Here are the latest trends in the NYC real estate market as well as the statewide market. In the current state of the NYC housing market, the balance between buyers and sellers is a crucial consideration. With the persistent decline in housing inventory and an increase in median prices, the market tends to favor sellers.

The limited supply of homes puts sellers in a favorable position, allowing them to potentially secure better deals. However, this doesn't necessarily mean it's a bleak scenario for buyers. The increased demand and fluctuating market conditions provide opportunities for those seeking to make strategic investments in real estate.

The surge in New York home prices reflects the impact of low housing inventory and heightened demand. As a result, the current trend suggests that home prices are not dropping but rather experiencing growth, indicating a robust market with potential for profitable returns for sellers.

The Current State of the New York Real Estate Market

Interest Rates and Market Trends:

The year 2024 commenced much like its predecessor, with low housing inventory and fluctuating interest rates around 6.5 percent, according to the New York State Association of REALTORS®. The average on a 30-year fixed-rate mortgage experienced a marginal decrease from 6.82 percent in December 2023 to 6.64 percent in January 2024. However, when compared to the same period last year, the interest rate has shown an increase from 6.27 percent, highlighting the dynamic nature of the real estate market.

Housing Inventory and Market Dynamics:

One of the notable shifts in the market is the continuous decline in housing inventory, which has persisted for 11 consecutive months in year-over-year comparisons. The inventory of homes for sale across New York decreased by 10.2 percent, dropping from 39,544 homes in 2023 to 35,492 units in 2024. This limited supply poses challenges for buyers but also creates an environment where sellers may find opportunities to leverage the scarcity of available homes.

Median Price and Market Performance:

The median price of homes in January 2024 witnessed a substantial increase, rising by 9.6 percent to reach $400,000. This marks a noteworthy surge from the median price of $365,000 in January 2023. The surge in prices is indicative of the demand for housing and the impact of reduced inventory on the overall market dynamics.

New Listings, Closed Sales, and Pending Sales:

New listings experienced a modest decline of 1.5 percent, totaling 9,279 in January 2024 compared to 9,423 in the same month of the previous year. Closed sales saw a more substantial decrease, dropping by 3.8 percent from 7,486 to 7,203 homes in January 2024. In contrast, pending sales increased by 8.9 percent, signaling a potential rebound and heightened activity in the coming months.

Market Indicators and Future Prospects:

Days on Market decreased by 6.8 percent, reaching a duration of 55 days. The Months Supply of Inventory remained flat at 3.9, indicating a delicate balance between supply and demand. As we navigate the intricacies of the New York housing market, it is crucial for both buyers and sellers to stay informed about these market indicators to make informed decisions in this dynamic real estate environment.

The Current State of the New York City Housing Market

How is the NYC Housing Market Doing Currently?

The recent data from StreetEasy reveals interesting trends and shifts. January saw a 6.7% increase in the number of homes entering contract, marking a positive turn as buyers returned amidst declining mortgage rates. This surge, slightly higher than the average over the past five years, is attributed to the drop in mortgage rates during November and December, enticing buyers back into the market post-year-end holidays.

However, despite this uptick, challenges persist. Highly-priced homes are lingering longer on the market, keeping the city's median asking price elevated. Elevated asking prices, coupled with rising mortgage rates, are prompting sellers to make concessions to attract buyers, showcasing a nuanced market scenario.

How Competitive is the NYC Housing Market?

As of January, the median asking price in NYC stood at $1.095 million, reflecting an 11.7% increase from a year ago. This uptick is largely due to a slowdown in the luxury market, where homes priced at $4.975 million and above are taking longer to sell. The median asking price in Manhattan rose by 8.4% year-over-year to $1.68 million, indicating a market that's still resilient but experiencing notable shifts.

While luxury listings in Manhattan witnessed a rise in median asking price, the typical luxury listing received only 93.2% of its initial asking price, signaling a shift in power from sellers to buyers at the highest end of the market. In Brooklyn, where inventory is limited, the median asking price surged by 16.8% to $1.05 million. Meanwhile, Queens offers a more affordable option, with a 4.2% year-over-year increase, resulting in a median asking price of $624,900.

Are There Enough Homes for Sale in NYC to Meet Buyer Demand?

