The current state of the Dallas housing market reflects a landscape characterized by robust activity and sustained demand. With both the single-unit residential housing and single-family homes segments experiencing healthy increases in sales volume, average prices, and median metrics, it's evident that the market remains buoyant despite certain challenges.

The future market outlook for Dallas-Fort Worth-Arlington remains optimistic, with continued economic growth expected to bolster housing demand. However, challenges such as rising construction costs, labor shortages, and potential interest rate hikes could impact affordability and supply dynamics, influencing market dynamics in the coming months.

ALSO READ: Texas Housing Market Forecast

How is the Dallas housing market doing currently?

The Texas Real Estate Research Center provides monthly statistics on the DFW housing market for single-family homes. The Texas REALTORS® provided the data for this report. The Dallas-Fort Worth-Arlington housing market continues to display resilience and promise, fueled by both economic growth and sustained demand.

Dallas Single-Unit Residential Housing

The sales volume for single-unit residential housing saw a notable 12.46% year-over-year (YoY) increase, surging from 4,744 to 5,335 transactions. This uptick in transactions translated into a rise in dollar volume, soaring from $2.17 billion to $2.51 billion.

Noteworthy is the average sales price, which experienced a 2.81% YoY escalation, climbing from $457,425 to $470,299. Concurrently, the average price per square foot also saw a commensurate rise from $198.92 to $205.02.

Examining the median metrics, the median price ascended by 2.12% YoY, from $375,000 to $382,941, with the median price per square foot following suit, escalating from $188.89 to $192.20.

The months inventory for single-unit residential housing expanded from 2.2 to 2.6 months supply, indicating a growing inventory relative to demand. Meanwhile, days to sell decreased marginally from 95 to 92 days, reflecting the sustained pace of transactions in the market.

Dallas Single-Family Homes

Similarly, the sales volume for single-family homes experienced a healthy 13.62% YoY surge, climbing from 4,392 to 4,990 transactions. This rise in transactions translated into a dollar volume escalation from $2.04 billion to $2.37 billion.

The average sales price for single-family homes rose by 2.19% YoY, ascending from $465,320 to $475,506. Similarly, the average price per square foot witnessed an uptick from $196.40 to $202.32.

Examining median figures, the median price for single-family homes increased by 1.58% YoY, rising from $379,000 to $385,000, while the median price per square foot also saw growth, escalating from $187.38 to $190.68.

The months inventory for single-family homes rose slightly from 2.2 to 2.5 months supply, indicating a gradual increase in inventory relative to demand. Conversely, days to sell decreased marginally from 95 to 92 days, underscoring the continued activity within the market.

Economic Growth and Its Impact on Housing

The Dallas-Fort Worth-Arlington area's economic growth has been a significant driver of activity within the housing market. According to data from the Texas Workforce Commission, the average monthly job count surged from 4,090,691 in 2022 to 4,268,683 in 2023, reflecting a robust 4.35% YoY increase, equating to 177,992 new jobs.

However, it's important to note that alongside this growth, the average monthly unemployment rate experienced a slight uptick, rising to 3.77% from 3.51% in 2022. While this increase warrants attention, it remains within manageable levels and hasn't significantly dampened the overall economic vitality of the region.

Competitiveness of the Market

The competitiveness of the market is underscored by several factors, including the limited inventory of available homes relative to the high demand. With months inventory hovering around the 2.5 to 2.6-month range for both single-unit residential housing and single-family homes, buyers are contending with a competitive environment where securing a desirable property requires swift action.

Meeting Buyer Demand

Despite the competitive nature of the market, there are concerns regarding whether there are enough homes for sale to meet buyer demand adequately. While the increase in inventory from previous periods is a positive sign, it may still fall short of fully satisfying the robust demand driven by population growth, economic expansion, and low-interest rates.

Is Dallas a Buyer's or Seller's Housing Market?

