With a surge in home sales and increased prices, the current San Antonio housing market trend suggests a seller's market. Buyers should be prepared for a competitive landscape, with a limited inventory of homes. The consistent demand and robust pricing dynamics indicate a favorable environment for sellers, emphasizing the need for strategic decision-making.

San Antonio Housing Market Trends in 2024

How is the Housing Market Doing Currently?

January 2024 brought both ups and downs to the San Antonio housing market, as reported by the San Antonio Board of REALTORS® (SABOR). The Multiple Listing Service (MLS) Report unveils a significant 11% increase in closed home listings, totaling 2,018 transactions, encompassing both new and existing homes.

The market, however, witnessed a slight setback in terms of pricing, with average and median home prices experiencing 1% and 6% decreases, respectively, compared to the prior year. The residential rental sector remained stable, holding an average price of $1,773.

Existing homes and new constructions experienced distinct trajectories. Existing home sales increased by 4%, with the average price rising by 4% to $375,734. New construction homes, on the other hand, saw a 28% surge in sales but encountered a 11% decrease in average prices, settling at $329,146.

How Competitive is the San Antonio Housing Market?

SABOR's 2024 Chair of the Board, Will Curtis, noted that the Days on Market (DOM) remained consistent at 69 days, showcasing a 0% change from the previous year. Impressively, 92.6% of homes closed for their original list price, underscoring the robustness of the market. The inventory stands at 4.3 months, with 4,030 new listings, 2,551 pending listings, and 11,935 active listings.

In Bexar County, January 2024 witnessed an 8.2% increase in home sales, totaling 1,327 closed listings. However, the price per square foot experienced a 1.4% decrease to $162. The majority of homes, 92.7%, closed for their original list price. The average home price in the county decreased by 2.2%, settling at $330,125, with the median price seeing a 6.9% decrease to $270,000.

Comparatively, Travis County's median price decreased by 3% to $485,000, while Dallas County and Harris County experienced increases of 4.8% and 5%, ending the month at $351,000 and $315,000, respectively.

Across the state of Texas, there was an overall 7.9% increase in home sales, totaling 18,178 transactions in January 2024. Average and median home prices experienced a 2.5% increase, reaching $399,574 and $328,000, respectively. Homes, on average, stayed on the market for 65 days, with 3.4 months of inventory, and 93.7% closing for their original list price.

The state concluded the month with 36,635 new listings, 87,885 active listings, and 24,292 pending sales, indicating a vibrant and active real estate market.