The NYC housing market is grappling with the aftermath of elevated mortgage rates and median asking prices, constraining the pool of potential buyers. While the monthly mortgage payment on a median-priced home rose by 16.1% year-over-year to $5,619 in January, the median asking rent increased by just 0.1% to $3,500. With a considerable number of potential buyers still on the sidelines, those who can afford to stay in the market now have more room for negotiation.

The median asking price for homes entering contract in January was $925,000, 15.5% lower than the overall median asking price of homes on the market. This divergence indicates a market where more affordable homes are gaining traction among buyers, while the luxury segment experiences a slowdown.

What is the Future Market Outlook for NYC?

Despite the recent decline in mortgage rates, the outlook for the New York City housing market remains complex. Seller concessions, aimed at attracting buyers, have become more prevalent. In September 2023, when mortgage rates were above 7%, 2.7% of for-sale listings mentioned seller concessions. Despite a subsequent decline in average mortgage rates to 6.7%, concessions in January held steady at 2.3%, showcasing a significant increase from the 1.4% average in 2021.

In terms of negotiations, buyers are finding more areas to maneuver. NYC sellers are increasingly willing to offer concessions explicitly in their listings, helping to reduce closing costs for buyers without reducing the asking price. One notable concession gaining popularity is the rate buydown, with 1.7% of sponsor condos offering this option in January, a significant increase from the 0.1% average in 2021.

Is NYC a Buyer's or Seller's Housing Market?

As the market dynamics shift, buyers in NYC are gradually regaining negotiating power. In January, while the typical NYC home received 96.3% of its asking price, up from 95.4% a year ago, sellers are increasingly open to negotiations. The share of for-sale listings mentioning seller concessions, a tool to attract buyers, has increased despite a decline in average mortgage rates.

For sellers, a smart pricing strategy is crucial to increase the likelihood of receiving strong offers. While declining mortgage rates offer additional financial flexibility to homeowners looking to move, the market remains highly competitive. Nearly one in five homes (17.4%) sold for more than their initial asking price in January, emphasizing the importance of a compelling offer in the current market scenario.

New York Real Estate Market Forecast for 2024 and 2025

The New York Metropolitan Statistical Area (MSA) encompasses a vast geographical region, including multiple counties. The housing market within this MSA is substantial, catering to the diverse needs of its population. The counties within the MSA contribute to the overall housing market, with each area influencing the regional real estate landscape.

1. Average Home Value

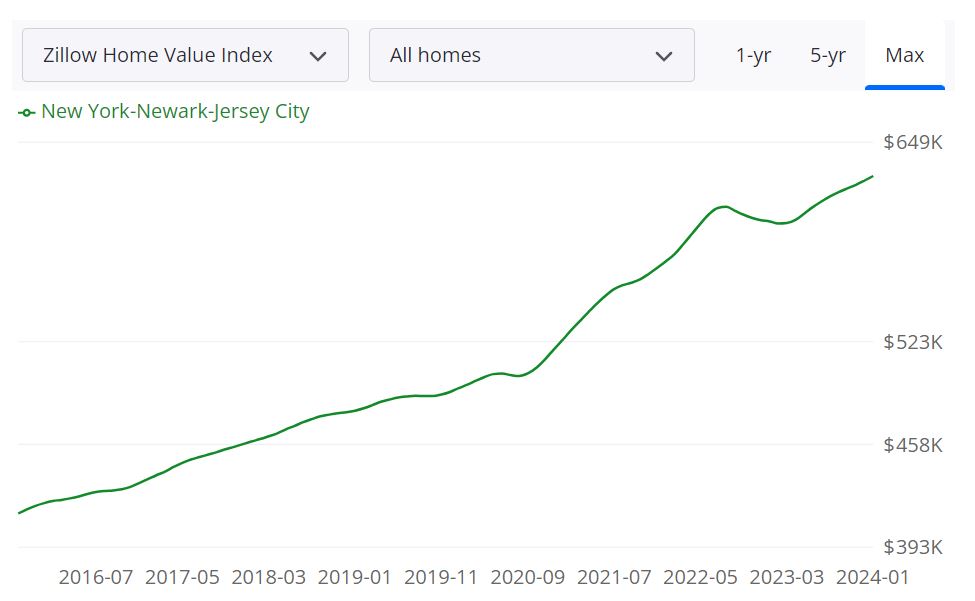

According to Zillow, the average home value in the New York-Newark-Jersey City area stands at $627,944, reflecting a 4.8% increase over the past year. This surge indicates a robust and thriving real estate market in the region. Homes in this area tend to go pending in approximately 37 days, showcasing the demand for properties.

