If you're thinking about buying a home or refinancing your current mortgage, you're probably wondering what's going to happen with interest rates over the next year. It’s a question I get asked all the time, and for good reason! Rates have been a rollercoaster ride for the past few years.

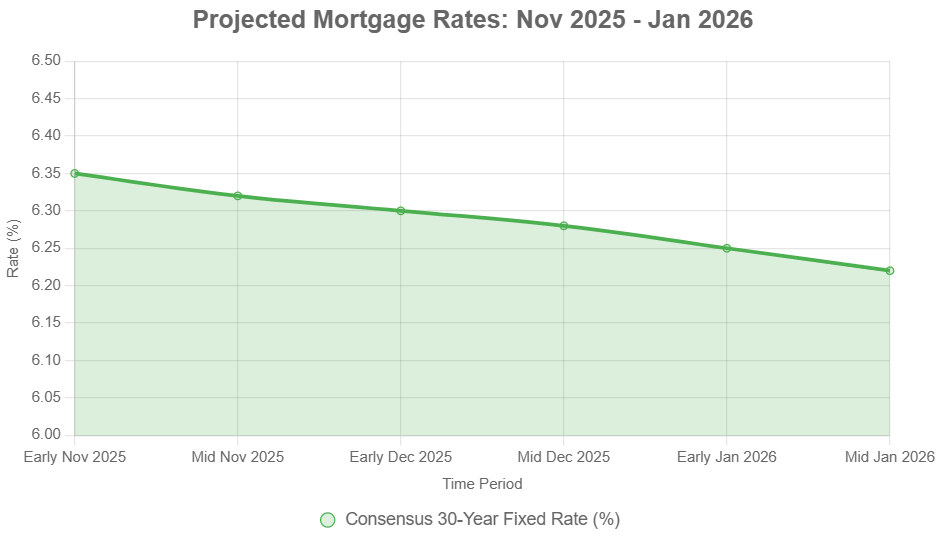

Right now, in mid-November 2025, we’re seeing the average 30-year fixed mortgage rate a bit lower than it was earlier in the year, hovering around 6.22%. While that’s a welcome drop from the highs we saw near 7%, it’s still quite a bit higher than those super-low rates from a few years ago. So, what’s in store for mortgage rates between November 2025 and November 2026? The good news is that most signs point to a gradual easing, but it's not going to be a straight shot down.

Mortgage Rates Predictions Next 12 Months: November 2025 to November 2026

What's Driving Mortgage Rates Right Now?

Before we peer into the crystal ball, let's quickly look at what's influencing mortgage rates today. Think of mortgage rates as being connected to a bunch of different economic factors, kind of like how your mood can be affected by how much sleep you got, what you ate, and what’s going on at work.

- The Federal Reserve's Moves: You've probably heard about the Fed cutting interest rates. They recently made a 0.25% cut, bringing their main rate down. This is good because it makes borrowing money cheaper for banks, and that can eventually trickle down to mortgage rates. The outlook is for a couple more cuts in 2025 and maybe one in 2026. However, mortgage rates are more closely tied to longer-term borrowing costs, not just the Fed's short-term rates.

- Treasury Yields: This is a big one. When people buy U.S. Treasury bonds, especially the 10-year ones, it's a bit like the market is setting a benchmark for interest rates. Right now, these yields are around 4.1%. The best predictions suggest they’ll stay in a similar range, maybe dipping slightly, through 2026. This means rates probably won't plummet, but they also shouldn’t skyrocket unless something unexpected happens.

- Inflation and the Economy: Is inflation cooling down? That's the golden question! If prices keep rising slower, the Fed has more room to cut rates, which usually means lower mortgage rates. We've seen some good signs, with inflation trending downwards. The job market is also still pretty strong, which is good for the economy but can sometimes keep inflation from falling too fast. It's a balancing act.

- Housing Market Stuff: Believe it or not, how many homes are for sale and how many people want to buy them also play a role. If there aren't many homes available, prices can stay high, and that can keep mortgage rates from dropping significantly.

Peeking Ahead: November 2025 to March 2026

For the next few months, into early 2026, I expect mortgage rates to mostly stay put, kind of like they’re holding their breath. We’ll likely see them hover in the mid-6% range.

- Possible Dips: If inflation continues to cool off nicely and those Treasury yields stay steady or even dip a bit, we might see rates sneak down toward 6.0% or 6.3%.

