Vancouver, WA is a thriving city located in the state of Washington, just across the river from Portland, Oregon. Known for its beautiful landscapes, outdoor recreational opportunities, and vibrant community, Vancouver has become an attractive place to live for many people. As the real estate market plays a significant role in the city's growth, it is essential to understand the current market trends and forecast for Vancouver, WA.

Current Vancouver WA Housing Market Trends

According to Realtor.com®, Vancouver, WA is a seller's market. This classification implies that the demand for homes surpassed the available inventory, creating an environment where sellers hold a favorable position. With more eager buyers than homes on the market, sellers can enjoy advantageous conditions, often leading to efficient transactions.

Median Listing Home Price and Year-Over-Year Trends

In January 2024, Vancouver, WA witnessed a median listing home price of $529.9K, exhibiting a noteworthy 1.9% year-over-year increase. This upward trajectory signifies the resilience and growth of the local real estate market, making it an enticing prospect for both buyers and sellers.

Median Listing Home Price per Square Foot

Understanding the finer details, the median listing home price per square foot in Vancouver, WA stood at a robust $299. This metric provides valuable insights for those seeking a more granular perspective on the housing market, showcasing the city's commitment to offering value in every square foot of real estate.

Median Home Sold Price and Sale-to-List Price Ratio

For those keen on actual transaction figures, the median home sold price in Vancouver, WA was recorded at $475K. Moreover, the sale-to-list price ratio stood at a commendable 100%, indicating that homes were generally fetching their asking prices. This parity between listing and selling prices highlights the equilibrium in the market, fostering a fair and transparent environment.

Median Days on Market

Time is of the essence in the Vancouver, WA housing market, with homes typically spending an average of 55 days on the market. The decreasing trend in median days on market since the previous month indicates a brisker pace of transactions. Comparatively, there's a slight uptick from the figures recorded last year, underlining the resilience and stability of the market over time.

Vancouver WA Housing Market Forecast for 2024 and 2025

As the Vancouver housing market unfolds against the backdrop of economic dynamics and shifting trends, understanding its current status and future projections becomes pivotal for anyone looking to engage in real estate transactions. Based on the provided data, there is no indication of an imminent housing market crash in Vancouver. The steady appreciation in home values and balanced market metrics suggest a resilient and stable real estate environment.

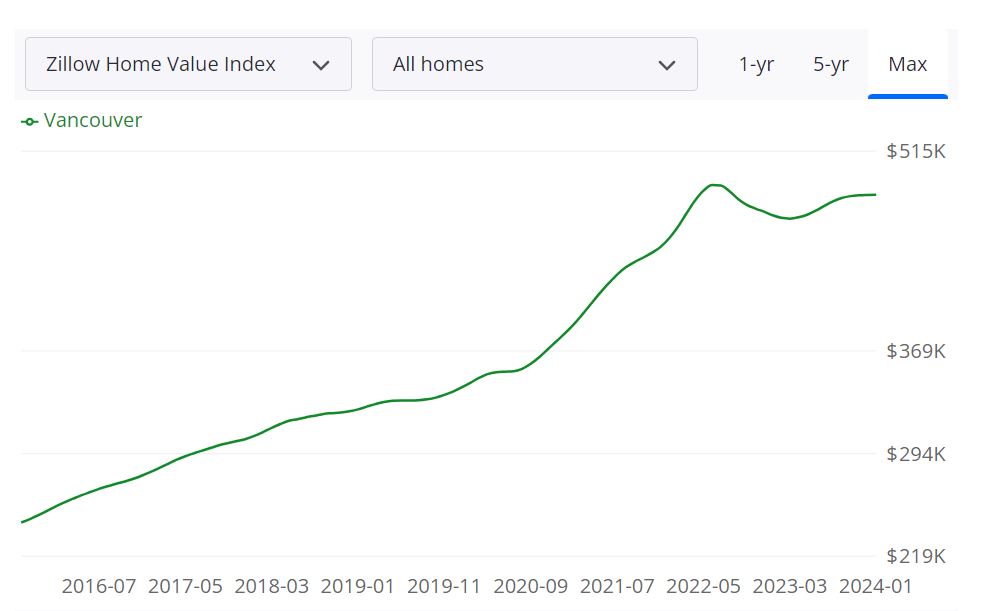

Average Home Value:

According to Zillow, the average home value in Vancouver stands at $483,765, reflecting a 3.2% increase over the past year. This data, accurate as of January 31, 2024, indicates a robust and appreciating housing market in the region.

Days on Market:

Homes in Vancouver are swiftly making their way to pending status, with an average of 23 days on the market. This quick turnaround time highlights the high demand for properties in the area.