Market Forecast

The 1-year market forecast as of January 31, 2024, is optimistic, projecting a 2.2% increase. This forecast is a positive sign for prospective buyers and sellers, hinting at sustained growth in property values.

2. For Sale Inventory

As of January 31, 2024, the New York-Newark-Jersey City area boasts a total of 36,432 homes available for sale. This inventory level plays a significant role in shaping the overall market dynamics, providing options for potential buyers.

3. New Listings

In the same period, the region witnessed 7,611 new listings, indicating a dynamic real estate market with continuous property turnover. This influx of new listings contributes to the variety of options available to potential buyers.

4. Median Sale to List Ratio

As of December 31, 2023, the median sale to list ratio stands at 1.000, emphasizing the equilibrium between listed and sold prices. This ratio is a crucial indicator of market stability and fair pricing.

5. Median Sale Price

December 31, 2023, recorded a median sale price of $565,000 for homes in the area. This metric provides a snapshot of the prevailing property values, guiding both buyers and sellers in their transactions.

6. Median List Price

As of January 31, 2024, the median list price is $689,967, indicating the average asking price for properties in the New York-Newark-Jersey City housing market. This figure guides sellers in setting competitive prices for their homes.

7. Percent of Sales Over and Under List Price

Examining sales dynamics, 49.6% of transactions as of December 31, 2023, were concluded over the list price, while 39.5% were under the list price. These percentages highlight the negotiation landscape and buyer-seller interactions in the market.

Places in New York Poised for Significant Home Price Increases

Delving into specific regions within the New York housing market, several areas stand out with the potential for notable increases in home prices. These projections, based on data from Zillow, provide valuable insights for both investors and homebuyers looking to make informed decisions.

1. Kingston, NY

In Kingston, New York, the housing market is anticipated to experience a substantial uplift in home prices. The forecast indicates a gradual progression, with a projected increase of 0.4% by February 29, 2024, followed by a more significant surge to 2% by April 30, 2024. Looking ahead to January 31, 2025, the expected increase is an impressive 7.4%. This upward trend suggests a thriving real estate environment in Kingston, making it an attractive prospect for potential property investors.

2. Rochester, NY

Rochester, New York, emerges as another hotspot for prospective homebuyers and investors. The forecast projects a steady climb in home prices, starting with a 0.4% increase by February 29, 2024, followed by a more substantial rise to 2.5% by April 30, 2024. The upward trajectory continues into January 31, 2025, with an anticipated 7% increase. This positive outlook positions Rochester as a region with growing real estate value and potential returns for those entering the market.

3. Syracuse, NY

Syracuse, New York, is poised for a noteworthy appreciation in home prices. The forecast outlines a progression from a 0.5% increase by February 29, 2024, to a more substantial 2.2% rise by April 30, 2024. Looking ahead to January 31, 2025, the projected increase is 6.4%. These projections underscore the attractiveness of Syracuse as a real estate investment destination, with potential gains for those entering the market.

4. Hudson, NY

Despite a slight dip in the short term with a projected decrease of -0.1% by February 29, 2024, Hudson, New York, is expected to rebound. The forecast indicates a subsequent rise to 1.3% by April 30, 2024, and a notable 6.4% increase by January 31, 2025. This indicates a potential buying opportunity for those willing to navigate through the temporary dip, as Hudson shows signs of resilience and growth in the real estate market.

5. Olean, NY

Olean, New York, demonstrates a positive trajectory in home price appreciation. The forecast outlines a steady increase, starting with 0.2% by February 29, 2024, rising to 1.6% by April 30, 2024. Looking further into the future, an anticipated 6.2% increase is projected by January 31, 2025. These projections position Olean as a region with potential investment opportunities and growing real estate value.

6. Jamestown, NY

In Jamestown, New York, the housing market is expected to experience a gradual rise in home prices. The forecast projects an increase of 0.1% by February 29, 2024, followed by a 1.2% surge by April 30, 2024. Looking ahead to January 31, 2025, a 6% increase is anticipated. These projections indicate stability and growth in Jamestown's real estate market, making it a region worth considering for potential investors.