Assessing whether it's a buyer's or seller's housing market requires considering various factors, including inventory levels, pricing trends, and market dynamics. Currently, the market exhibits characteristics of a balanced environment, where both buyers and sellers have opportunities. Buyers benefit from favorable interest rates and a diverse inventory, while sellers enjoy strong demand and the potential for competitive offers.

However, the competitive nature of the market suggests that buyers may face challenges in securing preferred properties, necessitating quick decision-making and potentially facing multiple offer scenarios. Conversely, sellers may find favorable conditions for listing their homes, with the potential for swift sales and competitive pricing.

Is Dallas Becoming Unaffordable?

Dallas has seen a surge in economic growth and urban development, contributing to its appeal as a vibrant metropolitan area. However, this growth can also impact affordability, particularly for housing.

The demand for housing combined with limited inventory has the potential to drive prices higher, potentially affecting the affordability for some segments of the population. Addressing housing affordability requires a multi-faceted approach, involving strategies to increase housing supply, promote sustainable development, and provide solutions for diverse income levels within the city.

Dallas Rent Price Trends

As of March 2024, the median rent for all bedroom counts and property types in Dallas, TX is $1,729. This is -11% lower than the national average. Rent prices for all bedroom counts and property types in Dallas, TX have decreased by 3% in the last month and have decreased by 10% in the last year.

The monthly rent for an apartment in Dallas, TX is $1,593. A 1-bedroom apartment in Dallas, TX costs about $1,546 on average, while a 2-bedroom apartment is $2,239. Houses for rent in Dallas, TX are more expensive, with an average monthly cost of $2,600.

Dallas Housing Market Forecast for 2024 and 2025

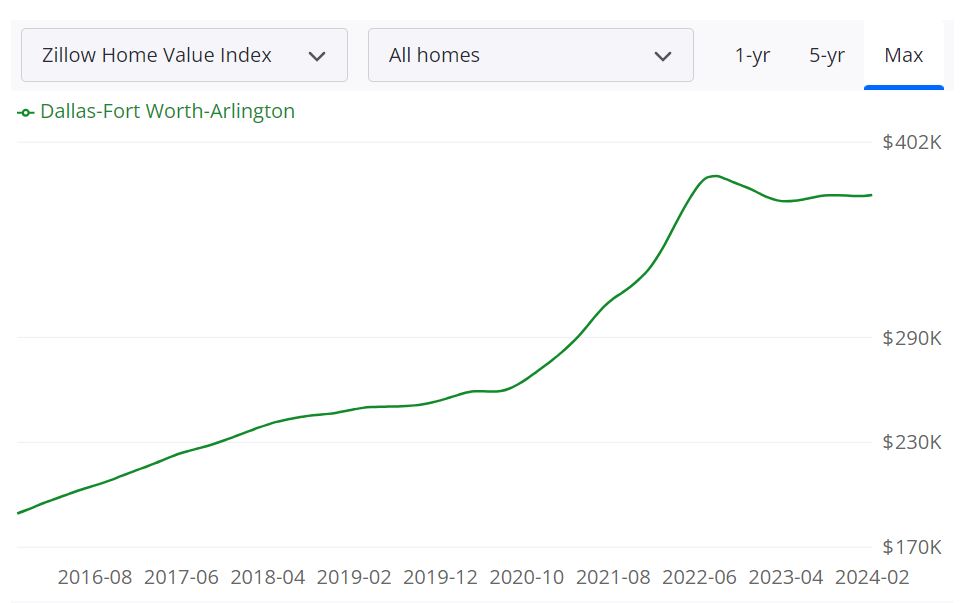

According to Zillow, the average home value in the Dallas-Fort Worth-Arlington metropolitan statistical area (MSA) stands at $371,777, marking a 0.4% increase over the past year. Homes in this area typically go to pending status in around 29 days. Looking ahead, there's a 0.9% projected increase in the market over the next year as of February 28, 2024.

Key Housing Metrics:

- For Sale Inventory: As of February 29, 2024, there are 21,367 properties available for sale in the Dallas area.

