California Housing Market Report

California's housing market finds itself in a state of flux. Sellers enjoy a robust market with favorable pricing, while buyers face limited inventory and fierce competition, demanding quick decisions and strategic tactics. C.A.R. Senior Vice President and Chief Economist Jordan Levine acknowledges potential challenges due to escalating mortgage rates.

Recent months have shown some resilience, but higher rates might cool housing activity in the short term. However, Mr. Levine maintains an optimistic outlook, suggesting a rebound once the market adjusts to evolving economic factors like inflation.

Data from the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) paints a picture of a California housing market in 2024 that's both resilient and challenged. March saw a slight slowdown, with existing single-family home sales at 267,470, a 7.8% decrease from February. This dip marks the first year-over-year decline in three months, following January and February's increases. Despite this, year-to-date sales remain modestly up by 0.7%.

California's Housing Prices Remain Strong

The median home price in California for March skyrocketed to $854,490, a significant 6.0% jump from February and a robust 7.7% increase year-over-year. This marks the ninth consecutive month of annual price growth, highlighting the ongoing strength of the state's housing market even amidst economic shifts.

Despite the slight dip in sales, California's housing market remains fiercely competitive. Homes are selling swiftly, outpacing last year's pace, indicating sustained demand. C.A.R. President Melanie Barker emphasizes the market's competitiveness, noting that properties are selling faster than in the previous year. This heightened competition underscores the desirability of California's real estate market, despite fluctuations in sales volumes.

The supply side of the market shows signs of improvement, with an increasing number of properties being listed as sellers adapt to the “new normal.” However, the pace of new listings may not fully match the demand, leading to a persistent imbalance between supply and demand. Sales of homes priced at or above $1 million have remained relatively stable, while the sub-$500,000 segment has experienced modest declines. This shift in sales mix has contributed to upward pressure on the statewide median price.

Regional Insights into the California Real Estate Market

Here's a breakdown of trends across major regions and counties:

- Sales Volume: Unadjusted sales dropped year-over-year in most regions except the Central Coast. The Central Valley saw the steepest decline (-9.6%), followed by Southern California (-7.8%), San Francisco Bay Area (-5.4%), and the Far North (-4.0%). The Central Coast bucked the trend with a +7.2% increase.

- County-Level Sales: Market nuances appear at the county level. While 33 of 53 tracked counties saw sales decline, others like Plumas (220.0%), Mono (120.0%), and Mariposa (56.3%) experienced significant gains. Tuolumne (-39.2%) and Tehama (-37.5%) had the steepest drops.

- Median Prices: All regions witnessed year-over-year increases. The San Francisco Bay Area led with a 15.5% jump, followed by Southern California (11.1%). The Far North, Central Valley, and Central Coast also saw growth, though at slower rates.

- County-Level Prices: Mono (66.7%), Siskiyou (45.8%), and Santa Barbara (32.0%) saw the biggest price hikes, while Mendocino (-23.9%) and Trinity (-16.3%) experienced declines.

- Inventory Dynamics: Unsold inventory decreased month-over-month but rose year-over-year. The Unsold Inventory Index (UII) dipped to 2.6 months in March, indicating tight inventory. Active listings, however, showed promise, increasing year-over-year for the second straight month. This growth, particularly in Solano and Santa Barbara counties, suggests potential improvement in housing supply.

While these trends offer some optimism, rising mortgage rates could lead to potential sellers delaying listings, impacting inventory. However, the increase in new listings coupled with a slight slowdown in demand suggests a possibility of achieving more balanced supply-demand dynamics in the future.

