Buffalo's housing market presents a balanced scenario for both buyers and sellers. While sellers can benefit from strong demand and the potential for competitive offers, buyers also have opportunities to find homes at relatively affordable prices compared to other regions. The equilibrium between supply and demand underscores the healthy dynamics of Buffalo's real estate market.

Recently, the Buffalo housing market has been a hot topic for both homebuyers and real estate enthusiasts. Buffalo takes the lead as the hottest housing market in 2024, as revealed by a recent report. Despite the challenging climate, this Western New York town has claimed the top spot on Zillow's list of the 50 “hottest” markets of 2024.

The driving force behind this unexpected ranking is the city's affordability, providing a real opportunity for young individuals to fulfill the dream of homeownership. Anushna Prakash, a data scientist for Zillow Economic Research, emphasized the correlation between affordable home prices and robust employment, creating a favorable environment for aspiring homeowners.

This synergy allows young individuals a genuine chance to buy a home and start building equity. The typical home in Buffalo is valued at $208,956 (January 2024), significantly lower than the national average, according to Zillow's estimates. This divergence in home prices sets Buffalo apart as an attractive market for potential homebuyers.

For those considering homeownership, a buyer putting 5% down on a typical home in Buffalo would face a mortgage of $1,792, as reported. In contrast, the typical rent in Queen City stands at $1,257 per month, making homeownership a compelling financial option. Zillow's analysis delved into the expected demand for housing in Buffalo by comparing the number of new jobs created in the city to the number of new homes being built.

Buffalo outshined among the 50 cities analyzed, boasting the highest number of jobs per new housing unit. However, this surge in demand is anticipated to drive up home prices unless additional housing units are constructed to meet the growing need. Thus, Buffalo's unexpected rise to the top of the housing market charts in 2024 can be attributed to a harmonious blend of affordability, employment opportunities, and a unique financial landscape.

Current Buffalo Housing Market Trends

How is the Housing Market Doing Currently?

In February 2024, the Buffalo housing market showcased robust growth, with home prices soaring by an impressive 20.0% compared to the previous year. According to Redfin, this surge in prices has positioned the median sale price at $180,000, a figure that reflects a significant 56% difference from the national average. Notably, homes in Buffalo are spending slightly longer on the market, with an average of 28 days compared to 22 days last year. Despite this slight increase, Buffalo remains a competitive market, where homes typically sell in 24 days.

How Competitive is the Buffalo Housing Market?

Buffalo's real estate landscape is marked by its competitive nature. Homes in the area often receive multiple offers, driving the average selling price to approximately the listing price. Hot properties, in particular, can command premiums of about 9% above the list price and attract offers within just 11 days. These figures underscore the fierce competition among buyers vying for desirable properties in Buffalo.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the intense competition among buyers, Buffalo faces challenges in meeting the surging demand for homes. The inventory remains somewhat constrained, leading to a situation where buyers must act swiftly to secure their desired properties. However, the market does witness a portion of homes experiencing price drops, indicating some flexibility for buyers seeking opportunities in Buffalo's housing market.

What is the Future Market Outlook for Buffalo?

Looking ahead, the future of Buffalo's housing market appears promising. The steady appreciation in home prices, coupled with sustained buyer interest, suggests continued growth in the foreseeable future. Additionally, the city's appealing affordability compared to national averages may continue to attract homebuyers seeking value and investment potential.

Examining migration and relocation trends offers insights into Buffalo's dynamic real estate landscape. Between December '23 and February '24, 27% of homebuyers expressed interest in moving out of Buffalo, while 73% preferred to stay within the metropolitan area. Notably, Buffalo attracts a fraction of homebuyers from outside metros, with Syracuse leading as the primary source of incoming migration, followed by New York and Rochester.

Buffalo Housing Market Forecast 2024 & 2025

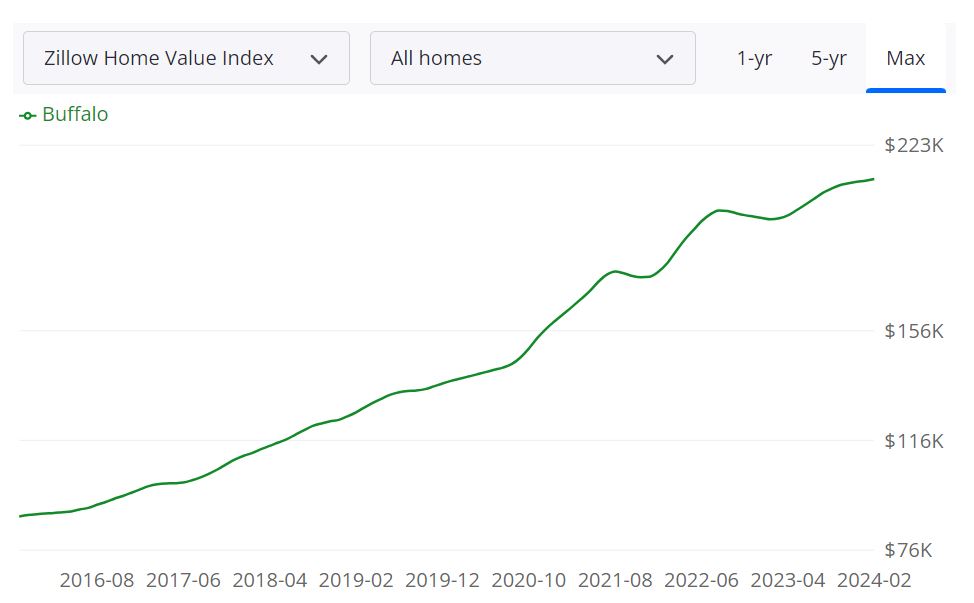

According to Zillow, the Buffalo housing market is currently experiencing a robust trend, with the average home value soaring to $211,615, marking a significant uptick of 7.5% over the past year. Homes in Buffalo typically go pending in a swift 15 days, indicating a high demand in the area.

