Considering the competitive nature of Omaha's housing market, it currently leans towards being a seller's market. The quick turnaround time for home sales, multiple offers, and homes selling at or above list price all indicate a market where sellers have a favorable position. However, the increasing presence of homes with price drops could be a signal for prospective buyers to navigate the market with a discerning eye, looking for opportunities amid the overall seller-friendly environment.

Omaha, Nebraska is arguably the buckle of the corn belt. It is typically ignored by most, given how much attention is focused on the coasts. If it makes the news, it is generally because of a tornado or flooding of the Missouri River. However, this city on the prairie has a number of good things going for it, and they go well beyond being the home of Warren Buffett.

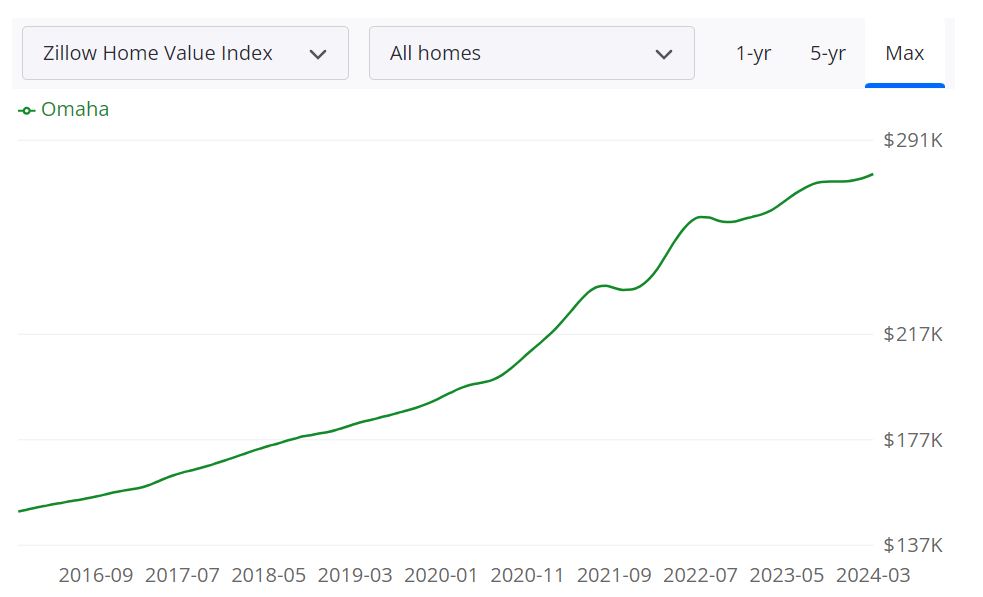

Latest Omaha Housing Market Trends in 2024

Competitiveness and Trends

The Omaha housing market is undeniably competitive, with homes receiving an average of 2 offers and selling within 12 days. According to Redfin, in March 2024, the median sale price of homes in Omaha was $267,000, reflecting a 5.3% increase from the previous year. The median sale price per square foot stood at $149, marking a 2.8% rise from the previous year.

Current Statistics

In March 2024, Omaha home prices experienced a 5.3% increase year-over-year, reaching a median price of $267,000. The average time homes spend on the market is 12 days, compared to 9 days the previous year. Throughout March, 378 homes were sold, slightly higher than the 377 sold during the same period last year.

Omaha vs. National Average

The median sale price in Omaha is 36% lower than the national average. Moreover, the overall cost of living in Omaha is 7% lower than the national average. Many homes in Omaha attract multiple offers, with some even waiving contingencies. On average, homes sell for 1% below list price, and hot homes can sell for 2% above list price.

Inbound Migration

Across the nation, 0.14% of homebuyers are interested in moving to Omaha from outside metros. Kansas City tops the list of metros, followed by Seattle and Los Angeles.

Outbound Migration

While Omaha attracts buyers from various metros, it also sees outbound migration. Milwaukee emerges as the top destination for outbound movers, followed by Phoenix and Des Moines.

Omaha Housing Market Forecast for 2024 and 2025

According to Zillow, the Omaha housing market has displayed steady growth over the past year. The average home value in Omaha stands at $278,352, reflecting a 5.3% increase compared to the previous year. Homes in Omaha are typically pending in around 8 days, indicating strong buyer demand.