Regional Market Data – March 2024

In March 2024, the California real estate market witnessed diverse trends across different regions, as indicated by the median sold prices of existing single-family homes.

| State/Region/County | March 2024 | Feb. 2024 | March 2023 | Price MTM% Chg | Price YTY% Chg | Sales MTM% Chg | Sales YTY% Chg |

|---|---|---|---|---|---|---|---|

| Los Angeles Metro Area | $801,000 | $790,000 | $735,000 | 1.4% | 9.0% | 20.0% | -8.0% |

| Central Coast | $950,000 | $950,000 | $922,500 | 0.0% | 3.0% | 30.1% | 7.2% |

| Central Valley | $478,600 | $478,200 | $455,000 | 0.1% | 5.2% | 18.7% | -9.6% |

| Far North | $374,950 | $379,000 | $355,000 | -1.1% | 5.6% | 17.8% | -4.0% |

| Inland Empire | $594,250 | $576,500 | $555,000 | 3.1% | 7.1% | 18.0% | -6.4% |

| San Francisco Bay Area | $1,386,500 | $1,256,500 | $1,200,000 | 10.3% | 15.5% | 31.7% | -5.4% |

| Southern California | $850,000 | $825,000 | $765,000 | 3.0% | 11.1% | 19.1% | -7.8% |

The Los Angeles Metro Area saw a median price increase of 9.0% year-over-year, reaching $801,000 in March 2024. Similarly, the Central Coast experienced a 3.0% year-over-year price increase, with a median price of $950,000. In contrast, the Far North region witnessed a 5.6% year-over-year price increase, reaching $374,950.

Sales performance varied across regions, with some experiencing growth and others facing declines. For instance, the Central Coast region saw a notable 7.2% year-over-year increase in sales, while the Central Valley region experienced a decline of -9.6% compared to the previous year.

Overall, these regional insights provide a comprehensive understanding of the California real estate market's dynamics in March 2024, reflecting both price appreciation and fluctuations in sales volume across different regions.

California Housing Market Forecast: Rebound on the Horizon

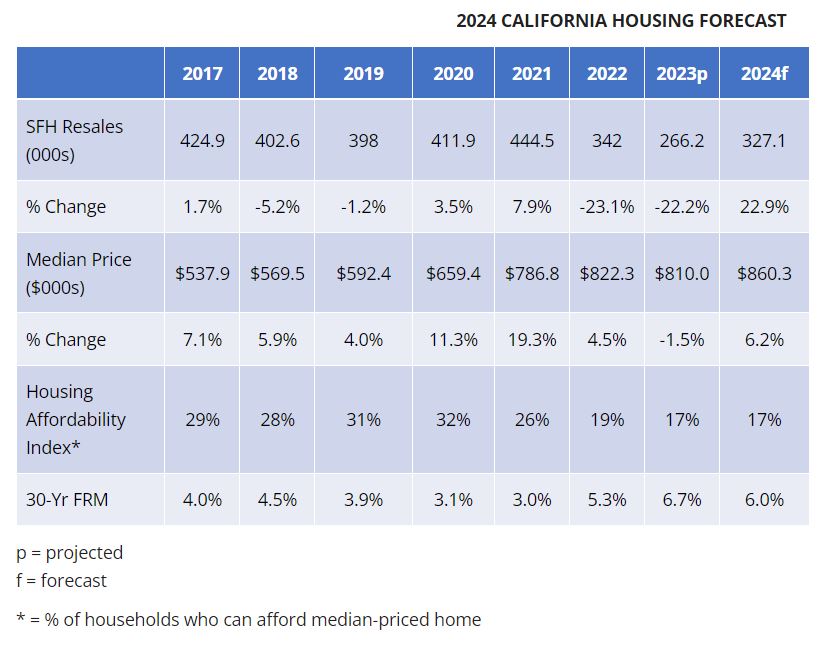

California‘s housing market appears poised for a comeback in 2024, according to the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) and their highly anticipated “2024 California Housing Market Forecast.” Let's delve into the key projections:

Positive Outlook: Sales and Prices

- The forecast predicts a substantial jump of 22.9% in existing single-family home sales compared to 2023.

- This translates to an estimated 327,100 units sold in 2024, a significant increase from the projected 266,200 units in 2023.

- California's median home price is anticipated to climb by 6.2% to $860,300 in 2024.

Driving Forces Behind the Rebound

- The forecast hinges on a decrease in mortgage rates due to slower economic growth and cooling inflation.

