While the increase in inventory suggests more options for buyers, competitive pricing and a relatively low percent of original list price received indicate continued seller leverage in the Asheville housing market. Asheville sits in the Blue Ridge Mountains in the western part of the state. This area is often overlooked in favor of larger cities like Charlotte or Durham.

However, the area has its attractions whether you’re a tourist or considering Asheville real estate investment. Asheville proper is home to around ninety thousand people. The Asheville housing market is larger than this, though, when you take the five-county metropolitan area into account. The larger Asheville real estate market is home to over four hundred thousand people.

Asheville Housing Market Trends in 2024

The Asheville housing market, encompassing counties such as Buncombe, Burke, Haywood, Henderson, Jackson, Madison, McDowell, Mitchell, Polk, Rutherford, Swain, Transylvania, and Yancey, is experiencing dynamic shifts in 2024. Let's delve into the key metrics provided by Canopy Realtor® Association for a comprehensive understanding of the current real estate scenario.

How is the Housing Market Doing Currently?

As of February 2024, the Asheville housing market has seen significant activity across several metrics. New listings have surged by 27.1% compared to the same period in 2023, indicating a potential increase in available properties. Additionally, pending sales have risen by 9.3%, suggesting a heightened level of buyer interest and market activity.

Closed sales have also experienced a 7.2% increase, reflecting a positive trend in completed real estate transactions. However, despite the uptick in activity, the median sales price has seen a slight decrease of 1.3% compared to last year, potentially offering buyers some relief in affordability.

How Competitive is the Asheville Housing Market?

The Asheville housing market remains competitive, as evidenced by key indicators such as the percent of original list price received and days on market until sale. While the percent of original list price received has decreased marginally by 1.0%, sellers continue to command a substantial portion of their asking price.

Days on market until sale have seen a modest increase of 1.9%, indicating that properties are spending slightly longer on the market before finding a buyer. Nonetheless, Asheville remains an attractive destination for homebuyers, contributing to ongoing market competitiveness.

Are There Enough Homes for Sale to Meet Buyer Demand?

One of the critical factors influencing the Asheville housing market is the inventory of homes for sale. Inventory levels have risen by 21.8% compared to the previous year, potentially offering buyers a broader selection of properties to choose from.

However, the months' supply of inventory has also increased by 27.8%, indicating a potential imbalance between supply and demand. While the increase in inventory is a positive sign for buyers, it may not fully alleviate the challenges posed by high demand in the market.

What is the Future Market Outlook for Asheville?

Looking ahead, the future market outlook for Asheville's real estate sector appears optimistic yet nuanced. While key metrics such as new listings and closed sales show positive growth, factors such as median sales price and days on market merit careful consideration.

Market participants should remain vigilant and adapt to changing conditions, leveraging data-driven insights to navigate the evolving landscape effectively. Collaboration with experienced real estate professionals can also provide valuable guidance in making strategic decisions.

Asheville Housing Market Forecast 2024 and 2025

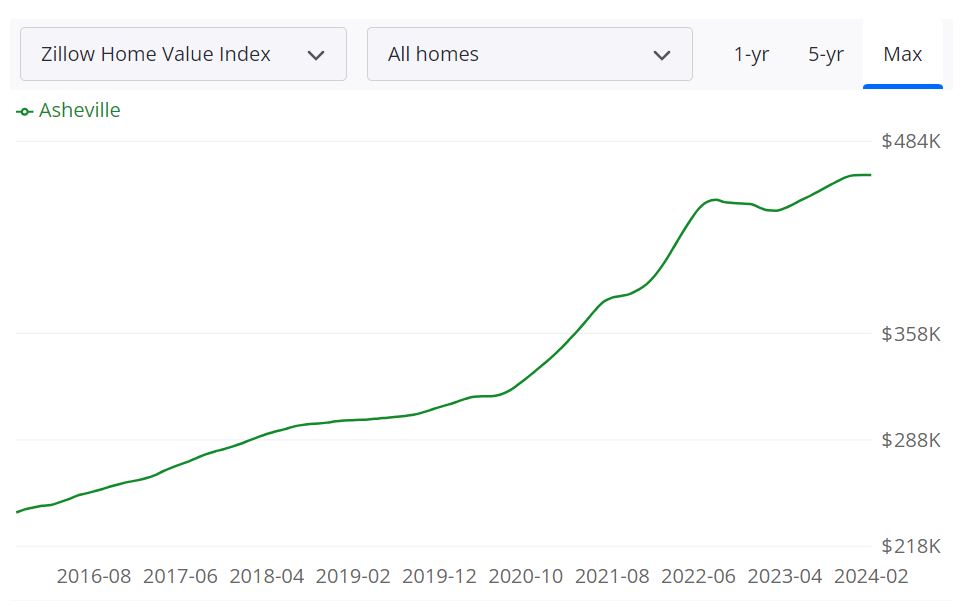

The Asheville housing market, like many others across the nation, is subject to fluctuations influenced by various economic factors. According to Zillow, as of February 29, 2024, the market boasts an average home value of $462,515, reflecting a 5.3% increase over the past year. Homes in Asheville typically spend around 40 days on the market before going pending. To delve deeper into the market dynamics, it's crucial to dissect key metrics such as inventory, new listings, median sale price, and median list price.

