The rise in single-family home sales, coupled with a decrease in days on market, suggests heightened competition among buyers in the Houston housing market. However, with months of inventory standing at slightly below the national average, the market remains relatively balanced, offering opportunities for both buyers and sellers to transact under favorable conditions.

Houston Housing Market Trends in 2024

- Single-family home sales rose 7.6 percent year-over-year, the third increase in the past year;

- Days on Market (DOM) for single-family homes went from 64 to 57 days;

- Total property sales rose 7.0 percent with 7,541 units sold;

- Total dollar volume was up 11.8 percent to $2.9 billion;

- The single-family median price rose 3.0 percent to $329,686;

- The single-family average price rose 4.1 percent to $400,252;

- Single-family home months of inventory registered a 3.4-months supply, up from 2.5 months a year earlier;

- Townhome/condominium sales continue to decline, falling 8.1 percent, with the median price up 8.9 percent to $237,500 and the average price up 5.5 percent to $258,587.

How is the Housing Market Doing Currently?

In February, the Houston housing market displayed a notable surge in activity, showcasing promising momentum for prospective buyers and sellers alike. According to the Houston Association of Realtors' (HAR) February 2024 Market Update, the region witnessed a significant increase in single-family home sales compared to the same period last year. This uptick marks the third consecutive monthly rise, signaling a positive trend after a series of fluctuations in the past year.

How Competitive is the Houston Housing Market?

The luxury housing segment, representing homes priced at $1 million and above, emerged as the frontrunner in February, experiencing a remarkable surge in sales year-over-year. This surge underscores a growing appetite for high-end properties in the Houston area. Additionally, the segment comprising homes priced between $500,000 and $1 million saw a substantial increase in sales, further illustrating the market's resilience and potential for growth.

Are There Enough Homes for Sale to Meet Buyer Demand?

While the luxury and mid-tier segments flourished, homes priced between $150,000 to $250,000 witnessed a slight decline in sales during the month. Despite this, the overall inventory expanded, with active listings soaring compared to the previous year. However, the increase in inventory did not outpace the rise in demand, as evidenced by the surge in total property sales, which rose year-over-year.

What is the Future Market Outlook for Houston?

The surge in home sales, coupled with a modest appreciation in prices and expanding inventory, sets an optimistic tone for the upcoming spring homebuying season. With pent-up demand driving consumer activity, the market is poised for continued growth and opportunities for both buyers and sellers. Moreover, the increase in single-family pending sales hints at sustained momentum in the months ahead.

Houston Housing Market Forecast 2024 and 2025

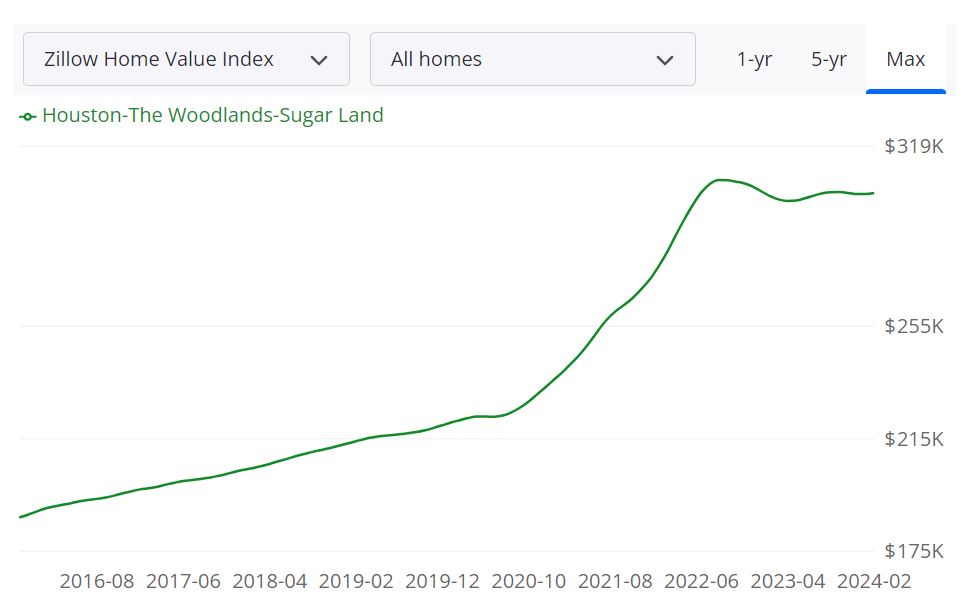

According to Zillow, the average Houston-The Woodlands-Sugar Land home value stands at $303,002, reflecting a 0.4% increase over the past year. Properties typically go to pending status within approximately 36 days, showcasing the region's brisk market activity.

While predicting market crashes with certainty is challenging, there are currently no indicators suggesting an imminent crash in the Houston housing market. The region's diverse economy, population growth, and steady demand for housing contribute to its resilience against severe downturns. However, external factors such as economic recessions or unforeseen events can influence market dynamics, highlighting the importance of continued monitoring and adaptability.

Explaining Housing Metrics:

- For Sale Inventory: As of February 29, 2024, 21,798 properties are available for sale in the Houston metropolitan area, providing options for potential buyers.

- New Listings: In the same period, 5,414 new listings entered the market, contributing to its diversity and choice.

- Median Sale to List Ratio: The 0.980 ratio recorded as of January 31, 2024 indicates the relationship between sale prices and list prices, influencing buyer-seller negotiations.

