Let’s be honest, the dream of homeownership often feels like the ultimate prize. You picture those cozy evenings, the freedom to paint your walls any color you please, and the feeling of rootedness. But what if I told you there’s a significant, and often surprising, price tag attached that goes way beyond your monthly mortgage payment?

A recent analysis by Zillow and Thumbtack reveals a stark reality: the hidden costs of owning a home now add up to nearly $16,000 a year, and these expenses are growing faster than our paychecks. This isn't just a small hiccup; it's a substantial financial commitment that many buyers simply aren't prepared for.

Hidden Costs of Homeownership Now Add Up to Nearly $16,000 a Year

The Real Price Tag Beyond the Mortgage

When I first heard this number, even with my years of observing the housing market, I was taken aback. We all know about the mortgage, the property taxes, and maybe even homeowners insurance. But the hidden costs? My own experience as a homeowner has certainly taught me that things break, need regular upkeep, and sometimes, big unexpected bills pop up out of nowhere.

According to the Zillow and Thumbtack research, the average homeowner shells out around $10,946 annually for maintenance. Think about it: HVAC systems need servicing, roofs don't last forever, appliances can fail, and your lawn will always need care. Then there's homeowners insurance, averaging about $2,003 per year, which has seen some serious hikes lately. And of course, property taxes hover around $3,030 annually.

When you stack these up, you’re looking at over $1,300 per month on average, just to keep your house in good shape and insured. What’s really concerning is that these essential ownership costs have climbed by 4.7 percent in the past year, while typical household incomes have only inched up by 3.8 percent. That gap, though it might seem small on paper, can create quite a squeeze on households, making the dream of owning a home feel a lot less attainable.

Coastal Metros Feel the Sharpest Squeeze

This financial pressure isn't felt equally across the country. If you're looking to buy in an already pricey coastal market, get ready for an even steeper climb. In New York City, for instance, homeowners are looking at an average of $24,381 per year in these hidden costs. San Francisco isn’t far behind at about $22,781, and Boston homeowners face around $21,320 annually.

Now, these figures are on top of already sky-high mortgage payments. Imagine trying to manage both! It really highlights the affordability crisis in some of our nation’s biggest and most desirable cities. It’s not just about saving up for a down payment anymore; it’s about having the ongoing cash flow to handle these substantial yearly expenses.

Insurance Costs: A Fast-Growing Worry

Of all the rising expenses, homeowner’s insurance premiums are probably the most alarming. Nationwide, these costs have jumped by a staggering 48 percent since early 2020, pushing the average annual bill north of $2,000.

But the national average only tells part of the story. In certain sweltering parts of the country, insurance premiums have gone through the roof. In Miami, homeowners are now paying an average of $4,607 annually, a 72 percent surge in just five years. Similar dramatic increases are hitting homeowners across Florida: Jacksonville has seen a 72 percent jump, Tampa 69 percent, and Orlando 68 percent.

It’s not just the Sunshine State. In New Orleans, premiums have climbed a massive 79 percent, while Sacramento, California, is looking at a 59 percent increase. Atlanta and Riverside, California, aren't far behind with 58 percent and 56 percent hikes, respectively. These jumps are far outpacing wage growth, creating a major headache for both first-time buyers trying to get their foot in the door and long-time homeowners. From my perspective, this is a critical factor that needs more public attention. It’s easy to get caught up in the housing market frenzy, but ignoring rising insurance costs is a recipe for financial distress.

Breaking Down What Goes Into These Costs

It's worth understanding how Zillow and Thumbtack put these numbers together. They combined Zillow's data on local property taxes and insurance premiums with Thumbtack's detailed information on home maintenance costs.

Thumbtack’s maintenance estimates cover a broad range of essential tasks, including:

- Routine and seasonal HVAC system servicing

- Roof inspections and minor repairs

- Lawn care and landscaping

- Gutter cleaning

- Tree trimming and removal

- Pest control

These estimates are based on actual project data shared by homeowners and professionals, meaning they reflect real-world costs and market fluctuations. This holistic approach gives us a much clearer picture of the ongoing financial demands of homeownership. My advice to anyone considering buying is to think beyond the obvious. These are not optional expenses; they are investments in preserving the value and livability of your largest asset.

The Bottom Line: Prepare for the Full Picture

Homeownership has long been presented as a solid path to financial stability. And in many ways, it still is. However, the analysis from Zillow and Thumbtack clearly shows that the ongoing expenses associated with maintaining a home are climbing at a faster pace than many people's incomes.

