The Chicago housing market exhibited mixed trends in March 2024, with a decrease in home sales juxtaposed against rising median prices. Expert analysis suggests that while challenges such as shrinking inventory persist, the market remains resilient. As consumer confidence continues to drive demand, the outlook for the Chicago housing market remains cautiously optimistic, with expectations of steady growth in sales and prices in the coming months.

Chicago Housing Market Trends

In March 2024, the housing market in the Chicago area experienced a slight downturn in home sales compared to the previous year. According to Illinois REALTORS®, a total of 6,794 homes, including single-family residences and condominiums, were sold in the nine-county Chicago Metro Area.

This figure represented a 14.1 percent decrease from the 7,911 homes sold in March 2023. Concurrently, there was a notable decline in the number of homes available for purchase, with inventory decreasing by 15.5 percent from March 2023 to March 2024, leaving only 10,409 homes on the market.

Price Trends

Despite the decrease in sales volume and inventory, there was a notable increase in the median home price in the Chicago Metro Area. In March 2024, the median price of a home reached $339,900, marking a 9.6 percent rise from the previous year when it was $310,000. This upward trend in prices suggests a continued demand for housing in the region.

Insights from Real Estate Experts

Dr. Daniel McMillen, a distinguished Professor of Real Estate and Associate Dean for Faculty Affairs at the University of Illinois-Chicago College of Business Administration, provided valuable insights into the market dynamics. He noted a significant rise in sales from February to March, coupled with an increase in prices.

However, despite these positive indicators, the number of sales remained lower compared to the previous year. Dr. McMillen expressed optimism regarding future market performance, citing high consumer confidence and the traditional seasonal upswing in sales during the spring months.

City-Specific Trends

Within the city of Chicago, the housing market also experienced a decline in year-over-year home sales. In March 2024, there were 1,790 home sales, reflecting an 18.9 percent decrease from the previous year's figure of 2,208 sales. Similarly, the inventory of available homes in Chicago decreased by 16.4 percent during the same period, leaving only 4,216 homes for sale. Despite the decrease in sales volume, the median home price in Chicago rose to $359,000 in March 2024, indicating a 7.3 percent increase from the previous year.

Expert Analysis

Drussy Hernandez, president of the Chicago Association of REALTORS® and vice president of brokerage services for Coldwell Banker Realty in Chicago, offered insights into the market dynamics within the city. She noted that while closed sales experienced a decline, there was an upward trend in median sales prices, accompanied by a reduction in the number of days homes spent on the market. These observations suggest a robust spring season in Chicago, despite challenges posed by a constrained inventory market.