- Median Sale Price: As of January 31, 2024, the median sale price in the region was $310,833, reflecting the average transaction value.

- Median List Price: The median list price as of February 29, 2024, stands at $349,983, representing the midpoint of all listed properties.

- Percent of Sales Over/Under List Price: 14.1% of sales were recorded over list price, while 67.0% were under list price, indicating the negotiation dynamics within the market.

Understanding these metrics provides valuable insights into the Houston housing market's health and dynamics. The Houston-The Woodlands-Sugar Land metropolitan statistical area (MSA) encompasses several counties, including Harris, Fort Bend, and Montgomery, among others, collectively constituting a significant portion of the Texas housing market.

The Houston housing market is characterized by its size and diversity, catering to a wide range of buyers and sellers. With its strategic location, diverse economy, and cultural attractions, Houston remains an attractive destination for real estate investment and homeownership.

Are Home Prices Dropping in Houston?

Despite fluctuations in the real estate market, Houston has generally seen a trend of increasing home prices over the past few years. While there may be occasional dips or periods of stabilization, significant drops in home prices are not common in the region. However, it's essential to monitor market trends closely for any shifts that may occur. Currently, the market tends to favor sellers, characterized by low inventory levels, relatively fast sales, and a median sale price that has been on the rise. This indicates a competitive environment where sellers may have the upper hand in negotiations.

Is Now a Good Time to Buy a House?

For potential homebuyers, assessing whether it's a good time to buy a house depends on various factors, including personal financial situation, long-term goals, and market conditions. In the current Houston market, low interest rates as compared to last year and relatively stable home prices may present favorable conditions for buyers. However, competition and limited inventory could pose challenges. It's advisable to consult with real estate professionals and carefully evaluate individual circumstances before making a decision.

Houston Rental Market Trends

The Zumper Houston Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Texas one bedroom median rent was $1,134 last month. Pearland was the most expensive cities with one bedroom priced at $1,310. Huntsville was the most affordable city with rent at $860.

The Fastest Growing Cities For Rents in Houston Metro Area (Year-Over-Year)

- Baytown had the fastest growing rent, up 9.7% since this time last year.

- League City saw rent climb 8.8%, making it second.

- Pasadena was third with rent increasing 3.4%.

The Fastest Growing Cities For Rents in Houston Metro Area (Month-Over-Month)

- Baytown experienced the largest monthly rent price growth rate, growing 4.1%.

Houston Real Estate Investment Outlook

The city of Houston has long been a beacon for real estate investors seeking opportunities for long-term growth. As one of the largest and most dynamic cities in the United States, Houston offers a unique landscape for those looking to make strategic real estate investments. In this essay, we'll explore the factors that make Houston a promising destination for long-term real estate investment and provide insights into its outlook for sustainable growth.

Economic Resilience

One of the fundamental factors that underpin Houston's real estate investment potential is its economic resilience. Houston is home to a diverse range of industries, including energy, healthcare, manufacturing, and aerospace. Its role as the energy capital of the world has historically been a significant driver of economic activity.

While energy markets can be cyclical, Houston's economy has shown remarkable resilience even in the face of energy price fluctuations. This economic diversity serves as a stabilizing force for real estate investors, reducing the risk associated with economic downturns in any single sector.

Population Growth

Houston has consistently experienced population growth over the years. This demographic expansion is driven by several factors, including a robust job market, affordable housing, and a high quality of life. The city's attractiveness to both domestic and international migrants bodes well for long-term real estate investment. As the population continues to grow, the demand for housing and commercial properties is expected to follow suit, creating a reliable source of rental income and property appreciation for investors.

Infrastructure Development

Houston has made significant investments in infrastructure development. The city's commitment to improving transportation, public amenities, and urban planning has enhanced its livability and attractiveness. Infrastructure investments not only make the city a better place to live but also contribute to increasing property values. As Houston continues to expand and modernize its infrastructure, investors can expect to see a positive impact on their real estate holdings in the long term.

Real Estate Diversity

Houston's real estate market offers a diverse range of investment opportunities. Whether you're interested in residential, commercial, industrial, or mixed-use properties, Houston has options to suit various investment strategies. The city's size and varied neighborhoods provide investors with choices to tailor their portfolios to their specific goals. This diversity allows for risk mitigation through portfolio diversification, a key strategy for long-term real estate investors.

Top 10 Highest Appreciating Neighborhoods in Houston

- Gulfgate Riverview Pine Valley East

- Lawndale Wayside South

- Downtown Southeast

- Gulfton South

- Second Ward East

- Close In

- Second Ward

- Greenway Upper Kirby Area West

- Second Ward West

- South Main

(List by Neighborhoodscout.com)

Conclusion: Houston's Promise for Long-Term Real Estate Investment

When considering the outlook for long-term real estate investment, Houston stands out as a city with immense potential. Its economic resilience, population growth, infrastructure development, and real estate diversity create a fertile ground for investors seeking sustainable and reliable returns. The city's track record of weathering economic challenges and its proactive approach to urban development positions it as an attractive destination for those who value long-term real estate investments. As Houston continues to evolve and expand, it will likely remain a shining star in the constellation of real estate investment opportunities.

References:

- https://www.har.com/content/mls

- https://www.zillow.com/houston-tx/home-values

- https://www.neighborhoodscout.com/tx/houston/real-estate

- https://www.realtor.com/realestateandhomes-search/Houston_TX/overview