Feeling like the dream of owning a home is slipping further away? You're not the only one. Federal Reserve Chair Jerome Powell recently highlighted that the housing market's woes run deep, extending beyond just the current high interest rates. The core issue? A persistent shortage of available homes, a problem that sadly requires long-term fixes, not just a quick tweak from the Federal Reserve.

Housing Market Faces a Long-Term Crisis: Jerome Powell

Lately, the conversation has been dominated by inflation, interest rates, and tariffs. It's easy to get caught up in these immediate concerns, but Powell's recent remarks serve as a crucial reminder: the challenges in the housing market are more than skin deep. It's not just about today's mortgage rates; it's about a fundamental mismatch between the number of people who want to buy homes and the number of homes available.

The “Longer-Run Problem”: A Persistent Home Deficit

So, what exactly does Powell mean by a “longer-run problem?” Simply put, we haven't been building enough houses for years. The pace of new home construction hasn't kept up with population growth and the formation of new households. Think of it like trying to squeeze too many people into a house with too few rooms – eventually, things get crowded and, yes, expensive!

This ongoing shortage has fueled:

- Rising home prices: When demand for homes outstrips supply, prices naturally climb.

- Decreased affordability: Sky-high prices make it incredibly difficult for many, especially first-time buyers, to even get their foot on the property ladder.

Peeling Back the Layers: The Reasons Behind the Shortage

Why haven't we been building enough houses? Several factors are at play:

- Surging Construction Costs: The price of materials, land, and labor has increased significantly, making new construction more expensive.

- Restrictive Zoning Laws: Many cities and towns have regulations that limit where and what types of houses can be built. These rules can inadvertently hinder the development of much-needed housing.

- Construction Labor Gap: There simply aren't enough skilled workers in the construction industry to build the number of homes we need.

The “Short-Run Pressures”: High Rates and Uncertainty

Adding to the long-term supply issue, the housing market is also grappling with more immediate hurdles:

- Elevated Mortgage Rates: The Federal Reserve's efforts to combat inflation have led to higher interest rates, including mortgage rates, which currently hover around 7% for a standard 30-year fixed loan. Speaking from experience watching the market, this is clearly impacting what people can afford.

- Slower Market Pace: High rates and high prices have cooled down home sales considerably. With borrowing costs up, many are choosing to stay in their current homes.

- Tariff-Related Instability: New tariffs can inject uncertainty into the market by increasing the cost of building materials and creating broader economic unease.

Powell's Policy Focus: Stability First

While some might wish for the Fed to lower rates to give the housing market a boost, Powell contends that the most beneficial action the Fed can take is to concentrate on bringing prices under control and fostering a strong job market. His view is that a solid overall economy provides the best foundation for a healthy housing sector.

In his own words:

“Basically, the situation is we have a longer-run shortage of housing, and we also have high rates right now. I think the best thing we can do for the housing market is to restore price stability in a sustainable way and create a strong labor market.”

In essence, artificially lowering rates to prop up the housing market might offer only a temporary fix, whereas a stable economy will provide more lasting support.

Looking to the Horizon: What's Next for Housing?

Despite the current challenges, there are some potential bright spots on the horizon:

- Mortgage rates could find a stable point: If inflation starts to ease, mortgage rates might level off or even see some decline, potentially making homes more accessible.

- Inventory might see a bump: As the market slows, the number of homes available for sale could increase. This would give buyers more choices and possibly ease some of the pressure on prices.

- Price adjustments are underway: In certain areas, we're already observing a slight dip in home prices.

The Necessity of Foundational Changes: Building Our Way Forward

Ultimately, tackling the “longer-run problem” will require significant structural changes:

- More construction is key: We need to build more homes, especially in areas facing the most severe shortages.

- Streamlining approvals: Governments need to simplify and speed up the zoning and permitting processes for new construction.

- Addressing the labor gap: We need to invest in training programs to increase the number of skilled workers in the construction trades.

| Challenge | Potential Solution |

|---|---|

| Housing Shortage | Incentivize and streamline new home construction processes |

| Affordability Crisis | Re-evaluate zoning and promote a wider variety of housing options |

| Rising Construction Costs | Explore innovative building technologies and materials |

| Labor Shortages | Invest in and expand construction skills training programs |

Without these fundamental reforms, relying solely on the Federal Reserve's monetary policy won't address the core issue.

My Perspective: A Problem with Many Sides Needs Many Solutions

Having observed the housing market for quite some time, I wholeheartedly agree with Powell's assessment. The housing market squeeze isn't just about interest rates. It's a multifaceted issue involving a lack of available homes, increasing costs, and regulations that can hinder building.

