Given the swift pace of home sales, competitive pricing, and a notable percentage of sales over list price, the Columbus housing market leans towards being a seller's market. As of the latest data, home prices in Columbus have experienced an increase over the past year, indicating a trend of appreciation rather than a decline.

Central Ohio Housing Report

According to Columbus REALTORS®, the real estate market in Central Ohio is off to a promising start in 2024, with notable gains in various aspects compared to the same period last year. The statistics for January reveal encouraging developments that provide valuable insights for both potential buyers and sellers.

Robust Sales Performance

Closings Surge by 2.8%

In January 2024, Central Ohio witnessed a 2.8% increase in closed sales compared to the previous year, totaling 1,558. The majority of these transactions, constituting 86%, involved single-family homes, with the remaining 14% representing condominiums.

Inventory Growth Signals Opportunities

Another optimistic sign is the 10.3% surge in new listings, reaching a total of 2,066. This increase in inventory is a welcomed trend, with the current number of homes for sale standing at 2,890—a 17% rise from January 2023's figure of 2,471.

Insight from Columbus REALTORS® President

Scott Hrabcak, President of Columbus REALTORS®, acknowledged the positive momentum, stating, “We've been seeing some positive signs when it comes to increases in inventory over the last six to eight months.” He emphasized the opportune moment for prospective buyers, especially with homes taking just over a month on average to sell.

Escalating Prices Reflect Market Strength

Median Sale Price Soars by 8.9%

The median sales price in January surged to $286,098, reflecting an impressive 8.9% year-over-year increase. Five years ago, the median sales price was $181,500, underscoring the substantial growth in property values over time.

Financing Dynamics

With an average 30-year fixed-rate mortgage of 6.69% as of January 25, the financing landscape is an integral part of the market. Conventional loans constituted 55% of closed sales, while cash transactions accounted for 21%, and VA or FHA loans comprised 17%.

Regional Insights

Focus on School Districts

Central Ohio's real estate activity is not evenly distributed, with Columbus City Schools and Columbus (Corp.) leading the way with 950 closed sales in January. An additional 1,279 homes in these districts are currently under contract, indicating sustained demand.

Local Highlights

- Grove City: In the South-Western City School District, there were 86 closed sales at a median price of $269,150.

- Marysville: In Union County, Marysville experienced a 15% year-over-year increase, bringing the median sales price to $402,450.

The Central Ohio housing market in January 2024 paints a picture of resilience and growth, offering a favorable environment for both buyers and sellers. As the region experiences increased inventory, escalating prices, and diverse financing options, individuals considering real estate transactions are encouraged to seize the current opportunities.

Is Columbus Ohio a Seller's Real Estate Market?

According to Realtor.com, in February 2024, Columbus, OH is classified as a seller's market. This means that there are more prospective buyers than available homes. The imbalance in supply and demand puts sellers in a favorable position, potentially leading to quicker sales and competitive offers.

Current Market Trends

As of February 2024, the median listing home price in Columbus, OH stands at $274.7K, marking a 2.5% year-over-year increase. This robust growth reflects the city's resilience and attractiveness in the real estate sector. The median listing home price per square foot is $188, providing valuable insights into the cost dynamics in various neighborhoods.

Sale-to-List Price Ratio

One noteworthy statistic is the sale-to-list price ratio, which stands at 100%. This indicates that homes in Columbus, OH are selling for approximately the asking price on average. This equilibrium between listing and selling prices signifies a stable and competitive market, creating a favorable environment for both buyers and sellers.

Median Days on Market

One key metric for assessing the efficiency of the housing market is the median days on market. In Columbus, OH, homes typically sell after 27 days on the market. This statistic reflects a balanced pace, allowing for reasonable decision-making for both buyers and sellers. The trend shows a slight decrease compared to the previous month and a modest decline since last year, signaling a responsive and dynamic market.

In summary, the Columbus, OH housing market in 2024 is characterized by positive trends and balanced dynamics. The steady increase in median listing home prices, coupled with a strong sale-to-list price ratio, contributes to a resilient and competitive real estate landscape. As a seller's market, Columbus, OH offers opportunities for quick sales and favorable outcomes for those entering the housing market. Understanding the median days on market provides valuable insights for individuals navigating this dynamic environment.

