Good news for homebuyers! Zillow released a report predicting price increases in many US housing markets. Their analysis is based on tons of data, so you can trust it gives a good picture of where the market is headed. In this article, we'll take a look at some of the markets expected to see the biggest jumps in home prices over the next year.

The national housing market is expected to see a 1.4% increase in home prices by March 31, 2025. Out of 894 markets, roughly 22% (around 200) are expected to see home price declines over the next year. Prices are projected to hold steady in about 1% of markets, while the remaining 77% (roughly 684) can anticipate some level of price growth.

Let's dive into the hottest markets across different states, where homes are expected to see the biggest price gains over the next year (by March 2025). Get ready to see which metropolitan areas are predicted to be the top performers!

Market Forecast Analysis by States

Georgia (GA):

- Thomaston: The housing market in Thomaston, GA, is projected to experience significant growth in home prices, with an anticipated increase of 8.5% by March 2025.

- Toccoa: Similarly, Toccoa, GA, is expected to see a notable rise in home prices, with a forecasted increase of 6%.

- Cedartown: Cedartown, GA, is projected to see a significant 5.7% increase in home prices, reflecting a positive trend in the local real estate market.

- Cornelia: Similarly, Cornelia, GA, is forecasted to experience growth, with a predicted 5.4% rise in property values.

- Calhoun: Calhoun, GA, is projected to experience growth, with a predicted 4.9% increase in property values.

- Fitzgerald: Fitzgerald, GA, is forecasted to experience a 4.7% increase in home prices, reflecting positive market trends in the region.

- Statesboro: Similarly, Statesboro, GA, is anticipated to see a 4.5% rise in home prices.

- Athens: Athens, GA, is forecasted to see a 4.2% rise in home prices, reflecting positive market dynamics in the area.

- Gainesville: Similarly, Gainesville, GA, is anticipated to experience a 4.2% increase in home prices.

- Americus: Americus, GA, is anticipated to experience a 3.9% increase in home prices, reflecting positive market dynamics in the area.

Montana (MT):

- Kalispell: Home prices in Kalispell, MT, are forecasted to rise by 8.4%, indicating a robust housing market in the region.

- Butte: The housing market in Butte, MT, is expected to demonstrate growth, with a forecasted 5.4% increase in property values.

Colorado (CO):

- Steamboat Springs: The picturesque town of Steamboat Springs, CO, is expected to witness a substantial 7.7% increase in home prices, reflecting the area's desirability.

- Edwards: Similarly, Edwards, CO, is forecasted to experience a notable 6.1% growth in property values.

- Glenwood Springs: Glenwood Springs, CO, is forecasted to experience a 4.3% increase in home prices, indicating growth in the local housing market.

Tennessee (TN):

- Murray: The housing market in Murray, KY, is projected to demonstrate robust growth, with a forecasted increase of 7.1%.

- Crossville: Crossville, TN, is also poised for growth, with a predicted 6.5% rise in home prices.

- Knoxville: Knoxville, TN, is expected to see a significant 6.1% increase in property values.

- Greeneville: The housing market in Greeneville, TN, is forecasted to experience growth, with a predicted 5.3% increase in property values.

- Sevierville: Sevierville, TN, is forecasted to see a 4.7% rise in home prices, indicating growth in the local real estate market.

- Tullahoma: Tullahoma, TN, is projected to see a 4.3% rise in home prices, reflecting positive market trends in the region.

- Jackson: Jackson, TN, is projected to see a 4.2% rise in home prices, indicating growth in the local housing market.

- Cleveland: Cleveland, TN, is forecasted to experience a 4.2% increase in home prices.

- Johnson City: Similarly, Johnson City, TN, is anticipated to see a 4.1% rise in home prices.

- McMinnville: McMinnville, TN, is anticipated to experience a 4.1% increase in home prices, indicating growth in the local real estate market.

- Shelbyville: Shelbyville, TN, is anticipated to see a 3.9% rise in home prices, reflecting positive market trends in the region.