- New Listings: In the same timeframe, 6,191 new listings entered the market, indicating ongoing activity.

- Median Sale to List Ratio: The median sale to list ratio, calculated as of January 31, 2024, is 0.986, reflecting the relationship between listing prices and actual sale prices.

- Median Sale Price: As of January 31, 2024, the median sale price for homes in Dallas is $370,333.

- Median List Price: On February 29, 2024, the median list price is $414,333, indicating the average listing price in the market.

- Percent of Sales Over/Under List Price: According to data from January 31, 2024, 18.6% of sales were over list price, while 61.0% were under list price, highlighting the variability in pricing dynamics.

It's crucial to note that the Dallas-Fort Worth-Arlington MSA comprises several counties, including Dallas, Tarrant, and Collin, among others. This metropolitan area is one of the largest in the United States, both in terms of population and economic activity. With a diverse economy spanning industries such as technology, finance, and healthcare, Dallas attracts a steady influx of residents, contributing to the robustness of its housing market.

Are Home Prices Dropping in Dallas?

As of the latest data available, home prices in Dallas have not shown a significant trend of dropping. While there may be fluctuations in specific neighborhoods or property types, overall, the market has been experiencing gradual increases in home values.

Will the Dallas Housing Market Crash?

Speculating on whether a housing market will crash involves various factors, including economic conditions, housing supply, and demand dynamics. While no market is entirely immune to downturns, Dallas benefits from a diverse economy and steady population growth, which can provide stability even during challenging times. However, it's essential to monitor market trends and seek professional advice when making significant decisions.

Is Now a Good Time to Buy a House?

For prospective buyers considering entering the Dallas housing market, the decision hinges on personal circumstances and long-term goals. While prices may be relatively high compared to previous years, low-interest rates as compared to last year and potential appreciation can make homeownership a sound investment. However, buyers should conduct thorough research, assess their financial readiness, and consult with real estate professionals to determine if now is the right time to make a purchase.

Dallas Real Estate Market: Is It A Good Place For Investment?

Is Dallas a Good Place For Real Estate Investment? Many real estate investors have questioned whether or not purchasing a property in Dallas is a wise financial decision. If you want to know what the real estate market will be like for real estate investors and buyers in 2021, you need to dig deeper into the local trends. The Dallas housing market is an excellent place to invest in income properties, whether you're purchasing your first or simply adding another to your portfolio. It doesn't get much more “location” than this when it comes to real estate.

The Dallas housing market offers excellent profit-generating opportunities for all types of real estate investors, from first-time buyers to seasoned professionals. In Dallas, large apartment buildings and single-family homes account for the vast majority of the city's housing stock, with small apartment buildings accounting for the majority of the remaining properties. Renter-occupied and owner-occupied housing are found in equal amounts in Dallas.

Dallas is one of the cities in the United States where renting is more cost-effective than buying. A large part of the reason why Dallas has grown over the years has been the influx of young people who have settled in the city and are continuing to do so. They have preferred to start with rental properties rather than purchasing their own homes. In Dallas, the demand for rental units has increased by 14 percent in the last year, making now an excellent time to make a financial investment in the city's housing market.

Single-family homes make up approximately 43.51 percent of the total housing units in the city of Dallas. In January and February, Dallas-Fort Worth was the most active market in the country in terms of single-family construction starts. With 11,636 residential projects permitted, it ranked first in the nation for the combined number of single and multiple-family units being constructed, according to the U.S. Census Bureau's Building Permits Survey.

Dallas has a thriving economy and is experiencing steady population growth, which will help you put more money in your pocket. As rents rise, savvy investors should consider investing in Dallas commercial real estate. A single-family home or a multifamily apartment as an investment in the Dallas real estate market, regardless of whether it is a single-family home or a multifamily apartment, is an investment that can reap significant rewards if you have some experience and education in real estate investing. When it comes to investing in real estate, you need to know where to put your money, which means conducting extensive research to determine the best neighborhoods in the Dallas real estate market.