- This creates a more buyer-friendly environment, stimulating housing demand.

- While housing supply is expected to remain below typical levels, the slight increase in active listings could offer some relief.

Economic Factors and Market Dynamics

- The forecast considers economic indicators, including a modest 0.7% rise in the U.S. gross domestic product for 2024.

- California's nonfarm job growth rate is estimated at 0.5%, while the unemployment rate may see a slight increase to 5.0% in 2024.

- Despite potential economic softening, a persistent housing shortage and competitive market are predicted to maintain upward pressure on home prices.

- The anticipated easing of monetary policy by the Federal Reserve Bank is expected to decrease mortgage rates throughout 2024, potentially giving buyers more financial flexibility.

Conclusion: Valuable Insights for All

The C.A.R.'s forecast paints a promising picture for the California housing market in 2024. However, it's important to remember that these are projections. As the year unfolds, actual market performance will provide a clearer picture of these predictions' accuracy. Regardless, this information offers valuable insights for both home buyers and sellers navigating the market in the coming year.

California Home Values – Latest Data – April 2024

- Market Resilience: According to Zillow, despite rising interest rates, California's housing market shows continued growth. The average home value sits at $783,666, reflecting a 6.4% year-over-year increase.

- Fast-Paced Market: Properties are moving quickly, with an average time of just 15 days to go pending. This rapid pace reflects high buyer demand.

- Inventory Check: As of March 31, 2024, there are 57,154 properties for sale, offering diverse options for buyers. Additionally, 22,984 new listings entered the market on the same date, indicating ongoing activity.

Key Metrics Deep Dive:

- Median Sale-to-List Ratio: At 1.000 (as of February 29, 2024), this metric suggests a balanced market where list prices closely align with final sale prices.

- Price Insights: The median sale price is $673,333 (February 29, 2024), while the median list price sits at $720,933 (March 31, 2024). This difference highlights the importance of strategic pricing for sellers.

- Negotiation Landscape: With 41.1% of sales going over asking price and 44.4% falling below (February 29, 2024), negotiation plays a significant role. Factors like location, condition, and overall market demand influence the final price.

Top Areas in California Poised for Home Price Growth from 2024 to 2025

Based on data provided, several areas stand out as potential hotspots for home price growth from 2024 to 2025:

Santa Maria, CA

– Santa Maria, located in the Central Coast region of California, demonstrates promising growth potential. From April 2024 to March 2025, home prices are projected to increase steadily, with an anticipated growth rate of 3.9% by March 2025.

– The region's appeal may be attributed to its scenic landscapes, proximity to coastal amenities, and a growing economy, attracting both residents and investors seeking desirable living environments.

San Diego, CA

– San Diego, renowned for its pleasant climate and diverse communities, remains a sought-after destination for homebuyers. With a projected home price growth rate of 3.6% from June 2024 to March 2025, the region continues to offer robust opportunities for real estate investment.

– Factors such as a strong job market, thriving technology sector, and cultural attractions contribute to San Diego's allure, driving demand and supporting home price appreciation.

Bakersfield, CA

– Bakersfield, situated in California's Central Valley, emerges as another area poised for home price growth. With a projected increase of 2.7% from June 2024 to March 2025, the region presents opportunities for both buyers and sellers.

– Affordable housing options, a burgeoning agricultural industry, and strategic location along major transportation routes contribute to Bakersfield's appeal, attracting individuals and families seeking value and economic stability.

Riverside, CA

– Riverside, located in the Inland Empire region, showcases steady growth potential in its housing market. With a projected growth rate of 2% from June 2024 to March 2025, the region offers affordability coupled with access to urban amenities.

– Proximity to employment centers, recreational opportunities, and ongoing infrastructure developments contribute to Riverside's attractiveness, driving demand and supporting home price appreciation.

Visalia, CA

– Visalia, nestled in California's San Joaquin Valley, presents opportunities for home price growth in the coming years. With an anticipated increase of 1.9% from June 2024 to March 2025, the region appeals to buyers seeking affordability and a slower-paced lifestyle.

