Even if you're not in the market for a home right now, you've probably heard the buzz: President Trump is talking about a 50-year mortgage. Yep, you read that right, fifty years. It's a bold idea, aiming to jolt our housing market out of its funk and make buying a home feel a little less like an impossible dream, especially for young families and millennials. But is it a magic bullet for affordability, or a recipe for endless debt? I've been digging into this proposal, and let me tell you, it's a lot more complicated than a simple “yes” or “no.”

Pros and Cons of Trump's 50 Year Mortgage Plan: Affordability vs Massive Increase in Interest

The Big Idea: A Longer Road to Homeownership?

Back on November 8, 2025, the former President took to Truth Social with a proposal that immediately set tongues wagging. He pitched the concept of a 50-year, fixed-rate mortgage, likening it to the groundbreaking 30-year mortgage introduced by Franklin D. Roosevelt during the Great Depression. His goal? To combat the staggering rise in home prices, which have pushed the median home price nationwide well over $400,000. The core idea is that by spreading payments out over a much longer period, the monthly payment would become more manageable. Think of it like stretching out a big bill over many more months to make it easier on your wallet right now.

This isn't just a pipe dream. The proposal suggests it would likely be backed by the government, similar to FHA or VA loans. However, the details are still pretty fuzzy, and getting this off the ground would involve some serious legal and regulatory hurdles, particularly with the Dodd-Frank Act, which currently caps “qualified mortgages” at 30 years. It feels like Trump is trying to tap into a deep need for accessible housing, but the path from idea to reality is anything but smooth.

The Upside: Making Homeownership Seem Possible Again

Let's be real, the current housing market feels like a locked door for a lot of folks. Median home prices are sky-high, and interest rates, while they've cooled a bit from their peak, still mean big monthly payments. This is where the 50-year mortgage plan shines, at least in theory.

1. Easier on the Monthly Budget

This is the headline attraction. By stretching payments over 50 years (that's 600 months, folks!), the amount you pay each month for principal and interest could drop significantly compared to a 30-year equivalent. For a borrower looking at a $450,000 loan, we're talking about potential savings of around $300 per month. That might not sound like a fortune, but over a year, it adds up to nearly $4,000. For a young family trying to juggle childcare, student loans, and everyday expenses, that kind of breathing room could make the difference between renting forever and actually putting down roots. It could open the door for millions of Americans, especially those in their 30s and 40s, who have been priced out for years.

2. A Foot in the Door for Wealth Building

Homeownership has always been a cornerstone of building wealth in America. For many families, their home is their biggest asset. The 50-year mortgage, even with its drawbacks, could be the “foot in the door” that many need. It allows people to start building equity, even if it's slowly. The hope is that buyers could refinance into shorter-term loans down the line as their incomes increase, effectively shortening their mortgage term without the initial prohibitive monthly payments. It’s about getting people into the market so they can start benefiting from potential home appreciation.

3. A Potential Boost for the Economy

More people buying homes means more demand for construction, more jobs in building trades, and more spending on furniture, appliances, and home improvements. Proponents argue that this plan could act as a stimulus, driving economic growth. With the housing industry still recovering from various shocks, a fresh influx of buyers could be exactly what it needs to get back on solid footing. It’s a ripple effect that could extend beyond just the housing sector.

The Downside: The Long Game of Debt and Risk

While the immediate relief of a lower monthly payment is tempting, the extended timeline comes with some serious trade-offs that we can't ignore. This is where my own experience as someone who's navigated mortgages and financial planning really comes into play. I've seen firsthand how the total cost of a loan can balloon, and a 50-year term dramatically amplifies that.

1. The Astronomical Interest Bill

This is, by far, the biggest red flag. When you extend a loan term, you're giving the lender more time to collect interest. And with a 50-year mortgage, that extra time means a lot more interest paid. Let's look at that $450,000 loan again. If a 30-year mortgage at, say, 6.5% means paying around $550,000 in interest over its life, a 50-year loan—even at a slightly higher rate like 7.5% (which is a likely scenario due to the extended risk)—could mean paying well over a million dollars in interest. That’s nearly double the total interest paid on a 30-year loan. This isn't just a financial detail; for lower-income families, it could mean a lifetime of carrying significantly more debt, potentially widening the wealth gap we desperately need to close.

2. Equity Builds at a Snail's Pace

With a 50-year mortgage, your monthly payment is mostly going towards interest in the early years, just like any other mortgage. However, because the loan term is so long, you build equity—your ownership stake in the home—much, much slower. After 10 years on a 50-year loan, you might have significantly less equity built up compared to what you would have on a traditional 30-year or even a 15-year mortgage. This can be dangerous. If the housing market dips, and you have very little equity, you could find yourself “underwater”—owing more on your mortgage than your home is worth. This was a painful lesson learned by many in the 2008 housing crisis, and it's a risk that can't be overstated. Imagine being in your retirement years, still paying off a mortgage that you started decades ago.

