The current state of the Sioux Falls housing market leans towards being a Seller's Market, characterized by low inventory levels, high demand, and competitive bidding among buyers. With a limited supply of homes available for sale and steady demand from prospective buyers, sellers hold more leverage in negotiations, often resulting in quicker sales and potentially higher prices.

Current Sioux Falls Housing Market Trends

The housing market in Sioux Falls for February was influenced by several key factors, impacting various aspects of the market. Here's an in-depth analysis of the housing market statistics for the month from the REALTOR® Association of the Sioux Empire (RASE).

Rising Listings and Growing Demand

In the Sioux Falls region, there has been a remarkable surge in new listings, marking a significant 38.4 percent increase, totaling 465 listings. This uptick in available properties hints at a dynamic market responding to the demand for housing.

Simultaneously, pending sales have seen a robust uptrend, soaring by 61.4 percent to reach an impressive count of 302. This surge in pending sales underscores a strong demand from prospective homeowners, signaling a competitive and lively real estate scene.

Inventory Levels and Their Impact

As the market experiences a surge in listings and demand, it's crucial to assess the inventory levels to understand the supply-and-demand dynamics. Inventory levels in Sioux Falls rose by 10.7 percent, reaching a total of 1,329 units. This increase hints at a market that is actively responding to the heightened interest in homeownership.

Price Trends: A Steady Ascend

Prices in the Sioux Falls housing market have continued their upward trajectory, gaining traction with a 3.1 percent increase in the Median Sales Price, reaching an average of $295,000. This steady ascent in prices suggests a competitive market where property values are appreciating, making it an opportune time for sellers.

Days on Market: A Measure of Market Activity

While the market is bustling with activity, the Days on Market metric provides valuable insights into the pace of transactions. It recorded a 9.8 percent increase, bringing the average to 90 days. This indicates that properties are spending slightly more time on the market, potentially offering buyers a bit more time to make informed decisions.

Buyer Empowerment and Supply of Homes

Buyers in the Sioux Falls market have found themselves in an empowered position, given the rise in the Months Supply of Homes for Sale, which increased by 15.6 percent, reaching 3.7 months. This suggests a healthy balance between supply and demand, providing buyers with a range of options to explore.

Sioux Falls Housing Market Forecast 2024 and 2025

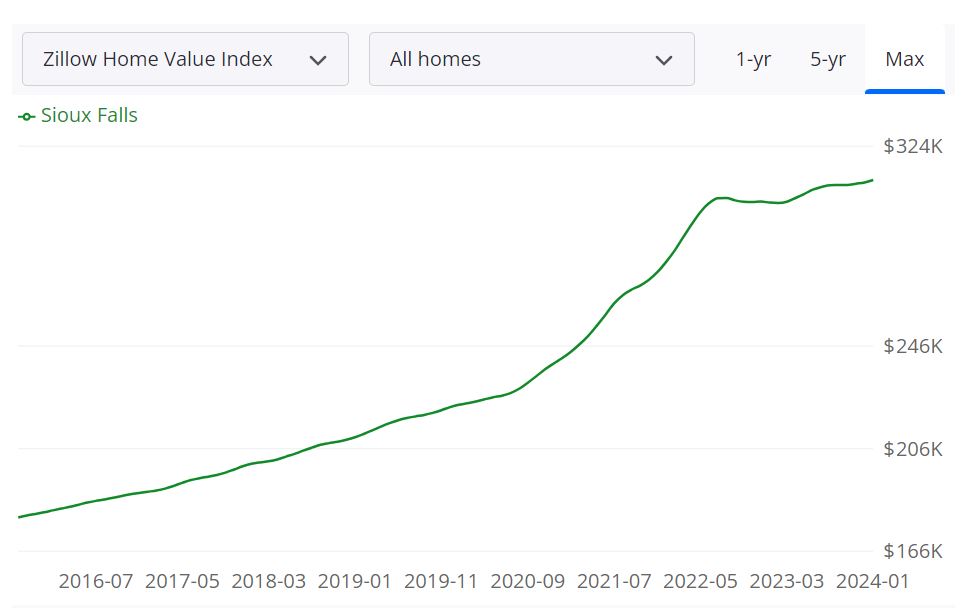

According to Zillow, the Sioux Falls housing market has shown resilience and growth, with the average home value reaching $311,408, reflecting a notable 2.9% increase over the past year (Data through January 31, 2024).

Key Housing Metrics Breakdown

- For Sale Inventory (January 31, 2024): The market boasts a diverse inventory, with 594 properties available for purchase.

- New Listings (January 31, 2024): Reflecting ongoing market activity, 127 new listings have emerged, contributing to the city's housing dynamism.

