The Phoenix housing market has seen robust growth and strong home price appreciation in recent years. As the capital and largest city in Arizona, Phoenix offers an attractive year-round climate, steady population and job expansion, and relatively affordable home prices that continue to draw new residents.

The current Phoenix housing market leans towards a seller's market, evident in the increased median sale price, reduced time on the market, and the prevalence of multiple offers. Sellers can benefit from the competitive environment, but buyers should approach the market with a strategic mindset, considering factors like the sale-to-list price ratio and the percentage of homes sold above list price.

How is the Phoenix housing market doing in 2024?

How is the Housing Market Doing Currently?

As of January 2024, the Phoenix housing market is displaying robust growth, with home prices experiencing a noteworthy uptick of 6.4% compared to the previous year. According to Redfin, the median home price now stands at a substantial $430,000. This surge in prices is indicative of the city's flourishing real estate market, creating an environment of opportunity for both buyers and sellers.

On average, homes in Phoenix are spending 54 days on the market, showcasing an impressive reduction from 70 days in the preceding year. A quicker turnover time signals increased demand and a more dynamic market.

Despite a slightly competitive atmosphere, Phoenix homes tend to sell expeditiously, with an average selling time of 49 days. Some properties even attract multiple offers, highlighting the desirability of homes within the area.

How Competitive is the Phoenix Housing Market?

Phoenix's median sale price, soaring at 13% higher than the national average, underscores the city's allure for potential homeowners. The market's competitiveness is evident as homes often sell for about 2% below the list price, emphasizing the willingness of buyers to secure a property swiftly.

The 97.6% sale-to-list price ratio, experiencing a +0.9 pt year-over-year increase, reflects the market's resilience and the confidence of sellers in obtaining favorable prices for their properties. Additionally, 14.4% of homes sold above the list price, indicating a growing trend of competitive bidding.

Moreover, the number of homes with price drops has decreased by 5.7 pt year-over-year, now standing at 31%. This decline suggests a stabilizing market where sellers are becoming more realistic with their pricing strategies.

Are There Enough Homes for Sale in Phoenix to Meet Buyer Demand?

Despite the intense competition, the Phoenix housing market is striving to meet the demand. With 1,028 homes sold in January 2024, there's a marginal decrease from 1,037 in the previous year. This dip in the number of homes sold may indicate a temporary imbalance in supply and demand, but it also reflects the overall stability of the market.

Interestingly, the migration and relocation trends provide insights into the market's dynamics. In the period from November '23 to January '24, 25% of Phoenix homebuyers explored opportunities to move out of the city, while 75% sought to stay within the metropolitan area. The net migration, coupled with local demand, contributes to the market's intricate balance.

Examining where people are moving from, 3% of homebuyers nationwide expressed an interest in relocating to Phoenix. Among them, Seattle homebuyers showed the highest interest, followed by Los Angeles and San Francisco, painting a picture of diverse interest in the Phoenix real estate market.

What is the Future Market Outlook for Phoenix?

While the current market presents a blend of competitiveness and stability, forecasting the future market outlook involves considering various factors. The consistent growth in home prices, coupled with decreasing time on the market, suggests a positive trajectory.

However, it's crucial to monitor migration trends, economic indicators, and external factors that might influence the real estate landscape. As Phoenix continues to be an attractive destination for both local and national homebuyers, the market is likely to remain dynamic and responsive to evolving trends.

ALSO READ: Arizona housing market forecast

Phoenix Housing Market Forecast: What to Expect in 2024 and 2025?