7. Binghamton, NY

Binghamton, New York, emerges as a promising market with projections indicating a steady rise in home prices. By February 29, 2024, a 0.7% increase is anticipated, followed by a more substantial 2.3% surge by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 5.4% increase. These positive trends position Binghamton as an area with growing real estate value, making it an attractive prospect for potential investors and homebuyers.

8. Buffalo, NY

Buffalo, New York, is poised for a noteworthy appreciation in home prices according to the forecast. The projections indicate a 0.3% increase by February 29, 2024, followed by a 1.5% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 5.2%. These positive indicators make Buffalo an interesting market for individuals seeking potential returns on their real estate investments.

9. Amsterdam, NY

Amsterdam, New York, is another region showing positive signs in its housing market. The forecast outlines a 0.3% increase by February 29, 2024, followed by a 1.4% rise by April 30, 2024. Looking ahead to January 31, 2025, the projected increase is 5.2%. These trends position Amsterdam as an area with potential for real estate appreciation, offering opportunities for investors and homebuyers alike.

10. Utica, NY

Utica, New York, stands out with projections indicating a positive trajectory in home prices. The forecast suggests a 0.3% increase by February 29, 2024, followed by a 1.6% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 5.1%. These projections make Utica an area worth considering for those seeking potential returns in the real estate market.

11. Batavia, NY

Batavia, New York, shows stability and potential growth in its housing market. Projections indicate a 0% increase by February 29, 2024, followed by a 1.2% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 4.8% increase. These indicators make Batavia an area with steady real estate value, offering a reliable investment option for those looking for stability in the market.

12. Gloversville, NY

Gloversville, New York, demonstrates positive trends in its housing market. The forecast outlines a 0.2% increase by February 29, 2024, followed by a 1.3% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 4.3%. These projections position Gloversville as a region with potential for real estate appreciation, making it a compelling choice for investors and homebuyers seeking growth in their property investments.

13. Auburn, NY

Auburn, New York, presents a stable real estate market with projections indicating consistent growth in home prices. The forecast suggests a 0% increase by February 29, 2024, followed by a 0.9% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 4.2%. These projections position Auburn as an area with reliable real estate value, offering a steady and potentially lucrative investment option for those seeking stability in the market.

14. Seneca Falls, NY

Seneca Falls, New York, demonstrates resilience in its housing market, even with a slight dip in the short term. Projections indicate a -0.1% decrease by February 29, 2024, followed by a 0.7% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 4.2% increase. This indicates potential opportunities for investors willing to navigate through the temporary dip in Seneca Falls, as the region shows signs of stability and growth in real estate values.

15. Glens Falls, NY

Glens Falls, New York, presents a positive outlook for potential investors and homebuyers. The forecast outlines a 0% increase by February 29, 2024, followed by a 0.9% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.9%. These projections make Glens Falls an area with potential for real estate appreciation, offering opportunities for those looking for growth in their property investments.

16. Albany, NY

Albany, New York, emerges as a robust market with positive projections for home price increases. The forecast suggests a 0.4% increase by February 29, 2024, followed by a 1.1% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.5%. These positive indicators position Albany as an attractive region for potential returns on real estate investments, reflecting a thriving market.

17. Plattsburgh, NY

Plattsburgh, New York, showcases stability and gradual growth in its housing market. Projections indicate a 0% increase by February 29, 2024, followed by a 0.8% rise by April 30, 2024. Looking ahead to January 31, 2025, the forecast suggests a 3.5% increase. These projections make Plattsburgh an area with steady real estate value, offering a reliable investment option for those looking for stability and potential growth in the market.

18. Ogdensburg, NY

Ogdensburg, New York, presents a market with stability and moderate growth in home prices. Projections indicate a -0.3% decrease by February 29, 2024, followed by a 0.4% rise by April 30, 2024. Looking ahead to January 31, 2025, the anticipated increase is 3.2%. These projections make Ogdensburg an area with potential for real estate appreciation, providing opportunities for investors and homebuyers seeking growth in their property investments.

Will the New York Housing Market Crash?

