For some investors, the goal is to own properties “free and clear,” that is, with no mortgage debt. While this is a worthy goal, it does not necessarily make financial sense.

For some investors, the goal is to own properties “free and clear,” that is, with no mortgage debt. While this is a worthy goal, it does not necessarily make financial sense.

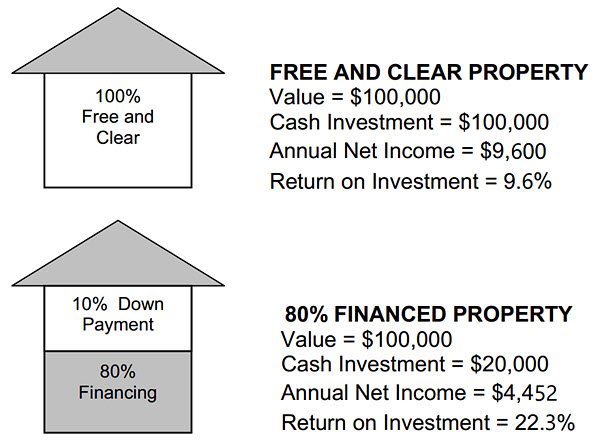

For example, consider a $100,000 property that brings in $9,600 per year in net income (net means gross rents collected, less expenses, such as property taxes, insurance, maintenance, and property management). The $100,000 in equity thus yields a 9.6 percent annual return on investment ($9,600, the annual net cash flow, divided by $100,000, the cash invested).

This formula is the property’s capitalization or “cap” rate, which has nothing to do with the mortgage payments for the property or the amount of cash you have invested.

The reason investors use cap rate is to compare potential return on investment with other investments, without regard to the financing on the property. However, cap rate alone is not necessarily the only factor to consider.

For example, if one property has a cap rate of 7% and another property has a 11% cap rate it would seem obvious that the higher cap rate would be desirable. This is not necessarily so because with a higher cap rate can come higher risk. You must determine if you are comfortable with higher risk associated with higher cap rate.

If the property were financed for 80 percent of its value ($80,000) at 5.0 percent interest, the monthly payment would be approximately $429 per month, or $5,148 per year. Net rent of $9,600 per year minus $5,148 in debt payments equals $4,452 per year in net cash flow. Divide the $4,452 in annual cash flow by the $20,000 cash investment and you have a 22.3 percent return on investment.

Furthermore, with $80,000 more cash, you could buy about four more properties.

As you can see, financing, even when you don’t necessarily “need” to do so, can be more profitable than investing all of your cash in one property.