The Phoenix housing market has been one of the hottest in the country in recent years. With a growing economy, strong job market, and desirable climate, it's no wonder that people are flocking to the Valley of the Sun. But what's ahead for the Phoenix housing market? Here's a look at some of the key trends to expect:

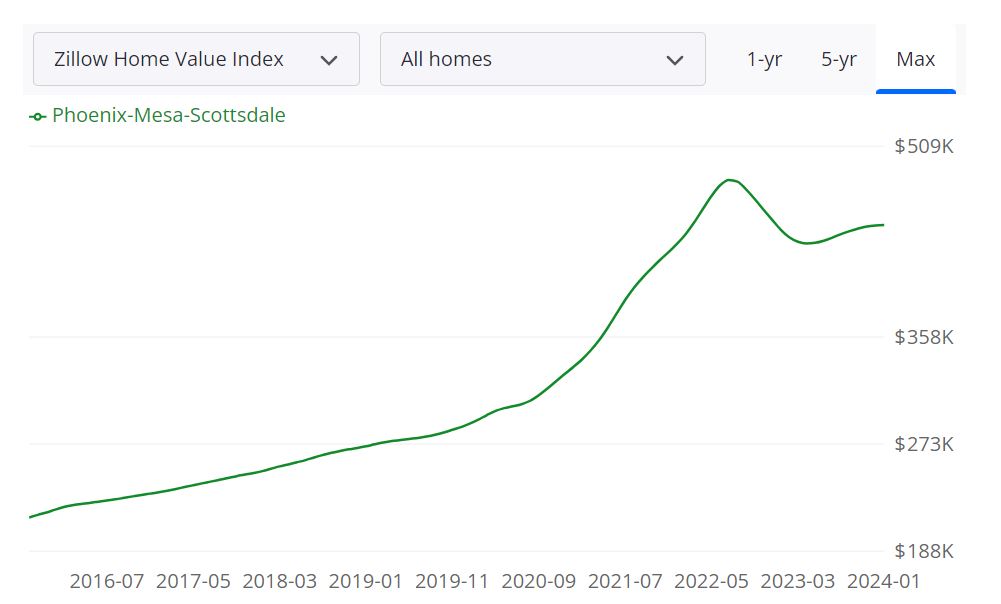

Overview of Phoenix-Mesa-Scottsdale Housing Market

According to Zillow, as of January 31, 2024, the average home value in this area stands at $447,074, experiencing a modest increase of 0.8% over the past year. Homes go to pending in approximately 33 days, showcasing the market's brisk pace.

Housing Metrics Breakdown

Let's delve into the specific housing metrics that provide insights into the Phoenix housing market:

- For Sale Inventory (January 31, 2024): 16,879

- New Listings (January 31, 2024): 4,981

- Median Sale to List Ratio (December 31, 2023): 0.989

- Median Sale Price (December 31, 2023): $435,000

- Median List Price (January 31, 2024): $504,109

- Percent of Sales Over List Price (December 31, 2023): 18.2%

- Percent of Sales Under List Price (December 31, 2023): 57.6%

These metrics provide a comprehensive view of the market's health, from the number of available homes to the pricing dynamics and the speed at which transactions occur.

Market Forecast and Future Trends

Looking ahead, the 1-year Market Forecast (January 31, 2024) predicts a 6.3% increase, indicating positive momentum in the Phoenix housing market.

Understanding the Scope: MSA and Counties

The Phoenix-Mesa-Scottsdale Metropolitan Statistical Area (MSA) encompasses various counties, contributing to the vast housing market. As one of the major metropolitan areas in the United States, its housing market is significant and has a notable impact on the regional and national real estate landscape. With a population of over 4.9 million, the Phoenix housing market is undeniably substantial, making it a key player in the real estate sector.

Are Home Prices Dropping in Phoenix?

Contrary to a drop in home prices, the data reveals an upward trend. The median sale price stands at $435,000 (December 31, 2023), with an average home value of $447,074 (as of January 31, 2024). These figures demonstrate a steady increase, indicating a robust market with appreciation in property values.

Will the Phoenix Housing Market Crash?

As of the current forecast and metrics, there is no indication of an imminent housing market crash. The 1-year Market Forecast (January 31, 2024) suggests a positive trajectory with a projected 6.3% increase. While real estate markets can be influenced by various factors, the current data points towards stability and growth in the Phoenix housing market.

Is Now a Good Time to Buy a House in Phoenix?

Considering the competitive nature of the market, potential buyers may find it challenging, but the decision ultimately depends on individual circumstances. With rising home values and a seller-favorable environment, those looking to invest in Phoenix real estate should carefully weigh their options and explore opportunities for a strategic purchase.