ALSO READ: Illinois Housing Market Forecast

Chicago Rent Price Trends

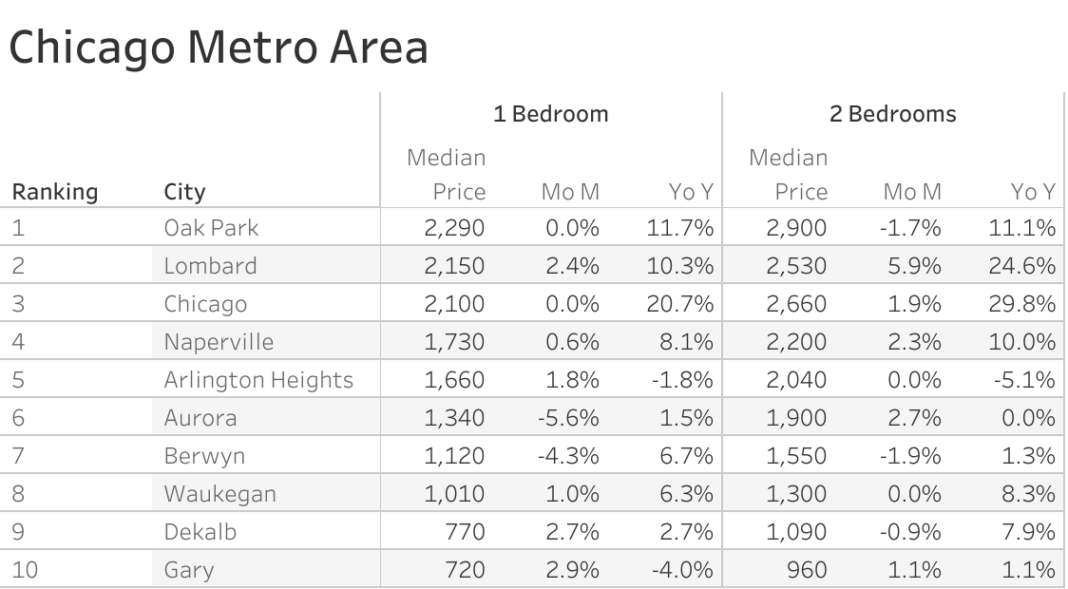

The Most Expensive Cities

According to the report by Zumper Chicago Metro Area Report, Oak Park emerges as the frontrunner in terms of expensive rental rates, with one-bedroom units commanding a hefty $2,290 per month. Following closely behind is Lombard, securing the second position with rents averaging at $2,150. Surprisingly, the city of Chicago itself comes in third, with the median rent standing at $2,100.

The Least Expensive Cities

On the flip side, affordability finds its haven in cities like Gary, where rental prices hover around a more modest $720. Dekalb clinches the second spot on the affordability scale, boasting rents of approximately $770. Meanwhile, Waukegan rounds up the list with one-bedroom units available at $1,010 per month.

Fastest Growing Rent Prices

Highlighting the dynamic nature of the rental market, the report also sheds light on the cities witnessing the most significant rental growth over time. Chicago takes the lead in this aspect, with rents surging by an impressive 20.7% compared to the previous year. Not far behind, Oak Park showcases a notable 11.7% increase, securing its position as the second fastest growing rental market. Lombard follows suit, albeit at a slightly slower pace, with a 10.3% hike in rental rates.

Monthly Rental Growth

Zooming in on the month-to-month changes in rental prices, Gary emerges as the frontrunner with a significant 2.9% increase in rents. Dekalb closely trails behind with a 2.7% surge in rental rates. Meanwhile, Lombard maintains its presence in the top ranks, experiencing a 2.4% hike in monthly rents.

Chicago Housing Market Forecast for 2024 and 2025

The Chicago housing market is shaping up to continue the trend of the last few years as one of the hottest markets in the United States. It is also one of the hottest real estate markets for investing in rental properties. What are the Chicago real estate market predictions for 2024?

According to the market forecast presented by Stuart Handler from the Department of Real Estate at the University of Illinois Chicago, in Illinois, the median price is poised for a significant uptick, with a forecasted change of 9.0% in April, followed by 8.2% in May, and 6.4% in June. Similarly, for the Chicago PMSA, we anticipate a rise of 8.5% in April, 6.5% in May, and 4.2% in June. These projections paint a picture of steady growth in property values, offering optimism to homeowners and investors alike.

Beyond the price metrics, the sales forecast also unveils promising trends, albeit with some nuances. For Illinois, we foresee an increase in sales on both yearly and monthly scales. However, the picture differs slightly for the Chicago PMSA, where while monthly sales are projected to rise, there's a decline compared to the previous year.

Annually, Illinois is expected to see a modest uptick in sales, ranging from 1.5% to 2.1%. Conversely, the Chicago PMSA is anticipated to experience a decline, with figures ranging from -6.5% to -8.7%. On a monthly basis, sales are forecasted to surge, with Illinois projecting an increase of 12.3% to 16.6%, and the Chicago PMSA showing a similar trend with a range of 16.0% to 21.6%.

Chicago Home Values Forecast

The Chicago-Naperville-Elgin Metropolitan Statistical Area (MSA) encompasses several counties in Illinois and Indiana. It is one of the largest metropolitan areas in the United States, spanning across Cook, DuPage, Lake, Will, Kane, McHenry, Kendall counties in Illinois, and Lake County in Indiana.

This MSA is home to a diverse population and economy, with urban and suburban areas offering a range of housing options. The region's housing market is significant, with a large inventory of homes and a steady flow of new listings.