Let’s take a look at the number of positive things going on in the Dallas real estate market which can help investors who are keen to buy an investment property in this city.

Dallas is a Growing Real Estate Market

DFW, which stands for Dallas-Fort Worth, is one of the fastest-growing metropolitan areas in the United States, and as a result, it has become an increasingly popular real estate market in recent years. The region's economy is booming, thanks to a diverse range of industries such as finance, technology, healthcare, transportation, and logistics. In addition, DFW is home to several major corporations and a large number of small businesses, which has helped create a robust job market.

Furthermore, the population in DFW has been steadily increasing over the past few years, with many people moving to the area for job opportunities and high quality of life. This growth in population has led to a surge in demand for housing, both for homeownership and for rentals. As a result, real estate investors in DFW have seen excellent returns on their investments in recent years.

Another reason why DFW is a growing real estate market is its location. The region's proximity to major cities such as Austin, Houston, and San Antonio, as well as its access to several major highways and airports, make it a hub for business and commerce. This has helped attract investors and businesses from all over the country and the world, further fueling the growth of the local economy and real estate market.

Overall, the combination of a strong economy, population growth, and strategic location make DFW a prime real estate market for investors looking to capitalize on the region's potential for long-term growth and profitability.

No State Capital Gains Tax

One of the reasons that make investing in DFW real estate attractive is that there is no state capital gains tax in Texas. Capital gains tax is a tax paid on the profits made from selling an investment or asset such as real estate, stocks, or bonds. In most states, capital gains are subject to both federal and state taxes, which can significantly reduce the return on investment.

However, Texas does not impose a state capital gains tax, which means that investors can keep a larger portion of their profits from the sale of real estate. This tax advantage is a big draw for investors looking to maximize their returns and grow their real estate portfolios.

Furthermore, the absence of a state capital gains tax is not the only tax benefit that real estate investors in DFW can enjoy. Texas has one of the lowest property tax rates in the country, which means lower operating costs for real estate investors. This makes it easier to generate positive cash flow and maximize returns on investment.

Dallas' Strong Economy

Dallas is one of the fastest-growing cities in the United States and has become a hot spot for real estate investment due to its strong economy. The city boasts a diverse range of industries, including finance, technology, healthcare, and energy, all of which have contributed to its robust economic growth. Here's a closer look at the factors that make Dallas' economy a reason for real estate investment.

One of the most significant drivers of the Dallas economy is its location. Dallas is situated in the heart of the United States, making it an ideal location for businesses to operate nationally. The city has a well-developed transportation network, with two major airports, extensive highway systems, and a busy port, which has made it a transportation hub for goods and people.

The city's diverse economy has also been instrumental in driving growth. The finance and insurance industries, for example, employ a significant portion of the city's population. Dallas is also home to several Fortune 500 companies, including AT&T, ExxonMobil, and American Airlines, which provide a stable source of employment and contribute to the city's economic growth.

Another factor contributing to Dallas' economic growth is its thriving technology sector. The city has become a hub for tech startups, thanks to its favorable business environment, which includes low taxes, affordable real estate, and a business-friendly regulatory environment. Companies like Texas Instruments, which has its headquarters in Dallas, have helped to spur technological innovation in the city.

The healthcare industry is another critical component of the Dallas economy. The city is home to several world-renowned medical centers, including the University of Texas Southwestern Medical Center and the Baylor University Medical Center, which have attracted both medical professionals and patients to the area. The healthcare industry has contributed significantly to the city's economic growth, providing thousands of jobs and driving demand for real estate.

Finally, the energy industry has been a significant contributor to Dallas' economic growth. The city has long been a center for oil and gas production, and it continues to be an important player in the energy sector. The presence of major energy companies, such as ExxonMobil and Chevron, has created a significant source of employment and investment in the city.