Is Phoenix a Good Place to Invest in Real Estate?

Investing in real estate is a significant decision that requires careful consideration of various factors. The Phoenix Metropolitan Statistical Area (MSA) has been a popular choice for real estate investment due to several compelling reasons supported by factual data:

1. Strong Population Growth

The Phoenix MSA has consistently experienced robust population growth. According to the U.S. Census Bureau, Phoenix was one of the fastest-growing cities in the United States. The increasing population creates a steady demand for housing, making it an attractive market for real estate investment.

2. Thriving Job Market

Phoenix boasts a diverse and thriving job market. The city has become a hub for various industries, including technology, healthcare, manufacturing, and finance. Employment growth stimulates demand for housing, which is a key driver for real estate investment. As of the latest available data, the unemployment rate in the Phoenix MSA is relatively low compared to the national average, indicating a stable job market.

3. Favorable Economic Environment

Phoenix offers a business-friendly environment, attracting corporations and entrepreneurs. The favorable economic conditions contribute to a strong real estate market. According to data from the Greater Phoenix Economic Council, the region has seen consistent economic growth, supporting real estate development and investment.

4. Affordable Housing Market

Compared to other major cities in the United States, the Phoenix MSA offers relatively affordable housing options. The cost of living and housing prices, although rising, is still attractive when compared to cities like Los Angeles, San Francisco, or New York. This affordability makes it appealing to both buyers and renters, increasing the potential for return on investment.

5. Tourism and Lifestyle Appeal

Phoenix is a popular tourist destination, attracting visitors throughout the year. The tourism industry contributes to the demand for short-term rental properties, making it a lucrative venture for real estate investors. Additionally, the city's favorable climate and lifestyle amenities make it an appealing location for both residents and investors.

6. Infrastructure and Development

The Phoenix MSA has witnessed substantial infrastructure development to accommodate its growing population and economy. Investments in transportation, education, healthcare, and other amenities enhance the overall quality of life, making the region more attractive for real estate investment.

Considering these factors, the Phoenix Metropolitan Statistical Area presents a compelling opportunity for real estate investment. However, it's essential to conduct thorough market research, consult with real estate professionals, and assess your investment goals before making any investment decisions.

7. Strong Demand for Rental Properties

Phoenix has experienced a significant influx of residents in recent years, driven by factors such as job opportunities, affordable living, and a desirable climate. Many newcomers initially opt for rental housing, creating a robust demand for rental properties. This demand is projected to continue as the population grows.

Rental rates in Phoenix have been steadily rising due to the high demand for rental properties and the overall growth of the area. While still more affordable than some major cities, rental rates have seen a notable increase, providing a potential for a favorable return on investment for property owners.

Phoenix's lower cost of living and relatively affordable rental rates compared to major cities make it an attractive option for individuals and families looking to rent. The affordability factor contributes to the sustained demand for rental properties in the area.