As of the latest available data and forecasts, there is no definitive indication that the New York housing market is on the verge of a crash. However, it's essential to approach this analysis with a nuanced understanding of the various factors influencing real estate dynamics.

The New York housing market currently exhibits positive trends, with an average home value of $627,944, reflecting a 4.8% increase over the past year. Additionally, the 1-year market forecast as of January 31, 2024, projects a 2.2% increase, indicating sustained growth. Metrics such as for sale inventory, new listings, and median sale prices contribute to the overall stability of the market.

While the overall market shows resilience, it's important to acknowledge regional variations. Specific areas within the New York housing market are projected to experience varying degrees of home price increases. Some regions, such as Kingston, Rochester, and Syracuse, anticipate substantial growth, while others, like Hudson and Ogdensburg, may face temporary declines or slower growth.

Several factors contribute to the stability of the New York housing market. The diverse economic activities, employment opportunities, and cultural attractions in the state contribute to sustained demand for housing. Additionally, historically low mortgage rates and a competitive real estate landscape further support market stability.

While the current outlook is positive, it's essential to consider potential risks. Economic fluctuations, interest rate changes, and unforeseen external factors can influence market dynamics. Additionally, the real estate market's sensitivity to broader economic conditions and global events should be taken into account when assessing the potential for a market shift.

As of now, the New York housing market does not show definitive signs of an impending crash. The overall positive trends, coupled with regional variations, suggest a nuanced and evolving landscape. However, individuals should remain vigilant, closely monitoring market indicators, economic conditions, and any regulatory changes that may impact the real estate sector. Making informed decisions based on a thorough understanding of market dynamics remains crucial in navigating the complexities of the New York housing market.

