for sale in February 2024 compared to the previous year. This increase in inventory provides buyers with more options to choose from, potentially reducing competition and pressure to make quick decisions.

Minneapolis Housing Market Forecast 2024 and 2025

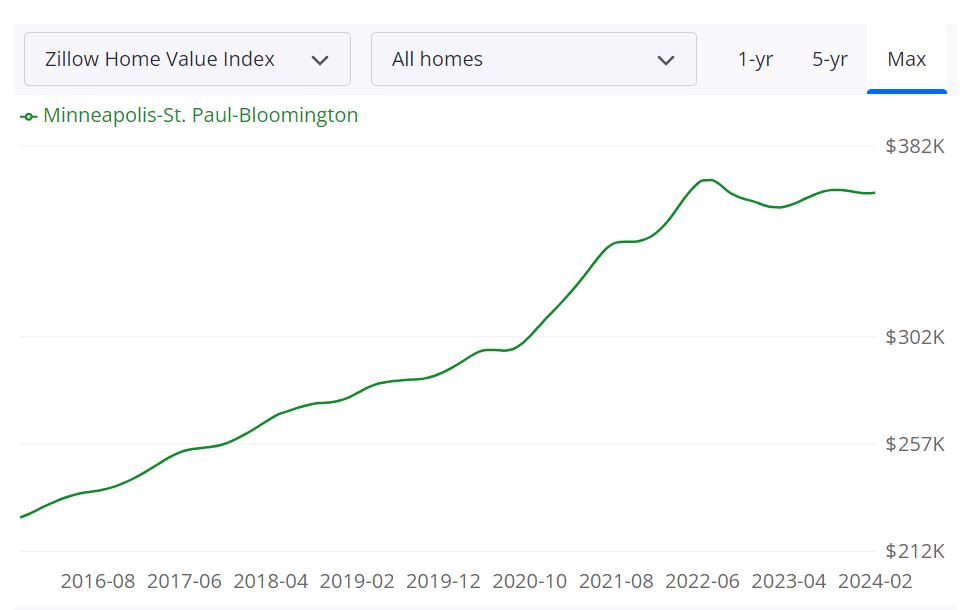

According to Zillow, the average home value in the Minneapolis-St. Paul-Bloomington MSA stands at $363,017, indicating a modest 1.7% increase over the past year. Properties in this region typically go pending in approximately 33 days.

Key Metrics

For Sale Inventory

As of February 29, 2024, the Minneapolis housing market boasts a total of 6,355 properties listed for sale. This figure provides valuable insight into the overall availability of homes for prospective buyers.

New Listings

During the same period, there were 2,124 new listings introduced to the market, indicating ongoing activity and opportunities for buyers to explore fresh options.

Median Sale to List Ratio

The median sale to list ratio, which stood at 0.999 as of January 31, 2024, reflects the relationship between the listed price of a property and its eventual selling price, offering valuable guidance to sellers on pricing strategies.

Median Sale Price and List Price

As of January 31, 2024, the median sale price in the Minneapolis-St. Paul-Bloomington MSA was $330,483, while the median list price as of February 29, 2024, was $355,000. These figures provide crucial benchmarks for both buyers and sellers in understanding market trends and setting realistic expectations.

Percent of Sales over and under List Price

Examining sales dynamics, Zillow data reveals that 30.9% of sales in January 31, 2024, occurred over the list price, while 47.7% occurred under the list price. These statistics offer valuable insights into market competitiveness and negotiation dynamics.

Scope of the Market

The Minneapolis-St. Paul-Bloomington MSA encompasses several counties, including Hennepin, Ramsey, Dakota, and Anoka. This vibrant region represents a significant housing market, attracting buyers and sellers alike with its diverse offerings and economic opportunities.

Are Home Prices Dropping in Minneapolis?

As of the latest data available from Zillow, home prices in the Minneapolis-St. Paul-Bloomington MSA have shown resilience, with a modest 1.7% increase over the past year. While slight fluctuations may occur in localized markets, overall trends indicate stability rather than significant drops in prices.

