18 Best Real Estate Investing Books For Beginners (2025)

Real estate investments can provide excellent returns if the proper steps are taken, but many new investors lack the necessary…

10 Rules of Successful Real Estate Investing

I came up with the following rules of successful real estate investing over my many years of successes and failures.…

We Made the List! (America’s Fastest-Growing Private Companies)

We are proud to announce that we have made the prestigious Inc. 5000 list of the fastest-growing private companies in…

Today's Mortgage Rates July 6, 2025: Persistent Stability in 30-Year FRM and 15-Year FRM

As of July 6, 2025, mortgage rates in the United States have remained relatively stable, with the average 30-year fixed mortgage…

Interest Rate Predictions for the Next 2 Years Ending 2027

Are you wondering where interest rates are heading? You're not alone! The Federal Reserve's (the Fed's) interest rate decisions affect everything from…

15-Year Mortgage Rate Forecast for the Next 5 Years: 2025-2029

Are you thinking about buying a home or refinancing your mortgage? If so, understanding where interest rates might be headed…

Mortgage Rates Today – July 5, 2025: 5-Year ARM Drops Massively by 50 Basis Points

If you've been eyeing a home purchase or considering refinancing, today's news could be a game-changer. According to Zillow, on…

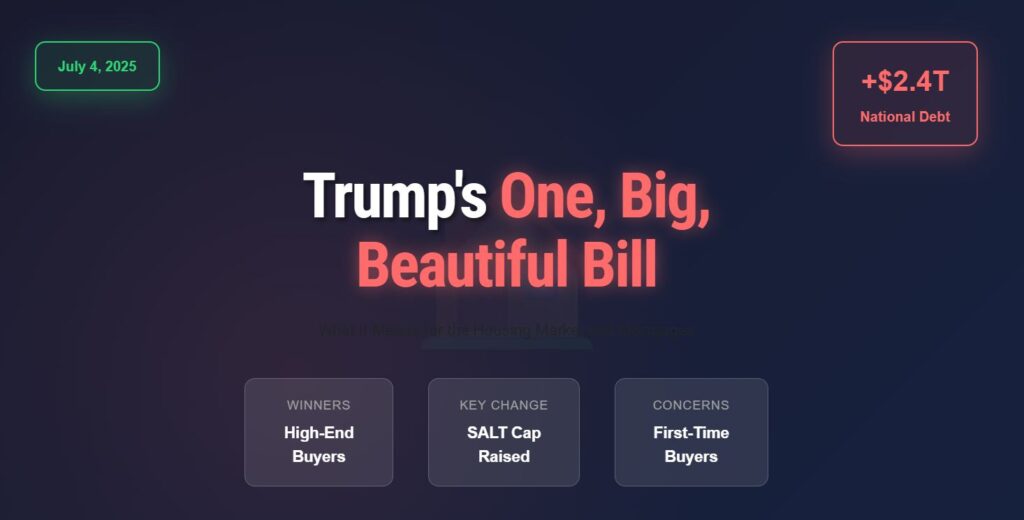

Is One Big Beautiful Bill a Game-Changer for the Housing Market and Mortgages?

Will Trump's “Big Beautiful Bill” truly reshape the housing market? The answer is complex. Signed into law on July 4,…

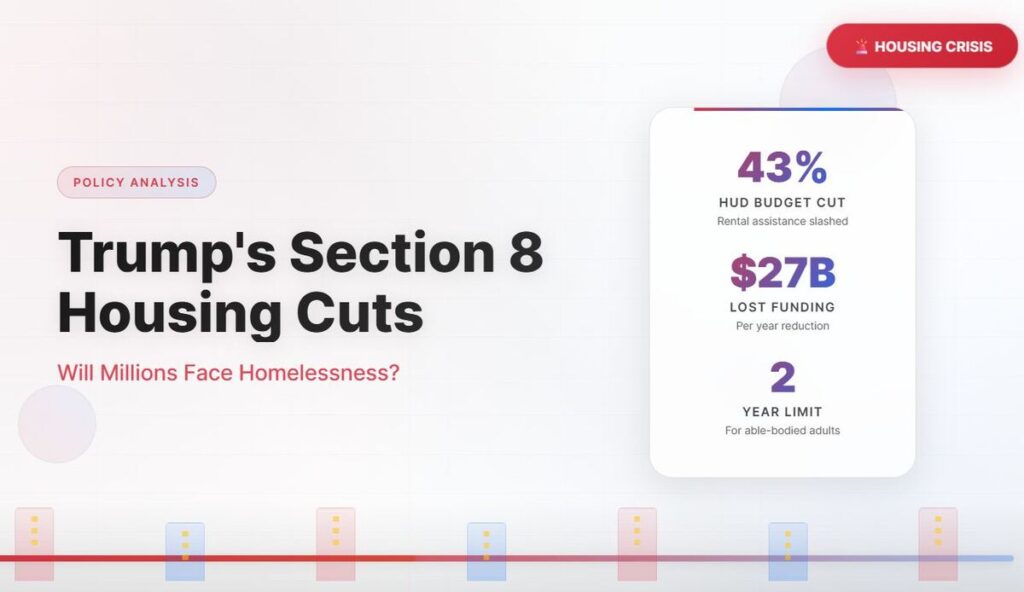

Trump’s Section 8 Housing Cuts: Will Millions Face Homelessness?

Are you worried about losing your home? Many people are, especially those who rely on Section 8 housing. Trump's Section 8 Cuts proposed…

10 Housing Markets Predicted to Boom Amid Economic Uncertainty in 2025

Are you trying to figure out where to invest in real estate, even with all the ups and downs in…

US Job Growth Booms in June 2025 With Payrolls Exceeding Expectations

The US job growth in June 2025 proved surprisingly strong, with nonfarm payrolls increasing by 147,000. This exceeded expectations of around 110,000 and…

Will AI Take Your Job: Fed Chair Jerome Powell's Cautious Warning

Is artificial intelligence (AI) poised to steal our jobs? That's the burning question on many minds, and Federal Reserve Chair Jerome Powell…