The Seattle housing market continues to exhibit resilience, characterized by increasing median prices and a seller's market environment marked by low inventory and high demand.

Active Listings for Sale: In March 2024, Seattle saw a total of 1,141 active listings, reflecting a 5.36% increase compared to the same period in 2023. However, in contrast, all of King County experienced a decrease of 6.80% in active listings, totaling 2,316.

Closed Sales: Brokers recorded 688 closed sales in Seattle, indicating a marginal 0.43% decrease from the previous year. In comparison, all of King County witnessed a 3.78% decline with 1,882 closed sales.

Pending Sales: Seattle showed promise in pending sales, registering 842 transactions, marking a 1.32% increase from the preceding year. Conversely, all of King County saw a more substantial uptick of 8.25%, totaling 2,559 pending sales.

Median Sales Price: The median sales price in Seattle climbed by 8.09% to $831,000, compared to $768,832 in March 2023. Similarly, in all of King County, the median price surged by 11.84% to $850,000, up from $760,000 in the previous year.

Months of Inventory (MOI): With 1.66 months of inventory, Seattle's housing market remains firmly in favor of sellers. This trend is mirrored in all of King County, where the MOI stands at 1.23, reinforcing the seller's market conditions.

Is Seattle a Seller's Housing Market?

Seattle is experiencing a seller's market. This status is characterized by high demand from buyers, surpassing the available inventory of homes. The median days on the market for homes in Seattle, WA is 26 days. This metric indicates that properties are selling relatively quickly, reflecting the competitive nature of the market.

In March 2024, Seattle maintained its stability with the median listing home price staying at $815,000, showing no significant change from the previous year. The median listing home price per square foot remained at $594. Meanwhile, the median home sold price stood at $830,000. These figures paint a picture of a market that is holding steady in terms of pricing.

The sale-to-list price ratio was reported at 100%, indicating that homes in Seattle, WA were typically selling for close to their asking price in March 2024. This ratio signifies a balanced market where buyers and sellers are finding common ground in negotiations.

The market is expected to maintain its resilience throughout 2024, with prices likely to remain stable. Factors such as a strong economy, robust job market, and desirable lifestyle amenities continue to attract buyers to the region. However, inventory shortages may persist, keeping the market competitive and driving prices upward in certain segments.

Monthly Market Update: Prices and Sales Surge Despite Reduced Inventory

According to Northwest MLS, despite a decrease in mortgage rates, which dropped by 0.15% to 6.79%, the market hasn't witnessed a significant shift in buyer behavior or seller sentiment. While this decline in interest rates is encouraging, it hasn't translated into a notable increase in purchasing power for buyers or motivated sellers to relinquish their low-rate mortgages.

Although the number of closed sales decreased by 11.2% year-over-year, median sales prices have continued to climb steadily, with a noteworthy increase of 7.5%. Selma Hepp, chief economist for CoreLogic, noted that the Northwestern markets are exhibiting signs of thawing, with new listings picking up from the lows experienced in 2023. However, despite this uptick in listings, the imbalance between supply and demand persists, leading to continued upward pressure on home prices.

Important Insights from March's Data

March's data revealed several key takeaways:

- The median sales price: Homes in 19 out of 26 counties saw an increase in median sales prices compared to March 2023. King County led the pack with a median sales price of $850,000, followed by San Juan and Snohomish counties.

- Inventory levels: Overall, there was a 1.16% year-over-year increase in active property listings across Washington counties covered by NWMLS.

- Sales activity: While six counties experienced an increase in the number of homes sold year-over-year, the majority saw a decrease. Condominium sales dipped slightly, but median sale prices increased by over 5%.

Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington, emphasized that while mortgage rates remain relatively high, inventory levels are on the rise. However, the scarcity of available homes continues to fuel competition among buyers, resulting in a continued upward trajectory for median home prices.

Consumer and Broker Activity

In March 2024, consumer activity remained robust:

- Showings: The total number of showings scheduled through NWMLS software increased by 4% from February 2024 to March 2024.

- Property access: Keyboxes at listed properties were accessed 23% more frequently in March 2024 compared to February 2024.

- Down Payment Resource (DPR) program: Brokers are actively identifying properties eligible for the DPR program, offering assistance to consumers navigating the market. In March 2024, over 11,000 listed properties were eligible for this program.

Looking ahead, while the increase in inventory levels is a positive sign, it's crucial to monitor how these trends unfold in the coming months. Will the market continue to favor sellers, or will we see a shift towards a more balanced landscape? Only time will unveil the answers.

Seattle (King County) Housing Market Trends

Below is the most recent Seattle Housing Market Report released by “Northwest MLS.” The report compares the key housing metrics of the City of Seattle (which is part of King County).