– Rich agricultural heritage, proximity to national parks, and a tight-knit community atmosphere contribute to Visalia's charm, attracting individuals and families looking to establish roots in a welcoming environment.

Merced, CA

– Merced, located in California's Central Valley, offers potential for home price appreciation in the forecasted period. With a projected growth rate of 1.9% from June 2024 to March 2025, the region presents opportunities for investment and homeownership.

– Factors such as affordable housing options, proximity to major cities like San Francisco and Sacramento, and ongoing revitalization efforts contribute to Merced's appeal, attracting buyers seeking value and growth potential in the real estate market.

Hanford, CA

– Hanford, located in the San Joaquin Valley, presents promising prospects for home price appreciation. With an anticipated growth rate of 1.8% from June 2024 to March 2025, the region offers affordability and a diverse range of housing options.

– Factors such as agricultural activity, access to transportation networks, and a growing local economy contribute to Hanford's appeal, attracting buyers seeking value and growth potential in the real estate market.

Madera, CA

– Madera, situated in California's Central Valley, emerges as another area poised for home price growth. With a projected increase of 1.7% from June 2024 to March 2025, the region offers affordability and proximity to urban centers.

– Strategic location, agricultural heritage, and ongoing development initiatives contribute to Madera's attractiveness, making it an appealing destination for both investors and homebuyers.

Fresno, CA

– Fresno, a major city in the San Joaquin Valley, showcases potential for home price appreciation in the forecasted period. With an anticipated growth rate of 1.6% from June 2024 to March 2025, the region offers diverse housing options and economic opportunities.

– Factors such as a robust job market, cultural attractions, and affordability compared to coastal cities contribute to Fresno's appeal, attracting individuals and families seeking quality living environments.

Salinas, CA

– Salinas, located in Monterey County, presents opportunities for home price growth in the coming years. With a projected increase of 1.6% from June 2024 to March 2025, the region offers proximity to coastal amenities and a thriving agricultural industry.

– Scenic landscapes, cultural diversity, and access to higher education institutions contribute to Salinas's appeal, attracting buyers looking for a blend of urban convenience and natural beauty.

El Centro, CA

– El Centro, situated in California's Imperial Valley, demonstrates potential for home price appreciation in the forecasted period. With an anticipated growth rate of 1.5% from June 2024 to March 2025, the region offers affordability and a warm climate.

– Factors such as agricultural activity, proximity to the Mexico border, and infrastructure improvements contribute to El Centro's appeal, attracting buyers seeking value and lifestyle amenities.

Modesto, CA

– Modesto, located in California's Central Valley, presents opportunities for home price growth in the coming years. With a projected increase of 1.4% from June 2024 to March 2025, the region offers affordability and access to urban amenities.

– Cultural attractions, recreational opportunities, and a growing local economy contribute to Modesto's appeal, making it an attractive destination for both investors and homebuyers.

San Luis Obispo, CA

– San Luis Obispo, situated along California's central coast, showcases potential for home price appreciation in the forecasted period. With an anticipated growth rate of 1.4% from June 2024 to March 2025, the region offers scenic beauty and a vibrant community.

– Coastal lifestyle, educational institutions, and recreational opportunities contribute to San Luis Obispo's appeal, attracting buyers seeking a blend of natural splendor and cultural richness.

Is It a Good Time to Buy a House in California?

Examining the week's activity ending on March 16, 2024, the following daily average figures were observed:

- Closed Sales: 518 per day

- Pending Sales: 621 per day

- New Listings: 746 per day

Realtors' Insights

- Realtors Anticipating Increase in Sales: 37.3% (+0.5%)

- Realtors Anticipating Increase in Prices: 39.1% (+19.7%)

- Realtors Anticipating Increase in Listings: 46.7% (+2.7%)

Evaluation

Based on the provided statistics and realtors' insights, let's assess whether it's a good time to buy a house in California:

- Closed Sales: The daily average of closed sales indicates a steady level of activity in the housing market.

- Pending Sales: The number of pending sales suggests continued demand for properties.