- Union City: Union City, TN, is projected to experience a 3.9% increase in home prices.

Idaho (ID):

- Mountain Home: Home prices in Mountain Home, ID, are anticipated to appreciate by 6.3%, reflecting the attractiveness of the region's real estate market.

- Hailey: Similarly, Hailey, ID, is forecasted to experience a 5.9% growth in property values.

- Blackfoot: Blackfoot, ID, is forecasted to experience growth, with a predicted 5% rise in property values.

- Coeur d'Alene: Similarly, Coeur d'Alene, ID, is anticipated to see a 4.7% increase in home prices.

- Sandpoint: Sandpoint, ID, is projected to experience a 4.6% increase in home prices, indicating growth in the local real estate market.

- Burley: Burley, ID, is projected to experience a 4.5% increase in home prices, indicating growth in the local real estate market.

- Twin Falls: Twin Falls, ID, is forecasted to experience a 4% increase in home prices, indicating growth in the local housing market.

Maine (ME):

- Augusta: The capital city of Augusta, ME, is expected to see a 6.1% increase in home prices, indicating a positive outlook for the housing market.

- Lewiston: Lewiston, ME, is also forecasted to experience growth, with a predicted 5.8% rise in property values.

- Bangor: Bangor, ME, is forecasted to experience a 4.2% increase in home prices, reflecting positive market trends in the region.

- Portland: Similarly, Portland, ME, is anticipated to see a 4.1% rise in home prices.

North Carolina (NC):

- Laurinburg: Home prices in Laurinburg, NC, are anticipated to appreciate by 5.7%, indicating a favorable market outlook for the region.

- Boone: Boone, NC, is also poised for growth, with a projected 5.3% increase in property values.

- Brevard: Brevard, NC, is projected to experience a 5.2% increase in home prices, reflecting positive momentum in the local real estate market.

- Pinehurst: Pinehurst, NC, is projected to experience a 4.7% increase in home prices, reflecting positive momentum in the local real estate market.

- Kinston: Similarly, Kinston, NC, is forecasted to see a 4.6% rise in home prices, indicating growth in the housing market.

- Rocky Mount: Rocky Mount, NC, is anticipated to see a 4.5% increase in home prices, reflecting positive market trends in the region.

- Wilson: Wilson, NC, is forecasted to experience a 4.4% increase in home prices, indicating growth in the local real estate market.

- Albemarle: Similarly, Albemarle, NC, is anticipated to see a 4.4% rise in home prices.

- Lumberton: Lumberton, NC, is forecasted to see a 4.1% rise in home prices, reflecting positive market dynamics in the area.

- Charlotte: Charlotte, NC, is anticipated to experience a 4% increase in home prices.

- Hickory: Similarly, Hickory, NC, is projected to see a 4% rise in home prices.

- Fayetteville: Fayetteville, NC, is anticipated to experience a 3.9% increase in home prices, indicating growth in the local housing market.

Florida (FL):

- Okeechobee: Okeechobee, FL, is expected to see a 5.5% increase in home prices, reflecting positive momentum in the local housing market.

- Wauchula: Similarly, Wauchula, FL, is forecasted to experience growth, with a predicted 5.3% rise in property values.

- Sebring: Sebring, FL, is projected to witness a 5% rise in home prices, indicating a favorable outlook for the local housing market.

- Lake City: Lake City, FL, is anticipated to experience a 4.7% increase in home prices, reflecting positive market dynamics in the area.

- Palatka: Palatka, FL, is forecasted to see a 4.2% rise in home prices, reflecting positive market dynamics in the area.

- Key West: Key West, FL, is anticipated to see a 4.1% rise in home prices, indicating growth in the local housing market.

- Arcadia: Arcadia, FL, is projected to experience a 4.1% increase in home prices.

New York (NY):

- Kingston: Kingston, NY, is projected to witness a 5.4% increase in home prices, indicating a positive trend in the local real estate market.

