The surge in home prices coupled with robust sales activity suggests that the San Diego housing market is among the hottest in the nation. San Diego home prices were up 11.2% year over year, according to the latest S&P/Case-Shiller Home Price Index. San Diego continued to lead the 20-city index from the last month.

The strongest annual home price acceleration compared with the previous month was again seen in San Diego with a monthly gain of 1.8%. The report shows that San Diego home prices increased faster than their pre-pandemic paces in January. As of March,

The median listing home price in San Diego is $995,000, with a median listing home price of $748 per square foot, according to Realtor.com. San Diego is a seller's housing market which means that more people are looking to buy than there are homes available. With its stunning coastal landscapes, thriving economy, and diverse communities, San Diego remains a sought-after destination for those looking to settle down or make profitable real estate ventures.

According to recent data from the California Association of Realtors (C.A.R.), the San Diego housing market reflects robust activity, with a notable upward trajectory in median sold prices for existing single-family homes. In March 2024, the median sold price surged to $1,020,000, marking a 4.1% increase from the previous month and an impressive 11.5% jump from the same period last year.

This substantial appreciation underscores the market's resilience and attractiveness to buyers. Furthermore, the sales volume in San Diego experienced a significant uptick, with a 15.7% month-over-month increase, though there was a slight 7.1% decline compared to March 2023. Despite this dip, the market remains buoyant and conducive to transactions.

Comparison with Southern California

Zooming out to assess the broader regional context, San Diego stands out among its Southern California counterparts. While the median sold price for existing single-family homes in Southern California as a whole reached $850,000 in March 2024, San Diego surpasses this figure significantly, indicating its prestige and desirability in the market.

Moreover, the month-over-month and year-over-year price increases in San Diego outpace those of Southern California, reflecting the city's resilience and attractiveness to potential buyers and investors.

Several factors contribute to the buoyancy of San Diego's housing market. The region's robust economy, anchored by key industries such as biotechnology, defense, and tourism, fuels the demand for housing. Additionally, San Diego's status as a cultural hub and destination for outdoor enthusiasts further enhances its appeal.

Furthermore, limited inventory continues to exert upward pressure on prices, as demand outweighs supply in many neighborhoods. While challenges such as affordability concerns and supply constraints persist, San Diego's allure and potential for long-term growth are undeniable.

San Diego Housing Market Forecast for 2024 and 2025

The San Diego-Carlsbad Metropolitan Statistical Area (MSA) encompasses San Diego County, one of the most populous counties in California. Its housing market is sizable, characterized by diverse neighborhoods and a range of property types catering to varied preferences and budgets.

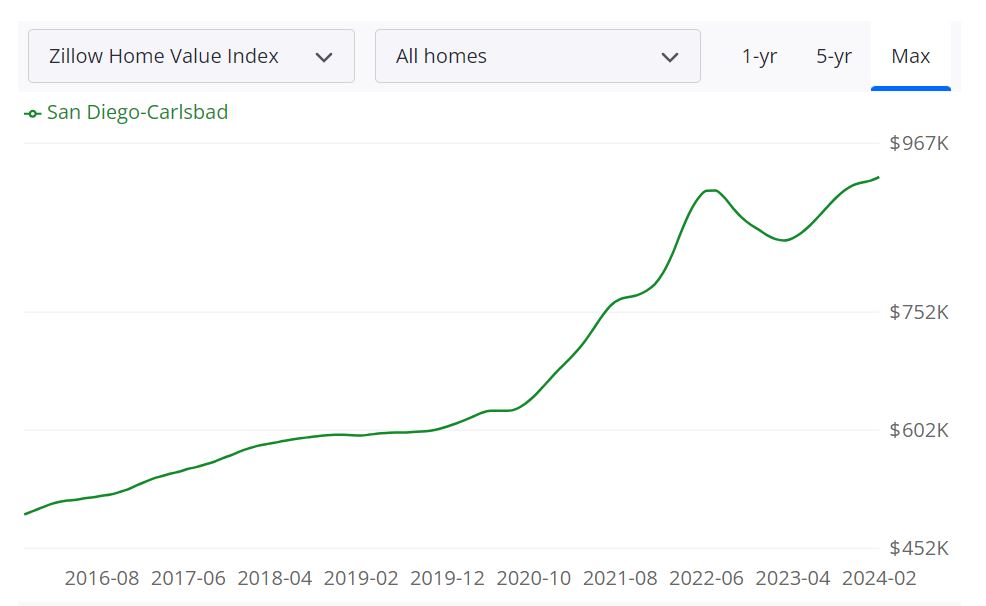

The San Diego-Carlsbad housing market is experiencing robust growth, with the average home value reaching $946,976, marking a significant 10.6% increase over the past year. According to Zillow, homes in this area typically go pending in approximately 11 days, reflecting a competitive market environment.

