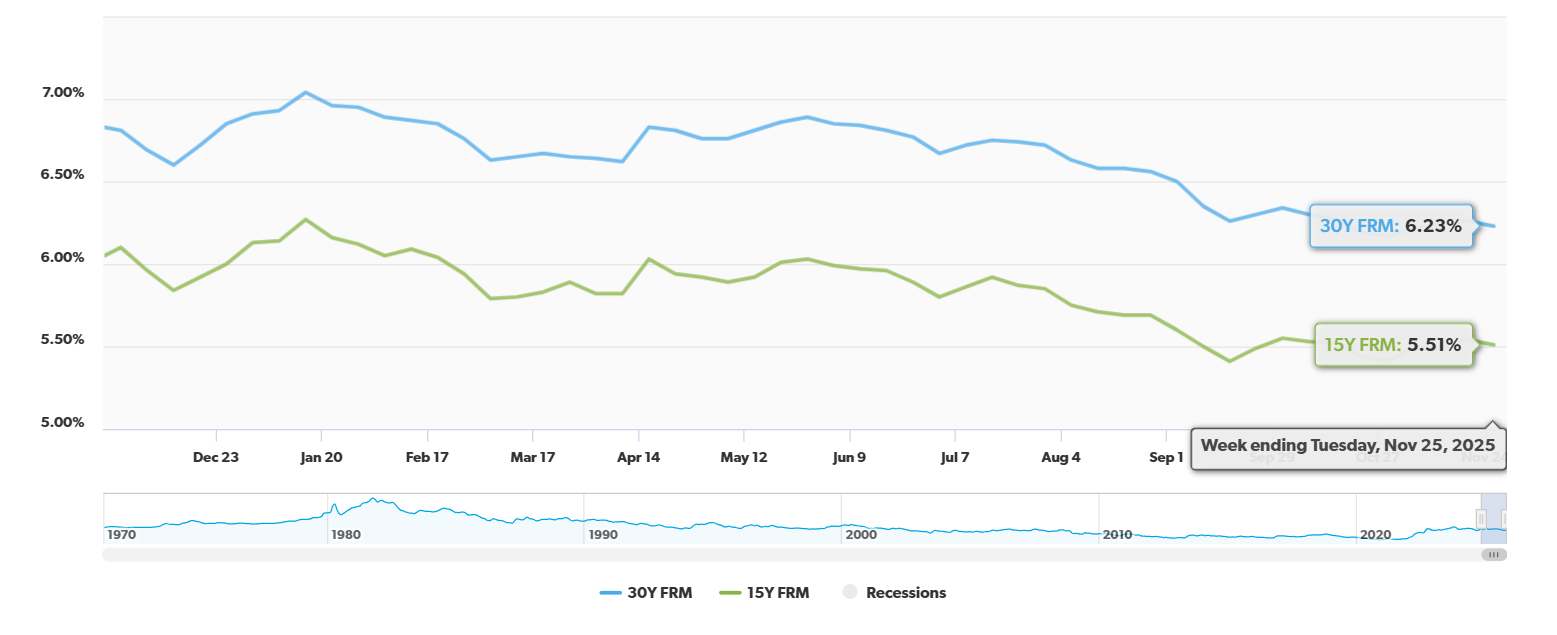

If you've been keeping an eye on mortgage rates, you'll be happy to know that as of November 27, they've dipped to their lowest levels since October 2024. This is genuinely welcome news for anyone looking to buy a home or for homeowners considering a refinance. According to Zillow's latest figures, the average 30-year fixed mortgage rate is now sitting at a cool 6.00%. This is a noticeable drop from just a year ago, when that same rate was closer to 6.81%. Personally, I see this as a significant moment, offering a real chance to secure more affordable financing.

It's not just the 30-year fixed that's seen some love; the 15-year fixed mortgage rate has also eased, now at 5.50%. Compared to last year's average of 6.10%, this is a substantial improvement. This steady movement downwards signals a more borrower-friendly environment as we head towards the end of the year. For anyone on the fence about buying a new home or looking to refinance their current mortgage, these rates represent one of the most competitive situations we've seen in over a year. It could mean unlocking significant long-term savings on your homeownership journey.

Today's Mortgage Rates, Nov 27: 30-Year FRM Drops to 6%, Making Loans More Affordable

Understanding Today's Mortgage Rate Snapshot

When we talk about mortgage rates, it's helpful to see the actual numbers. Here's a breakdown of the national averages, according to Zillow, for both purchase and refinance loans. Remember, these are averages, and your actual rate might be a little different based on your credit score, loan type, and other factors.

Purchase Mortgage Rates (National Averages)

| Loan Type | Interest Rate |

|---|---|

| 30-year fixed | 6.00% |

| 20-year fixed | 5.86% |

| 15-year fixed | 5.50% |

| 5/1 ARM | 6.11% |

| 7/1 ARM | 6.15% |

| 30-year VA | 5.44% |

| 15-year VA | 5.10% |

| 5/1 VA | 5.11% |

Refinance Mortgage Rates (National Averages)

| Loan Type | Interest Rate |

|---|---|

| 30-year fixed | 6.14% |

| 20-year fixed | 6.05% |

| 15-year fixed | 5.60% |

| 5/1 ARM | 6.55% |

| 7/1 ARM | 6.72% |

| 30-year VA | 5.57% |

| 15-year VA | 5.18% |

| 5/1 VA | 5.04% |

It’s always good to see the numbers laid out like this, isn't it? It helps to put things into perspective and see exactly where we stand.

