Given the competitive nature of the Massachusetts housing market and the limited inventory, it's safe to say that it is currently in a seller's market. Sellers have the upper hand, with multiple offers and bidding wars becoming increasingly common. However, for buyers willing to act swiftly and strategically, opportunities still abound.

Latest Massachusetts Housing Market Report in 2024

How is the Housing Market Doing Currently?

As we dive into the numbers by the Massachusetts Association of Realtors, it's evident that the market is buzzing with activity. New listings have seen a remarkable uptick, with single-family homes experiencing a surge of 23.0 percent, while condominium properties saw a healthy increase of 15.9 percent. Closed sales have also seen modest gains, with single-family homes up by 0.3 percent and condominium properties up by 1.4 percent.

Perhaps one of the most notable highlights is the surge in the median sales price. For single-family homes, the median sales price soared by 9.4 percent, reaching an impressive $569,000. Similarly, condominium properties saw a robust increase of 6.4 percent, with the median sales price hitting $500,000. These figures underscore the resilience of the housing market and the enduring appeal of Massachusetts as a real estate destination.

How Competitive is the Massachusetts Housing Market?

With prices on the rise and inventory levels fluctuating, the market is undoubtedly competitive. Buyers are vying for limited inventory, driving up demand and putting pressure on prices. The months supply of inventory remained steady for single-family units but witnessed a modest increase of 6.7 percent for condominium units. This indicates that while demand remains strong, there is a need for more inventory to satisfy buyer appetite.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the surge in new listings, this month marked the lowest number of single-family homes and condominiums for sale in February since data reporting began in 2004. This scarcity of inventory has contributed to the competitive nature of the market, with buyers scrambling to secure their dream homes amidst limited options.

What is the Future Market Outlook for Massachusetts?

Looking ahead, the future market outlook appears promising yet nuanced. While demand remains robust and prices continue to climb, there are factors such as inventory levels and economic conditions that could influence market dynamics. However, with interest rates remaining favorable and consumer confidence on the rise, the overall sentiment is optimistic.

Hence, the Massachusetts Housing Market Report for February 2024 paints a picture of a dynamic and competitive market landscape. With prices on the rise and inventory levels tightening, both buyers and sellers must stay informed and agile to navigate the complexities of the market.

