The housing market is one of the most important sectors of the economy, affecting millions of people's wealth, income, and well-being. However, it is also prone to cycles of boom and bust, as we have seen in the past. The last major housing market crash occurred in 2008, triggered by the subprime mortgage crisis and the global financial crisis. It took years for the market to recover, and some areas are still struggling to regain their pre-crisis levels.

Factors That Could Cause Another Housing Market Crash

So, what are the factors that could cause another housing market crash in the near future? Here are some possible scenarios:

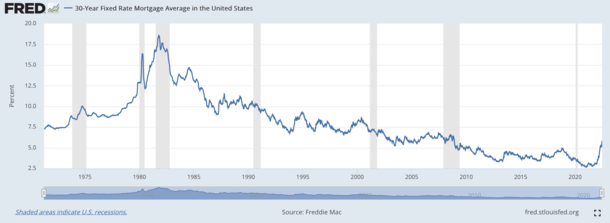

A Sharp Rise in Interest Rates

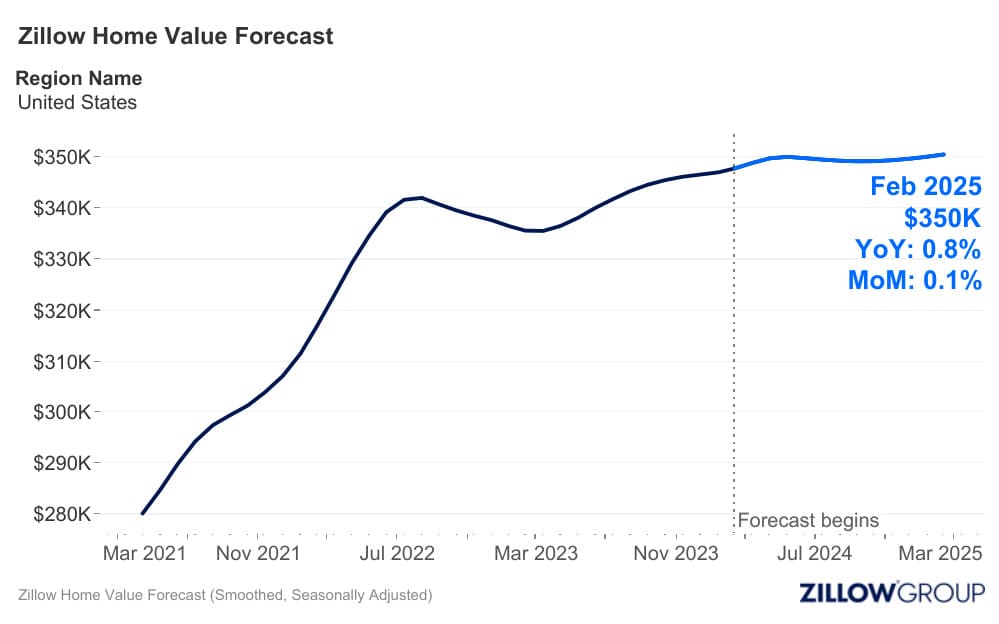

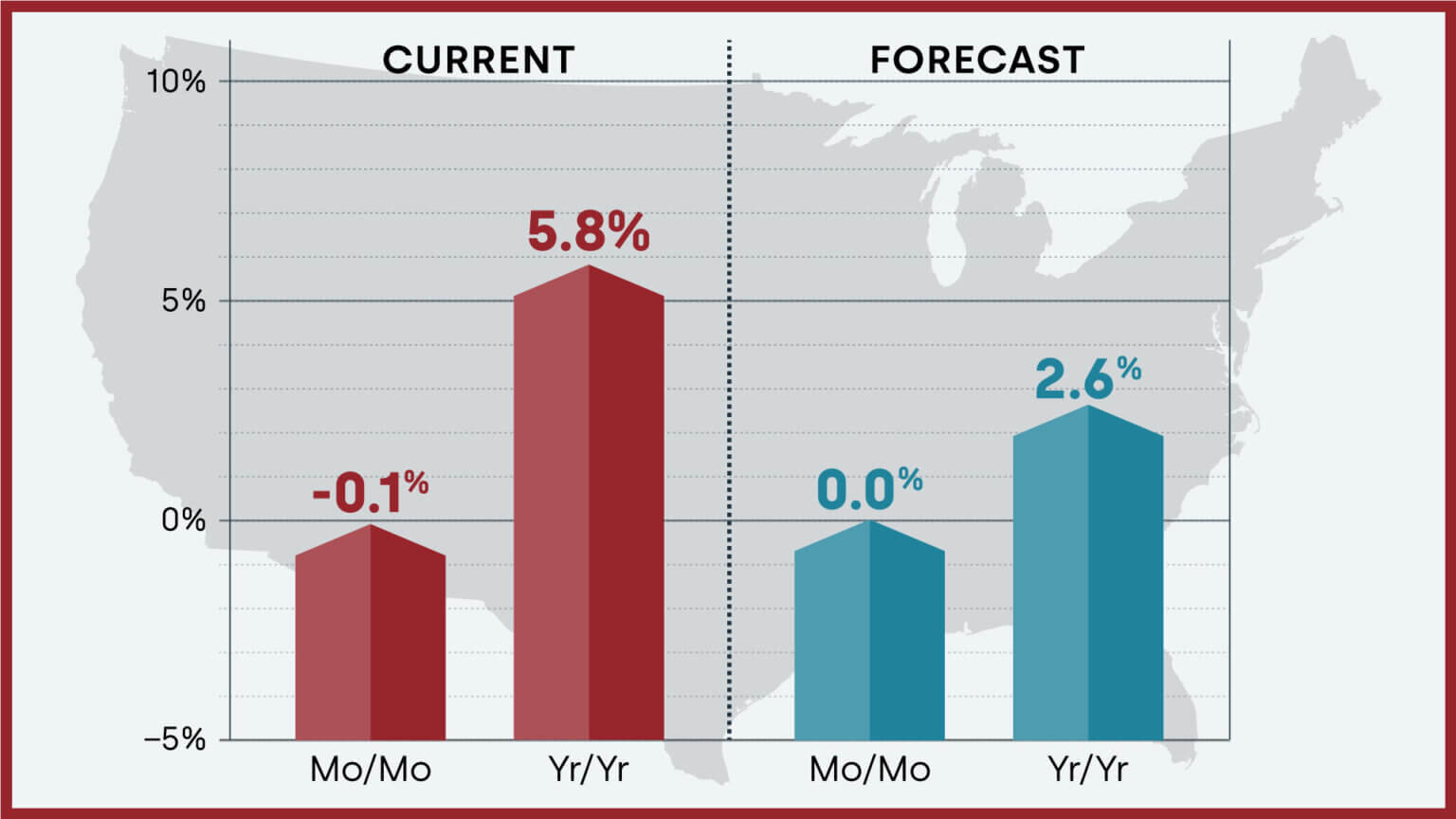

Low-interest rates make mortgages more affordable and stimulate demand for housing. However, if the Federal Reserve continues to raise interest rates to combat inflation or other economic risks, it could make borrowing more expensive and reduce the number of buyers in the market. This could lead to a drop in housing prices, especially in areas where prices are already high or overvalued.

A Surge in Foreclosures

The pandemic caused widespread unemployment and financial hardship for many households. Although the government has provided some relief measures, such as forbearance and moratoriums on evictions and foreclosures, these are temporary and may expire soon. If many homeowners are unable to resume their mortgage payments or find alternative solutions, they could face foreclosure and lose their homes. This could increase the supply of distressed properties in the market, driving down prices and creating a negative feedback loop.

A Decline in Population Growth or Migration

Population growth and migration are key drivers of housing demand, as they increase the number of households and potential buyers in the market. However, if population growth slows down or reverses due to lower birth rates, aging, or emigration, it could reduce the demand for housing and put downward pressure on prices. Similarly, if migration patterns change due to remote work, climate change, or other factors, it could affect the regional distribution of housing demand and supply, creating imbalances and price disparities.