San Antonio Housing Market Forecast 2024 and 2025

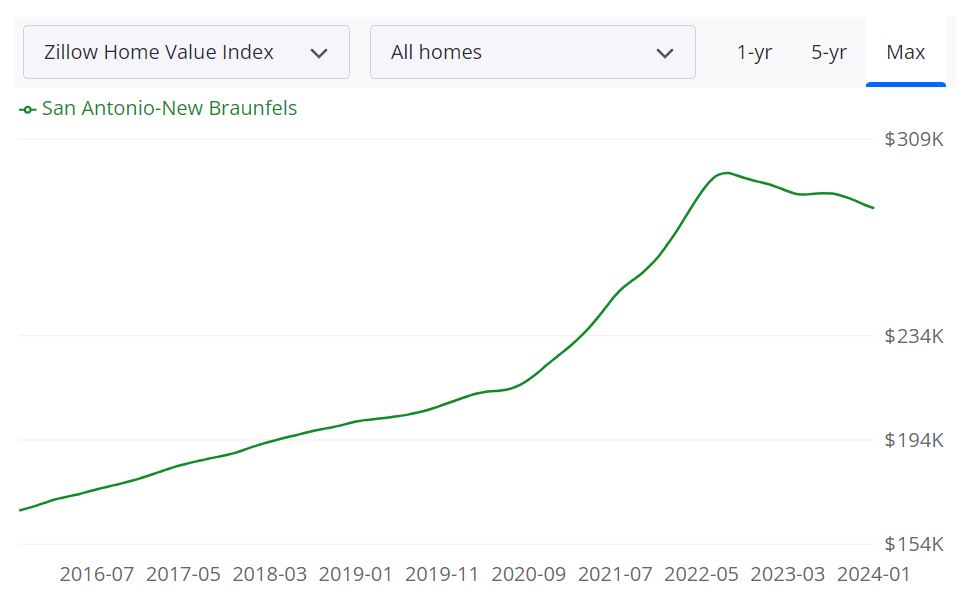

As of January 31, 2024, the San Antonio-New Braunfels housing market presents a dynamic landscape with intriguing data points. According to Zillow, a leading real estate information source, the average home value in this region stands at $283,161, marking a 3.1% decrease over the past year. Homes typically go pending in approximately 49 days, providing insights into the pace of transactions.

Market Forecast

Zillow's 1-year Market Forecast predicts a positive trend in the San Antonio housing market, indicating a +2.4% growth by January 31, 2024. This forecast suggests potential opportunities for homeowners and investors in the coming months.

Housing Metrics Breakdown

For Sale Inventory (January 31, 2024)

The current inventory for homes available for sale in the San Antonio-New Braunfels area is 10,123. This figure provides valuable insights into the abundance of housing options in the market as of the specified date.

New Listings (January 31, 2024)

With 1,941 new listings entering the market as of January 31, 2024, there seems to be a continuous flow of properties. This influx contributes to the overall diversity and availability of housing options for potential buyers.

Median Sale to List Ratio (December 31, 2023)

The median sale to list ratio as of December 31, 2023, is 0.983. This metric highlights the relationship between the listed and actual sale prices, providing a glimpse into the negotiation dynamics within the San Antonio housing market.

Median Sale Price (December 31, 2023)

As of December 31, 2023, the median sale price for homes in the San Antonio-New Braunfels area is $303,167. This figure serves as a benchmark for understanding the average price point within the market.

Median List Price (January 31, 2024)

The median list price for homes in the region as of January 31, 2024, is $331,333. This figure indicates the average asking price for properties available in the market, providing insights into seller expectations.

Percent of Sales Over/Under List Price (December 31, 2023)

On December 31, 2023, 15.8% of sales were recorded as being over list price, while 63.1% were under list price. These percentages shed light on the negotiation dynamics and buyer-seller interactions within the San Antonio housing market.

Understanding the Market

The San Antonio-New Braunfels metropolitan statistical area (MSA) encompasses various counties, contributing to the region's vibrant and expansive housing market. The MSA, with its diverse real estate offerings, plays a significant role in the overall economic landscape of the area.

With a housing market boasting a current inventory of over 10,000 homes, San Antonio-New Braunfels provides ample choices for potential buyers. The continuous influx of new listings and a forecasted market growth of +2.4% indicate the resilience and potential prosperity of this dynamic real estate market.

Are Home Prices Dropping in San Antonio?

The data reveals that the average home value in the San Antonio-New Braunfels area has experienced a 3.1% decrease over the past year, reflecting a slight drop in prices. However, the median sale price, as of December 31, 2023, stands at $303,167, showcasing a stable market. Buyers may find opportunities with this moderate decline, while sellers should consider pricing strategies based on current market dynamics.

With a median list price of $331,333 (as of January 31, 2024) and a forecasted market growth of +2.4%, the market leans slightly towards sellers. The demand, indicated by the 15.8% of sales recorded as being over list price on December 31, 2023, suggests a competitive landscape. However, buyers can still find opportunities, especially considering the 63.1% of sales under list price.

Will the San Antonio Housing Market Crash?

As of now, there is no imminent indication of a housing market crash in the San Antonio-New Braunfels area. The market's resilience, supported by a +2.4% 1-year forecast and various metrics pointing towards a balanced market, suggests stability. However, real estate markets are influenced by various factors, and continuous monitoring is advisable for both buyers and sellers. Keeping an eye on economic indicators, interest rates, and market trends is crucial to staying informed about potential shifts.