Overall, Dallas' strong economy has made it a prime location for real estate investment. The city's diverse range of industries, transportation network, and favorable business environment have helped to drive economic growth and create a stable source of employment. The city's real estate market has responded accordingly, with strong demand for both commercial and residential properties. The combination of a thriving economy and a robust real estate market makes Dallas an attractive destination for real estate investors looking for long-term growth opportunities.

Strong Dallas Rental Market

Dallas, Texas is a thriving and rapidly growing city that has been attracting people from all over the world. It is the ninth most populous city in the United States, and the Dallas-Fort Worth-Arlington Metropolitan Area is the fourth largest metropolitan area in the country. With such a large population and an ever-growing economy, the city offers great potential for investment, particularly in the rental market.

The rental market in Dallas is robust and has been growing steadily in recent years. The demand for rental properties is high, and the supply has not kept up with the demand, which has led to a shortage of affordable housing. The strong rental market in Dallas is due in part to the city's population growth.

According to the U.S. Census Bureau, the Dallas-Fort Worth-Arlington Metropolitan Area had a population of over 7.5 million in 2020, and it is projected to grow by another 1.5 million people by 2030. As the population continues to grow, the demand for rental properties will also increase.

Another factor that makes Dallas an attractive market for rental property investment is the city's strong economy. Dallas has a diverse and dynamic economy that is driven by various industries, including technology, healthcare, finance, and energy. A strong economy and low unemployment rate translate into more people looking for rental properties.

Moreover, the cost of living in Dallas is lower than in other major cities in the United States, making it an attractive destination for people looking for affordable housing options. This factor is particularly important for millennials, who are the largest group of renters in the country. According to a report by RentCafe, Dallas is one of the top ten cities in the United States where millennials are renting the most.

Investing in rental properties in Dallas can be a lucrative business, but it requires careful planning and research. One of the first steps in investing in rental properties is to identify the right location. Dallas is a large city with many neighborhoods, each with its own characteristics and market dynamics. Investors should look for neighborhoods with high rental demand, low vacancy rates, and strong appreciation potential.

Another important factor to consider is the type of rental property. Single-family homes, duplexes, and apartments are all viable options, but each has its own pros and cons. Single-family homes offer more privacy and space, but they can be more expensive to maintain. Apartments are more affordable and easier to manage, but they may have higher turnover rates. Duplexes offer a balance between the two, but they may be harder to find.

Investors should also consider the costs associated with owning and managing rental properties, including property taxes, insurance, maintenance, and repairs. These costs can add up quickly and eat into profits if not carefully managed. Investors should also be prepared for unexpected expenses, such as emergency repairs or vacancy periods.

Hence, we can say that the strong rental market in Dallas makes it an attractive destination for rental property investment. The city's growing population, strong economy, and affordable cost of living create a favorable environment for investors looking for long-term returns. However, investing in rental properties requires careful planning, research, and management to ensure success. With the right strategy, investors can capitalize on the strong rental market in Dallas and build a profitable rental property portfolio.