- Rochester: Rochester, NY, is anticipated to see a 5% increase in home prices, reflecting positive market trends in the region.

- Syracuse: Syracuse, NY, is anticipated to see a 4.5% rise in home prices, reflecting positive market dynamics in the area.

- Jamestown: Jamestown, NY, is anticipated to experience a 4.4% increase in home prices, indicating growth in the local real estate market.

- Hudson: Hudson, NY, is forecasted to see a 4.1% rise in home prices, reflecting positive market dynamics in the area.

Arizona (AZ):

- Flagstaff: Flagstaff, AZ, is anticipated to see a 5.3% rise in home prices, reflecting the area's attractiveness to homebuyers and investors.

- Show Low: Show Low, AZ, is anticipated to experience a 4.3% increase in home prices, indicating growth in the local real estate market.

New Hampshire (NH):

- Berlin: Berlin, NH, is expected to see a 5.3% increase in home prices, indicating positive market dynamics in the region.

- Keene: Similarly, Keene, NH, is forecasted to experience growth, with a predicted 5.2% rise in property values.

- Laconia: Laconia, NH, is anticipated to see a 4.8% rise in home prices, reflecting positive market dynamics in the area.

- Concord: Concord, NH, is anticipated to see a 4.5% rise in home prices, reflecting positive market trends in the region.

- Manchester: Manchester, NH, is projected to see a 4.1% rise in home prices, reflecting positive market trends in the region.

Massachusetts (MA):

- Vineyard Haven: Vineyard Haven, MA, is expected to see a 5.2% rise in home prices, indicating favorable market dynamics in the area.

- Barnstable Town: Barnstable Town, MA, is projected to see a 3.8% rise in home prices, indicating growth in the local real estate market.

Utah (UT):

- Price: The housing market in Price, UT, is forecasted to demonstrate growth, with a projected 5.2% increase in property values.

- Heber: Heber, UT, is also poised for growth, with a predicted 5.1% rise in home prices.

- Vernal: Vernal, UT, is forecasted to see a 3.9% rise in home prices, indicating growth in the local housing market.

Oregon (OR):

- Ontario: Ontario, OR, is expected to see a 5% increase in home prices, reflecting positive market dynamics in the area.

New Jersey (NJ):

- Atlantic City: Atlantic City, NJ, is expected to see a 4.9% rise in home prices, indicating positive market trends in the area.

Kentucky (KY):

- Mayfield: The housing market in Mayfield, KY, is forecasted to demonstrate growth, with a projected 4.8% increase in home prices.

Missouri (MO):

- West Plains: West Plains, MO, is projected to see a 4.7% rise in home prices, indicating growth in the local housing market.

Connecticut (CT):

- Torrington: Torrington, CT, is forecasted to experience a 4.5% increase in home prices, indicating growth in the local housing market.

- Hartford: Hartford, CT, is projected to see a 4% rise in home prices, reflecting positive market trends in the region.

- New Haven: Similarly, New Haven, CT, is anticipated to see a 4% increase in home prices.

Virginia (VA):

- Danville: Danville, VA, is projected to experience a 4.5% increase in home prices, indicating growth in the local real estate market.

Pennsylvania (PA):

- East Stroudsburg: East Stroudsburg, PA, is forecasted to see a 4.4% rise in home prices, reflecting positive market dynamics in the area.

- Pottsville: Pottsville, PA, is projected to experience a 4.1% increase in home prices, indicating growth in the local real estate market.

Wisconsin (WI):

- Manitowoc: Manitowoc, WI, is projected to see a 4.4% rise in home prices, reflecting positive market trends in the region.

- Shawano: Shawano, WI, is also poised for growth, with a predicted 4.3% increase in home prices.

Oklahoma (OK):

- Shawnee: Shawnee, OK, is projected to experience a 4.4% increase in home prices, indicating growth in the local housing market.

