If you're looking to buy a house, you might be wondering if it's a good time to buy a house or if should you wait. This is a question that many people are asking themselves these days, as the housing market continues to be in flux. There is no easy answer, as it depends on a number of factors, including your individual financial situation, your long-term goals, and your local market conditions.

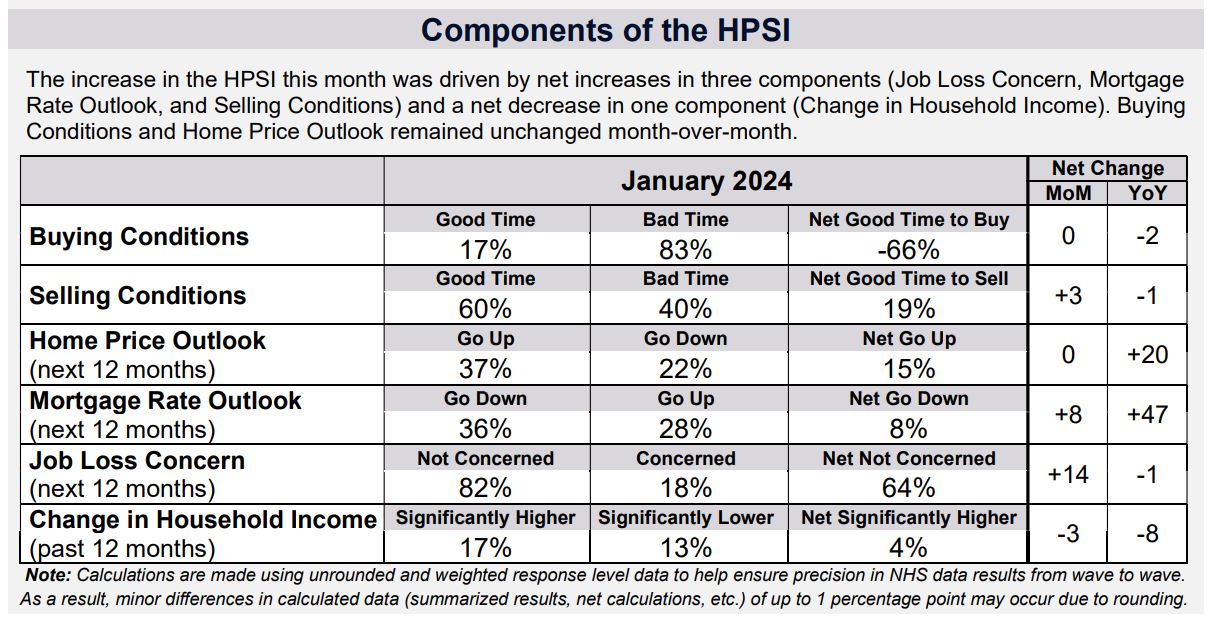

A recent survey by Fannie Mae found that there is an increase in optimism about mortgage rates, with 36% of respondents expecting them to decrease in the next year. However, affordability concerns remain due to high home prices and stagnant wages. The overall sentiment on homebuying is still negative, with only 17% of respondents believing it is a good time to buy.

Is 2024 a Good Time to Buy a House?

The Fannie Mae Home Purchase Sentiment Index (HPSI) experienced a notable increase of 3.5 points in January, reaching its highest level since March 2022 at 70.7. This surge can be attributed to heightened consumer confidence in job security and a significant rise in the percentage of consumers expecting mortgage rates to decrease.

Job Security and Mortgage Rate Expectations

In January, a remarkable 82% of consumers expressed confidence in their job security for the next 12 months, up from 75% the previous month. Moreover, an all-time survey-high of 36% of respondents anticipated a decline in mortgage rates over the next year, signaling a shift in consumer expectations. Only 28% expected rates to rise, while 35% believed rates would remain constant.

Optimism and Challenges in the Housing Market

Despite the overall positive sentiment, perceptions of homebuying conditions remained predominantly pessimistic, with only 17% of consumers considering it a good time to buy a home. However, the Home Purchase Sentiment Index showed an impressive 9.1-point increase year over year, indicating a potential upward trend.

