The Bay Area housing market remains a hot property, with strong buyer interest and consistent price increases. The region's economic strength and desirable lifestyle continue to make it a top destination for homebuyers. Property values in the San Francisco Bay Area show no signs of cooling down.

Data from March 2024 reveals a significant year-over-year jump in median sold prices, solidifying the upward trend. This sustained growth highlights the Bay Area housing market's resilience and reflects the ongoing demand for homes in the region. While short-term fluctuations are possible, the overall outlook points toward continued price appreciation.

A key indicator of a market's health is the median sold price of existing single-family homes. According to the California Association of Realtors (C.A.R.), the San Francisco Bay Area saw a notable surge in this metric in March 2024, with a median sold price of $1,386,500.

This represents a significant increase from both the previous month's figure of $1,256,500 and the same period last year, translating to a 10.3% rise month-over-month and a substantial 15.5% jump year-over-year.

This spike in median sold price reflects the robust demand for housing in the Bay Area. This demand is fueled by a number of factors, including a booming job market, appealing amenities, and the region's reputation as a tech hub.

Bay Area Sales Activity: A Mixed Bag

The rising median sold price paints a rosy picture, but for a well-rounded view of the market, it's crucial to delve into sales figures. March 2024 saw a sharp 31.7% month-over-month increase in Bay Area sales, indicating a surge in buying activity. However, compared to the same period last year, there's a contrasting trend with a 5.4% year-over-year decline in sales.

This fluctuation in sales figures highlights the Bay Area's nuanced market. Consumer confidence and external factors significantly impact buying behavior. Despite the slight year-over-year dip, the month-over-month sales surge suggests underlying resilience in the Bay Area housing market.

Bay Area Regional Housing Data: March 2024

Let's dissect the regional data to get a clearer picture of the Bay Area housing market in March 2024. By examining the median sold price of existing single-family homes alongside sales figures, we can uncover specific trends in each county:

Alameda County: Alameda saw a steep 7.7% increase in median sold price from February, reaching $1,400,000. This is on top of a significant 16.2% surge compared to March 2023. Sales activity also remained robust, with a 31.2% month-over-month jump, despite a slight 3.7% year-over-year dip.

Contra Costa County: Contra Costa County's median sold price climbed to $890,000, reflecting a 4.7% month-over-month rise and a solid 9.5% year-over-year increase. However, sales activity showed a steeper decline of 21.0% compared to March 2023, hinting at potential shifts in buyer behavior.

Marin County: Marin County witnessed a remarkable surge in both median sold price and sales activity. The median price reached a staggering $1,957,500, representing a 21.6% month-over-month increase and a substantial 22.3% rise year-over-year. This confirms Marin County's status as a highly desirable market for both buyers and sellers.

Napa County: Despite a slight dip in median sold price compared to February, Napa County held steady at $880,000. However, sales activity experienced a notable decline of 18.1% year-over-year, suggesting potential challenges in the local market.

San Francisco County: San Francisco saw a significant increase in median sold price, reaching $1,745,000, with a 9.7% month-over-month rise and a more modest 2.6% year-over-year increase. Sales activity remained robust, indicating continued demand in the city's real estate market.

San Mateo County: San Mateo County experienced a substantial increase in both median sold price and sales activity. The median price hit $2,170,000, reflecting a 12.9% month-over-month jump and a significant 16.7% rise year-over-year. This further solidifies the county's position as a highly sought-after destination for homebuyers.

Santa Clara County: In Santa Clara County, the median sold price climbed to $1,910,000, with a 5.6% month-over-month increase and a notable 12.4% rise year-over-year. Sales activity surged by an impressive 49.2% compared to March 2023, highlighting the county's strong market dynamics.

Solano County: Solano County's median sold price remained stable, with a slight month-over-month increase to $584,950. However, sales activity experienced a 5.9% decrease compared to March 2023, highlighting potential challenges in the county's real estate market.