- New Listings: With a substantial daily average of new listings, there appears to be adequate inventory for potential buyers to consider.

- Realtors' Expectations: The positive outlook from realtors regarding increases in sales, prices, and listings indicates a positive market sentiment.

Considering the balanced market activity and optimistic forecasts from real estate professionals, now may be a favorable time to consider purchasing a house in California. However, it's essential for buyers to conduct thorough research, consider their financial situation, and consult with a trusted real estate agent to make informed decisions.

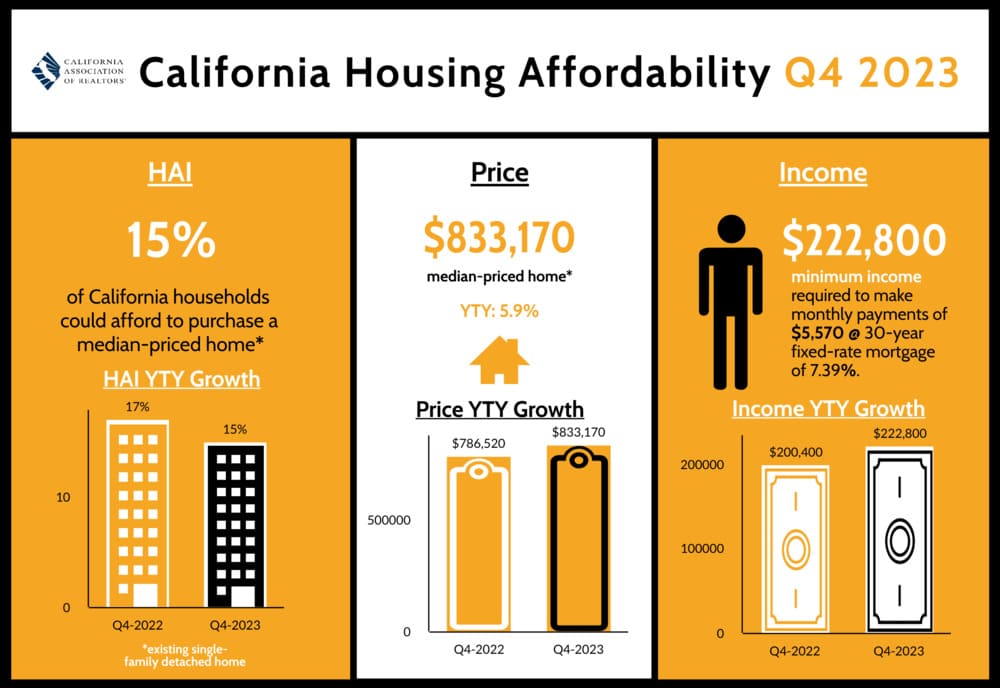

Housing Affordability Trends in California – 4th Quarter

The fourth quarter of 2023 witnessed a confluence of factors that have significantly impacted housing affordability. Elevated interest rates and a persistent shortage in home inventory have contributed to a 16-year low in housing affordability, according to the latest report from the California Association of Realtors (C.A.R.).

Current Affordability Landscape

During the fourth quarter of 2023, only 15 percent of California households could afford to purchase the median-priced home, which stood at $833,170. This figure remained unchanged from the previous quarter and marked a decrease from 17 percent in the same quarter of the previous year. These statistics highlight the persistent struggle for Californians aspiring to own a single-family home.

To put this into perspective, a minimum annual income of $222,800 was required to make monthly payments of $5,570. These calculations included principal, interest, and taxes on a 30-year fixed-rate mortgage with an interest rate of 7.39 percent. Notably, this interest rate is the second consecutive quarter where it rose above 7 percent in more than two decades.

Comparative Analysis: Condos/Townhomes vs. Single-Family Homes

While the affordability of single-family homes declined, there was a relatively better scenario for condominiums and townhomes. In the fourth quarter of 2023, 22 percent of homebuyers were able to afford the median-priced condo or townhome, which was pegged at $650,000. To make a monthly payment of $4,350, a minimum annual income of $174,000 was required.