- Tahlequah: Tahlequah, OK, is anticipated to see a 4% rise in home prices, reflecting positive market dynamics in the area.

Kansas (KS):

- Atchison: Atchison, KS, is forecasted to see a 4.4% rise in home prices, reflecting positive market dynamics in the area.

- Dodge City: Dodge City, KS, is projected to experience a 4% increase in home prices, indicating growth in the local real estate market.

Arkansas (AR):

- Fayetteville: Fayetteville, AR, is projected to experience a 4.2% increase in home prices, indicating growth in the local real estate market.

- Hot Springs: Hot Springs, AR, is forecasted to see a 3.9% rise in home prices, indicating growth in the local housing market.

Michigan (MI):

- Battle Creek: Battle Creek, MI, is projected to experience a 4.2% increase in home prices, indicating growth in the local real estate market.

Indiana (IN):

- Frankfort: Frankfort, IN, is anticipated to experience a 4.2% increase in home prices, indicating growth in the local housing market.

- Muncie: Muncie, IN, is anticipated to see a 3.9% rise in home prices, reflecting positive market dynamics in the area.

- Connersville: Similarly, Connersville, IN, is projected to experience a 3.9% increase in home prices.

New Jersey (NJ):

- Ocean City: Ocean City, NJ, is forecasted to experience a 4.1% increase in home prices, reflecting positive market trends in the region.

- Vineland: Vineland, NJ, is forecasted to experience a 3.9% increase in home prices, indicating growth in the local real estate market.

Texas (TX):

- McAllen: McAllen, TX, is forecasted to see a 3.9% rise in home prices, reflecting positive market dynamics in the area.

