PREDICTABLE INCOME WITH PROMISSORY NOTES

Passive Investments Yielding Fixed 12% in Any Market

You don’t have to chase the unpredictable returns offered by the stock market! Norada Capital Management offers investors the opportunity to invest in Promissory Notes with fixed rates of return up to 16.7% per year.

Investment SUMMARY

Norada Capital provides investors with promissory note investments that generate predictable monthly income and double-digit returns between 12% to 15% per year. Our fund’s portfolio is made up of thriving companies that continue to grow. Our notes are ideal for passive investors seeking to add and diversify their income streams. Interest payments are deposited monthly, making it a truly hands-off passive investment opportunity.

Effortless Passive Investments

Predictable Monthly Income

12-15% Fixed Rates of Return

Current Holdings

Investor Objectives

Norada Capital Management’s objectives are to provide Investors with:

High Yield Returns

Rates of return that are higher than the bank’s traditional low-yield bonds, and higher than most stock dividends.

Regular Income

Additional monthly or quarterly income for retirement, living expenses, or to build your savings account.

IRA Friendly

This investment provides investors with a way to put to use their self-directed traditional IRA or Roth IRA.

Rollover Option

Option to automatically roll over your investment so you don’t miss out on earning interest or future investment opportunities.

Shorter Terms

We offer Note investments ranging in maturity dates from 3 to 7 years.

How it Works

1. Purchase a Promissory Note

You choose the amount you want to invest and the length of time until your note matures.

2. Get Monthly Direct-Deposit Payments

We make your monthly ACH interest payments directly into the funding account. The full amount of the principal is redeposited when the note matures.

3. Spend Your Time Doing What You Love

This is a truly effortless passive investment. We handle all the due diligence, maintenance, marketing, and management of our investments. You spend your time doing what you love to do.

Current Offerings

Option One

A $50,000 minimum investment earns a 12% annual rate of return (interest). Distributions are paid monthly through ACH direct deposit.

Option Two

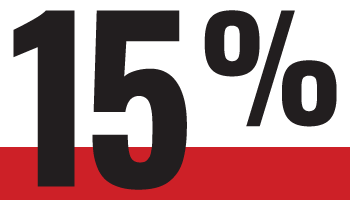

A $100,000 investment earns a 15% annual rate of return (interest). Distributions are paid monthly through ACH direct deposit.

Option Three

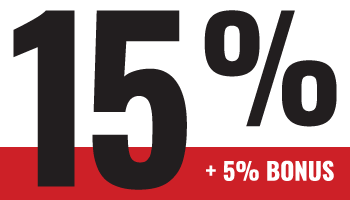

A $200,000+ investment earns a 15% annual rate of return (interest), plus a 5% interest bonus at maturity. Distributions are paid monthly through ACH deposit.

Investment Structure

The investment is provided through Promissory Notes as follows:

NOTE TERMS: 3, 4, 5, 6 and 7 years.

NOTE RATE: See chart below.

BONUS RATE: 5% paid at maturity. *

MAX RETURN: 16.7% per year.

PAYMENTS: Monthly payments.

PAYOFF: Repaid at maturity.

MINIMUM: $20,000 (Amortized).

MINIMUM: $50,000 (Interest Only).

START DATE: 1st of the month.

* See info packet for additional information.

INVESTMENT |

ANNUAL RATE |

| $50,000 | 12.0% |

| $100,000 | 15.0% |

| $200,000+ | 15.0% + Bonus |

TESTIMONIALS

“Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman.”

Yes, I’m Interested!

Please send me an info packet

*To qualify as an accredited investor, a person must have at least $200,000 in personal income, or $300,000 for combined incomes, over the past two years, with the expectation of the same or higher income in the current year. People with a net worth of more than $1 million jointly or with their spouse, excluding the value of their home, also qualify.

Disclaimer: This is not a solicitation to sell securities, which is only done through appropriate disclosure documents and only to qualified investors.