This trend diverges from the broader housing market, where single-family homes face greater affordability challenges. The median price of condos and townhomes held up better than their single-family counterparts, showcasing a nuanced picture of the real estate landscape in California.

Insights from C.A.R.'s Traditional Housing Affordability Index (HAI)

C.A.R.'s HAI provides a comprehensive view of housing well-being for homebuyers in the state. The index, which measures the percentage of households that can afford a median-priced, single-family home, stands at 15 percent for the fourth quarter of 2023. This is a stark contrast to the peak high of 56 percent recorded in the first quarter of 2012, underscoring the long-term challenges in housing affordability.

The minimum annual income of $222,800 required to qualify for the purchase of a $833,170 median-priced home signifies the financial barriers faced by many Californians. The monthly payment, including taxes and insurance, has become a substantial financial commitment for aspiring homeowners.

Market Dynamics: Interest Rates and Economic Trends

Despite a modest decline in interest rates during the latter part of the fourth quarter of 2023, the overall trend remains elevated. Rates dropped by about 100 basis points from the peak in mid-October but have stabilized in recent weeks. This stability, coupled with unexpected economic resilience, has led to speculations that the Federal Reserve might refrain from rate cutting at their upcoming March meeting.

This scenario suggests that elevated interest rates are likely to persist through the first half of the year, putting continuous downward pressure on affordability. The real estate market in California is navigating through a complex interplay of economic factors that impact the ability of households to enter the housing market.

National Perspective: California vs. the Rest of the Nation

When compared with the national average, California's housing affordability paints a challenging picture. While 15 percent of households could afford the median-priced home in the state, more than a third of the nation's households could afford a $391,700 median-priced home, requiring a minimum annual income of $104,800 to make monthly payments of $2,620. This discrepancy underscores the unique challenges faced by Californians in the real estate market.

Regional Disparities: A Closer Look at County-Level Housing Affordability

The housing affordability landscape in California is characterized by significant regional disparities, as evident in the county-level analysis provided in the fourth-quarter 2023 report. Key findings highlight the dynamic nature of affordability, showcasing variations between counties and the impact of changing market conditions.

Quarterly Changes

Comparing the fourth quarter of 2023 with the previous quarter, housing affordability declined in 15 counties, while it remained unchanged in 17. Notably, 19 counties exhibited improvements in affordability, attributed to more modest price declines compared to other regions during the same period. This nuanced interplay between counties underscores the localized nature of the challenges faced by potential homebuyers.

Year-Over-Year Trends

On a year-over-year basis, the report highlights that five counties experienced an improvement in affordability, while 39 counties recorded a decline, and seven remained unchanged. These trends provide insights into the evolving nature of housing affordability, with certain regions facing more acute challenges compared to others.

Most and Least Affordable Counties

At the forefront of affordability, Lassen County maintained its position as the most affordable county in California, boasting an affordability index of 49 percent. Alongside Tehama County (40 percent), these two counties were the only ones with an affordability index of 40 percent or higher in the fourth quarter of 2023. The Far North region of the state dominated the top three, with Shasta County (36 percent) securing the third spot.

Conversely, Mono County (5 percent), Monterey County (8 percent), and San Luis Obispo County (8 percent) emerged as the least affordable counties. These regions required a minimum income of at least $242,800 to purchase a median-priced home. At the top of the list, San Mateo County demanded the highest minimum qualifying income, surpassing $500,000, followed by Santa Clara County and Marin County.

Yearly Affordability Changes

Examining the year-over-year changes, Mariposa County witnessed the most significant decline, dropping nine points from the fourth quarter of 2022 to the same period in 2023. Kings, Stanislaus, and Yuba followed closely, registering a six-point decrease in affordability. Despite higher household income, elevated home prices, and increased mortgage rates, several counties, including San Bernardino, Glenn, Merced, Sacramento, and Lassen, experienced a notable decline in affordability, emphasizing the broader challenges across the state.