Columbus Ohio Housing Market Forecast for 2024 and 2025

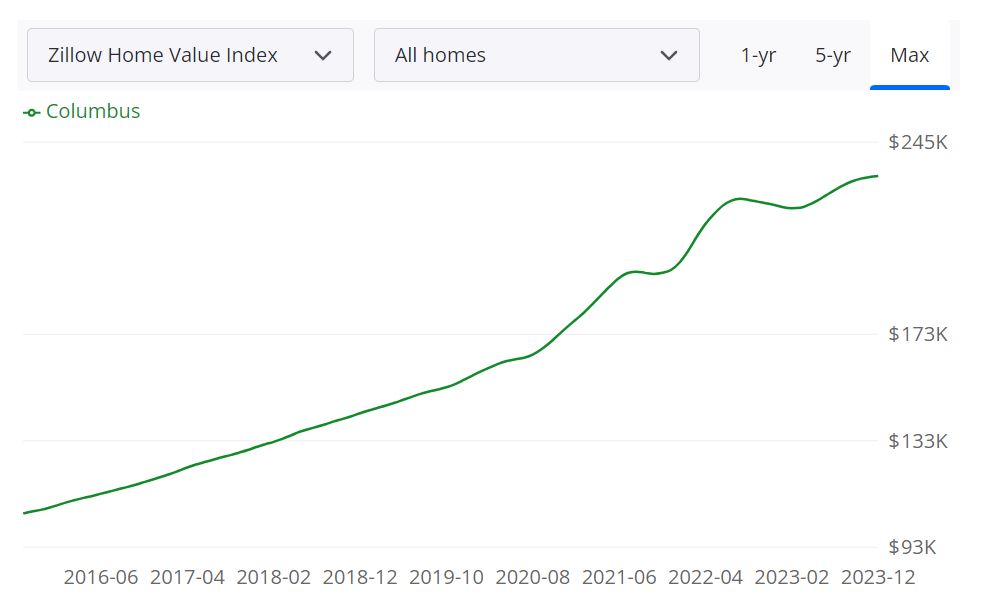

According to data sourced from Zillow, the average home value in Columbus stands at $233,634, reflecting a 5.7% increase over the past year. Remarkably, homes are going pending in a swift 11 days, underscoring the brisk pace of the local real estate market as of January 31, 2024.

Key Housing Metrics

- For Sale Inventory (January 31, 2024): The market currently boasts 1,358 homes available for sale, indicating a dynamic inventory landscape.

- New Listings (January 31, 2024): A total of 511 new listings have surfaced, contributing to the vitality of the market.

- Median Sale to List Ratio (December 31, 2023): The median sale price to list ratio, a crucial indicator of market competitiveness, stands at a robust 1.000.

- Median Sale Price (December 31, 2023): The median sale price reached $218,733, underscoring the value appreciation within the market.

- Median List Price (January 31, 2024): Currently, the median list price is $263,300, reflecting the price expectations of sellers in the current market conditions.

- Percent of Sales Over/Under List Price (December 31, 2023): Notably, 38.8% of sales were transacted above list price, while 43.9% occurred below list price, highlighting the diversity in pricing strategies.

Columbus MSA Housing Market Forecast

Delving into the future, the Columbus Metropolitan Statistical Area (MSA) housing market is poised for continued growth. The forecast, as of January 31, 2024, predicts an incremental increase with a projected growth rate of 5.7% by January 31, 2025.

The Columbus MSA (Metropolitan Statistical Area) encompasses various counties within the state of Ohio. Notable counties contributing to this vibrant housing market include Franklin, Delaware, and Fairfield, each playing a distinctive role in shaping the overall real estate landscape. The collective impact of these counties positions the Columbus MSA as a substantial player in the broader Ohio housing market.

Size and Scope: With a diverse range of residential offerings and a growing population, the Columbus MSA boasts a sizable housing market. The interplay of economic factors, urban development, and regional demand contribute to the dynamic nature of this real estate environment.

Is Columbus a Buyer's or Seller's Housing Market?

In the current Columbus housing market, the balance between buyers and sellers is nuanced. With a median sale-to-list ratio standing at a robust 1.000 as of December 31, 2023, the equilibrium suggests a competitive scenario where both buyers and sellers have opportunities. The 1,358 homes available for sale provide options for buyers, while the 38.8% of sales occurring over list price indicate the assertive position of sellers. It's a market where strategic decisions and a keen understanding of local trends become paramount for both buyers and sellers.

Are Home Prices Dropping in Columbus?

Contrary to a decline, the Columbus housing market demonstrates resilience with a 5.7% increase in average home value over the past year, reaching $233,634 as of January 31, 2024. This upward trajectory aligns with the broader trend of appreciation, making it clear that, at least for the specified period, home prices are not on a downward trajectory.

Will the Columbus Housing Market Crash?

The current indicators do not point towards an impending housing market crash in Columbus. With a balanced inventory, consistent demand, and steady price growth, the market exhibits stability. However, it's crucial to monitor factors such as economic shifts, interest rates, and external influences that could impact the real estate landscape. At present, the Columbus housing market reflects resilience and adaptability, mitigating the likelihood of a sudden market crash.

Is Now a Good Time to Buy a House in Columbus?

For prospective buyers, the decision to purchase a house in Columbus depends on various factors. The current market conditions, including the median sale-to-list ratio, the average home value increase, and the availability of inventory, provide a favorable backdrop for buyers. However, individual circumstances, financial considerations, and long-term goals should be carefully evaluated. Engaging with a local real estate professional can offer personalized insights, helping buyers make informed decisions in alignment with their specific needs and aspirations.

Columbus Real Estate Investment Overview?