Doug Duncan, Fannie Mae's Senior Vice President and Chief Economist, highlighted the noteworthy shift in consumer beliefs. He emphasized the substantial increase in optimism regarding mortgage rates, marking the first time a higher percentage of consumers expected rates to decrease rather than increase over the next year. Additionally, improved confidence in job situations was identified as a positive indicator for housing sentiment in 2024.

Challenges Ahead for Affordability

Duncan acknowledged that while a lower mortgage rate trajectory supports forecasts for increased housing demand, challenges persist. A significant majority still anticipated either rising or stable home prices, the ‘good time to buy' sentiment remained historically low, and fewer than one in five respondents reported a significant year-over-year increase in household income. Duncan emphasized the need for a meaningful increase in housing supply to address affordability barriers.

Key Considerations for Prospective Homebuyers

1. Job Security and Economic Outlook

With an impressive 82% of consumers expressing confidence in their job security for the next 12 months, the current economic landscape appears stable. This positive sentiment is a vital factor for those contemplating a home purchase, as job security is intricately linked to one's ability to commit to a long-term financial investment.

2. Mortgage Rate Expectations

The notable shift in consumer expectations regarding mortgage rates is a noteworthy trend. A survey-high 36% of respondents anticipate a decrease in mortgage rates over the next year. This optimism not only impacts the affordability of homes but also signals a potential boon for those considering entering the market.

3. Home Price Expectations

While the majority still anticipates an increase or stability in home prices, the marginal decrease in those expecting a rise may suggest a slight easing of the upward price trajectory. However, with 40% believing home prices will remain the same, it's evident that perceptions vary among consumers, necessitating a careful consideration of individual circumstances.

4. Affordability Challenges

Doug Duncan's insights underscore the lingering challenges in housing affordability. Despite positive shifts in job security and mortgage rate expectations, concerns about rising home prices and limited income growth persist. Aspiring homeowners must weigh these factors against the potential benefits of a lower mortgage rate environment.

Remember that the real estate market is subject to change, and staying informed is key to making a well-informed and financially sound choice. Read the full research report for additional information.

ALSO READ: When is the Best Time to Buy a House?

ALSO READ: Will the Housing Market Crash?

Should I Buy a House Now or Wait Until 2025?

The decision to buy a house is a significant step that involves a thorough assessment of your financial situation, market conditions, and personal goals. As you contemplate this important choice, it's crucial to consider both the current housing landscape and your individual circumstances.

Assessing Current Market Conditions

Understanding the current state of the housing market is essential when making a decision about buying a house. Here are some key factors to consider:

1. Interest Rates:

Mortgage interest rates play a significant role in determining the affordability of a home purchase. As of now, it's important to research and monitor interest rate trends. Low-interest rates can make homeownership more affordable, while higher rates can increase your monthly payments.

2. Home Prices:

Examine the trend of home prices in the area you're interested in. Are prices currently high or stable? Are they expected to increase or decrease in the near future? Understanding price trends can help you make an informed decision about timing your purchase.

3. Inventory Levels:

Consider the availability of homes on the market. A low inventory of homes for sale might lead to more competition among buyers and potentially higher prices. Conversely, a higher inventory might give you more options to choose from.

4. Economic Conditions:

Evaluate the broader economic environment. Factors like job stability, local job market trends, and overall economic indicators can impact your ability to make mortgage payments in the long run.

Your Personal Financial Situation

Beyond market conditions, your personal financial situation plays a crucial role in determining whether it's the right time for you to buy a house:

1. Financial Readiness:

Assess your financial health. Do you have a stable income and a good credit score? Have you saved enough for a down payment, closing costs, and potential emergencies?

2. Long-Term Goals:

Consider your long-term goals. How does buying a house fit into your overall financial plan? Are you planning to stay in the area for an extended period? Your answers can help you determine whether homeownership aligns with your life plans.

3. Budget and Affordability:

Create a detailed budget to understand how much you can comfortably afford for a monthly mortgage payment. Remember that owning a home involves more than just the mortgage; property taxes, insurance, maintenance, and utilities are additional costs to consider.

Buy a House Now or Wait?

After evaluating market conditions and your personal financial situation, you'll be better equipped to decide whether to buy a house now or wait:

Buy Now If:

- Interest rates are low, making homeownership more affordable.

- You've saved for a down payment and other associated costs.

- The housing market in your area is stable or showing positive growth.

- You've evaluated your long-term goals and buying aligns with them.