In March 2024, the Omaha housing market had 998 homes for sale. During the same period, there were 479 new listings. The median sale-to-list ratio was 0.997 in February 2024, suggesting that homes were selling close to their list prices. The median sale price in Omaha was $271,750 in February 2024, while the median list price was $289,667 in March 2024. Notably, 23.2% of sales were above the list price, and 49.5% were below the list price during the same period.

The Omaha Metropolitan Statistical Area (MSA) Housing Market Forecast provides insights into the region's anticipated performance. According to the available data, the Omaha MSA is expected to see a 0.5% increase in housing market activity by the end of April 2024, a 1.2% increase by the end of June 2024, and a 1.9% increase by the end of March 2025.

The Omaha MSA encompasses several counties, including Douglas, Sarpy, Cass, and Washington counties in Nebraska, as well as Pottawattamie County in Iowa. This metro area is a significant housing market, with a diverse range of residential properties, from single-family homes to condominiums and apartments.

Are Home Prices Dropping in Omaha?

The data does not suggest that home prices in Omaha are dropping. In fact, the average home value has increased by 5.3% over the past year, reaching $278,352. The median sale price of $271,750 in February 2024 and the median list price of $289,667 in March 2024 both indicate that home prices in Omaha are on an upward trend, rather than declining.

Will the Omaha Housing Market Crash?

Based on the available information, there is no clear indication that the Omaha housing market is headed for a crash. The market is showing signs of continued growth, with the Omaha MSA forecast predicting increases in housing market activity over the next year. While market conditions can change, the current data does not suggest an imminent housing market crash in Omaha.

Is Now a Good Time to Buy a House in Omaha?

With mortgage rates lower compared to the previous year, now may be a favorable time for potential homebuyers in Omaha to consider purchasing a property. The strong demand and seller's market conditions mean buyers may need to act quickly and potentially face competition, but the lower mortgage rates could help offset some of the challenges. Ultimately, the decision to buy a home depends on an individual's financial situation, long-term goals, and personal preferences.

Omaha Real Estate Investment Overview

Is it worth buying a house in Omaha, NE? Investing in real estate is touted as a great way to become wealthy. Many real estate investors have asked themselves if buying a property in Omaha is a good investment. You need to drill deeper into local trends if you want to know what the market holds for the year ahead. We have already discussed the Omaha housing market forecast for answers on why to put resources into this market. The market is bolstered by a limited supply of affordable starter homes and a healthy economy that attracts people from across the region to come here for work.

Omaha real estate investment has a strong, long-term future for one key reason – demographics. The average age of Omaha residents is 35, several years younger than the state average. This is partially due to the number of colleges within the Omaha housing market. It is also because many college students who graduate remain in the strong job market, settle down, and start families. This contributes to the slowly growing demand for Omaha real estate market in a region best known for small towns drying up.

Residents of Omaha have relatively few complaints compared to other major housing markets. They aren’t complaining about crime, insane rental rates, or a lack of services. Instead, they complain about the traffic. However, the government’s own Omaha real estate investment takes the form of infrastructure. The city has set up a metro transit system that serves downtown, and they’re working on expanding it. Omaha has connected its roughly forty miles of bike trails and dedicated bike lanes, too, to make it easier for people to bike instead of drive to wherever they need to go.

Investing in Omaha real estate will fetch you good returns in the long term as the home prices in Omaha are predicted to rise in the next twelve months. Let’s take a look at the number of positive things going on in the Omaha real estate market which can help investors who are keen to buy an investment property in this city.

Omaha City is Surprisingly Large

Omaha is the largest city in Nebraska. It is home to almost half a million people. Omaha is the center of the Omaha Metropolitan Area, a metro area that includes Council Bluffs, Iowa. This combined statistical area is home to almost a million people. Roughly 1.3 million live within a fifty-mile radius of downtown Omaha. This makes the Omaha real estate market one of the largest in the Midwest. However, size isn’t the only reason to consider Omaha's real estate investment.

Omaha has a Diverse Economy

Omaha’s economy is robust because it is so diverse. While agricultural products and services are part of the economy, it doesn’t dominate the local economy. For example, several financial firms have regional or national headquarters in Omaha. There are major insurance companies, railroads, and architectural firms in the area. As the major services hub for the region, there are hospitals, schools, and other service providers based in Omaha, each employing thousands.