The current housing market in the San Diego Metro area leans towards being a seller's market. With limited inventory and high demand, sellers have the upper hand in negotiations, often receiving multiple offers and achieving sales prices at or above listing prices. Buyers may encounter fierce competition and may need to act quickly to secure desired properties.

Contrary to expectations, home prices in the San Diego Metro area are not dropping. Instead, they continue to rise steadily, as evidenced by the 10.6% increase in average home value over the past year. This trend reflects the strong demand and limited supply conditions prevailing in the market.

While predictions about market crashes are speculative, there are currently no indications of an imminent housing market crash in the San Diego Metro area. The market is characterized by stable growth and robust demand, supported by factors such as a strong economy, low mortgage rates, and desirable living conditions. However, it's essential to monitor market trends and factors that could influence future outcomes.

Key Housing Metrics Explained

1. 1-year Market Forecast

The 1-year market forecast as of March 31, 2024, indicates a +3.6% projected growth in the housing market. This forecast provides insights into the anticipated trajectory of property values and market trends.

2. For Sale Inventory

As of March 31, 2024, there are 4,440 properties listed for sale in the San Diego-Carlsbad area. This inventory represents the available housing stock and plays a crucial role in determining market supply and demand dynamics.

3. New Listings

In March 31, 2024, 2,117 new listings entered the market. These fresh listings contribute to the overall inventory and offer opportunities for prospective buyers to explore a variety of housing options.

4. Median Sale to List Ratio

The median sale to list ratio provides insight into pricing trends and negotiation dynamics. As of February 29, 2024, the ratio stands at 1.000, indicating that, on average, properties are selling at their listed price.

5. Median Sale Price

The median sale price in the San Diego-Carlsbad area, recorded on February 29, 2024, is $833,333. This figure represents the midpoint of all property sale prices and offers a benchmark for assessing market affordability.

6. Median List Price

With a median list price of $934,133 as of March 31, 2024, sellers in the San Diego Metro area are positioning their properties competitively in line with prevailing market conditions.

7. Percent of Sales Over and Under List Price

The percent of sales over list price and percent of sales under list price metrics, both recorded on February 29, 2024, at 43.0% and 42.9% respectively, shed light on pricing dynamics and the prevalence of bidding wars in the market.

Here's the graph showing the San Diego home price appreciation and forecast for the next twelve months.

Exploring the Greater San Diego Area Housing Market: March 2024 Report

The Greater San Diego housing market, as detailed in the recent report by the Greater San Diego Association of REALTORS®, shows that while there are fluctuations in various metrics, but the overall market remains active and dynamic.

Market Activity Overview

In March 2024, there were notable changes in various aspects of the housing market. Closed sales saw a 10.9% decrease for detached homes and a 7.3% decrease for attached homes. However, pending sales showed a 4.6% increase for detached homes, albeit with a 2.4% decrease for attached homes.

Inventory and Supply Dynamics

One of the significant shifts was observed in inventory levels. While inventory decreased slightly by 1.1% for detached homes, attached homes saw a significant increase of 33.4%. This surge in attached home inventory could indicate changing preferences or market conditions in certain segments.

Price Trends

Median sales prices also experienced noteworthy changes. Detached homes saw a substantial 12.1% increase, reaching a median price of $1,050,000. Attached homes, on the other hand, saw a 5.2% uptick, with a median price of $670,000. These price increases reflect the ongoing demand for housing in the Greater San Diego Area.

Market Efficiency

Days on market, a crucial metric indicating market efficiency, decreased by 23.7% for detached homes and 9.4% for attached homes. This reduction suggests that properties are selling more quickly, possibly due to strong demand or effective marketing strategies by sellers.

Supply and Demand Balance

Despite the increase in inventory for attached homes, supply increased by 15.4% for detached homes and 45.5% for attached homes. This imbalance between supply and demand could influence future market dynamics, potentially impacting pricing and negotiation strategies.