Will the Minneapolis Housing Market Crash?

Predicting a housing market crash requires careful consideration of various economic indicators and market fundamentals. While no market is immune to downturns, current data suggests that the Minneapolis housing market remains relatively stable, supported by factors such as job growth, population trends, and housing demand. However, vigilance and prudent decision-making are essential to mitigate risks and adapt to changing conditions.

Is Now a Good Time to Buy a House in Minneapolis?

For prospective buyers evaluating the timing of their purchase, several factors should be considered. While current market conditions offer opportunities for both buyers and sellers, individual circumstances, such as financial readiness, long-term plans, and personal preferences, play a significant role in determining whether now is the right time to buy a house. Consulting with real estate professionals and carefully assessing market dynamics can help buyers make informed decisions aligned with their goals and aspirations.

Minneapolis Real Estate Investment: Is It A Good Place For Investment?

Minneapolis, located in the state of Minnesota, is a major economic hub in the Midwest region of the United States. The city has a diverse economy with major industries including healthcare, finance, and manufacturing. With a population of over 400,000 and a metro population of over 3.6 million, Minneapolis has a strong demand for housing. If you are considering investing in real estate, here are 5 reasons why Minneapolis might be a good place to invest:

- Strong Rental Property Market: The rental property market in Minneapolis is strong, with high occupancy rates and steady rent growth. The city has a large number of renters, including students from the University of Minnesota, young professionals, and families. Additionally, the city has a strong job market, which supports a steady demand for rental properties.

- Diverse Economy: Minneapolis has a diverse economy that is not dependent on any one industry. The city is home to several Fortune 500 companies, including Target, Best Buy, and General Mills. The city's strong economy supports a steady demand for housing.

- Affordable Real Estate Prices: Compared to other major cities in the United States, Minneapolis has relatively affordable real estate prices. This makes it an attractive market for real estate investors looking to maximize their return on investment.

- Strong Housing Market: Despite some recent fluctuations, Minneapolis has a strong housing market. According to Zillow, the median home value in Minneapolis is $290,000, up 0.5% from the previous year. Additionally, Minneapolis has a relatively low foreclosure rate, which indicates a stable market.

- Growing Population: The population of Minneapolis has been growing steadily over the past decade, driven by both natural growth and migration. This growing population supports a steady demand for housing in the city.

- Big Student Market: One of the factors that make Minneapolis a great place for real estate investment is the massive student market. With the presence of several major universities and colleges, including the University of Minnesota, Minneapolis Community and Technical College, and Augsburg University, there is a large population of students in the area. These students require housing, which presents an opportunity for real estate investors to invest in rental properties. Investing in rental properties in Minneapolis can be a lucrative business as the demand for student housing is usually high. Additionally, the student market in Minneapolis is not limited to traditional students. The city also has a large number of professionals and individuals pursuing advanced degrees who require housing. This diverse population provides real estate investors with a wide range of opportunities to invest in rental properties.

- The Landlord-Friendliness of Minneapolis: Minneapolis is known for its pro-landlord laws and regulations, which provide a stable and predictable environment for property owners. This means that landlords have more control over their properties and can protect their investments more effectively. For example, the city has laws in place that allow landlords to evict tenants for non-payment of rent or other violations of the lease agreement. This can give landlords peace of mind knowing that they can take action if necessary to protect their property and rental income. Furthermore, the city has relatively low property taxes and a streamlined process for obtaining permits and licenses, making it easier for landlords to manage their properties. Additionally, the city's rental market is strong, with a high demand for rental properties due to the growing population and a large number of college students in the area. As a result, landlords in Minneapolis can expect to receive a steady stream of rental income, making it a desirable market for real estate investment.