3. Potential for Market Distortions

This plan, critics argue, doesn't address the root cause of high housing prices: a severe shortage of homes. If we just increase the number of people who can borrow more money without increasing the supply of houses, prices are likely to go up even further. This could negate some of the affordability benefits by making homes even more expensive in the long run. It's like trying to cool a room by blowing more warm air into it. Experts suggest that without significant policy changes that encourage building more homes, this plan could simply inflate prices, benefiting sellers and lenders more than buyers.

4. Regulatory and Implementation Headaches

As I mentioned, the Dodd-Frank Act is a major hurdle. Changing these regulations would require congressional approval, which is never a quick or easy process. There's also the question of who would offer these loans. Banks and mortgage lenders might be hesitant to take on loans that extend so far into the future, given the increased risks. Early reports suggest even within the White House, there were hesitations and surprise about the proposal's rollout.

A Look at the Numbers: What Does It Really Mean?

To help visualize the impact, let's crunch some numbers. Suppose you're buying a $500,000 home and need a mortgage. With a 20% down payment ($100,000), you're looking at a $400,000 loan. Note: The numbers below are illustrative based on the data provided and my own understanding of mortgage amortization, assuming slightly altered loan amounts and rates for clarity.

Illustrative Comparison: $400,000 Loan

| Loan Term | Estimated Interest Rate | Monthly Payment (P&I) | Total Interest Paid Over Life of Loan | Equity After 10 Years (Approx.) |

|---|---|---|---|---|

| 15-Year Fixed | 6.0% | ~$3,271 | ~$90,000 | ~$110,000 |

| 30-Year Fixed | 6.5% | ~$2,529 | ~$510,000 | ~$50,000 |

| 50-Year Fixed | 7.5% | ~$2,500* | ~$1,100,000 | ~$25,000 |

Note: The 50-year payment is shown as only slightly lower than the 30-year here to reflect the possibility of lower monthly savings due to a higher interest rate and the compounding of interest. Actual savings could vary.

Key Takeaways from the Table:

- You can see the significant monthly savings between the 30-year and 50-year options.

- However, the total interest paid on the 50-year mortgage is shockingly high – more than double the 30-year.

- Equity builds much slower on the 50-year loan. After 10 years, you've built a fraction of the equity compared to a 15-year or 30-year loan, making you more vulnerable if home prices fall.

This table really drives home the trade-off: immediate monthly affordability versus long-term cost and equity building.

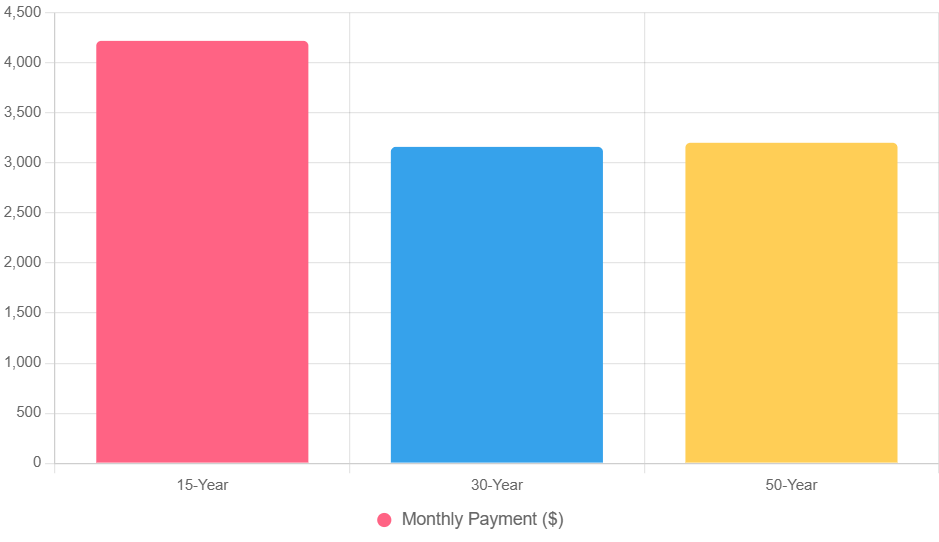

Chart 1: Monthly Payments by Loan Term

This bar chart shows how extending the term affects cash flow—note the 50-year option barely saves money if rates rise.