Here are the numbers (RESIDENTIAL+CONDO) for March 2024 compared with March 2023.

ACTIVE LISTINGS FOR SALE

- The total active listings in Seattle were 1,141.

- This represents an increase of 5.36% as compared to March 2023.

- The total active listings in All of King County were 2,316.

- This represents a drop of -6.80% as compared to March 2023.

CLOSED SALES

- 688 closed sales were registered by brokers in Seattle.

- This represents a year-over-year decrease of 0.43%.

- 1,882 closed sales were registered in All of King County.

- This represents a year-over-year decrease of 3.78%.

PENDING SALES

- 842 pending sales were registered by brokers in Seattle.

- This represents an increase of 1.32% from the same month a year ago.

- 2,559 pending sales were registered in All of King County.

- This represents an increase of 8.25% from the same month a year ago.

MEDIAN SALES PRICE

- Seattle's median sales price increased by 8.09% to $831,000.

- Last year, at this time, the median price in Seattle was $768,832.

- King County's median price increased by 11.84% to $850,000.

- Last year, at this time, the median price in King County was $760,000.

MONTHS OF INVENTORY (MOI)

- 1.66 months represents the number in Seattle.

- Months of supply in All of King County is 1.23.

- 6 months of supply is when you have a balanced real estate market.

- This shows that this region continues to be a seller’s housing market.

Why is the Seattle Housing Market So Hot?

Seattle's housing market is red hot, and it's due to the influx of high-paid tech employees from companies like Amazon, Microsoft, Google, and Facebook. These employees have been seeking more spacious homes with office areas to work remotely during the pandemic, and they have the financial resources to outcompete other buyers and drive up home prices.

Despite an increase in inventory, the Puget Sound region's housing market remains tight, with less than two months of supply. This means the region continues to be a seller's market, with a limited number of homes available to meet the high demand from buyers. As a result, home prices are likely to remain high for the foreseeable future.

The city's vibrant cultural scene, scenic beauty, and excellent quality of life also make it an attractive place to live. Despite the rising prices, Seattle's housing market continues to attract buyers from all over the country. The city's strong job market, diverse economy, and progressive values make it a desirable destination for people from different backgrounds and professions. This has resulted in a highly competitive real estate market, where homes are selling quickly and above asking prices.

However, the shortage of housing inventory has become a major concern for the city's policymakers, as it has led to affordability issues and exclusionary zoning practices. To address these challenges, Seattle has launched several initiatives, such as increasing the supply of affordable housing, promoting sustainable development, and reforming zoning laws. These efforts aim to ensure that Seattle remains an inclusive and livable city for all its residents, regardless of their income or background.

ALSO READ: Which Are The Hottest Markets in Seattle?

ALSO READ: Washington State Housing Market Forecast

Seattle Housing Market Forecast for 2024 and 2025

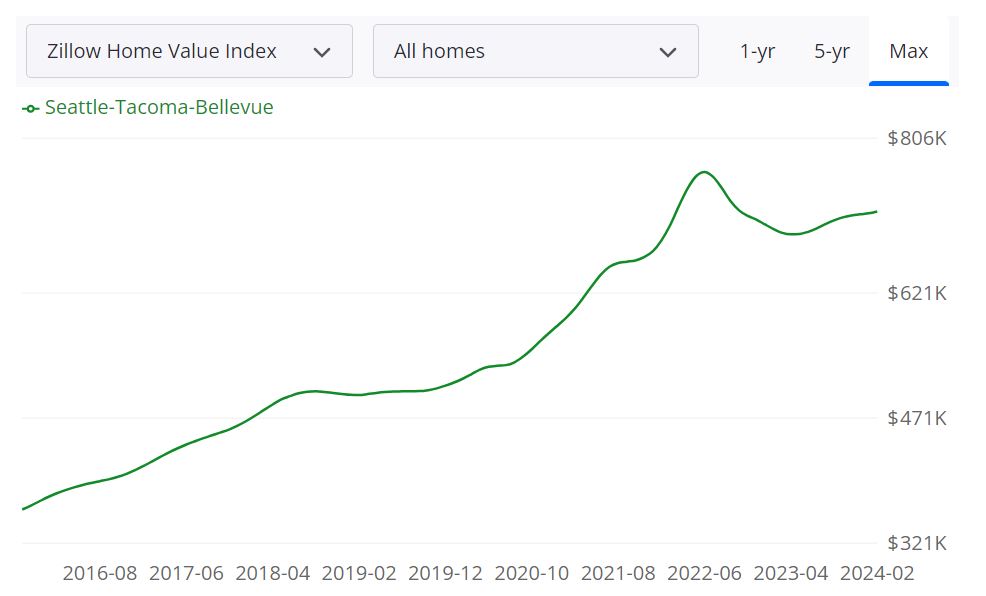

According to Zillow, the average home value in the Seattle-Tacoma-Bellevue metropolitan area stands at $719,217, reflecting a 49.7% decrease over the past year. Additionally, properties typically transition to pending status within an expedited timeframe of approximately 14 days. These figures, based on data through February 29, 2024, indicate notable trends within the region's real estate landscape.