Massachusetts Housing Market Forecast for 2024 and 2025

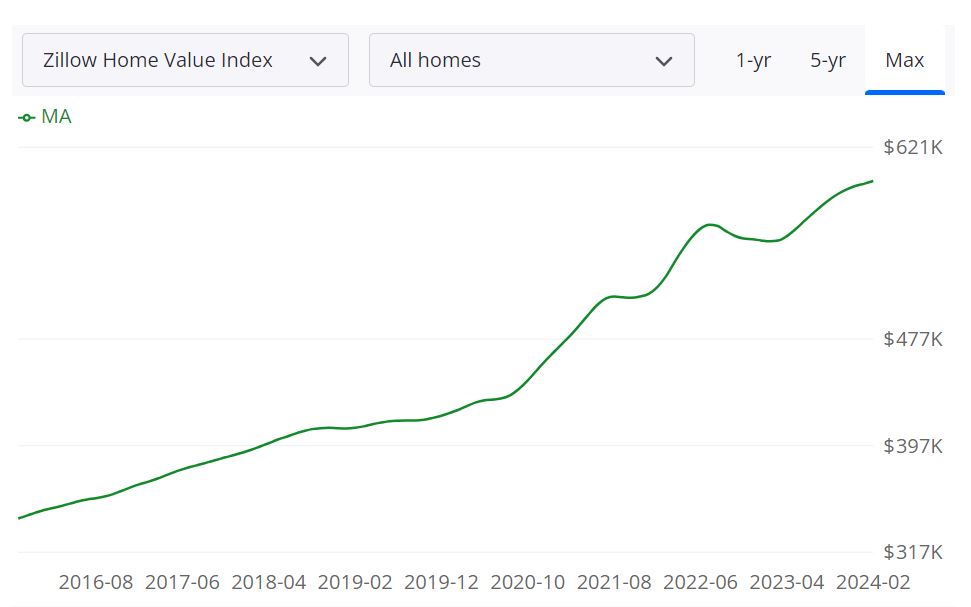

According to Zillow, the average Massachusetts home value stands at $596,410, marking an 8.2% increase over the past year. Homes in Massachusetts typically go to pending status in approximately 13 days. Let's dissect these housing metrics to gain a comprehensive understanding:

For Sale Inventory and New Listings

The Massachusetts housing market boasts 8,929 properties listed for sale as of February 29, 2024. Additionally, there were 3,375 new listings added on the same date, indicating a continuous influx of properties into the market.

Sale Price Metrics

The median sale price for homes in Massachusetts was $537,983 as of January 31, 2024, while the median list price stood slightly higher at $656,286 as of February 29, 2024. This disparity suggests that sellers may be pricing their properties optimistically, potentially leading to negotiation room for buyers.

Sale-to-List Ratio and Sales Performance

The median sale-to-list ratio in Massachusetts was 1.000 as of January 31, 2024, indicating that homes typically sell for their listed price. Moreover, 46.0% of sales were recorded over the list price, while 42.3% were under the list price, demonstrating varied negotiation dynamics within the market.

Are Home Prices Dropping in Massachusetts?

While the Massachusetts housing market has seen fluctuations over time, there is currently no indication of a widespread drop in home prices. In fact, recent data suggests that home prices have been steadily increasing, albeit at varying rates across different regions within the state. Factors such as low inventory and strong demand continue to support price growth in many areas.

As of the latest data available, the housing market in Massachusetts leans towards being a seller's market. This is indicated by factors such as low inventory levels, high demand from buyers, and homes often selling above their listing prices. In such market conditions, sellers typically have the advantage, with multiple offers and bidding wars becoming common occurrences.

Is Now a Good Time to Buy a House in Massachusetts?

Whether it's a good time to buy a house in Massachusetts depends on various factors, including individual circumstances, financial readiness, and long-term goals. While the current market conditions may favor sellers, buyers can still find opportunities, especially with low mortgage rates as compared to last year. It's advisable for prospective buyers to carefully assess their financial situation, conduct thorough research, and consult with real estate professionals to determine if now is the right time to make a purchase.

Insight into Regional Housing Market Forecast in Massachusetts

When analyzing the regional housing market forecast for various areas in Massachusetts, it becomes evident that each region presents unique dynamics and growth trajectories. The data provided showcases forecasts for several key regions in the state, including Boston, Worcester, Springfield, Barnstable Town, Pittsfield, and Vineyard Haven, over multiple time intervals.

1. Boston, MA

- In Boston, the metropolitan statistical area (MSA), the forecast indicates a 0.5% increase in housing market growth by 31st March 2024, followed by a 1.2% rise by 31st May 2024. However, the growth rate is expected to taper off slightly to 0.6% by 28th February 2025.

2. Worcester, MA

- Similarly, in Worcester, another significant MSA in Massachusetts, the forecast suggests a 0.5% increase in housing market growth by 31st March 2024, followed by a slightly higher growth rate of 1.3% by 31st May 2024. The growth is anticipated to accelerate further to 2.1% by 28th February 2025.

3. Springfield, MA

- Springfield, another prominent region, is forecasted to experience a 0.4% growth in housing market by 31st March 2024, followed by a steady increase to 1% by 31st May 2024. The growth rate is expected to stabilize at 0.9% by 28th February 2025.

4. Barnstable Town, MA

- In Barnstable Town, situated on Cape Cod, the forecast indicates a modest 0.1% growth by 31st March 2024, which is projected to pick up pace to 0.8% by 31st May 2024. The growth trajectory is expected to steepen significantly to 2.6% by 28th February 2025.