Key Metrics Breakdown

- For Sale Inventory: As of February 29, 2024, Asheville had 442 properties listed for sale, indicating the available housing stock.

- New Listings: In the same period, the market saw 89 new properties listed, contributing to inventory turnover and market activity.

- Median Sale Price: The median sale price, recorded as of January 31, 2024, stands at $449,833, providing insight into the typical transaction value.

- Median List Price: As of February 29, 2024, the median list price for properties in Asheville was $488,000, illustrating seller expectations.

Forecast for the Asheville Metropolitan Statistical Area (MSA)

MSA, or Metropolitan Statistical Area, refers to a geographical region centered around an urban center and encompassing adjacent counties with significant social and economic ties to the core city. In the case of Asheville, NC, the MSA comprises counties within North Carolina. The Zillow forecast for the Asheville MSA, extending to March 31, 2024, anticipates a modest 0.2% increase, followed by further growth to 0.6% by May 31, 2024. Looking ahead to February 28, 2025, the forecast projects a more substantial 1.6% rise in housing market performance.

The Asheville MSA encompasses a cluster of counties interconnected by economic activities and residential mobility patterns. These counties, closely linked to the urban core of Asheville, collectively form a regional market entity. With its diverse economic base, scenic landscapes, and cultural attractions, the Asheville housing market exerts a considerable influence on the broader regional economy. As one of North Carolina's prominent urban centers, Asheville's housing market serves as a barometer for regional economic health and residential real estate trends.

Are Home Prices Dropping in Asheville?

Despite fluctuations in the housing market, Asheville has experienced a steady increase in home prices over the past year, with the average home value rising by 5.3%. However, it's essential to note that real estate markets are inherently cyclical, and periods of growth may be followed by stabilization or slight declines.

Assessing whether the Asheville housing market favors buyers or sellers requires a multifaceted analysis of supply, demand, and pricing trends. With a relatively low inventory of 442 properties for sale as of February 29, 2024, coupled with a median list price of $488,000, sellers may have the upper hand in negotiations.

However, buyer demand remains robust, as evidenced by the 89 new listings added to the market during the same period. Ultimately, market conditions can vary by neighborhood and property type, influencing the balance of power between buyers and sellers.

Will the Asheville Housing Market Crash?

Predicting a housing market crash requires careful analysis of economic indicators, housing supply, and demand dynamics. While the Asheville housing market may experience fluctuations, a crash typically results from systemic economic shocks or unsustainable speculative activity. As of now, there are no imminent signs of a housing market crash in Asheville.

Is Now a Good Time to Buy a House in Asheville?

Determining the optimal timing for purchasing a house depends on individual circumstances, financial readiness, and long-term goals. Despite the current market conditions favoring sellers, low mortgage rates as compared to last year and strong demand may still present opportunities for buyers. Assessing personal finances, conducting thorough market research, and considering factors such as job stability and future housing needs can help prospective buyers determine whether now is a suitable time to enter the Asheville housing market.

Asheville Real Estate Investment Overview

Is it worth buying a house in Asheville, NC? Investing in real estate is touted as a great way to become wealthy. Many real estate investors have asked themselves if buying a property in Asheville is a good investment? You need to drill deeper into local trends if you want to know what the market holds for the year ahead.

We have already discussed the Asheville housing market forecast for answers on why to put resources into this market. Although, this article alone is not a comprehensive source to make a final investment decision for Asheville we have collected ten evidence-based positive things for those who are keen to invest in the Asheville real estate.

Investing in Asheville real estate will fetch you good returns in the long term as the home prices in Asheville have been trending up year over year. Let’s take a look at the number of positive things going on in the Asheville real estate market which can help investors who are keen to buy an investment property in this city.

The Large and Diverse Student Market

Any college creates a large population of permanent renters. The Asheville housing market beats many college towns because it is home to several different universities. We’ll ignore the technical community college in Asheville and look at schools like Black Mountain College, Shaw University, Brevard College, Lenoir-Rhyne University, and Mars Hill University. Each has several hundred to several thousand students.

You could own multiple Asheville real estate investment properties, each near a different school, and thus have a diversified real estate portfolio for relatively little money. Yet the area’s economy is so diverse you could rent the same properties out to students if any of these small liberal arts colleges fold. Or you could simply rent out properties in the Asheville real estate market to UNC Asheville students.

Asheville and the Asheville metropolitan area have higher rents than the average for North Carolina but are generally close to the national average. Rents are increasing in the Asheville market, but prices fluctuate and options exist at both the low and high ends of the rent spectrum.