Columbus, Ohio, is one of the fastest-growing cities in the Midwest, with a population of over 900,000. The city's real estate market has been on an upward trajectory in recent years, with home prices and rental rates rising steadily. This makes it an attractive destination for real estate investors looking for a stable and profitable investment.

Investing in Columbus real estate offers a wide range of opportunities, from single-family homes to multi-unit apartment complexes. The city's diverse economy, low unemployment rate, and growing population make it a promising market for rental properties. According to Zillow, the average home value in Columbus is up over the past year. This suggests that property values are on an upward trend, which can be advantageous for investors seeking long-term appreciation.

One key advantage of investing in Columbus real estate is the affordability of properties compared to other major cities. While coastal markets like New York and San Francisco may have higher appreciation rates, they also have significantly higher price tags, making it difficult for many investors to enter the market. In contrast, Columbus offers relatively affordable properties with solid returns on investment.

Another factor that makes Columbus an attractive real estate investment destination is the city's growing job market. The unemployment rate in Columbus is consistently below the national average, with a diverse economy that includes sectors like healthcare, education, and technology. This means there is a steady demand for rental properties from young professionals and families who are moving to the city to take advantage of job opportunities.

The Columbus real estate market is also attractive to investors due to the city's robust infrastructure and transportation network. The city has a well-developed public transportation system, including buses, light rail, and bike-sharing programs, making it easy for residents to get around without a car. Additionally, the city is home to Port Columbus International Airport, which provides direct flights to many major U.S. cities.

When considering investing in Columbus real estate, it's essential to note that the market can vary significantly from neighborhood to neighborhood. For example, the median home value in Italian Village is $397,113, while in Milo-Grogan, it is $114,460. Therefore, it's essential to research individual neighborhoods and consult with a local real estate agent who has a deep understanding of the market.

In summary, Columbus offers a promising real estate investment opportunity, with affordable properties, a strong job market, and a growing population. While the market can vary by neighborhood, investing in Columbus real estate offers the potential for solid returns on investment in both the short and long term.

Top Reasons to Invest in Columbus Real Estate Market for the Long Term

Investing in real estate can be a lucrative long-term strategy, but it's important to choose the right market. Columbus, Ohio, is a city that is increasingly becoming popular among real estate investors. Here are the top six reasons to consider investing in Columbus real estate market for the long term:

- Strong Job Market: Columbus has a diverse economy and a strong job market. The city is home to several Fortune 500 companies, including Nationwide Insurance, American Electric Power, and Huntington Bancshares. The city also boasts a thriving technology sector, with companies like IBM and JPMorgan Chase had a significant presence in the area. With a low unemployment rate and a growing economy, Columbus is an attractive location for those looking to invest in real estate.

- Growing Population: Columbus has experienced steady population growth over the past decade, making it one of the fastest-growing cities in the United States. This growth is expected to continue in the coming years, with estimates suggesting that the population will increase by 10% by 2030. A growing population means an increased demand for housing, which can translate to higher rental yields and property values.

- Affordable Housing Market: Despite its strong job market and growing population, Columbus remains an affordable housing market, especially when compared to other major cities. The median home price in Columbus is currently around $227,481, which is significantly lower than in other cities like New York, San Francisco, or Los Angeles. This makes Columbus an attractive option for real estate investors looking to get in on the ground floor of an emerging market.

- Strong Rental Market: Columbus has a strong rental market, with rental demand consistently outpacing supply. This has resulted in a relatively low vacancy rate, which has been hovering around 5% for the past few years. The strong rental market is good news for real estate investors, as it means they are likely to find tenants quickly and keep their properties occupied for longer periods. As of March 2024, the median rent for all bedroom counts and property types in Columbus, OH is $1,425. This is -27% lower than the national average. Rent prices for all bedroom counts and property types in Columbus, OH have remained the same in the last month and have decreased by 4% in the last year.

- Favorable Tax Climate: Ohio has a relatively low tax burden compared to other states, making it an attractive location for real estate investors. Property taxes in Columbus are also relatively low compared to other major cities, which can help investors keep their expenses down and their profits up.

- Thriving Arts and Culture Scene: Columbus has a vibrant arts and culture scene, with several museums, theaters, and galleries located in the city. The city also hosts several festivals throughout the year, including the Columbus Arts Festival and the Ohio State Fair. This cultural richness attracts more people to the city and makes it an even more attractive place to live, work, and invest in real estate.

Therefore, Columbus, Ohio, offers a combination of strong economic fundamentals, affordable housing, and a thriving rental market, making it an attractive option for real estate investors looking to make long-term investments. As with any real estate purchase, act wisely. Evaluate the specifics of the Columbus housing market at the time you intend to purchase.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Columbus.

Sources:

- https://www.columbusrealtors.com/housing-reports

- https://www.zillow.com/Columbus-oh/home-values

- https://www.neighborhoodscout.com/oh/columbus/real-estate

- https://www.realtor.com/realestateandhomes-search/Columbus_OH/overview