Sonoma County: Sonoma County witnessed a steady increase in both median sold price and sales activity. The median price reached $865,000, reflecting a 4.7% month-over-month rise and a 4.3% year-over-year increase. This suggests Sonoma County remains an attractive option for homebuyers.

Bay Area Housing Forecast: 2024 and Beyond

The Bay Area, consistently topping lists of priciest U.S. real estate and boasting dense populations, remains a housing market powerhouse. Encompassing nine counties (Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma) and over 100 municipalities, the region centers around San Francisco, Oakland, and the largest, San Jose. Let's delve into predictions for the Bay Area housing market in 2024 and 2025.

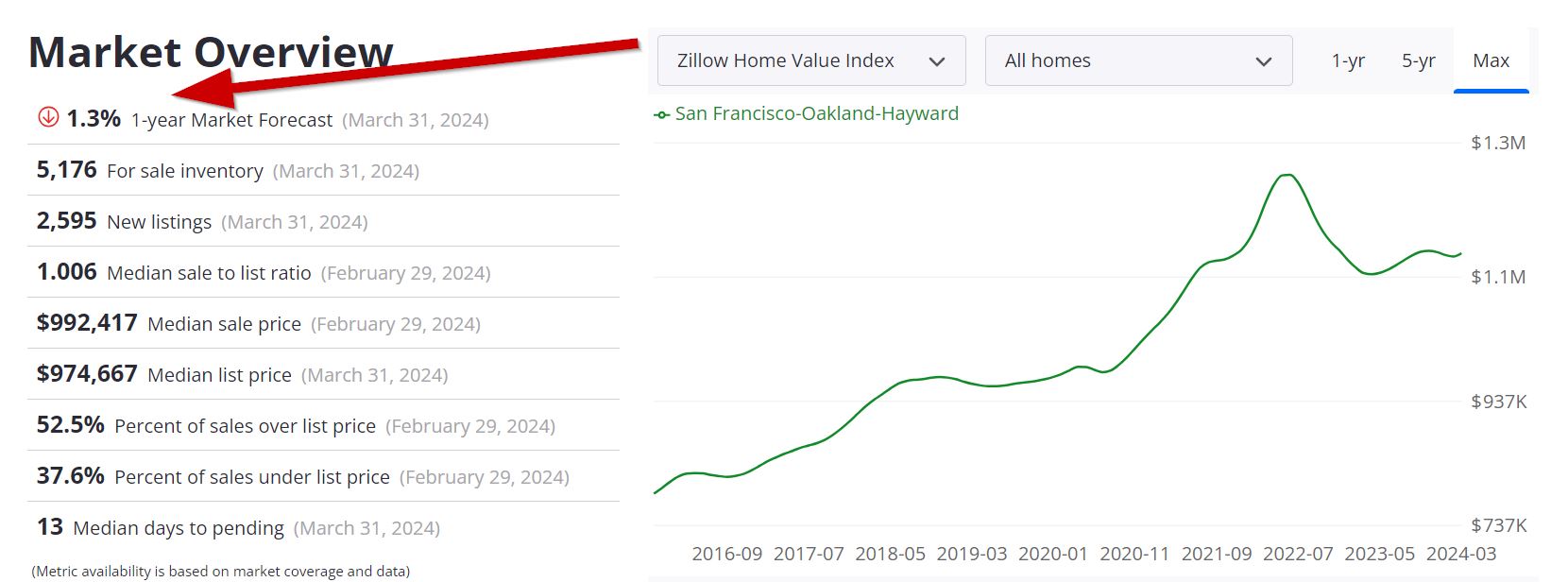

The San Francisco-Oakland-Hayward region continues to see steady growth in home values, with the average property reaching $1,176,322 – a modest 2.8% increase over the past year. Homes are also moving quickly, going into pending status in an average of just 13 days. Here's a closer look at some key market indicators:

- Market Forecast: Analysts at Zillow predict continued growth with a 1.3% increase expected over the next year.

- For-Sale Inventory: The current inventory sits at 5,176 homes, offering a selection for buyers.

- New Listings: Market activity remains healthy with 2,595 new listings added in the last month.

