A home purchase is a monumental financial decision that requires careful consideration. Determining the right time to buy depends on various factors, including your financial situation, interest rates, and negotiating power. To gain insight into current market conditions, Freddie Mac provides monthly economic outlooks that analyze the housing market's present state and expectations for the future.

Current Market Conditions

Home Prices:

Freddie’s Forecast predicts that home prices will experience an increase in 2024, albeit at a slower pace than the previous year. The importance of this lies in the fact that home values generally appreciate over time, making homeownership a secure investment and a means to build wealth.

In the latter half of 2023, home prices surged, driven by a persistent shortage of housing supply and existing homeowners reluctant to sell due to favorable mortgage rates. Looking ahead to 2024, Freddie Mac anticipates a slower economy with modest improvements in housing supply and mortgage rates, resulting in home prices rising at half the speed of 2023.

Mortgage Rates:

According to Freddie’s Forecast, mortgage rates are expected to witness a steady decline throughout 2024 but remain within the 6% to 7% range. Monitoring mortgage rates is crucial, as lenders determine your rate based on market conditions, and slight differences can significantly impact your monthly payments.

While mortgage rates reached a two-decade high in October 2023, there has been a consistent decline since then. The expectation for further declines in 2024 brings favorable news for potential homebuyers, providing them with a more conducive borrowing environment.

Housing Supply:

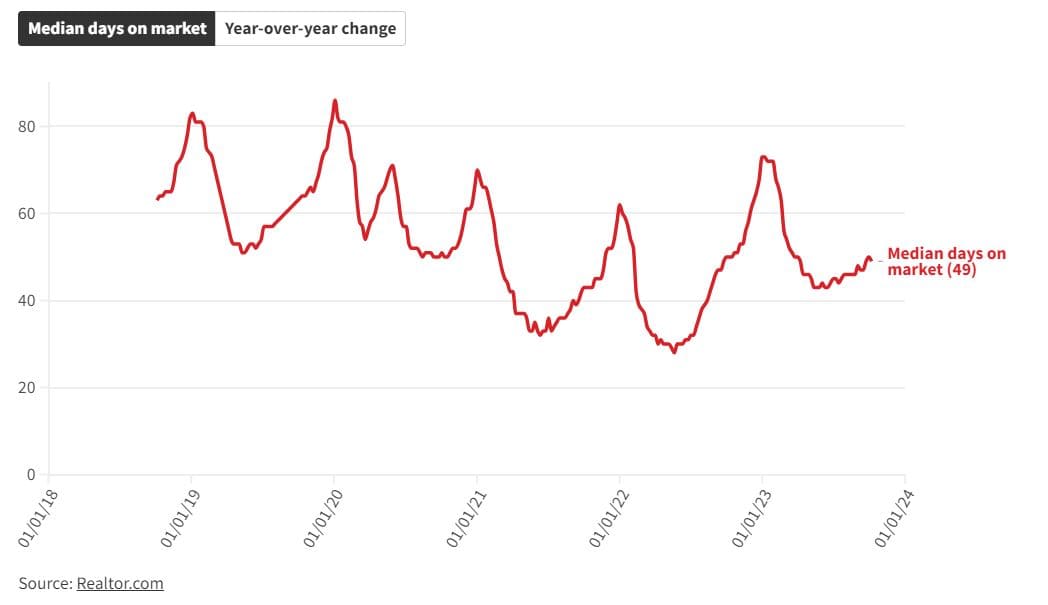

Freddie’s Forecast indicates that housing supply will continue to be a challenge until more homes are built or mortgage rates decrease further. The interplay between demand, home prices, and mortgage rates is a crucial dynamic. When demand surpasses the available homes for sale, prices tend to rise.

While the monthly supply of homes has increased, reflecting the highest levels since January 2023, the market remains tilted in favor of sellers. A supply-demand imbalance persists, emphasizing the need for more homes to enter the market, either through new construction or existing homes being listed for sale.

Is 2024 a Good Time to Buy?

The Verdict: Yes, but with potential improvements ahead.

What to Know: Current market conditions indicate a thawing of the previously frozen housing market. In 2024, the growth in home prices is expected to slow, mortgage rates are down from their recent peak and likely to stabilize. However, the overall housing supply remains a challenge. To fully overcome the freeze, a decrease in rates and increased incentives for current homeowners to sell are crucial.

How to Prepare for Homeownership

Successfully transitioning into homeownership requires careful preparation. Here are essential steps to ensure you are ready when the time is right:

- Understand Your Affordability: Estimate how much home you can afford by considering factors such as monthly income, current interest rates, debt, and credit history. Most lenders recommend spending no more than 28% of your monthly income on your mortgage payment.

- Set a Savings Goal: Establish a savings goal for your down payment. Contrary to the myth of a 20% down payment requirement, some loan products allow down payments as low as 3%. Keep in mind that a smaller down payment results in a larger monthly payment.

- Build Your Homebuying Team: Assemble a team of experienced professionals, including a housing counselor, real estate agent, and lender. Each plays a vital role in guiding you through the homebuying process, ensuring informed decisions and avoiding common pitfalls.

By following these steps and staying informed about market conditions, you can position yourself for successful and sustainable homeownership.