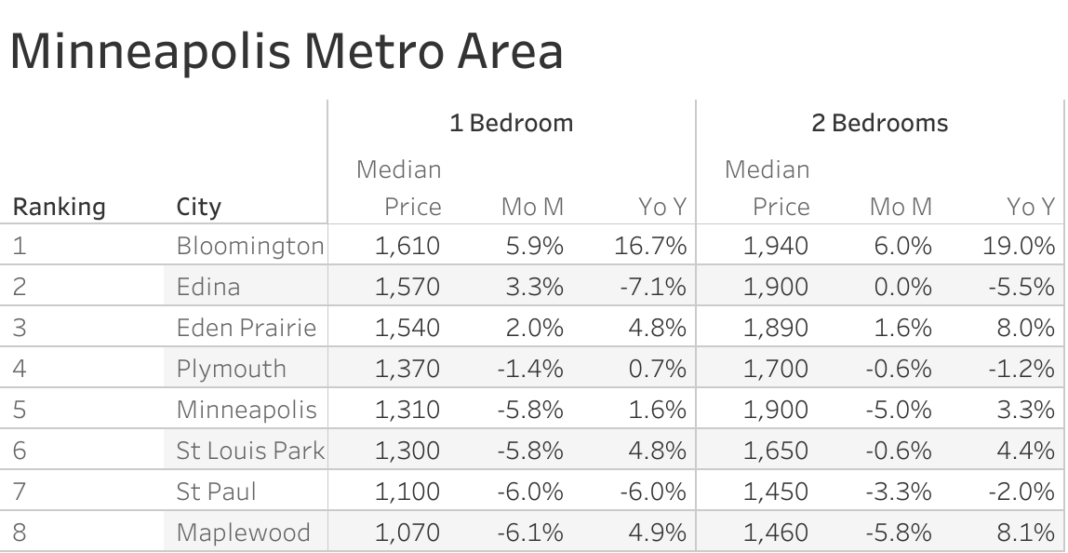

Current Rental Statistics: As of February 2024, the median rent for all bedroom counts and property types in Minneapolis, MN is $1,565. This is -19% lower than the national average. Rent prices for all bedroom counts and property types in Minneapolis, MN have decreased by 9% in the last month and have increased by 6% in the last year.

The Zumper Minneapolis Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Minnesota one bedroom median rent was $1,233 last month. Bloomington was the most expensive city with one bedrooms priced at $1,610 while Maplewood was the most affordable city with one bedroom priced at $1,070.

The best place to buy rental property is to find growing markets. Cities like Maplewood, St. Paul, and Roseville are good for investors looking to get started with rental property ownership at an affordable price. These cities look good for rental property investment this year as rents are growing over there. These trends provide a macro look at the growing rental demand.

Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present opportunities for investors. Here are the best areas to invest in a rental property in the Minneapolis Metro Area in 2022. Most of these places have the same things in common, including rising rents and increasing property values.

The Fastest Growing Cities For Rents in Minneapolis Metro Area (Y/Y%)

- Bloomington had the fastest growing rent, up 16.7% since this time last year.

- Maplewood rent grew 4.9%, making it second.

- Eden Prairie was third with rent increasing 4.8%.

The Fastest Growing Cities For Rents in Minneapolis Metro Area (M/M%)

- Bloomington had the largest monthly growth rate, up 5.9%.

- Edina was second with rent climbing 3.3%.

- Eden Prairie saw rent increase 2%, making it third.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Minneapolis and the Twin Cities region.

Consult with one of the investment counselors who can help build you a custom portfolio of Minneapolis turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Minneapolis. Not just limited to Minneapolis or the Twin Cities of Minnesota but you can also invest in some of the best real estate markets in the United States.

All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Minneapolis turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability. Let us know other than the Twin Cities region which housing markets you consider best for real estate investing!

Sources:

- https://www.mplsrealtor.com/

- http://maar.stats.10kresearch.com/reports/lmu

- https://www.mnrealtor.com/buyers-sellers/marketreports

- https://www.zillow.com/Minneapolis-mn/home-values

- https://www.realtor.com/realestateandhomes-search/Minneapolis_MN/overview

- https://www.neighborhoodscout.com/mn/minneapolis/real-estate