Have you ever felt like finding the right home was like searching for a needle in a haystack? Well, if you've been keeping an eye on the housing market, you might have noticed a significant shift. Finally, after what feels like ages, the number of homes up for grabs has surged dramatically. In fact, May 2025 marked a notable milestone, with the housing supply skyrocketing to a 6-year high. This increase in inventory offers a glimmer of hope for potential homebuyers who have been patiently waiting on the sidelines.

Housing Supply Booms as Listings Surge to Highest Level Since 2019

According to the latest weekly data from Realtor.com, the total number of homes listed for sale across the U.S. jumped by a substantial 31.1% compared to this time last year. This pushed the total inventory above the one-million mark for the first time since late 2019 – a truly significant jump. This marks the 78th consecutive week of year-over-year increases in active listings, signaling a clear trend of more homes becoming available.

Now, I know what you might be thinking: “More houses, great! Does that mean it's finally easier to buy one?” While the increase in housing supply is definitely a positive development, the full picture is a bit more nuanced. While sellers seem eager to put their properties on the market, many potential buyers are still hesitant to jump in.

A Welcome Increase, But Demand Remains Soft

The surge in housing supply is undoubtedly good news for those who have been frustrated by the limited options available in recent years. After a long period of tight inventory, especially in regions like the Midwest and Northeast, this influx of new listings provides more choices and could potentially ease some of the competitive pressure we've been seeing.

We're seeing a rebound in new listings, reaching their highest point since mid-2022, with a 9.3% year-over-year increase. This suggests that homeowners who might have been holding back are now feeling more confident about putting their properties on the market. As one expert pointed out, this momentum from earlier in the year points towards a more active market as we move into the warmer months.

However, despite this encouraging increase in available homes, buyer demand hasn't kept pace. Many would-be homeowners are still grappling with affordability challenges. Factors like economic uncertainty and low consumer confidence are making people think twice before making such a significant financial commitment.

Affordability Concerns Loom Large

The reality is that even with more homes on the market, the dream of homeownership remains out of reach for many due to persistent affordability issues. Interest rates, while they haven't seen further increases recently, are still at levels that make monthly mortgage payments quite substantial. Combine this with the general cost of living and economic anxieties, and it's understandable why some buyers are proceeding with caution.