Is Now a Good Time to Buy a House in San Antonio?

Considering the current state of the San Antonio housing market, now could be a favorable time for buyers. The 3.1% decrease in average home value over the past year and a median sale price of $303,167 present opportunities for those looking to make a purchase. Additionally, the forecasted +2.4% market growth indicates potential appreciation, adding to the appeal for prospective homebuyers. However, individual circumstances and financial considerations should always be taken into account when making such decisions.

San Antonio Real Estate Investment: Should You Invest Here?

San Antonio is a city located in South Central Texas that has shown steady growth in its real estate market over the years. With its strong economy and affordable cost of living, San Antonio is a great place for real estate investment. Whether you are a first-time investor or an experienced one, San Antonio offers a wide range of real estate opportunities.

Top 7 reasons to invest in San Antonio for the long term:

- Strong Job Market: San Antonio's economy is diverse and has a low unemployment rate, which makes it an attractive place for job seekers. This means that the demand for housing will continue to grow, making it an ideal place for real estate investment.

- Affordable Housing: San Antonio's housing market offers affordable options for both investors and homebuyers. With a lower median home price compared to other major cities in Texas, San Antonio offers a chance for investors to buy properties at a lower cost.

- Population Growth: San Antonio is among the fastest-growing cities in the United States, with a population growth rate of 16.5% from 2010 to 2020. This population growth has resulted in a high demand for housing, which translates to a stable real estate market for investors.

- Military Presence: San Antonio is home to several military bases, which has a positive impact on the local economy. The presence of military personnel means that there is a consistent demand for housing in the area, making it an ideal place for real estate investment.

- Pro-Business Climate: San Antonio is known for its pro-business environment, which attracts new businesses and creates job opportunities. This environment helps to keep the local economy stable and supports the growth of the real estate market.

- Favorable Landlord-Tenant Laws: Texas has some of the most favorable landlord-tenant laws in the country, which can make investing in San Antonio's real estate market less risky for investors. These laws provide landlords with more control over their properties and help ensure that tenants fulfill their lease agreements.

- Strong Rental Demand: San Antonio has a strong rental market, with a vacancy rate of less than 6%. This means that there is a high demand for rental properties, which can help investors generate a steady stream of rental income.

- Appreciation Potential: San Antonio's real estate market has been appreciating steadily over the past decade, and this trend is expected to continue in the coming years. This means that investors who purchase property in San Antonio now could see their investments appreciate in value over time

- Favorable Tax Laws: Texas has favorable tax laws for real estate investors, including no state income tax and low property taxes. This can help investors save money on taxes and increase their net returns on investment.

- Tourism: San Antonio is a popular tourist destination, attracting millions of visitors each year. The city is home to several famous landmarks, including the Alamo and the River Walk, which contribute to the local economy and provide additional opportunities for real estate investment.

- Quality of Life: San Antonio offers a high quality of life with excellent schools, affordable cost of living, and a warm climate. This makes it an attractive place for families and retirees, which in turn increases the demand for housing and creates a stable real estate market for investors.

- Low Cost of Living: San Antonio's low cost of living makes it an attractive destination for residents and investors alike. The city offers affordable housing, transportation, and entertainment options, which can help investors maximize their returns.

Overall, San Antonio's growing population, diverse housing options, strong economy, and favorable landlord-tenant laws make it an attractive destination for real estate investors. With strong rental demand, appreciation potential, and favorable tax laws, San Antonio is a promising market for long-term real estate investment.

References

- https://realestate.sabor.com/

- https://www.zillow.com/sanantonio-tx/home-values

- https://www.zumper.com/rent-research/san-antonio-tx

- https://www.rentcafe.com/average-rent-market-trends/us/tx/bexar-county/san-antonio/