Why Are Rates Moving Down? A Look at the Drivers

So, what's behind this pleasant dip in mortgage rates? A big player is the Federal Reserve. There’s a lot of buzz about the Fed potentially cutting its key interest rate in December, and this anticipation has been a significant driver in pushing mortgage rates downward. We saw this pattern play out earlier in September and October too, where expectations of Fed action preceded falling mortgage rates.

From my perspective, this shows how closely tied mortgage rates are to broader economic forecasts. When it looks like the cost of borrowing money might go down for the central bank, it signals to the market that lenders might be able to offer loans at lower rates too.

The Refinancing Opportunity: Is Now the Time?

For homeowners who might have locked in their mortgages at higher rates, say around 7% or even higher, these current numbers present a real refinancing opportunity. I often talk to people who are hesitant to refinance, thinking it’s too much hassle. But when you look at the potential savings over the life of a 30-year loan by dropping even a percentage point or two, the effort can really pay off. It’s worth crunching the numbers to see if lowering your monthly payment and saving on interest is achievable for you.

Impact of Lower Rates on Buyer Affordability

For those looking to buy, lower mortgage rates translate directly into better affordability. This means that for the same monthly payment, a buyer can potentially qualify for a larger loan amount, or they can simply enjoy a lower monthly cost for the same home price.

Let's say you have a budget for a $2,000 monthly mortgage payment.

- At 7.00% on a 30-year fixed loan, that payment can cover a loan of approximately $300,000.

- If rates drop to 6.00%, that same $2,000 payment can now cover a loan of roughly $335,000.

That's an extra $35,000 in purchasing power, just from a 1% decrease in the interest rate! This can make the difference between being able to afford a home in your desired area or having to look further out.

ARM vs. Fixed-Rate Options in Today’s Market

When considering a mortgage, one of the first big decisions is choosing between a fixed-rate and an adjustable-rate mortgage (ARM).

- Fixed-Rate Mortgages: These offer stability. Your interest rate and monthly principal and interest payment stay the same for the entire life of the loan (e.g., 15 or 30 years). I generally recommend fixed-rate mortgages for most buyers because they provide peace of mind and predictable budgeting.

- Adjustable-Rate Mortgages (ARMs): These loans typically have a lower interest rate for an initial period (like 5 or 7 years), after which the rate adjusts periodically based on market conditions. The 5/1 ARM at 6.11% and 7/1 ARM at 6.15% are currently very close to, or even slightly higher than, some fixed-rate options. Historically, ARMs were attractive because their initial rates were significantly lower than fixed rates. However, with current fixed rates being so competitive, the benefit of an ARM today is less pronounced unless you plan to sell or refinance before the adjustment period. You need to be comfortable with the risk of your payment increasing later on.

Given today's rate environment, I'm leaning towards recommending fixed-rate mortgages for most people. The difference between the 30-year fixed and the ARM rates isn't as dramatic as it used to be, making the security of a fixed rate very appealing.

VA Loan Rates and Benefits for Borrowers

For our nation's veterans and active-duty military members, VA loans continue to offer some of the most attractive rates available. As you can see from the tables, the 30-year VA loan at 5.44% and the 15-year VA loan at 5.10% are significantly lower than their conventional counterparts.

What's more, VA loans often come with fantastic benefits, such as:

- No down payment required for most eligible borrowers.

- No private mortgage insurance (PMI), which is a significant monthly saving compared to conventional loans with less than 20% down.

- Competitive interest rates, as highlighted by the data.

If you’re a veteran or active military personnel, exploring VA loan options is absolutely a must. I’ve seen firsthand how these loans can make homeownership more accessible and affordable for those who have served.

A Look Back and Ahead: Historical Context and Outlook

While today's rates are a welcome relief, it’s important to remember the historical context. We experienced an unprecedented period of extremely low rates during the pandemic, with 30-year fixed mortgages dipping into the 2% range. Experts widely agree that a return to those 2% to 3% rates is highly unlikely in the foreseeable future. The current ~6% range is a more normalized, albeit still favorable, environment compared to the highs we saw in the past year.

Looking ahead, economists are cautiously optimistic about the housing market gaining momentum. With rates hovering near what could be 2025’s low points, and the possibility of further drops in early 2026, we might see more activity. However, some homeowners who are sitting on very low rates from years ago are understandably hesitant to move and give up those favorable terms, leading to a bit of a “wait-and-see” approach in some parts of the market.

From my vantage point, this is a great time for serious buyers to engage. Waiting for rates to drop back to pandemic-era lows is a gamble that's unlikely to pay off. Securing a competitive rate now, especially if you plan to stay in your home for many years, can be a smart financial move.

Final Thoughts

The mortgage market can feel complex, but understanding where rates are today, why they're moving, and what options are best for you is key. As of November 27, the trend is moving in a positive direction for borrowers. Whether you’re eyeing your first home or looking to improve your current mortgage situation, now is a prime time to explore your options and potentially lock in some significant savings. It's always wise to speak with a trusted mortgage professional to get personalized advice.

Invest Smartly in Turnkey Rental Properties

With rates dipping to their lowest levels, investors are locking in financing to maximize cash flow and long-term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?