Housing Metrics Breakdown:

- For Sale Inventory (January 31, 2024): 620

- New Listings (January 31, 2024): 187

- Median Sale to List Ratio (December 31, 2023): 1.000

- Median Sale Price (December 31, 2023): $471,667

- Median List Price (January 31, 2024): $506,630

- Percent of Sales Over List Price (December 31, 2023): 28.5%

- Percent of Sales Under List Price (December 31, 2023): 45.7%

Analysis:

The inventory of homes for sale as of January 31, 2024, is 620, providing potential buyers with a range of options. This, coupled with 187 new listings in the same period, showcases a healthy and active real estate market in Vancouver.

The median sale to list ratio of 1.000 as of December 31, 2023, indicates a balanced market where properties are generally selling close to their listed prices. Moreover, the median sale price of $471,667 and the median list price of $506,630 provide valuable insights into the affordability and expectations within the market.

Notably, 28.5% of sales over list price and 45.7% under list price, as of December 31, 2023, suggest a diverse range of negotiation scenarios, indicating a market that caters to both sellers and buyers.

Are Home Prices Dropping in Vancouver?

Contrary to the notion of dropping home prices, the data suggests a different trend. The average home value in Vancouver has experienced a 3.2% increase over the past year, indicating a steady appreciation rather than a decline. As of now, the market reflects stability and growth, making it less likely for home prices to drop significantly in the immediate future.

Will the Vancouver Housing Market Crash?

While predicting market crashes is inherently challenging, the current indicators for the Vancouver housing market do not signal an impending crash. The steady increase in average home value, coupled with a balanced median sale to list ratio of 1.000 as of December 31, 2023, suggests a resilient market. However, it's essential to stay vigilant and monitor economic factors that may influence the real estate landscape.

Is Now a Good Time to Buy a House in Vancouver?

Considering the dynamics of the Vancouver housing market, the question of whether now is a good time to buy a house depends on individual circumstances and goals. For potential buyers, the relatively low inventory and the upward trajectory of home values may pose challenges. However, securing a property in a market that shows consistent growth can be a sound long-term investment.

Should You Invest in Vancouver Real Estate Market?

The Vancouver real estate market can be an attractive investment opportunity for those looking for a stable and growing market. The city's strong economy and rental property market make it an attractive destination for investors. Here are some reasons why you should consider investing in Vancouver real estate:

- Strong economy: Vancouver's economy is diverse and growing, with a mix of industries such as technology, healthcare, and education. The city has a low unemployment rate and a high median household income, which makes it an attractive destination for people looking to relocate for work. A strong economy means that there is a high demand for housing, which can translate into higher rental income and appreciation of property values. Additionally, Vancouver's proximity to major cities like Portland and Seattle has made it an attractive location for businesses and investors alike.

- Rental property market: Vancouver's rental market is strong, with a high demand for rental properties and low vacancy rates. This makes it an attractive option for investors looking for steady rental income. Additionally, the city has introduced measures to protect tenants, which provides more security for renters and encourages them to stay longer in their rental properties.

- Additionally, Vancouver's strong tourism industry has led to a growing demand for short-term rental properties like Airbnb, which can be a lucrative investment opportunity for savvy investors.

- Growing population: Vancouver's population is growing, which means that there will be a continued demand for housing. The city is a popular destination for immigrants and students, which adds to the demand for rental properties.

- The Favorable Tax Climate: One reason to consider investing in the Vancouver real estate market is the state's tax climate. Washington state doesn't impose an income tax, which means investors don't have to pay taxes on revenue from their properties. This could be a significant advantage for investors who are looking to maximize their profits. Additionally, the flat property tax rate in Vancouver is another benefit. Property taxes are around one percent, which is slightly lower than the national average. This could result in a more affordable tax bill for investors compared to other markets, allowing them to allocate more funds toward growing their real estate portfolio.

Potential drawbacks:

One potential drawback to investing in the Vancouver real estate market is the high purchase prices and low inventory. This can make it difficult for investors to find properties that meet their investment criteria and may require them to be more flexible in their investment strategy. Additionally, the rising interest rates may increase the cost of borrowing for investors, which can impact their ability to finance their investments and reduce their overall returns.

Overall, the Vancouver real estate market offers many opportunities for investors looking to grow their portfolios. However, it is important to work with experienced professionals and to carefully evaluate each investment opportunity to ensure that it meets your investment goals and aligns with your risk tolerance.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Sources:

- https://www.zillow.com/home-values/48215/vancouver-wa/

- https://www.redfin.com/city/18823/WA/Vancouver/housing-market

- https://www.realtor.com/realestateandhomes-search/Vancouver_WA/overview