In today's market, with high mortgage rates and a limited selection of homes, understanding these hidden costs is absolutely crucial. Whether you’re a first-time buyer dreaming of your own place or a seasoned homeowner looking to budget wisely, being aware of the full financial picture is the first step toward making informed decisions. Don't let the excitement of finding “the one” blind you to the reality of keeping it. Being prepared for these hidden costs will help you avoid financial strain and truly enjoy the benefits of owning your home.

Small Investors Are Winning Big in Today’s Housing Market

Turnkey rental properties in affordable, high-demand metros are helping everyday investors build passive income, equity, and long-term wealth—without the headaches of active management.

Norada Real Estate makes it easy to scale your portfolio in the markets where small investors are outpacing institutional buyers and locking in strong returns.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights:

- Small Investors Dominate the Housing Market From Detroit to Vegas

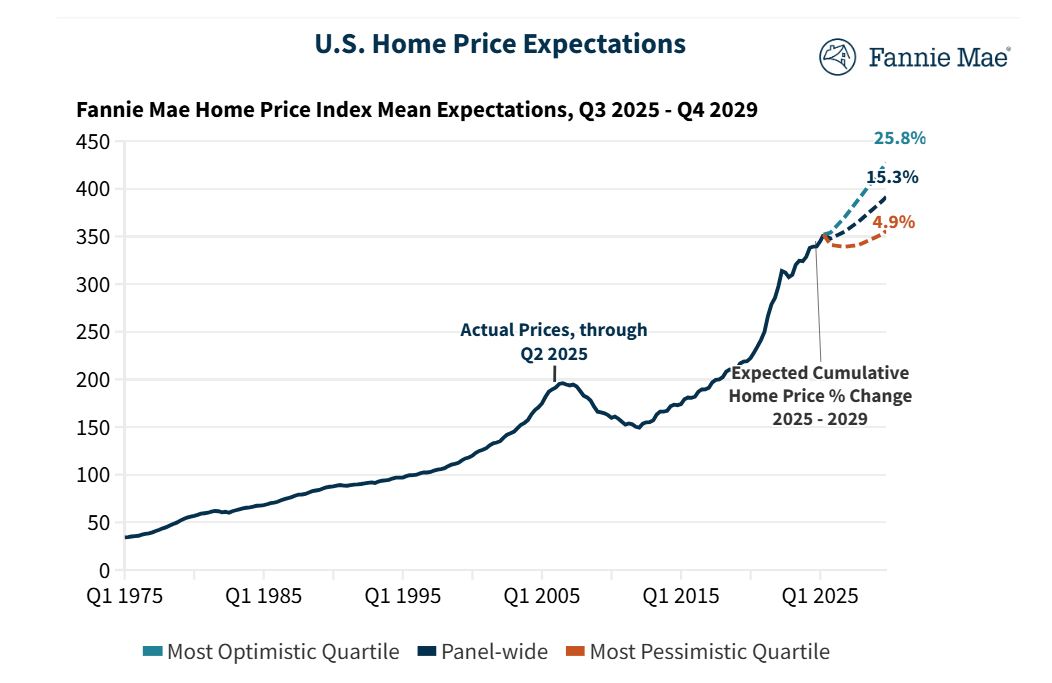

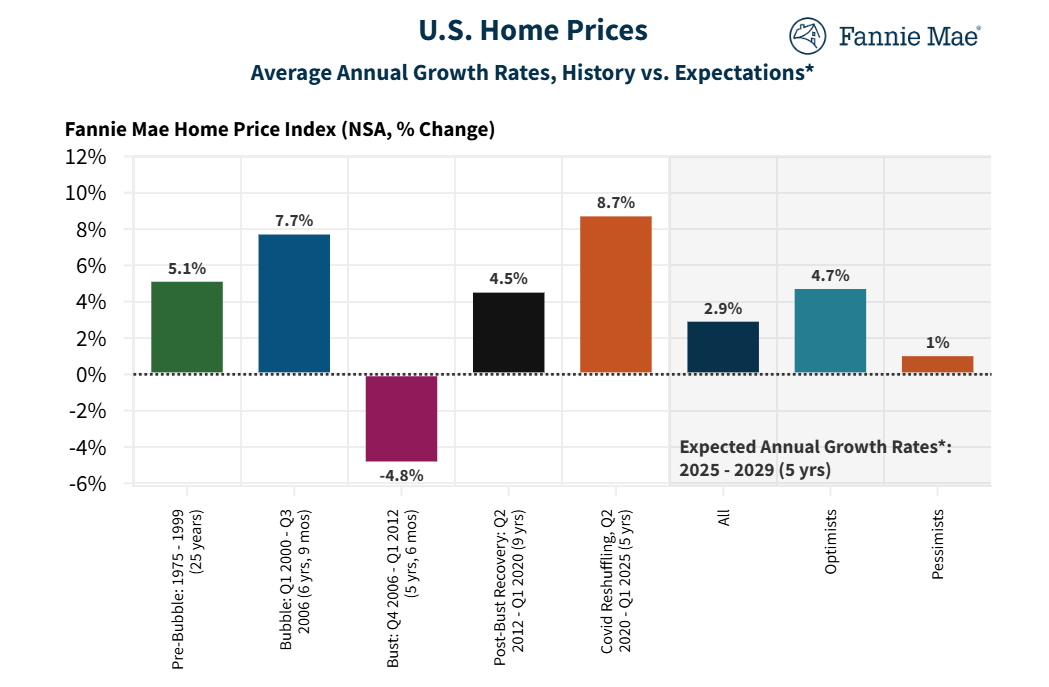

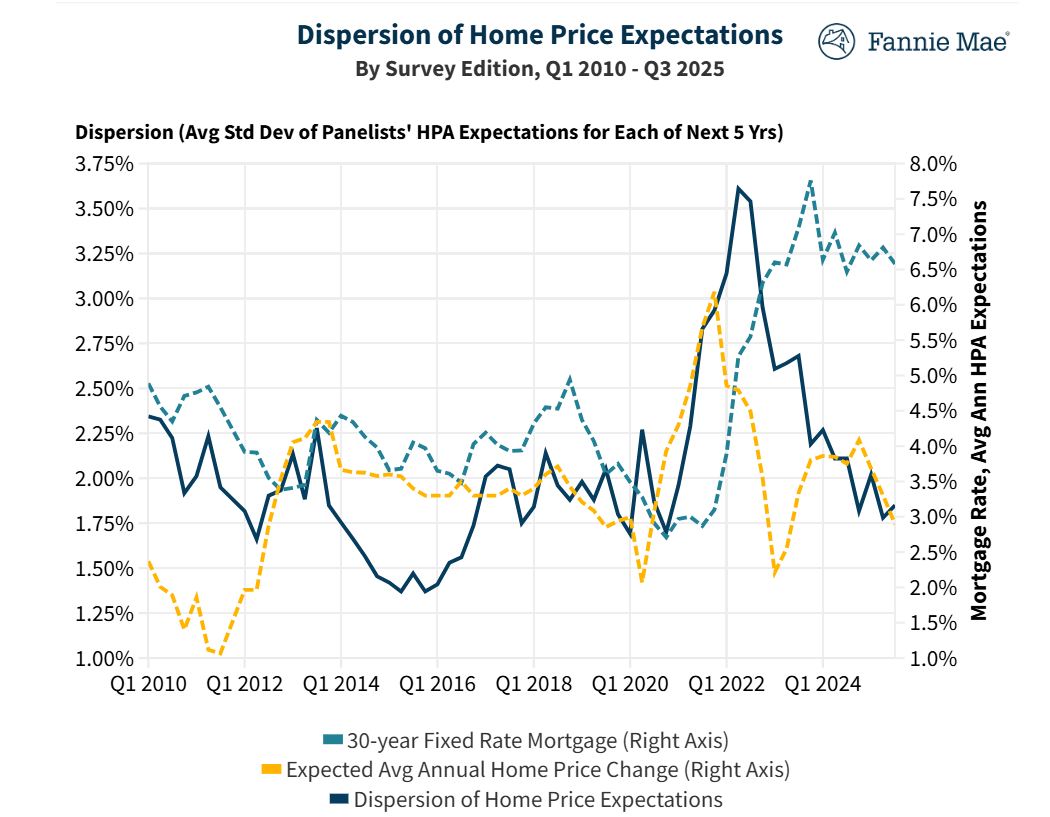

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

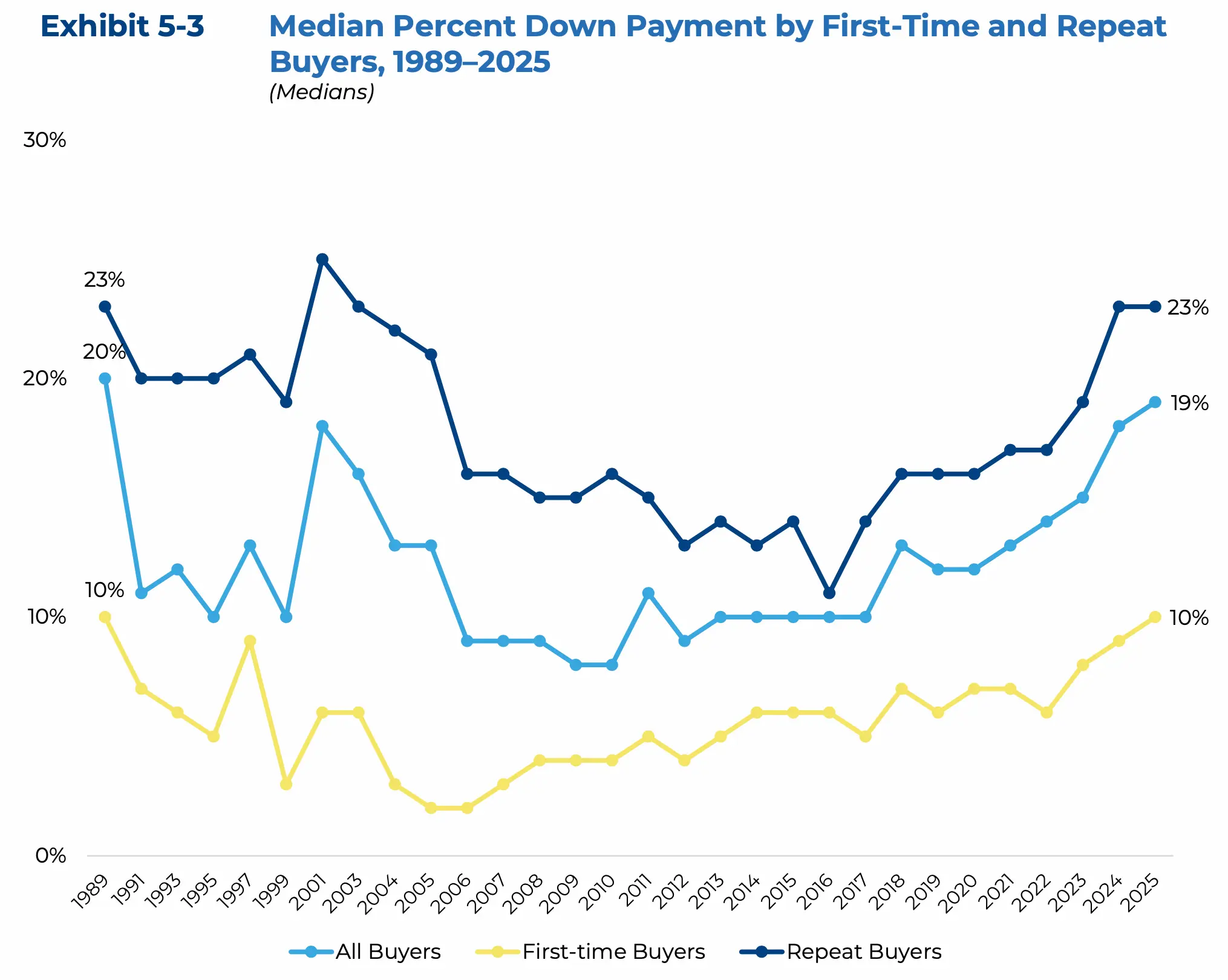

- Housing Market 2025 Splits Between Wealthy Buyers and First-Timers

- Housing Markets at Risk of Double-Digit Price Decline Over the Next 12 Months

- Housing Market Trends: Nearly 1 in 3 Buyers Still Opt for All-Cash Deals in 2025

- Will the Housing Market Shift to a Buyer’s Market in 2026?

- Housing Market 2025: Booming vs. Shrinking Inventory Across America

- Housing Market Gains Supply But Buyers Hit Pause in 2025

- Mid-Atlantic Housing Market Heats Up as Mortgage Rates Go Down

- NAR Chief's Bold Predictions for the 2025 Housing Market

- Housing Market Update 2025: NAR Report Indicates Sluggish Trends

- 7 Buyer-Friendly Housing Markets in 2025 With Abundant Homes for Sale

- The $1 Trillion Club: America's Richest Housing Markets Revealed

- 4 States Dominate as the Riskiest Housing Markets in 2025

- Housing Market Predictions 2025 by Norada Real Estate