- Negotiation Dynamics: The median sale-to-list ratio of 1.006 suggests a balanced market where list prices are fairly close to final sale prices.

- Median Sales: The median sale price for existing single-family homes is currently $992,417, while the median list price sits at $974,667.

- Competitive Landscape: Over half (52.5%) of homes sold above the asking price in February, highlighting a competitive market. However, there's still negotiation room, with 37.6% of sales closing below the list price.

This graph illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

Buyer's or Seller's Market?

The current Bay Area market leans slightly towards sellers. The combination of steady home value growth, low inventory, and competitive bidding situations creates an environment that favors sellers. However, the recent dip in year-over-year sales growth and the increasing number of homes selling below list price suggest a gradual shift towards a more balanced market.

Will the Bay Area Housing Market Crash in 2024?

Home prices in the Bay Area are not experiencing a significant drop. While the year-over-year growth rate might be moderating, the overall trend points towards continued appreciation, albeit at a potentially slower pace than in previous years.

Experts aren't predicting a housing market crash in the Bay Area. The region's strong economic fundamentals, limited housing supply, and high demand are likely to continue supporting home values. However, a slight correction or a period of slower growth can't be entirely ruled out.

Is Now a Good Time to Buy a House in Bay Area?

This depends on your individual circumstances and risk tolerance. While there might be more negotiation opportunities compared to the peak seller's market conditions, the Bay Area housing market remains competitive. Here are some factors to consider:

Further, the question of whether 2024 is a good time to buy a house in the Bay Area is multifaceted and depends on various factors, including personal circumstances, financial situation, and long-term objectives. Here are some considerations to aid in this decision:

- Market Conditions: While the market has seen a slight decline in home values over the past year, the forecast suggests a potential uptick. If the forecast aligns with your investment horizon, it might be a favorable time.

- Competitive Nature: The high percentage of sales over the list price indicates a competitive market. Buyers should be prepared for potential bidding wars and act swiftly.

- Interest Rates: Consider prevailing interest rates, as they influence your borrowing costs. If rates are relatively low, it could be advantageous for buyers.

- Long-Term Goals: Evaluate if buying aligns with your long-term goals. If you plan to settle in the Bay Area for a considerable period, purchasing a home can be a prudent investment.

Ultimately, the decision to buy a house in the Bay Area in 2024 should be based on a comprehensive assessment of your unique circumstances and careful consideration of the market conditions and trends outlined by Zillow.

SF Bay Area Real Estate Investment Outlook

The San Francisco Bay Area is a magnet for real estate investors, but understanding the market landscape is critical. Here's a breakdown of key factors for informed investment decisions.

- Enduring Demand: The Bay Area's allure for homebuyers remains strong, fueled by tech industry jobs and stunning natural beauty. This steady demand is a key factor for investors to consider.

- Location is King: From vibrant downtowns to charming suburbs, the Bay Area boasts diverse neighborhoods. Meticulous research is essential, as each micro-market offers varying growth potential and rental yields.

- Rental Market Strength: Evaluate the rental market performance in your chosen area. Robust rental demand can be advantageous for investors seeking income properties.

- Picking Your Property: Will you invest in single-family homes, multi-unit buildings, or something else? Each type presents unique advantages and risks. Align your investment goals and risk tolerance with your property selection.

- Expert Insights: Consulting with real estate professionals and economists is vital. Their market forecasts and insights can equip you to make informed investment decisions.

Why are Houses So Expensive in San Francisco?

The high cost of housing in San Francisco can be attributed to several factors:

- Strong Economy: The Bay Area is a global tech hub, home to Silicon Valley, and numerous tech giants. The region's strong economy attracts high-income professionals, leading to increased demand for housing, and driving up prices.

- Limited Supply: Geographical constraints and strict zoning regulations limit new construction in San Francisco. The supply of housing struggles to keep up with the growing demand, resulting in scarcity and rising costs.

- High Land Costs: The cost of land in San Francisco is exceptionally high, which makes it expensive for developers to acquire land for new housing projects. This cost is often passed on to homebuyers and renters.