Studio apartments are the most affordable option, averaging $866 in Asheville and $794 in the Asheville metropolitan area. In this market, median rents are $848 based on 29 units available, down 7% over one year. One-bedroom apartments, a popular option, are slightly more, averaging $870 in the city and $799 in the metro area. In this market, median rents are $1,071 based on 204 units available, up 6% over one year.

CURRENT RENTAL TRENDS: As of March 2024, the median rent for all bedroom counts and property types in Asheville, NC is $1,810. This is -8% lower than the national average. Rent prices for all bedroom counts and property types in Asheville, NC have decreased by 3% in the last month and have decreased by 21% in the last year.

The monthly rent for an apartment in Asheville, NC is $1,653. A 1-bedroom apartment in Asheville, NC costs about $1,421 on average, while a 2-bedroom apartment is $1,782. Houses for rent in Asheville, NC are more expensive, with an average monthly cost of $2,297.

The Demand for Affordable Homes is High

Given the amazing views, proximity to nature, and examples like the Vanderbilt property in the area, the Asheville real estate market has seen more luxury homes built than affordable ones. Yet it is the smaller homes that appeal to couples looking for starter homes and retirees who don’t need something big. Depending on the area in the Asheville real estate market, it can be hard to find properties below 400,000. This is compounded by neighborhoods that say homes must be at least 1000 or 1200 square feet in size, preventing much cheaper homes from being built. This creates strong demand for affordable single-family rentals in the Asheville housing market.

The Literal Constraints of Geography

The same geography that attracts many tourists to the city limits the growth of the city. Asheville has east-west access via I-40 while Highway 26 connects it to other towns north and south. However, new construction going up mountainsides is expensive and risky. They simply cannot expand into Pisgah National Forest or the massive Nantahala National Forest. This limits the potential growth of the city.

Asheville is a charming city and metropolitan area that offers something for everyone, including scenic mountains, live music, locally produced food and drink, and a thriving arts scene. With approximately 89,000 residents and a metropolitan population of approximately 425,000, Asheville is the largest city in western North Carolina. Asheville can be found nestled between the Blue Ridge and the Great Smoky Mountains. Its location is one of the many factors that contributed to its inclusion on our list of the best places to live in North Carolina.

Walkable communities are all the rage. It is so important to many young couples and downsizing couples that new walkable planned neighborhoods are being built around the U.S. The Asheville housing market is unusual for already having an established, walkable downtown. The downtown is large enough to be a community in its own right, but it isn’t so large that the Asheville real estate market is depressed by blighted areas.

The Diversified Job Market

If Asheville’s lifeblood was tourism, we couldn’t recommend Asheville real estate investment because it would be too risky. However, the Asheville real estate market is buoyed by a diversified, solid job market. The city is the regional services hub. This means that the city, the state, and several government agencies are large local employers. So, too, are the local VA medical center, school system, and health system. Furniture makers, equipment manufacturers, and research facilities dot the area. This creates a large, healthy job market that can weather almost any storm.

The Potential for Short Term Rentals

The lush forests around Asheville attract tourists for hiking, rafting, and other outdoor activities. The city has limited short-term rentals, but that doesn’t mean this isn’t an option if you own Asheville real estate investment properties. For example, parts of the Asheville real estate market are zoned as “resorts”. You can rent these properties out on short-term rental sites to your heart’s delight.

Properties that already had short-term vacation rental permits are grandfathered into the existing rules, though you should verify the permit could transfer to you before buying the Asheville real estate investment property. Towns outside of Asheville proper have their own rules, too, and are more relaxed in this regard.

The Landlord-Friendly Environment

North Carolina in general is landlord friendly. The state is also far more landlord friendly than surrounding states like South Carolina, Virginia, and Tennessee. You can evict people for non-payment of rent, breaching the lease, criminal activity, and remaining on the property after termination of the lease. Major cities in the state don’t tack on additional tenant protections, either. We just can’t give North Carolina extra points on being tax-friendly for property owners; they’re literally average when it comes to income and property taxes.

References

Housing Market Data & Statistics

https://www.zillow.com/asheville-nc/home-values/

https://www.zillow.com/asheville-nc-28802/home-values/

https://www.carolinahome.com/market-data/monthly-reports

https://www.redfin.com/city/555/NC/Asheville/housing-market

https://www.realtor.com/realestateandhomes-search/Asheville_NC/overview

https://www.neighborhoodscout.com/nc/asheville/real-estate/

Job & Student market

https://en.wikipedia.org/wiki/Asheville,_North_Carolina

Walkable

https://expertvagabond.com/asheville-things-to-do

Landlord friendly

https://wallethub.com/edu/best-worst-states-to-be-a-taxpayer/2416

https://www.avail.co/education/laws/north-carolina-landlord-tenant-law

Short term rentals

https://www.usatoday.com/story/tech/news/2018/06/02/one-airbnb-hosts-fight-asheville-n-c-nearing-1-m-fines/657653002

https://www.citizen-times.com/story/news/local/2018/01/18/guide-ashevilles-short-term-vacation-rental-rules-can-you-rent-your-space/1035531001