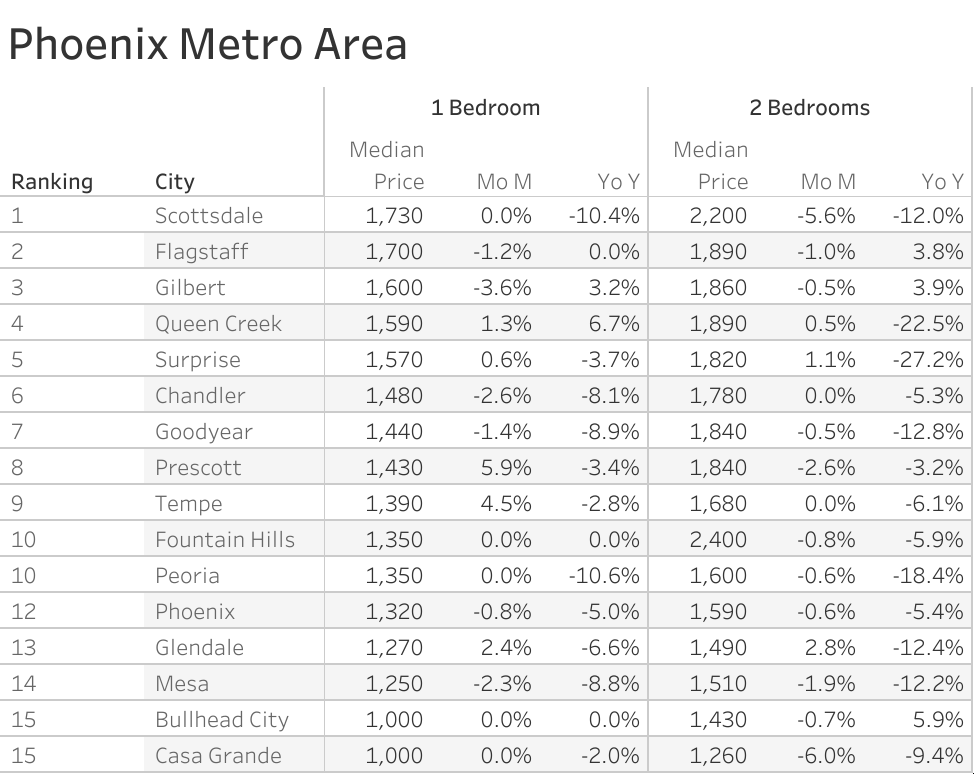

As of February 2024, the median rent for all bedroom counts and property types in Phoenix, AZ is $1,710. This is -10% lower than the national average. Rent prices for all bedroom counts and property types in Phoenix, AZ have decreased by 7% in the last month and have decreased by 16% in the last year.

The “Zumper Phoenix Metro Area Report” analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Arizona one bedroom median rent was $1,307 last month. Scottsdale was the most expensive city with one bedrooms priced at $1,730 whereas Casa Grande & Bullhead City were tied for the most affordable city with one-bedrooms both priced at $1,000.

The best place to buy rental property is to find growing markets. Cities like Surprise and Glendale are good for investors looking to get started with rental property ownership at an affordable price. These trends provide a macro look at the growing rental demand. Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present their own opportunities for investors.

These cities look good for rental property investment this year as rents are growing over there.

The Fastest Growing Cities For Rents in Phoenix Metro Area (Y/Y%)

- Queen Creek had the fastest growing rent, up 6.7% since this time last year.

- Gilbert saw rent climb 3.2%, making it second.

The Fastest Growing Cities For Rents in Phoenix Metro Area (M/M%)

- Prescott had the largest monthly growth rate, up 5.9%.

- Tempe rent increased 4.5% last month, making it second.

- Glendale was third with rent climbing 2.4%.

Tips for Buying and Renting a Home in the Phoenix Housing Market

Buying a Home:

- Get Pre-Approved for a Mortgage: Obtain pre-approval for a mortgage before beginning your home search to understand your budget and enhance your appeal to sellers.

- Act Quickly: Be prepared to make an offer swiftly when you find a home you love, as the Phoenix housing market is highly competitive and homes sell fast.

- Be Willing to Compromise: Recognize that you may need to make concessions in order to enter the market, as it may be challenging to find a home that meets all your preferences.

- Work with a Qualified Real Estate Agent: Collaborate with a proficient real estate agent to assist you in finding the right home and negotiating the best possible price.

Renting a Home:

- Start Your Search Early: Initiate your search well in advance since the rental market in Phoenix is highly competitive, and the best homes are often leased quickly.

- Act Quickly on Desired Homes: If you find a rental property you love, be prepared to act swiftly, given the competitiveness of the Phoenix rental market.

- Be Prepared for a Deposit: Expect to pay a deposit, typically equivalent to one month's rent, as most landlords require it as part of the rental agreement.

- Be Ready to Sign a Lease: Leases in Phoenix usually run for one year, although short-term leases may also be available based on your needs and preferences.

- Engage a Skilled Real Estate Agent: Partner with an experienced real estate agent to assist you in finding the right rental home and negotiating an optimal rental agreement.

References:

- https://armls.com/

- https://www.zillow.com/Phoenix-az/home-values

- https://www.redfin.com/city/14240/AZ/Phoenix/housing-market

- https://www.realtor.com/realestateandhomes-search/Phoenix_AZ/overview