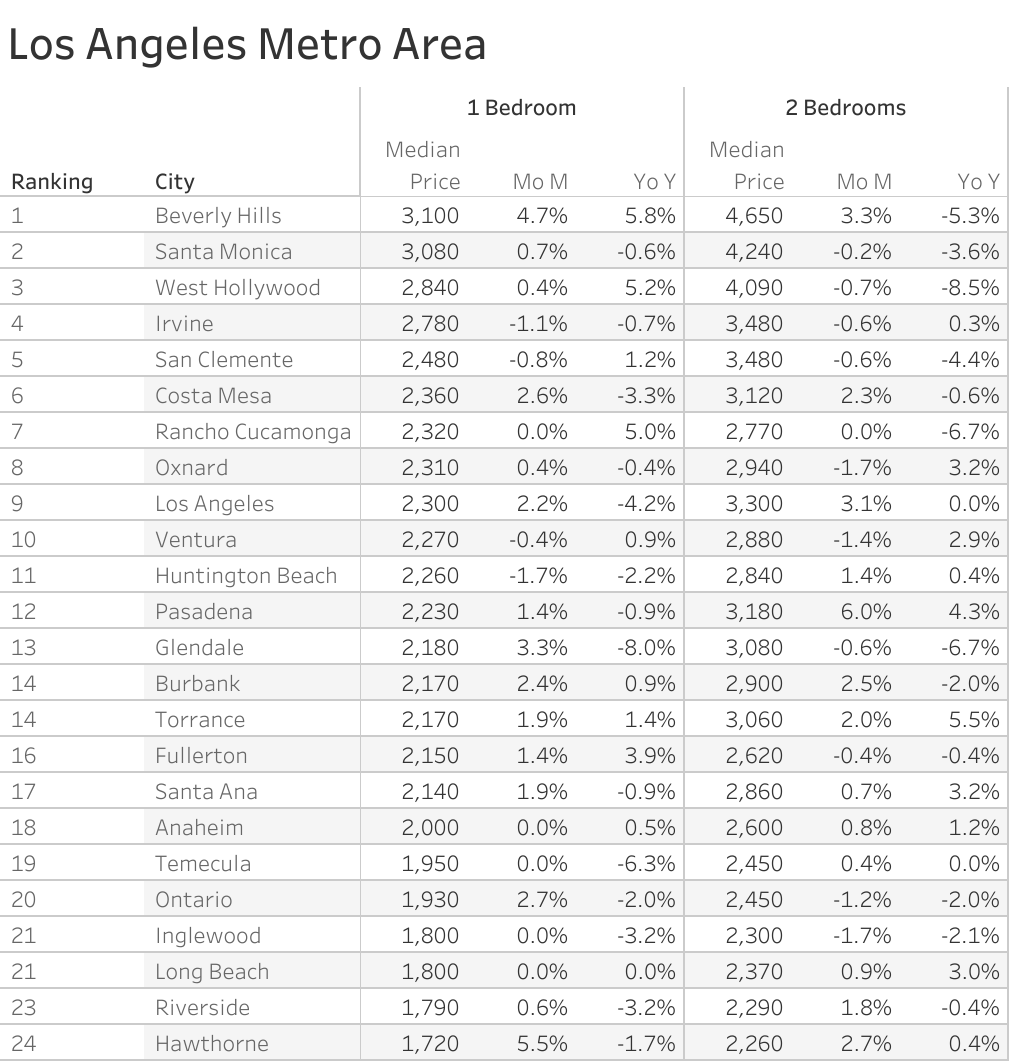

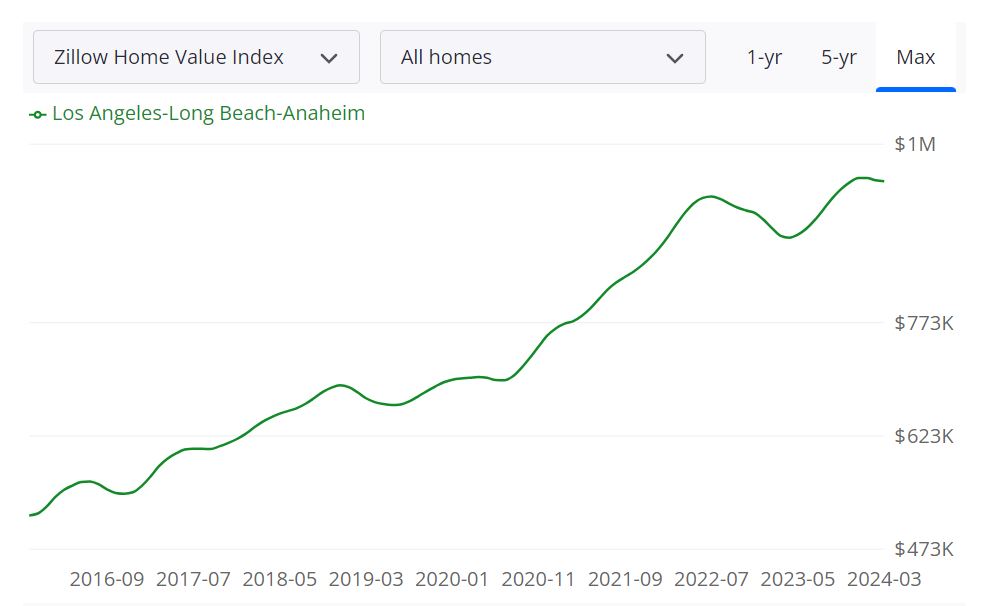

California (CA):

- Santa Maria: Santa Maria, CA, is projected to see a 3.9% increase in home prices, reflecting positive market trends in the region.

South Carolina (SC):

- Seneca: Seneca, SC, is projected to experience a 3.9% increase in home prices, indicating growth in the local real estate market.

Note that we have covered only some of the 684 housing markets that have a positive home price forecast until March 2025. These projections by Zillow underscore the dynamic nature of the housing market, with various regions across the United States poised for growth in home prices. As prospective homeowners and investors consider their options, these insights provide valuable information for making informed decisions in the real estate market. Stay tuned for further analysis as we continue to monitor and assess housing market trends.