Looking ahead, the 1-year market forecast for the Seattle housing market presents a glimpse into the anticipated trends and potential shifts in the coming months. With a projected growth rate of 1.1%, as of February 28, 2024, this forecast suggests a modest yet stable trajectory for the region's real estate sector.

Key Housing Metrics Explained

1. For Sale Inventory: As of February 29, 2024, there were 4,741 properties listed for sale within the Seattle-Tacoma-Bellevue area, reflecting the available housing stock within the market.

2. New Listings: The number of 1,987 new listings added to the market as of February 29, 2024, signifies ongoing activity and potential opportunities for buyers and sellers alike.

3. Median Sale to List Ratio: With a 1.000 median sale to list ratio recorded as of January 31, 2024, this metric provides insight into the correlation between listed prices and actual sale prices, indicating market competitiveness.

4. Median Sale Price: The median sale price in the Seattle area, standing at $640,000 as of January 31, 2024, represents the midpoint value of homes sold within the specified timeframe.

5. Median List Price: Reflecting the current asking prices within the market, the median list price as of February 29, 2024, was $683,317, guiding both buyers and sellers in their decision-making processes.

6. Percent of Sales Over and Under List Price: These percentages, recorded as 30.6% and 46.6% respectively as of January 31, 2024, highlight the prevalence of competitive bidding and negotiation strategies in the market.

Understanding the Market Area

The Seattle-Tacoma-Bellevue metropolitan statistical area (MSA) encompasses a diverse range of communities, including major cities such as Seattle, Tacoma, and Bellevue, as well as surrounding suburban and rural areas. This expansive region spans several counties, including King County, Pierce County, and Snohomish County, among others.

With its housing market characterized by a blend of urban amenities, natural beauty, and economic opportunities, the Seattle area attracts a wide range of homebuyers and investors. Its status as a major tech hub, coupled with picturesque landscapes and a vibrant cultural scene, underpins its appeal and contributes to its robust real estate market.

Are Home Prices Dropping in Seattle?

The data indicates that home prices in the Seattle area have indeed experienced a decrease over the past year, with the average home value down by 49.7%. While this may raise concerns about a potential downward trend in prices, it's essential to consider broader market factors and historical trends.

Market fluctuations are a natural part of the real estate cycle, influenced by factors such as economic conditions, housing supply, and demand dynamics. While recent declines in home prices may reflect current market conditions, they do not necessarily indicate a prolonged trend. Continued monitoring of market indicators and expert analysis can provide valuable insights into future price movements.

Will the Seattle Housing Market Crash?

The question of whether the Seattle housing market is at risk of a crash is a complex one, influenced by various factors and uncertainties. While recent data may raise concerns about the stability of the market, it's essential to consider the broader context and historical trends.

Market crashes are typically precipitated by a combination of factors, including economic downturns, speculative bubbles, and external shocks. While no market is immune to fluctuations, the Seattle area's diverse economy, strong job market, and continued demand for housing suggest a degree of resilience.

Is Now a Good Time to Buy a House in Seattle?

Whether now is a good time to buy a house in the Seattle market depends on various factors, including individual circumstances, financial considerations, and long-term goals. While recent data may suggest opportunities for buyers, it's essential to consider both short-term and long-term trends.

Market conditions, such as pricing trends, inventory levels, and interest rates, can influence the timing of a home purchase. Additionally, factors such as personal finances, employment stability, and lifestyle preferences play a significant role in the decision-making process.

For some buyers, current market conditions may present favorable opportunities, such as competitive pricing and a diverse selection of properties. However, it's advisable to conduct thorough research, seek expert advice, and carefully evaluate individual needs and objectives before making a decision.

REFERENCES

- https://www.nwmls.com/

- https://www.zillow.com/seattle-wa/home-values

- https://www.redfin.com/news/seattle-homes-sold-above-list-price/

- https://www.realtor.com/realestateandhomes-search/Seattle_WA/overview

- https://www.rentcafe.com/average-rent-market-trends/us/wa/seattle

- https://www.neighborhoodscout.com/wa/seattle/real-estate

- https://seattlerealestatenews.com/category/info/seattle-monthly-housing-news

- https://www.seattlepi.com/coronavirus/article/best-time-to-buy-or-sell-a-house-during-pandemic-15287608.php