A Burst of Speculative Bubbles

Speculation is another factor that can influence housing prices, as investors buy properties with the expectation of selling them at a higher price later. This can create bubbles, where prices rise above their fundamental value based on supply and demand. However, bubbles are unstable and can burst when expectations change or external shocks occur. This can cause a sudden drop in prices and a loss of confidence in the market.

How Can We Protect Against Housing Market Crash?

To protect against housing market crashes, there are some steps that can be taken by different actors in the market:

Borrowers: Borrowers should avoid taking on more debt than they can afford, and choose mortgages that suit their financial situation and goals. They should also be aware of the terms and conditions of their loans, and seek professional advice if they have any doubts or questions.

Lenders: Lenders should follow responsible lending standards and practices, such as verifying the income and credit history of borrowers, ensuring that they have adequate collateral and down payment, and disclosing all the fees and risks involved in the loans. They should also monitor the performance of their loans and take corrective actions if needed.

Investors: Investors should conduct due diligence and research before buying mortgage-backed securities or other financial products related to the housing market. They should also diversify their portfolio and hedge their risks with appropriate instruments, such as credit default swaps or put options.

Regulators: Regulators should oversee and enforce the rules and regulations that govern the housing market, such as capital requirements, disclosure standards, consumer protection laws, and anti-fraud measures. They should also monitor the market conditions and intervene if necessary to prevent or mitigate systemic risks.

By following these steps, we can reduce the likelihood and severity of housing market crashes, and ensure a more stable and sustainable housing market for everyone.