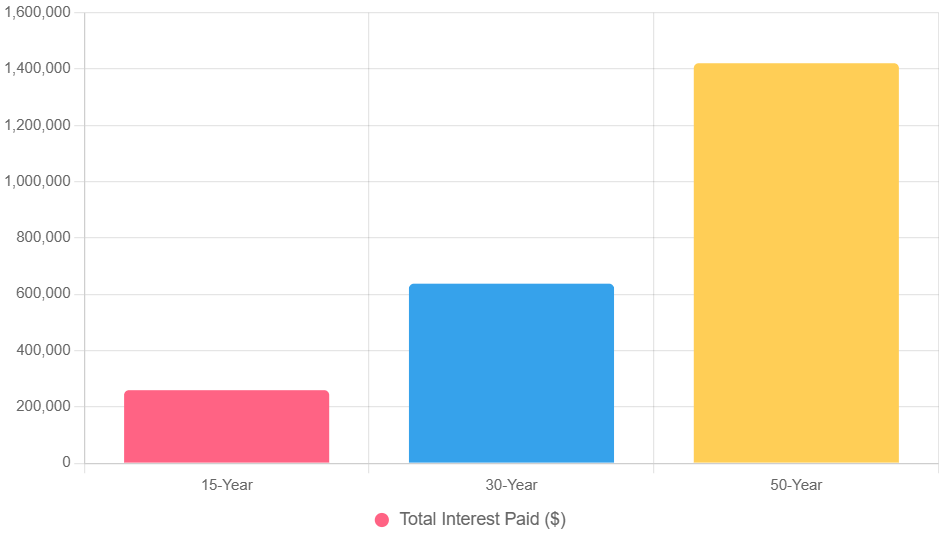

Chart 2: Total Lifetime Interest by Loan Term

A stark illustration of the “interest trap”—the 50-year loan more than doubles costs compared to shorter options.

Expert Opinions and Real-World Implications

The reaction from financial experts has been, shall we say, mixed. Some laud it as a creative solution for a generation struggling to enter the housing market. Others sound the alarm, calling it fiscally irresponsible or a temporary band-aid on a much larger problem.

I tend to lean towards the cautionary view. As someone who believes in strong personal finance and long-term stability, extending debt for an additional 20 years, especially when it drastically increases the total cost and slows equity growth, feels like a risky proposition for many borrowers. It feels like it could be a short-term fix that creates long-term headaches.

The real difficulty lies in the details. How will these loans be underwritten? What kind of protections will be in place? Will they truly be “fixed” or will there be escalators down the line? These are questions that need solid answers before such a plan could gain widespread approval or implementation.

Looking Ahead: What's the Real Solution?

While the 50-year mortgage is an interesting concept designed to tackle a pressing issue, I believe the sustainable path to housing affordability lies in a multi-pronged approach.

- Increase Housing Supply: This is paramount. We need policies that encourage the construction of more homes of all types, especially in areas where demand is highest. This means rethinking zoning laws, streamlining permitting processes, and incentivizing builders.

- Support Targeted Assistance: Instead of a blanket extension of loan terms, perhaps more targeted programs that help with down payments, reduce interest rates for first-time buyers, or offer down payment assistance could achieve affordability without the massive long-term interest burden and equity risks.

- Affordability Measures Focused on Entry: Programs that help first-time buyers get into homes with manageable, short-to-medium term adjustable rates (that can be converted later), or shared equity models, might offer a better balance.

President Trump's 50-year mortgage plan is an ambitious idea born out of a genuine need for housing solutions. It promises immediate relief but carries potentially enormous long-term financial consequences. For me, the extended timeline and the massive increase in total interest paid raise serious questions about whether it truly helps families build a secure financial future, or simply saddles them with debt for decades to come.

Smart Leverage or Long-Term Risk for Rental Investors?

Ultra-long mortgage terms can lower monthly payments and boost cash flow—but they also extend debt horizons and slow equity growth. For turnkey investors, the key is knowing when and how to use them strategically.

Norada Real Estate helps you evaluate financing options and match them to high-performing rental markets—so you can build wealth without overextending your timeline.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- Is Trump's 50-Year Mortgage Plan a Game Changer or Debt Trap for Borrowers?

- What Are Typical Credit Score Ranges for Mortgage Borrowers?

- FHA Mortgage Rates by Credit Score: 620, 700, 580, 640

- Does Wells Fargo Offer Home Loans with a 500 Credit Score?

- First Time Home Buyer Loans with Bad Credit and Zero Down

- Who Qualifies for Kamala Harris' $25,000 Homebuyer Program?

- Biden Administration's Bold Move for Affordable Housing Plan

- Biden's Student Debt Relief Plan: A Beacon of Hope for Borrowers

- What Credit Score Do You Need to Buy House With No Money Down?

- How Long Does It Take to Get a 700-800 Credit Score?

- How To Improve Your FICO Credit Score: A Guide

- FHA Credit Score Requirements for Homeownership

- 10 Proven Methods to Elevate Your FICO Credit Score

- Mortgages for Low Credit Scores: Your Complete Guide