Long Island, renowned for its scenic beauty and vibrant communities, faces an insidious challenge – a housing crisis that imperils its economic vitality. The region's ability to attract and retain vital workers is compromised as affordable housing options dwindle. Even high-earning professionals like cardiologists, with salaries exceeding $350,000, find themselves priced out of the market, as highlighted by Paul Connor, chief administrative officer at Stony Brook Eastern Long Island Hospital.

“This is the most challenging place to recruit,” Connor told Bloomberg. “The single most difficult impediment to get around right now is the housing prices.”

The repercussions extend beyond urban centers like New York City. Greenport, a picturesque town on the North Fork, embodies the spillover effect. Once an affordable haven amidst the opulence of the Hamptons, Greenport has witnessed a surge in housing prices, eroding its affordability advantage, as explained by Jonathan Miller, president of Miller Samuel.

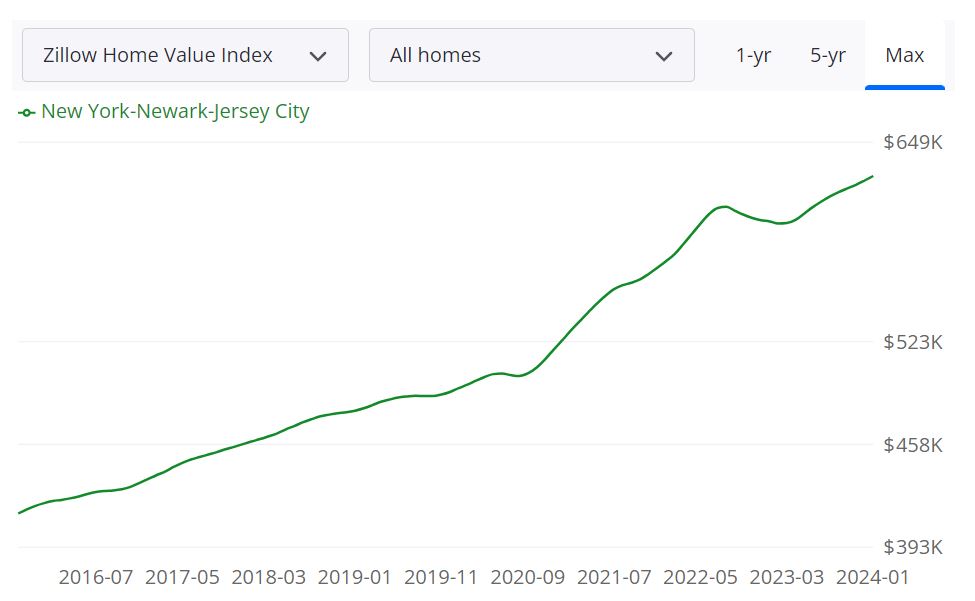

Median home prices in the North Fork skyrocketed by 50% in just four years, reaching nearly $1 million, accompanied by a staggering 60% decline in available listings. This crisis transcends local boundaries, as emphasized by Rachel Fee, executive director of the New York Housing Conference.

Recognizing the urgency, Governor Kathy Hochul unveiled a comprehensive plan to address the crisis. The proposal encompasses tax breaks to incentivize affordable housing development, wage increases for construction workers, and tenant protections to stabilize the market. Additionally, measures to facilitate rent stabilization, building size restrictions, and office space conversions are proposed to enhance housing availability.

While offering hope, the plan faces scrutiny from critics like the Real Estate Board of New York, citing concerns about long-term efficacy.

Amidst the turmoil, local institutions like Stony Brook Eastern Long Island Hospital are taking proactive measures. Witnessing a decline in local staff, the hospital explores innovative solutions, such as shared equity programs, to expand housing options for its workforce.

The Long Island housing crisis underscores the interconnectedness of a local economy. Beyond individual hardships, it threatens essential institutions. Success hinges on the proposed legislative plan and local endeavors, epitomized by initiatives at Stony Brook Eastern Long Island Hospital, to ensure Long Island's resilience and prosperity.