Current Market Trends

According to Zillow, the average home value in the Chicago-Naperville-Elgin area stands at $313,396. This figure reflects a 7.0% increase over the past year, indicating growth and stability in the market. Homes in this area typically go pending in approximately 12 days, showcasing a competitive environment for buyers.

As of March 31, 2024, the market forecast for the next year shows a 0.4% increase, suggesting moderate growth in the foreseeable future. Inventory remains steady, with 19,049 homes listed for sale and 7,720 new listings in March 2024.

Key Metrics

– Median Sale Price: The median sale price for homes in the Chicago-Naperville-Elgin area is $286,500 as of February 29, 2024.

– Median List Price: Sellers are listing their homes at a median price of $329,967 as of March 31, 2024.

– Sale to List Ratio: The median sale to list ratio stands at 0.992, indicating that homes are typically selling close to their listed price.

– Market Competition: 32.5% of sales are happening over the list price, while 52.7% are under the list price, highlighting the competitive nature of the market.

Is Chicago a Buyer's or Seller's Housing Market?

As of now, the Chicago housing market leans towards being a seller's market. With low inventory and high demand, sellers have the upper hand in negotiations. Multiple offers on properties and bidding wars are not uncommon, indicating a competitive landscape favoring sellers.

Despite the competitive market conditions, there is no evidence to suggest a significant drop in home prices in the Chicago-Naperville-Elgin area. While market fluctuations may occur, the overall trend has been one of appreciation, with home values steadily increasing over time.

Will the Chicago Housing Market Crash?

Predicting a housing market crash is inherently difficult and subject to various factors. While there may be fluctuations and adjustments in the market, a crash is not imminent based on current data and trends. However, it's essential to monitor market conditions and economic indicators for any signs of instability.

With mortgage rates lower compared to last year, now could be a favorable time for prospective buyers to enter the market. Lower interest rates can result in reduced monthly payments and overall savings over the life of a mortgage. However, buyers should also consider other factors such as market conditions, personal financial situation, and long-term housing goals before making a decision.

Is Chicago a Good Place for Real Estate Investment?

Population Growth and Trends

Chicago, known for its diverse neighborhoods and rich history, has been experiencing steady population growth over the years. The city's population growth is driven by factors such as employment opportunities, higher education institutions, and cultural attractions. The diverse demographic makeup of Chicago provides a broad tenant pool for real estate investors, making it an attractive market.

- Diverse Demographics: Chicago's diverse population ensures a wide range of tenant preferences and needs, reducing the risk of high vacancy rates.

- Steady Growth: The city's population growth indicates a consistent demand for housing, especially in well-located neighborhoods.

Rehabbed Homes Fix and Flip Opportunities

Chicago's real estate market offers lucrative opportunities for fix and flip investors. Many older properties in desirable neighborhoods are prime candidates for rehabilitation and resale. This segment of the market can yield significant profits for investors with the right skills and resources.

- Older Properties: Chicago has a substantial inventory of older homes that can be acquired at competitive prices and then renovated for profit.

- Increasing Demand: Renovated homes in sought-after neighborhoods are in high demand, allowing for premium pricing.

Economy and Jobs

The strength of the local economy plays a crucial role in real estate market stability. Chicago's diverse economy is bolstered by various industries, including finance, technology, manufacturing, and healthcare. The city offers a robust job market, which is attractive to both renters and potential buyers.

- Diverse Economy: A mix of industries reduces the risk associated with economic downturns in a specific sector.

- Job Opportunities: A strong job market ensures a constant influx of renters and potential homebuyers.

Livability and Other Factors

Chicago's livability is a key factor for real estate investors. The city's vibrant cultural scene, excellent public transportation, and diverse dining options contribute to its appeal. Additionally, the city's commitment to infrastructure and public services further enhances its livability.

- Cultural Attractions: Chicago offers world-class cultural experiences, attracting residents and tourists alike.

- Public Transportation: An extensive public transit system makes it convenient for residents to commute, reducing the importance of owning a car.