5. Pittsfield, MA

- Pittsfield, located in the Berkshire Mountains region, is anticipated to see a 0.2% growth in housing market by 31st March 2024, followed by a gradual increase to 1% by 31st May 2024. The growth rate is then forecasted to rise sharply to 2.5% by 28th February 2025.

6. Vineyard Haven, MA

- Lastly, Vineyard Haven, situated on the island of Martha's Vineyard, is projected to experience a 0.3% growth in housing market by 31st March 2024, which is expected to accelerate to 1.4% by 31st May 2024. The growth rate is forecasted to reach 3.8% by 28th February 2025.

Will Home prices drop in Massachusetts?

While it's impossible to predict the future with certainty, there are currently no indications of an imminent housing market crash in Massachusetts. Despite periodic fluctuations and economic uncertainties, the state's housing market has shown resilience over time. However, it's essential to monitor factors such as interest rates, economic indicators, and housing affordability, as they can influence market stability.

Indicators That Can Impact The Housing Market in Massachusetts

The Massachusetts housing market, like any dynamic entity, is shaped by a multitude of factors. From demographic shifts to economic fluctuations, these variables interplay to define the ebb and flow of the real estate landscape. In this section, we delve into some of the significant indicators that wield considerable influence over the housing market in the Bay State.

Population Growth: A Pillar of Market Dynamics

From 2010 to 2020, the Massachusetts population witnessed a notable increase of 7.4%, soaring beyond 7 million residents. This population surge is more than just a statistic; it's a fundamental driver of the housing market. As demand for housing increases with population growth, property values can experience upward pressure, particularly in regions experiencing rapid expansion.

Economic Canvas: An Overview of Massachusetts Economy

The health of the housing market is closely intertwined with the overall state of the economy. In 2022, Massachusetts showcased a population of 7,002,533, growing at an annualized rate of 0.4% over five years to 2022, positioning it 30th among the 50 US states by growth rate. The gross state product (GSP) in 2022 hit an impressive $543.6 billion, registering growth of 2.3% over five years. The top three employment sectors – Professional, Scientific and Technical Services, Real Estate and Rental and Leasing, Manufacturing – collectively employ a substantial portion of the state's workforce.

Gross Domestic Product (GDP) Insights

Massachusetts' GDP reached $543.6 billion in 2022, exhibiting a 2.3% increase from the previous year. This steady growth reflects a robust economic landscape that positively influences the housing market. A growing GDP often signifies higher income levels, which, in turn, can bolster demand for housing and contribute to increased property values.

Sector Dynamics: Unraveling the Tapestry

Different sectors contribute varying shares to Massachusetts' GDP, impacting the housing market in diverse ways. In 2022, the Professional, Scientific and Technical Services, Real Estate and Rental and Leasing, and Manufacturing sectors collectively constituted 42.3% of the state's GDP. The growth trends within these sectors offer insights into economic patterns and potential demand shifts.

The Ripple Effect on the Housing Market

These indicators are more than mere statistics; they form the foundation on which the housing market thrives or adjusts. A growing population triggers demand for housing, fueling competition and possibly leading to higher prices. A robust economy drives consumer confidence and purchasing power, influencing whether people invest in homes or hold back.

Understanding the intricate relationship between these indicators and the housing market enables buyers, sellers, and real estate professionals to make informed decisions. As the Massachusetts housing market continues to evolve, these indicators will serve as beacons, guiding stakeholders through the complex interplay of data, trends, and opportunities.

Sources:

- https://www.marealtor.com/market-data/

- https://fred.stlouisfed.org/series/MASTHPI#

- https://wallethub.com/edu/best-states-to-live-in/62617

- https://www.ibisworld.com/united-states/economic-profiles/massachusetts/

- https://www.census.gov/library/stories/state-by-state/massachusetts-population-change-between-census-decade.html