- Foreign Investment: San Francisco's reputation as a global city attracts international investors, further driving up property values.

- Desirability: The city's quality of life, cultural attractions, and natural beauty make it a highly desirable place to live, leading to a willingness to pay a premium for housing.

- Limited Space for Growth: San Francisco is surrounded by water on three sides, leaving limited room for urban expansion. This geographical constraint intensifies competition for available properties.

Is Real Estate Investment a Good Option in this Region?

Investing in the Bay Area's real estate market can be both lucrative and challenging. Here are some considerations:

- Lucrative Returns: Despite high prices, rental rates in San Francisco are also substantial, making it possible to generate good rental income.

- Appreciation Potential: The Bay Area's strong economy suggests that property values are likely to appreciate over time.

- Diversification: San Francisco is known for its tech industry, and investing in real estate diversifies your investment portfolio, which may be tech-heavy.

- Challenges: High property prices mean a substantial initial investment. Additionally, property management and regulations can be complex.

- Risk Mitigation: Careful property selection, understanding market dynamics, and working with local experts can help mitigate risks.

Investor Preferences in the Bay Area

Investors in the Bay Area have various options to consider:

- Residential Properties: Single-family homes and condos are attractive for long-term rental income.

- Multi-Family Units: Apartments or multi-unit buildings can offer multiple rental income streams.

- Commercial Real Estate: Office and retail properties may provide stable rental income, particularly in business districts.

- Short-Term Rentals: With tourism being a significant part of the Bay Area's economy, short-term rentals through platforms like Airbnb can be profitable.

- Real Estate Investment Trusts (REITs): For those seeking to invest without direct property ownership, REITs focused on the Bay Area offer an alternative.

Economy and Growth

The San Francisco Bay Area boasts a robust and diverse economy, primarily driven by the technology sector, often referred to as Silicon Valley. This economic powerhouse has led to sustained growth, high incomes, and a robust job market, making it a hotspot for professionals and businesses. As a result, the region consistently attracts individuals seeking employment opportunities, which, in turn, fuels the demand for housing.

Housing Supply Shortage vs. Demand

The Bay Area faces a persistent challenge with housing supply shortages. Geographical constraints, coupled with stringent zoning regulations, limit the construction of new housing units. This limitation in supply collides with the consistently high demand for housing, primarily from tech professionals and other high-income earners. The resultant scarcity drives up property prices, making homeownership and rentals expensive propositions in the region.

Geography & Zoning Restrictions

Geography plays a significant role in the Bay Area's real estate market dynamics. Surrounded by water on three sides, the region has limited space for urban expansion. As a result, land is at a premium, and developers often face challenges in acquiring suitable land for housing projects. Zoning regulations, aimed at preserving the unique character of different neighborhoods, can further limit the potential for new construction. These factors collectively contribute to the scarcity of housing and rising property values.

Luxury Real Estate Market

The Bay Area hosts a thriving luxury real estate market, catering to high-net-worth individuals and investors. Luxury properties in prestigious neighborhoods like Atherton, Hillsborough, and Bel Air offer premium amenities and stunning views. The region's desirability, coupled with a strong economy, has sustained the luxury real estate segment, making it an attractive option for those seeking upscale investments.

High Real Estate Appreciation Rate

Despite the high cost of entry, real estate in the San Francisco Bay Area is known for its impressive appreciation rates. The region's strong economic fundamentals and limited supply have historically driven property values upward. This means that real estate investments often offer the potential for substantial capital gains over time.

While San Francisco's high housing costs can be a barrier, the region's strong economy and desirability continue to attract investors. Careful consideration of factors such as property type, location, and market dynamics is crucial for making informed investment decisions in the San Francisco Bay Area. Investors should assess their goals, risk tolerance, and long-term strategies to determine whether this market aligns with their investment objectives.

References:

- https://www.car.org/en/marketdata/data

- https://www.zillow.com/home-values/403105/bay-area-ca/

- https://www.realtor.com/realestateandhomes-search/SanFrancisco_CA/overview