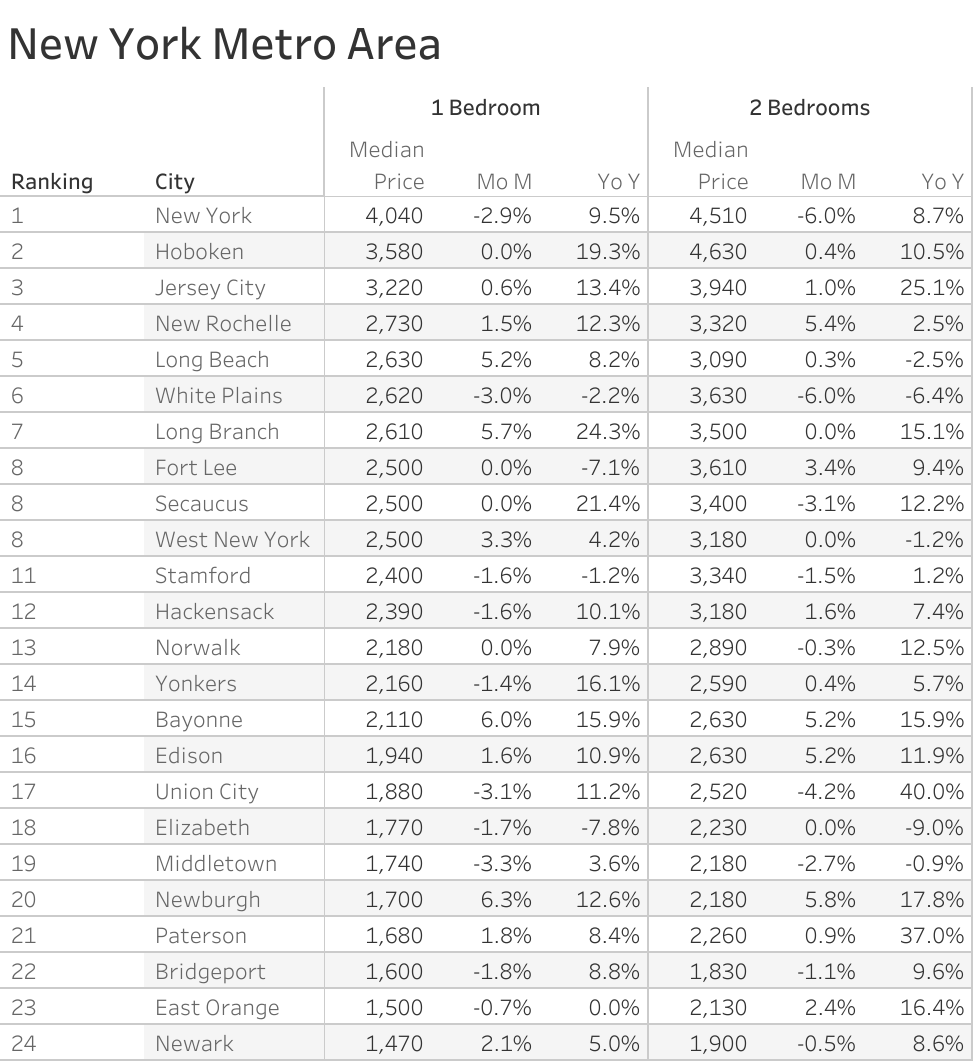

New York Rental Market Report

The Zumper New York City Metro Area Report analyzed active listings across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The New York one-bedroom median rent was $2,390 last month. New York City was the most expensive market with one-bedrooms priced at $4,040 whereas Newark was the most affordable city with rent priced at $1,470.

Here are the places where it makes sense to invest in rental properties in the New York City Metro Area. These are the places where the demand for rentals is growing strong in 2024.

The Fastest Growing Cities For Rents in New York City Metro Area (Y/Y%)

- Long Branch had the fastest growing rent, up 24.3% since this time last year.

- Secaucus saw rent climb 21.4%, making it second.

- Hoboken rent was the third fastest growing, jumping 19.3%.

The Fastest Growing Cities For Rents in New York City Metro Area (M/M%)

- Newburgh had the largest monthly rental growth rate, up 6.3%.

- Bayonne rent was the second fastest growing, climbing 6%.

- Long Branch was third with rent growing 5.7%.

Top Real Estate Estate Markets in New York

Buffalo real estate market

The Buffalo real estate investment offers a surprisingly good deal with low prices and relatively high rental rates. The Buffalo real estate market is dominated by older homes. A majority of homes in the Buffalo housing market were built before World War 2. Interestingly, this also means that many small apartment buildings are designed to serve a population that rented small units close to their jobs.

For example, roughly a third of homes are single-family detached homes, while almost half take the form of small apartment buildings. This creates an excellent opportunity for those in the market for Buffalo rental properties. You could buy a small apartment building with multiple tenants for the cost of a single rental property in a more expensive New York real estate market.

Syracuse real estate market

Syracuse's real estate market offers cheaper property with a higher return on investment and a less hostile legal climate. It is one of the better choices if you want to invest in New York state. Another issue that factors into the equation is the job market. Lots of cities have a great quality of life but almost no one can afford to live there.

The Syracuse housing market ranked 6.3 out of 10 for its job market. That’s better than rural and much of upstate New York. And it is why there is a slow trickle of people moving in to replace those who leave. That’s why the Syracuse real estate market has a net migration of 5 or a stable population. This is in sharp contrast to the depopulation seen in most Rust Belt cities. It also means Syracuse's real estate investment properties will hold their value for the foreseeable future if they don’t appreciate it.

Albany real estate market

Albany is a steadily appreciating real estate market. While it isn’t as famous or hot as NYC, it offers an affordable entry point and a massive pool of perpetual renters. Though it may not be somewhere you want to live, many locals are choosing to stay and make their homes here. And that will continue to drive demand for Albany real estate investment properties as long as they are priced right.

Rochester real estate market

You can also consider Rochester. The Rochester real estate market is stable, offering slow appreciation, affordable properties to outsiders, and good returns. It has strong, long-term potential that is only buoyed if NYC collapses. And this is one of the reasons why being everything the Big Apple isn’t is in your favor.

The Rochester real estate market enjoys a healthy population profile. Roughly a quarter of the population consists of children, and many are likely to remain due to the healthy job market. It also means that the Rochester housing market won’t crash if the job market weakens the way San Francisco collapses whenever the tech bubble bursts. Others choose to remain here because of the low cost of living.

References

- https://www.nysar.com/news/market-data/reports

- https://www.redfin.com/blog/data-center

- https://www.zillow.com/new-york-ny/home-values

- https://www.realtor.com/realestateandhomes-search/New-York_NY/overview

- https://streeteasy.com/blog/nyc-housing-market-data/

- https://www.redfin.com/city/30749/NY/New-York/housing-market

- https://www.elliman.com/corporate-resources/market-reports