The housing metrics provide a comprehensive snapshot of the Buffalo market's vitality. With 517 properties listed for sale as of February 29, 2024, and 179 new listings added during the same period, the market showcases a healthy inventory turnover.

The median sale price stands at $205,850, slightly surpassing the median list price of $194,952. Notably, the median sale to list ratio, a key indicator of market competitiveness, reached 1.027 as of January 31, 2024. Moreover, 63.6% of sales exceeded the list price, while 27.1% were finalized under the list price during the same period.

Deciphering the Buffalo MSA Housing Market Forecast

In considering the broader Buffalo Metropolitan Statistical Area (MSA), encompassing various counties within New York State, the forecast appears promising. As of February 29, 2024, the projected growth stands at 0.5%, with subsequent increases expected to reach 1.4% by May 31, 2024, and 2% by February 28, 2025.

Buffalo's MSA, comprising Erie and Niagara counties primarily, boasts a housing market of considerable size. The region's economic significance underpins its housing market, with a diverse array of industries contributing to its stability. The MSA serves as a pivotal economic hub, attracting both residents and investors seeking opportunities within its vibrant community.

Are Home Prices Dropping in Buffalo?

As of the latest data, there are no indications of home prices dropping in the Buffalo housing market. On the contrary, the market has experienced a steady increase in home values over the past year, with a notable 7.5% uptick. The median sale price remains strong, reflecting sustained demand and market stability.

Will the Buffalo Housing Market Crash?

While no market is immune to fluctuations, there are currently no indicators suggesting an imminent crash in the Buffalo housing market. The market fundamentals, including steady demand, limited inventory, and favorable pricing dynamics, suggest a resilient and stable housing landscape. However, it's essential to monitor market trends and economic indicators closely to anticipate and navigate any potential shifts in the future.

Is Now a Good Time to Buy a House in Buffalo?

For prospective buyers considering entering the Buffalo housing market, now could indeed be a favorable time to make a purchase. While competition may be stiff, low-interest rates and steady home appreciation present compelling opportunities for buyers to invest in the market. However, it's crucial for buyers to conduct thorough research, assess their financial readiness, and work with experienced real estate professionals to navigate the competitive landscape effectively.

Should You Invest in the Buffalo Real Estate Market?

Investing in real estate is a significant decision that requires careful consideration of various factors. As you contemplate your investment options, the Buffalo real estate market emerges as an intriguing candidate. With its unique characteristics, trends, and potential, the Buffalo market presents both opportunities and considerations for prospective investors.

The Current Landscape

At the heart of any investment decision is the current state of the market. As of now, the Buffalo housing market showcases noteworthy trends that capture attention. The average home value in Buffalo stands at approximately $211,615, representing a 7.5% increase over the past year. This consistent growth underscores the resilience of the market, making it an attractive prospect for investors seeking appreciation.

Furthermore, the rapid pace at which homes transition to a pending status—around nine days—signifies strong demand and competition among buyers. This aspect can be particularly appealing to investors seeking to capitalize on a bustling market environment. These metrics reveal the competitive nature of the market, with a high percentage of sales occurring above the list price. The swift median days to pending also highlight the urgency with which properties are being snapped up, indicating robust demand from buyers.

Looking Ahead: Forecast Insights

Peering into the future is essential when considering an investment. The Buffalo Metropolitan Statistical Area (MSA) housing market forecast offers valuable insights into the potential trajectory. With projected growth rates of 2% by February 2025, the forecast hints at a promising outlook. These figures underscore the market's potential for appreciation, making it a noteworthy candidate for investors seeking long-term gains.

Factors to Weigh

As you assess whether the Buffalo real estate market aligns with your investment goals, consider a few key factors:

- Market Dynamics: The competitive market environment can lead to multiple offers and quick sales. Assess if this aligns with your investment strategy.

- Rental Demand: Investigate the demand for rental properties in Buffalo, as this can be a viable investment avenue.

- Local Economy: Understanding the economic landscape of Buffalo is crucial, as it influences housing demand and tenant stability.

- Long-Term Vision: Determine if your investment horizon aligns with the potential for market appreciation over time.

Investing in the Buffalo real estate market offers a blend of promising opportunities and thoughtful considerations. With its steady growth, competitive dynamics, and positive forecast, the market holds appeal for those seeking to diversify their investment portfolio. However, as with any investment, conducting thorough research, considering your goals, and consulting with professionals can help you make an informed decision that aligns with your financial aspirations.

Sources:

- https://www.zillow.com/buffalo-ny/home-values

- https://www.redfin.com/city/2832/NY/Buffalo/housing-market

- https://www.realtor.com/realestateandhomes-search/Buffalo_NY/overview