In my view, we need a comprehensive approach. While the Fed focuses on maintaining a stable economy, governments and communities must step up to make it easier to build more homes. This includes rethinking zoning laws, investing in workforce development, and encouraging new ideas in the construction industry. Otherwise, homeownership will become an increasingly distant dream for many.

As Powell astutely pointed out, monetary policy alone can't fix this deep-seated imbalance between supply and demand. Instead, achieving equilibrium will require a coordinated effort across various levels of government, the industry, and local communities, all aimed at boosting construction and ensuring environmentally responsible growth.

It's a complex puzzle, but until there's a real commitment to tackling this ‘longer-run issue', even the most ambitious plans to improve affordability are likely to fall short of their goals.

Bottom Line: Jerome Powell's statements make it clear that resolving the challenges in the housing market isn't a quick fix. It demands patience, careful planning, and cooperation from many different players. While the Federal Reserve has a role to play, the real answers lie in addressing the fundamental shortage of homes and developing a more sustainable and affordable housing system for everyone.

Plan Ahead with 2026 Housing Market Insights

The housing market is shifting—some regions are cooling while others remain resilient. Stay ahead of national trends by focusing on stable investment areas with long-term growth potential.

Norada helps investors like you discover turnkey real estate opportunities in cities forecasted for strong performance in both 2025 and 2026.

HOT NEW LISTINGS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

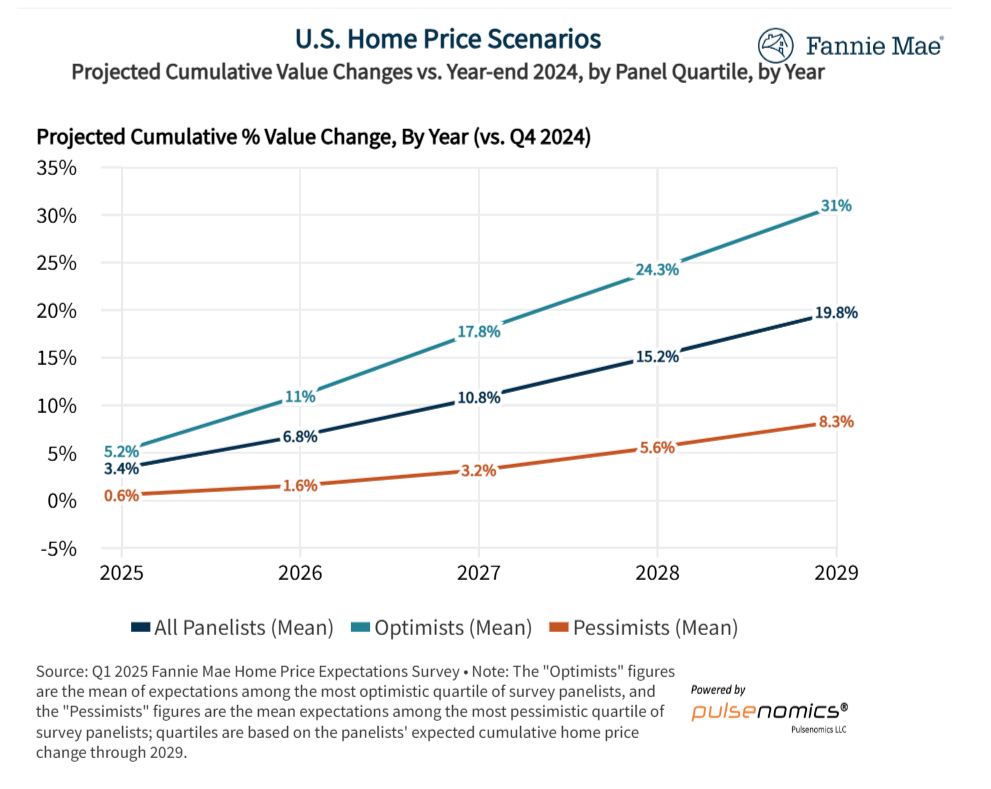

- Housing Market Forecast 2026: Will Prices Rise or Fall Next Year?

- Housing Market Predictions: Home Prices to Drop 1.4% in 2025

- Housing Market Alert: Over 600 Metros Will See Prices Decline by 2026

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025

- Will Real Estate Rebound in 2025: Top Predictions by Experts

- Recession in Real Estate: Smart Ways to Profit in a Down Market

- Will There Be a Real Estate Recession in 2025: A Forecast

- Will the Housing Market Crash Due to Looming Recession in 2025?

- 4 States Facing the Major Housing Market Crash or Correction

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?