As the cost of borrowing remains near all-time highs, and housing affordability faces headwinds, understanding these county-level dynamics becomes crucial for both policymakers and prospective homebuyers seeking to navigate California's diverse real estate landscape.

Challenges Facing the California Housing Market in 2024

Several factors have contributed to the challenges facing the California housing market. Here are some key factors that interact with each other, creating a complex and dynamic housing market in California.

1. High Demand and Limited Supply:

California has a high population density and strong economic growth, leading to a high demand for housing. However, there is a limited supply of available housing, particularly in desirable areas. This imbalance between supply and demand has driven up housing prices, making it difficult for many prospective buyers to afford homes.

2. Affordability Issues:

The high cost of housing in California has made homeownership less attainable for many residents. The median home price in the state is significantly higher than the national average. The combination of high home prices, rising interest rates, and stringent mortgage qualification rules has created affordability challenges for prospective buyers.

3. Strict Zoning and Land Use Regulations:

California has some of the most stringent zoning and land use regulations in the country. These regulations often restrict new construction and development, making it difficult to increase the housing supply to meet demand. This has resulted in a housing shortage and contributed to the rising prices.

4. Lack of Affordable Housing:

California faces a severe shortage of affordable housing, particularly in major cities. The cost of constructing affordable housing and the complex process of obtaining approvals and permits have hindered the development of affordable units. This has exacerbated the affordability crisis and led to a growing population of renters.

5. Economic Factors:

Economic conditions, such as job growth, wages, and interest rates, can significantly impact the housing market. Slowing economic growth or stagnant wages can dampen demand for housing, while rising interest rates can increase borrowing costs and dissuade potential buyers. These factors, in combination with high housing prices, have made it challenging for many Californians to enter the housing market.

6. Impact of Natural Disasters:

California is prone to natural disasters, including wildfires and earthquakes, which can damage or destroy homes and disrupt the housing market. Rebuilding efforts and insurance costs following these events can impact housing availability and affordability in affected areas.

7. Migration Patterns:

Migration patterns also play a role in the housing market. California has experienced both domestic and international migration, leading to increased demand for housing. However, in recent years, there has been a trend of net outmigration, with some residents leaving the state due to affordability concerns, congestion, and other factors. This can impact the supply and demand dynamics of the housing market.

Are California Rent Prices Going Down?

According to the latest California rent report for Q3 2023 by Rentometer, the average rent prices for three-bedroom (3-BR) single-family rentals (SFRs) in these five cities: Los Angeles, Sacramento, San Diego, San Francisco, and San Jose. San Diego had the largest year-over-year rent increase of 8%, while San Jose had the smallest increase of 2%.

Rent prices in these five California cities experienced the following year-over-year rent increases in Q3 2023:

- The average San Diego rent price is $4,595 with a year-over-year rent price increase of 8%

- The average San Francisco rent price is $5,431 with a year-over-year rent price increase of 5%

- The average Los Angeles rent price is $5,172 with a year-over-year rent price increase of 5%

- The average Sacramento rent price is $2,550 with a year-over-year rent price increase of 4%

- The average San Jose rent price is $4,061 with a year-over-year rent price increase of 2%

| City/State | Q3 2022 Average Rent |

Q3 2023 Average Rent |

YoY % Change |

| San Diego, CA | $4,262 | $4,595 | 8% |

| San Francisco, CA | $5,166 | $5,431 | 5% |

| Los Angeles, CA | $4,949 | $5,172 | 5% |

| Sacramento, CA | $2,457 | $2,550 | 4% |

| San Jose, CA | $3,981 | $4,061 | 2% |

ALSO READ:

Will the California Housing Market Crash in 2024?

Will the US Housing Market Crash?

Most Expensive Housing Markets in California

Sources:

- https://www.car.org/

- https://www.car.org/aboutus/mediacenter/newsreleases

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.car.org/marketdata/marketforecast

- https://www.car.org/marketdata/marketminute

- https://www.car.org/marketdata/interactive/housingmarketoverview

- https://www.zillow.com/ca/home-values

- https://www.rentometer.com/california-home-rents