This has contributed to the stable Omaha housing market and the roughly 3 percent unemployment rate. Nebraska’s latest unemployment rate of 1.9% represented an all-time low for the second straight month, and that April level remains tied for the lowest reached by any state in history. Only Utah has ever dropped to such a level, tying with Nebraska for the record low (Unemployment data go back to 1976).

You may read about how one state has higher property taxes than another, while a third state can advertise its lower income tax rate. What Nebraska offers is financial solvency. In 2018, Nebraska ranked the most fiscally healthy state in the nation. This is arguably more important than its relatively high 1.8 percent property tax rate.

Because they have enough money coming in to pay the bills and make debt payments, they won’t be jacking up the property tax rate to make up for a budget shortfall. On the flip side, the affordable Omaha housing market means that a roughly 2 percent property tax rate turns into a nearly 4,000 dollar-a-year property tax bill.

There is a Sizable Military Presence For Rentals

Offutt Air Force Base adds more than eight thousand jobs in the Omaha area, and it creates a large population of renters in the Omaha real estate market. More importantly to those considering Omaha real estate investment, the fact that Omaha’s economy is so diverse means that the Omaha housing market won’t crate if the base is downsized or outright closed.

The Omaha housing market also hosts a large number of students, though they don’t all attend the flagship University of Nebraska at Omaha. The affiliated medical center is notable for being one of the few dozen advanced cancer hospitals in the United States. Private universities in the area include Bellevue University, College of Saint Mary, Nebraska Methodist College, Nebraska Christian College, Doane College, and Creighton University.

This allows those considering Omaha real estate investment properties to own houses or condos close to multiple schools instead of tying their fortunes to one institution of higher learning. Rental rates have been climbing more slowly, but they have also been bolstered by the sizable military and student markets that are not as price sensitive as the average person working a service job.

As of April 2024, the median rent for all bedroom counts and property types in Omaha, NE is $1,210. This is -39% lower than the national average. Rent prices for all bedroom counts and property types in Omaha, NE have decreased by 12% in the last month and have decreased by 3% in the last year.

The monthly rent for an apartment in Omaha, NE is $1,197. A 1-bedroom apartment in Omaha, NE costs about $1,035 on average, while a 2-bedroom apartment is $1,415. Houses for rent in Omaha, NE are more expensive, with an average monthly cost of $1,895.

Omaha is a slow, steady, and growing real estate market that has quite a few things going for it. It is attractive to residents, allowing it to retain its youth, while it attracts people from across the country in search of work. That isn’t going to make the headlines, but it is exactly the sort of long-term value play that we’d associate with the Oracle of Omaha.

The other best place to invest in real estate in Tacoma, WA. Rents and property values in the Tacoma area are rising due to increased demand and constrained supply. This is an ideal time to buy. Furthermore, there are many reasons to consider investing in Tacoma real estate over homes and condominiums in nearby housing markets. The Tacoma housing market is ideal for those who want to rent to college students.

Being home to so many universities, it allows investors to diversify their holdings instead of being beholden to the reputation and enrollment of any particular school. Tacoma is home to the University of Puget Sound, the University of Washington Tacoma Campus, Faith Evangelical College, Pacific Lutheran University, and St. Martin’s University to name a few.

Buying an investment property is different from buying an owner-occupied home. Whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success as a Real Estate Investor in Omaha, NE is your ability to find great real estate investments in that area.

We, at Norada Real Estate Investments, strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability. Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you may fill up the form given here. One of our investment specialists will contact you to discuss all facets of searching for, buying, and owning a turnkey investment property.

References

- https://www.zillow.com/omaha-ne/home-values

- https://www.neighborhoodscout.com/ne/omaha/real-estate

- https://www.redfin.com/city/9417/NE/Omaha/housing-market

- https://www.realtor.com/realestateandhomes-search/Omaha_NE/overview

- https://www.mercatus.org/bridge/commentary/why-nebraska-ranked-most-fiscally-healthy-state

- https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

- https://smartasset.com/taxes/nebraska-property-tax-calculator

- https://realestate.usnews.com/places/nebraska/omaha

- https://en.wikipedia.org/wiki/Omaha,_Nebraska

- http://www.city-data.com/city/Omaha-Nebraska.html