- Watch Out for Surprises: However, things can change quickly. If there's a surprise jump in inflation or some big news on the world stage (like a new geopolitical tension), rates could become a bit jumpy and move back up. It's going to be important to keep an eye on the weekly reports.

Looking Further Out: April to November 2026

As we move into the later half of 2026, the picture starts to get a bit clearer, and the signs lean towards a gradual decline.

- The Trend is Down (Slowly): Most experts who study this stuff are predicting that rates will likely ease down to around 5.9% to 6.2% by the time November 2026 rolls around. This is thanks to more anticipated interest rate cuts from the Federal Reserve and hopefully continued cooling of inflation.

- Why Not Lower?: Even with these drops, it’s unlikely we’ll see a return to those super-low rates from the pandemic days anytime soon. Part of the reason is that there's still a shortage of homes for sale. When demand is high and supply is low, it tends to put a floor under how low prices and rates can go. Some economists think rates might not comfortably drop below 6% until the middle of 2026.

What the Experts Are Saying: Forecasts from Key Players

It’s always helpful to see what the major organizations in the housing and real estate world are predicting. When you look at a few different groups, a general pattern emerges: rates are expected to moderate, not crash.

Here’s a quick look at some of their predictions as gathered from recent reports:

| Organization | End of 2025 Forecast | 2026 Average/End Forecast | What They're Watching |

|---|---|---|---|

| Fannie Mae (September 2025) | 6.4% | 5.9% (by end of 2026) | Steady economic growth, inflation around 2.7% |

| Mortgage Bankers Association (MBA) (October 2025) | 6.5% | ~6.3% (average for 2026) | Expects rates to level off; more home loans being made. |

| National Association of Realtors (NAR) | Mid-6% (second half avg. 6.4%) | 6.0%–6.1% (average) | Tied to rising home sales; a drop to 6% could boost sales. |

| National Association of Home Builders (NAHB) | N/A | 6.25% (by end of 2026) | Focus on builder confidence; gradual rate drop expected. |

These are estimates, folks! They all depend on the economy behaving in certain ways. If the economy grows stronger than expected, rates might stay a bit higher. If it slows down more than anticipated, rates could fall faster.

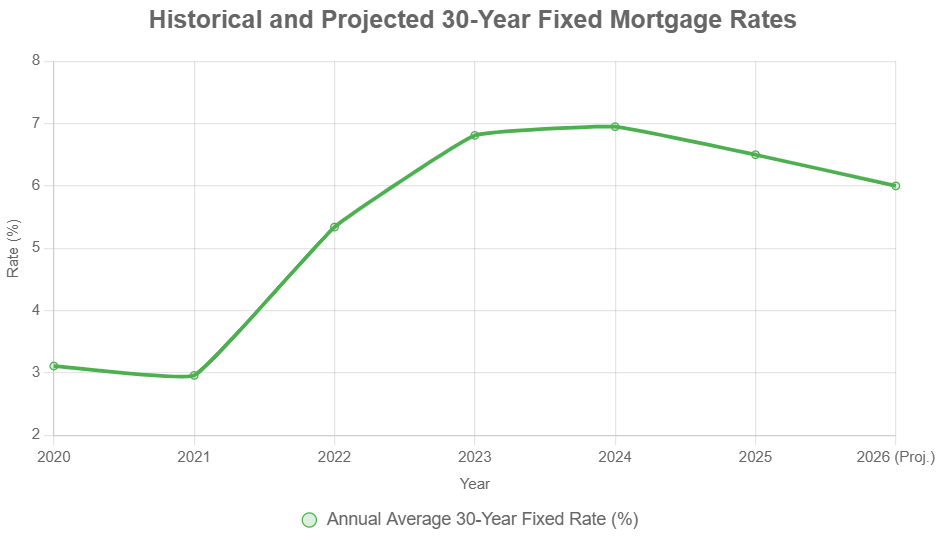

A Look Back to See the Future: Historical Context

To really get a feel for where we might be going, it's useful to see where we've been. Mortgage rates have been all over the place. Remember when they were close to 18% in the early 1980s? Or how they dipped below 3% during the pandemic?

Here's a look at annual average rates for a 30-year fixed mortgage:

- 2020: 3.11% (Pandemic lows!)

- 2021: 2.96%

- 2022: 5.34% (Inflation hits hard!)