The San Diego real estate market has been ranked among the ten most expensive real estate markets in the country, though it ranks below several other West Coast cities. This creates massive demand for San Diego rental properties by those who simply cannot afford to buy homes.

The rental market will continue to grow as the city grows an estimated 500,000 population by 2050, adding tens of thousands each year. The median rent in San Diego is $2700. The rent you’d receive on single-family San Diego rental properties would, of course, be much higher.

Renters vs. Owners in San Diego

San Diego's property rental market is influenced by several factors, including the local economy, job opportunities, and the overall demand for housing. It's a city known for its mix of urban and suburban neighborhoods, each with its own rental and ownership dynamics.

San Diego had a diverse housing landscape with a mix of renters and property owners.

- Renters: San Diego has a significant population of renters, comprising individuals and families who lease residential properties. This includes apartments, condominiums, townhouses, and single-family homes. The exact percentage of renters relative to property owners can vary by neighborhood and demographic factors.

- Owners: San Diego also has a substantial number of property owners. These are individuals or entities who own residential properties and may either live in their properties or lease them out to renters. Property owners contribute to the diversity of the city's housing options.

Size of the Rental Market

The size of the San Diego property rental market is substantial, with a wide range of rental properties available to residents. This market includes apartments, houses, and various types of housing units. The exact size of the rental market can fluctuate based on factors like population growth, economic conditions, and housing development trends.

Real estate agencies, rental platforms, and government agencies often track and report on the status of the rental market, offering detailed insights into its size and dynamics.

For the most up-to-date and specific information regarding the current state of the San Diego property rental market, including the number of renters and property owners, it's recommended to refer to the latest reports and data from sources like local real estate associations, government housing agencies, and real estate websites.

San Diego's property rental market is an essential component of the city's real estate landscape, offering a wide range of housing options to its diverse population.

San Diego County shows it has a Median Gross Rent of $1,842 which is the third most of all other counties in the greater region. Comparing rental rates to the United States average of $1,163, San Diego County is 58.4% larger. Also, measured against the state of California, rental rates of $1,698, San Diego County is 8.5% larger.

San Diego Apartment Rent Prices

As of April 2024, the median rent for all bedroom counts and property types in San Diego, CA is $2,850. This is +43% higher than the national average.

Rent prices for all bedroom counts and property types in San Diego, CA have increased by 4% in the last month and have decreased by 3% in the last year.

The monthly rent for an apartment in San Diego, CA is $2,618. A 1-bedroom apartment in San Diego, CA costs about $2,388 on average, while a 2-bedroom apartment is $3,200. Houses for rent in San Diego, CA are more expensive, with an average monthly cost of $4,100.

Housing Units and Occupancy

In terms of occupied housing units, San Diego has the following distribution:

- Renter-occupied Households: Renter-occupied households make up 53% of the housing units in San Diego, indicating a significant presence of renters in the city.

- Owner-occupied Households: Owner-occupied households account for 48% of the housing units, highlighting a balanced mix of homeowners in the area.

Affordable and Expensive Neighborhoods

San Diego's neighborhoods offer a range of rental prices, making it accessible for various budgets:

The Most Affordable Neighborhoods:

- Bay Park: The average rent in Bay Park is $2,135 per month.

- University Heights: In University Heights, the average rent is around $2,200 per month.

- North Park: North Park offers an average rent of approximately $2,273 per month.

The Most Expensive Neighborhoods:

- Carmel Valley: Carmel Valley is one of the more expensive neighborhoods, with an average rent of $2,942 per month.

- Mission Valley East: In Mission Valley East, the average rent can go for $2,894 per month.

- Mission Beach: Mission Beach has an average rent of $2,850 per month.

Popular Neighborhoods

Some neighborhoods in San Diego are particularly popular among renters:

- Mission Beach: Mission Beach tops the list with 1,115 listings, making it a sought-after area for renters.

- Pacific Beach: Pacific Beach is also a popular choice, offering 760 listings for prospective renters.

- Ocean Beach: Ocean Beach features 295 places for rent, making it a vibrant neighborhood for renters.

These insights provide a snapshot of the current rental market in San Diego. Rental prices have seen some fluctuations in recent months, with variations in different apartment types. The city offers a range of neighborhoods to suit different budgets and preferences, with a balanced mix of renters and homeowners.

References

- https://www.car.org/

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.sdar.com/press-releases.html

- https://www.zillow.com/SanDiego-ca/home-values

- https://www.zumper.com/rent-research/san-diego-ca