Chicago Rental Property Market Size and Growth

The size and growth of the Chicago rental property market are promising for investors. The city's diverse neighborhoods and housing options cater to a wide range of tenant preferences. This, coupled with population growth, ensures a robust and expanding rental market.

- Diverse Neighborhoods: Chicago's neighborhoods offer various housing options, from apartments to single-family homes, appealing to a wide range of renters.

- Growth Potential: With a growing population, the demand for rental properties is likely to continue to rise.

Other Factors Related to Real Estate Investing

When considering real estate investment in Chicago, it's essential to account for various other factors:

- Local Regulations: Familiarize yourself with Chicago's property regulations and tax laws to ensure compliance and maximize returns.

- Market Research: Thoroughly research neighborhoods and property types to identify areas with growth potential.

- Property Management: Whether you plan to manage properties yourself or hire a management company, effective property management is vital for success.

Investing in the Chicago real estate market offers numerous advantages. The city's population growth, diverse demographics, job opportunities, and livability make it an attractive destination for real estate investors. Additionally, the fix and flip opportunities, the size and growth of the rental market, and other related factors provide a solid foundation for potential returns on investment. However, it's crucial to conduct thorough research, stay informed about local regulations, and manage properties effectively to maximize the benefits of investing in Chicago's real estate market.

Highest Appreciating Chicago Neighborhoods

Chicago has witnessed significant changes in its neighborhoods since the year 2000. Here are the neighborhoods that have experienced the highest appreciation in terms of property values, according to Neighborhoodscout.

W Wabansia Ave / N Whipple St

Located in the heart of Chicago, the W Wabansia Ave / N Whipple St neighborhood has seen remarkable property value appreciation. This area's proximity to various amenities and its strong community appeal have contributed to its growth.

Humboldt Park Northeast

The Humboldt Park Northeast neighborhood has seen a steady increase in property values since 2000. The neighborhood's green spaces, cultural attractions, and improving infrastructure have made it an attractive destination for homebuyers and investors.

W Wabansia Ave / N Kimball Ave

This neighborhood, situated near W Wabansia Ave and N Kimball Ave, has experienced substantial property value appreciation. The presence of local businesses, parks, and good public transportation options has boosted its desirability among residents and investors.

Palmer Square East

Palmer Square East is another neighborhood that has seen significant appreciation in property values. Its charming streets, proximity to parks, and vibrant local scene have made it a sought-after area for both residents and real estate investors.

W Wabansia Ave / N Francisco Ave

The W Wabansia Ave / N Francisco Ave neighborhood has been on an upward trajectory in terms of property values. Its location and access to various amenities have attracted homebuyers and investors looking for long-term growth.

Logan Square Northwest

Logan Square Northwest is known for its thriving arts and dining scene. The neighborhood's cultural appeal, coupled with improved public services and transportation, has contributed to its property value appreciation.

W Cortland St / N Mozart St

W Cortland St / N Mozart St is a neighborhood that has experienced remarkable growth in property values. Its accessibility to urban conveniences and a sense of community have made it a desirable place to live and invest.

Palmer Square

Palmer Square, located in Chicago, has seen substantial property value appreciation. The neighborhood's green spaces, historic architecture, and community activities have made it a popular choice for homeowners and real estate investors.

Humboldt Park North

Humboldt Park North, with its green expanses and recreational opportunities, has seen a consistent increase in property values since 2000. The neighborhood's combination of natural beauty and urban amenities has attracted both residents and investors.

W Cortland St / N Albany Ave

W Cortland St / N Albany Ave is another Chicago neighborhood that has experienced substantial appreciation in property values. Its accessibility to city amenities and transportation options have bolstered its appeal to homebuyers and real estate investors.

These neighborhoods have not only appreciated in property values but also offer various amenities, community vibes, and urban conveniences, making them attractive options for both residents and real estate investors seeking long-term growth and value appreciation in Chicago.

References:

- https://www.illinoisrealtors.org/marketstats/

- https://www.zillow.com/chicago-il/home-values

- https://www.neighborhoodscout.com/il/chicago/real-estate

- https://www.realtor.com/realestateandhomes-search/Chicago_IL/overview