- 2023: 6.81%

- 2024: Averaging around 6.95%

- 2025 (So far): Around 6.50% (Starting to ease a bit)

And based on what experts are saying now, we could see an average of around 6.0% in 2026. This chart helps us see that while we're not going back to the ultra-low rates anytime soon, the current rates are much closer to the pre-pandemic norm than the peaks we saw.

What Does This Mean for You?

If you're looking to buy or refinance, these predictions have real-world impacts:

- For Buyers: As rates slowly ease, it could open the door for more people to buy. This might mean things stay competitive, but without the crazy bidding wars we saw a couple of years ago. Over the next year, seeing rates move down from the mid-6% range towards the low 6% or even dipping below 6% is a real possibility. This could make monthly payments more affordable.

- For Refinancers: If your current mortgage rate is significantly higher than the ones available, refinancing could save you a good chunk of money each month. Keep an eye on those rate drops and do the math to see if it makes sense for you.

- Home Prices: We're not expecting home prices to skyrocket, nor are we expecting them to crash. Most forecasts predict modest price increases, or even staying flat in some areas. This is good because it prevents the market from getting overheated again.

My Take on It (Based on Experience!)

Having followed the housing market for years, I've learned that predicting exact numbers is a tricky business. However, I'm pretty confident in the overall trend. We're likely past the peak anxiety of super-high rates. The Federal Reserve is signaling they want to help the economy, and inflation seems to be cooperating, albeit slowly.

It's my opinion that we’ll see rates gradually settle into a range that's more sustainable for the housing market. This means that those who can afford the current rates will continue to buy, and as rates inch lower, more buyers will be able to jump in. We won't likely see a drastic plunge, but rather a steady, measured decline that makes homeownership more accessible over the next year. The key will be for borrowers to stay patient and informed.

The Bottom Line: Cautious Optimism

Looking ahead to November 2026, the mortgage rate picture is one of cautious optimism. I expect a slow and steady descent, with rates likely finding a home in the 5.9% to 6.2% range. This gradual easing should help the housing market continue to stabilize and become more accessible without causing any sudden shocks.

It's a balancing act, for sure. The economy needs to cooperate, inflation needs to stay in check, and the Federal Reserve will continue to play a key role. For anyone in the market for a home or looking to refinance, staying informed, being prepared, and acting strategically will be your best tools. The next 12 months offer a promising path towards more affordable borrowing, but it’s a journey that requires a watchful eye.

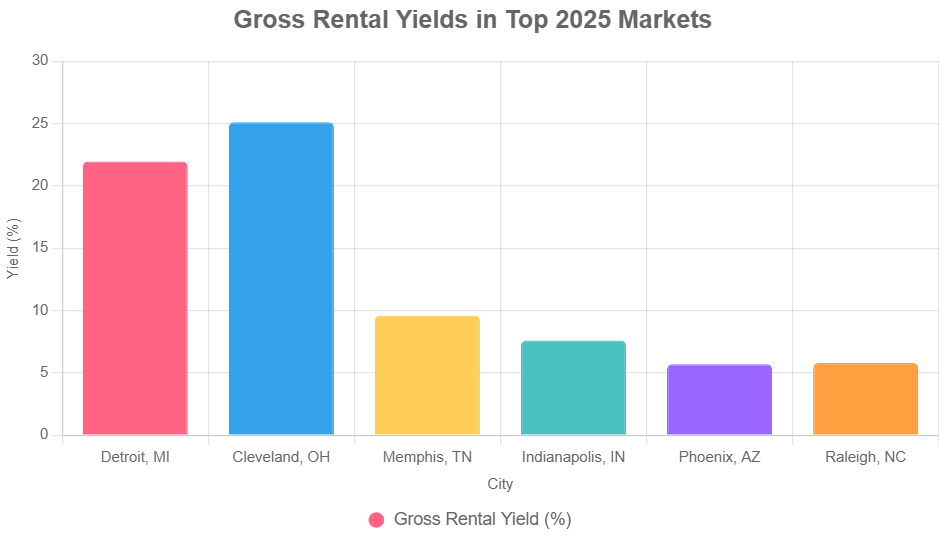

Grab the Deals—Turnkey Properties That Deliver Monthly Returns

As mortgage rates remain high, savvy investors are locking in properties that deliver consistent rental income and long-term appreciation.

Work with Norada Real Estate to find turnkey, cash-flowing homes in stable markets—helping you grow wealth no matter which way rates move.

HOT NEW INVESTMENT PROPERTIES JUST LISTED!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?