Wait If:

- Interest rates are high, and you anticipate they might decrease in the near future.

- Your financial situation needs improvement, such as increasing your credit score or saving more for a down payment.

- The housing market in your area is volatile or experiencing a downward trend in prices.

- Your long-term plans are uncertain, and committing to homeownership doesn't currently make sense.

Is it a Good Time to Buy a House for First-Time Buyers?

For first-time homebuyers, assessing whether it's a good time to purchase a house is a crucial decision. Several factors influence this decision, including mortgage credit availability, market conditions, and personal financial stability.

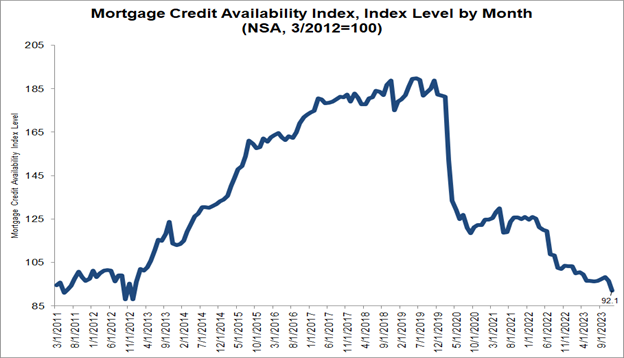

Mortgage credit availability decreased in December according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

The MCAI fell by 4.6 percent to 92.1 in December. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI decreased 3.2 percent, while the Government MCAI decreased by 5.9 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.7 percent, and the Conforming MCAI fell by 5.9 percent.

“Credit availability declined in December to the lowest level since 2012, as ongoing industry consolidation is resulting in more loan programs being removed from the marketplace,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both conventional and government indices experienced decreases. The decrease in the government index was driven by lower investor demand for renovation loans and streamline refinance loans.”

On the one hand:

Tightening credit standards: According to the Mortgage Credit Availability Index (MCAI), it's become slightly harder to qualify for a mortgage in December 2023. This can make it more challenging for first-time buyers with limited credit history or lower income.

On the other hand:

Decreased competition: The overall housing market has shown signs of cooling down in recent months. This translates to potentially less competition for available homes, which could benefit first-time buyers.

Potentially lower mortgage rates: Experts predict a slight decrease in mortgage rates in 2024. Lower rates can translate to lower monthly payments and potentially more buying power for first-time buyers.

The decision of whether it's a good time for first-time buyers to buy a house depends on a multitude of factors beyond just mortgage credit availability. Other important considerations include:

- Personal Financial Situation: First-time buyers should assess their own financial stability, income, credit score, and existing debt. These factors play a significant role in their ability to secure a mortgage and afford homeownership.

- Real Estate Market Conditions: Housing market conditions, including supply and demand, local property values, and trends in the area, will impact whether it's a favorable time to buy. A buyer's market with more inventory and lower prices might be more appealing.

- Interest Rates: While the information provided mentioned higher mortgage rates, the actual rates prevailing in the market at the time of purchase will greatly influence the affordability of a home loan.

- Long-Term Plans: First-time buyers should consider their long-term plans. If they plan to stay in the home for several years, changes in the mortgage market might have less of an impact.

- Down Payment and Affordability: The ability to make a substantial down payment and afford monthly mortgage payments is crucial. A higher down payment can mitigate some challenges posed by tighter lending standards.

- Employment Stability: A steady job or income source is important for mortgage approval and overall financial security.

- Government Programs: Government-backed programs such as FHA loans might offer more lenient requirements for first-time buyers, making homeownership more accessible even during periods of tighter lending.

Given these factors, it's recommended that first-time buyers consult with financial advisors, mortgage professionals, and real estate experts to make an informed decision. While the decrease in mortgage credit availability might present some challenges, it doesn't necessarily mean that it's a universally bad time for first-time buyers to purchase a house. The broader context of personal circumstances, market conditions, and financial preparedness should guide the decision-making process.

Sources:

- https://www.fanniemae.com/research-and-insights/surveys-indices/national-housing-survey

- https://www.realtor.com/research/december-2022-data/

- https://www.bankrate.com/mortgages/todays-rates/

- https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- https://www.bankrate.com/mortgages/rate-trends/

- https://www.mba.org/news-and-research/research-and-economics/single-family-research/mortgage-credit-availability-index-x241340