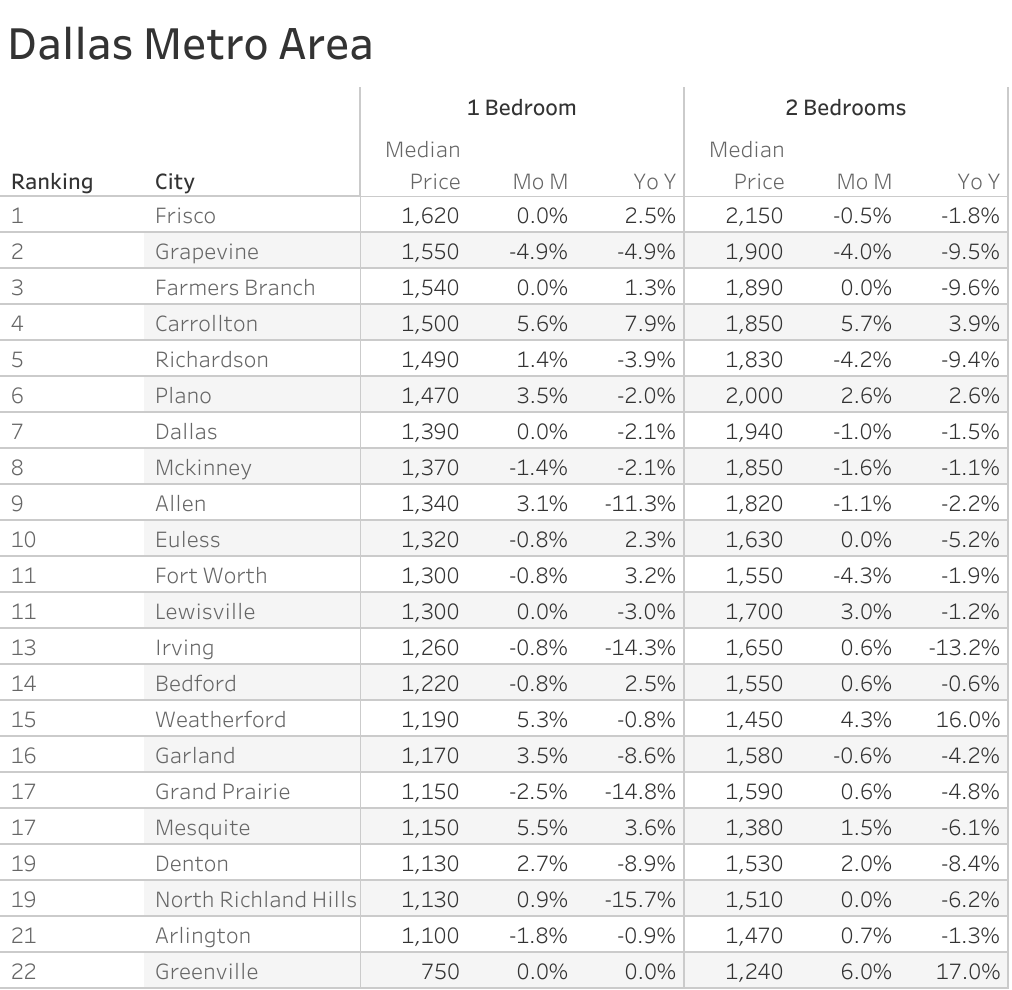

The Zumper Dallas Metro Area Report analyzed active listings across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Texas one bedroom median rent was $1,132 last month. Frisco ranked as the most expensive city with one-bedrooms both priced at $1,580 while Greenville ranked as the most affordable city with one bedrooms priced at $730.

The best place to buy rental property is about finding growing markets. Cities like Richardson, Plano & Garland are good for investors looking to get started with rental property ownership at an affordable price. These trends provide a macro look at the growing rental demand. Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present their own opportunities for investors.

These cities look good for rental property investment this year as rents are growing over there.

The Fastest Growing Cities For Rents in DFW (Month-Over-Month)

- Weatherford had the largest monthly rent price decline, down 5.9%.

- Plano was second with rent dipping 4.1% last month.

- Euless saw rent decrease 3.9% last month, making it third.

Sources:

- https://www.texasrealestate.com/market-research

- https://www.mymetrotex.com/market-reports

- https://www.zillow.com/dallas-tx/home-values

- https://www.neighborhoodscout.com/tx/dallas/real-estate

- https://www.realtor.com/realestateandhomes-search/Dallas_TX/overview

- http://www.homebuyinginstitute.com/news/dallas-forecast-one-of-the-hottest

- https://www.zillow.com/research/zillow-hottest-markets-2021-28667/

- https://www.zumper.com/blog/dallas-metro-report/

- https://www.zumper.com/rent-research/dallas-tx

- https://www.rentcafe.com/apartments-for-rent/us/tx/dallas/#rent-report

- https://www.mashvisor.com/blog/dallas-investment-properties

- https://rentberry.com/blog/dallas-investment-opportunities