- Median Sale Price (December 31, 2023): The median sale price stands at $281,333, showcasing the market's stability and attractiveness to potential buyers.

- Median List Price (January 31, 2024): The median list price, at $325,767, hints at the competitive nature of the Sioux Falls real estate market.

Sioux Falls MSA Housing Market Forecast

Looking ahead, the Sioux Falls Metropolitan Statistical Area (MSA) is poised for continued growth. According to the forecast, as of January 31, 2024, the projected growth rates are 0.3% by February 29, 1.4% by April 30, and a substantial 4.5% by January 31, 2025. This positive trajectory reflects the region's robust real estate dynamics, making it an enticing prospect for both buyers and investors.

The Sioux Falls MSA encompasses various counties in South Dakota, constituting a significant portion of the state's real estate landscape. The market's size and growth potential make it a key player in the state's economic development, attracting attention from those looking to invest in a thriving and promising real estate market.

Are Home Prices Dropping in Sioux Falls?

As of the latest data, there is no indication of home prices dropping in the Sioux Falls housing market. On the contrary, the average home value has experienced a 2.9% increase over the past year, showcasing the market's resilience and stability.

Will the Sioux Falls Housing Market Crash?

While it's impossible to predict with certainty, there are currently no signs pointing towards an imminent housing market crash in Sioux Falls. The market has shown steady growth and resilience, supported by factors such as low unemployment rates, a growing economy, and sustained demand for housing.

Is Now a Good Time to Buy a House in Sioux Falls?

For prospective buyers, the decision to purchase a home in Sioux Falls depends on various factors, including personal finances, long-term plans, and market conditions. While the current market favors sellers, interest rates remain relatively low, making homeownership accessible to many. Additionally, buying a home in a stable and growing market like Sioux Falls can be a wise investment in the long run, provided buyers conduct thorough research and consider their financial circumstances carefully.

Should You Invest in the Sioux Falls Real Estate Market?

Sioux Falls, South Dakota is a city that has been attracting a lot of attention from real estate investors in recent years, thanks to its strong economy, affordable housing, and high quality of life. If you're considering investing in the Sioux Falls real estate market, there are many compelling reasons to do so. The city's economy is diverse and growing, with major employers in healthcare, finance, and manufacturing, which has created a strong demand for housing, especially in the rental market.

Additionally, Sioux Falls has a growing population and is consistently ranked as one of the best places to live in the United States. With a focus on the keyword “Sioux Falls real estate market,” it's clear that this city is a promising destination for real estate investors looking for a stable and profitable market. However, as with any investment, it's important to weigh the potential risks and benefits before making a decision.

If you're considering investing in the Sioux Falls real estate market, here are some top reasons why it might be a good idea:

- Strong job market: Sioux Falls has a diverse and growing economy, with major employers in industries like healthcare, finance, and manufacturing. This means that there is a steady demand for housing, and the rental market is particularly strong.

- Affordable housing: The cost of living in Sioux Falls is relatively low compared to other parts of the country, which means that housing prices are also relatively affordable. This can make it easier to generate cash flow from rental properties, and there may also be potential for appreciation over time.

- Growing population: Sioux Falls has been consistently growing over the past decade, with a population increase of more than 14% since 2010. This means that there is likely to be continued demand for housing in the city.

- Quality of life: Sioux Falls is consistently ranked as one of the best places to live in the United States, with a high quality of life, a strong sense of community, and abundant outdoor recreation opportunities.

- The Low Tax Rate: One advantage of investing in the Sioux Falls real estate market is the low tax rate, as there is no state or local income tax or state business income tax. Although the state has a slightly higher than average property tax rate of 1.2 percent, the low overall property costs in Sioux Falls result in average to below-average property tax bills. Additionally, property owners in Sioux Falls benefit from the state's lack of laws on certain issues, such as the requirement to provide receipts for deposits or record deposit withholdings, though it's recommended to do so. With no state or local income tax or state business income tax, investors can potentially save money on taxes and increase their overall return on investment.

Despite these benefits, there are also some potential drawbacks to investing in the Sioux Falls real estate market. One potential concern is the risk of overbuilding, particularly in the apartment sector. There is also the risk of a downturn in the local economy, particularly if there are major shifts in industries that drive job growth in the region.

Overall, however, Sioux Falls appears to be a promising market for real estate investors, particularly those looking for strong cash flow from rental properties in a growing and stable community. As with any investment, it's important to conduct thorough due diligence and work with local experts to make informed decisions.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Sources:

- https://www.zillow.com/sioux-falls-sd/home-values/

- https://rase-inc.org/rase-members/monthly-rase-mls-statistics/

- https://www.redfin.com/city/15282/SD/Sioux-Falls/housing-market

- https://www.realtor.com/realestateandhomes-search/Sioux-Falls_SD/overview