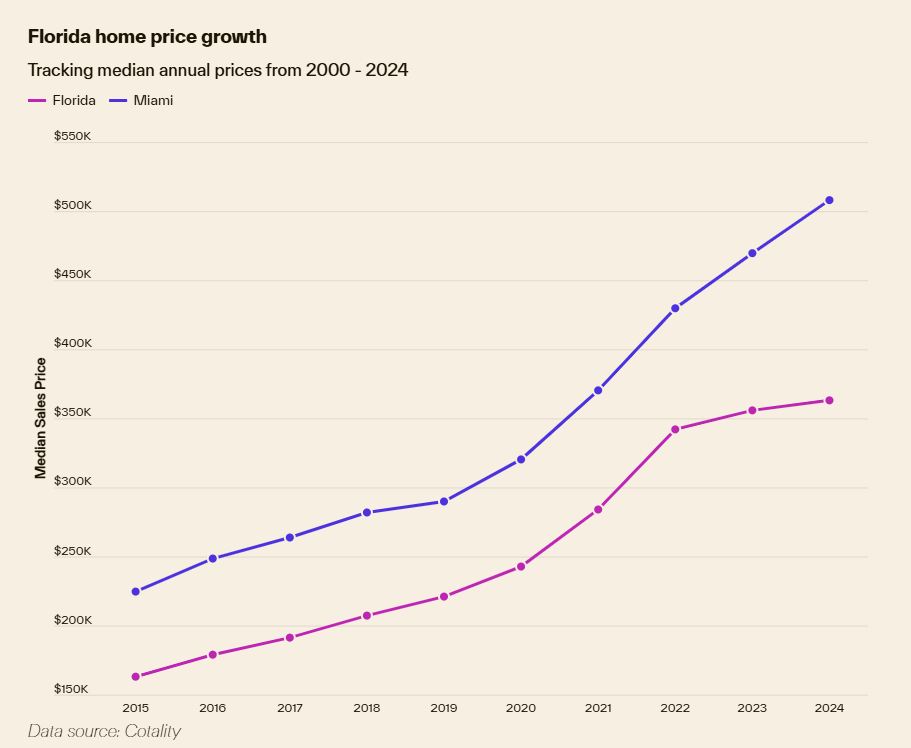

Interestingly, despite the cooling demand, the national median list price has seen a slight increase of 0.9% compared to last year. While modest, this is the highest annual price growth in over a year. This indicates that while there are more homes available, prices haven't yet significantly softened in many areas, largely due to the fact that overall inventory is still below pre-pandemic levels in many parts of the country.

Sellers Are Starting to Adjust

Recognizing the hesitancy among buyers, some sellers are starting to take a more pragmatic approach. We're seeing an uptick in the share of homes with price reductions, up 0.6 percentage points from last year. This suggests that sellers are becoming more willing to lower their expectations to attract buyers in this evolving market. For buyers who are in a position to make a move, this could present some opportunities to find a home at a more negotiable price.

The Pace of the Market is Slowing Down

Another key indicator of the shifting market dynamics is the amount of time homes are staying on the market. The typical for-sale home spent four days longer waiting for a buyer compared to the same week last year. This is a continuation of a trend we've been observing, indicating that the frenzied pace of the pandemic-era housing market is definitely behind us.

From a buyer's perspective, this slowdown can actually be a positive thing. It provides more time to consider different options, conduct thorough inspections, and make more informed decisions without feeling rushed by intense competition. While the market is still moving slightly faster than before the pandemic, it's a significant step back from the breakneck speed we saw just a couple of years ago.

Looking Ahead: A Balancing Act

The current state of the housing market feels like a balancing act. We have a growing housing supply, which is a welcome change, but buyer demand remains somewhat subdued due to affordability concerns. Sellers are starting to adjust their strategies, and the pace of the market is moderating.

What does this mean for the future? Well, I believe we're entering a phase where the market is becoming more balanced. Buyers might find more options and potentially more negotiating power, while sellers will need to be realistic about pricing and be prepared for homes to take a little longer to sell.

The Federal Reserve's recent decision to keep interest rates steady, while expected, underscores the ongoing economic uncertainties. The warning about potential risks of higher unemployment and inflation adds another layer of complexity to the housing market outlook. We'll need to keep a close eye on upcoming economic data to see how these factors influence buyer confidence and market activity.

For anyone looking to buy a home, now might be a good time to start actively exploring the market. With more inventory available, you have a better chance of finding a property that meets your needs. Just be sure to carefully consider your financial situation and be prepared to negotiate.

For sellers, it's crucial to price your home competitively and work with a real estate professional who understands the current market dynamics. Being open to negotiation and ensuring your property is well-presented will be key to attracting serious buyers.

Ultimately, the increase in housing supply is a significant development that could pave the way for a more accessible housing market. While challenges remain, this shift offers a sense of optimism for those who have been waiting for the right opportunity to buy their dream home.

Work with Norada, Your Trusted Source for

Real Estate Investment in the Top U.S. Markets

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Housing Market Crisis: Why Homeownership Dreams Are Fading

- 22 Housing Markets Poised for Boom Over the Next 12 Months

- Housing Market Predictions 2026: Will it Crash or Boom?

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Housing Prices Are Set to Rise by 4.1% by the End of 2025

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Will Real Estate Rebound in 2025: Top Predictions by Experts

- Will the Housing Market Crash Due to Looming Recession in 2025?

- 4 States Facing the Major Housing Market Crash or Correction