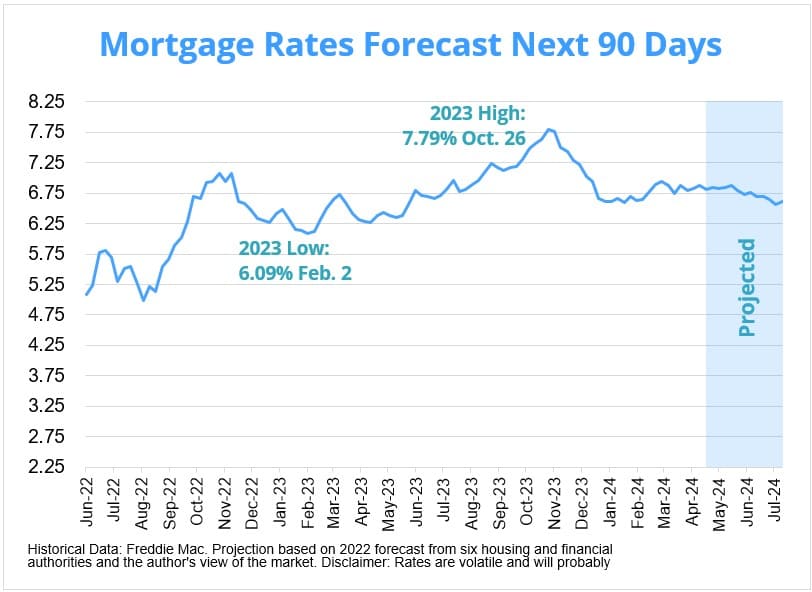

In this article, we'll explore the latest predictions for mortgage rates over the next 90 days. The next 90 days are unlikely to bring significant relief in mortgage rates. Economic conditions, inflation trends, and market sentiment suggest a relatively stable or slightly upward bias in rates. While a few months of improved inflation data could create space for rates to fall, the current outlook favors a scenario where mortgage rates remain within a narrow range.

Mortgage Rates Forecast for Next 90 Days

After a period of speculation regarding the trajectory of interest rates, the focus has shifted to whether rates will start to decline. The Federal Reserve's decision-making regarding the federal funds rate has significant implications for mortgage rates. However, other factors, such as inflation trends and economic indicators, also play crucial roles.

Factors Influencing Mortgage Rates

The anticipation of a potential decrease in the federal funds rate has led to speculation about mortgage rate movements. However, it's essential to recognize that a lower federal funds rate doesn't necessarily guarantee a proportional decline in mortgage rates. Several factors contribute to mortgage rate fluctuations:

- Inflation Trends: If inflation retreats and remains low, or if there's a softening in the economy or labor market, mortgage rates may decline.

- Government Debt: Record levels of government debt issuance can limit the extent to which mortgage rates can fall.

- Market Perception vs. Reality: Expectations regarding future monetary policy must align with economic realities for mortgage rates to adjust significantly.

Recent Trends

Recent market behavior reflects fluctuating expectations regarding the Federal Reserve's actions and economic indicators:

- Initial expectations of multiple rate cuts in 2024 led to a decline in mortgage rates.

- As expectations for rate cuts diminished, mortgage rates stabilized and even reversed slightly.

- Factors such as strong economic growth, robust labor markets, and persistent inflation pressures have influenced market sentiment.

Forecast for Next 90

Looking ahead to the next 90 days, several factors suggest that mortgage rates may not experience significant declines:

- Inflation Concerns: While inflation isn't worsening, it's not improving either, reducing the likelihood of substantial rate cuts from the Federal Reserve.

- Economic Outlook: Absent significant changes in economic indicators or labor market conditions, the potential for lower mortgage rates appears limited.

- Market Sentiment: Uncertainty surrounding future Fed policy and inflation trends makes it challenging for mortgage rates to move substantially higher or lower.

Will Mortgage Rates Go Down Next Month (May)?

The mortgage rates have been on a rollercoaster ride, fluctuating significantly throughout 2023. According to Freddie Mac, the average 30-year fixed rate hit a low of 6.09% on February 2 and soared to 7.79% by October 26. The driving forces behind this fluctuation were a mix of Federal Reserve policies aimed at combating inflation and uncertainties in the banking sector, triggered by the collapse of Silicon Valley Bank.

As April 12th, 2024 dawns, homebuyers and investors alike are keen to know: will mortgage rates continue their ascent or will they finally begin to descend come May?

While the predictions vary, a consensus emerges among experts that mortgage rates are likely to undergo a period of moderation in May, influenced primarily by the trajectory of inflation and Federal Reserve policy. Homebuyers and investors are advised to stay vigilant, as economic indicators and policy shifts will continue to shape the mortgage rate landscape in the coming months.

Let's delve into the insights provided by industry experts to gain a clearer perspective on the potential trajectory of mortgage rates.

Expert Insights

Craig Berry, Branch Manager at Acopia Home Loans

Prediction: Rates will moderate

Berry suggests that while inflation has decreased compared to the previous year, it seems to have hit a plateau and might even be gearing up for another rise. Although some Fed officials have hinted at potential rate cuts later in the year, Berry anticipates mortgage rates to remain stable in May, akin to April's rates.

Molly Boesel, Principal Economist at CoreLogic

Prediction: Rates will moderate

Boesel echoes the sentiment that despite the possibility of easing on the horizon, mortgage rates are likely to remain in the high-6% range in May.

Ralph DiBugnara, President at Home Qualified

Prediction: Rates will rise

DiBugnara takes a more cautious stance, citing the persistent inflation as a barrier to rate cuts. He forecasts 30-year fixed rate mortgages to hover around 7.4% in May, signaling a potential upward trend.

Danielle Hale, Chief Economist at Realtor.com

Prediction: Rates will moderate

Hale emphasizes the influence of inflation on mortgage rates, anticipating a potential spike in late April. The trajectory of rates in May, she suggests, will hinge on economic indicators such as the jobs report and inflation data.

Odeta Kushi, Deputy Chief Economist at First American

Prediction: Rates will moderate

Kushi underscores the impact of inflation on investor sentiments and anticipates mortgage rates to remain relatively stable if inflation data continues to exceed expectations.

Rick Sharga, CEO at CJ Patrick Company

Prediction: Rates will moderate

Sharga highlights the robustness of the labor markets and the stagnation in inflation as factors likely to keep mortgage rates steady. He suggests that significant declines in rates may only occur after the Federal Reserve makes its move.

Mortgage Interest Rates Forecast for the Next 90 Days

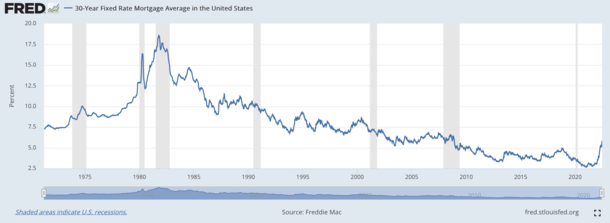

As inflation ran rampant in 2022, the Federal Reserve took decisive action to curb its effects, resulting in a spike in the average 30-year fixed-rate mortgage in 2023.

With inflation gradually cooling and the Fed adjusting its policies, including skipped hikes and expected cuts this year, the mortgage interest rates are poised for potential changes in the coming months. Moreover, with the economy exhibiting signs of slowing down, many experts anticipate a gradual descent in mortgage interest rates throughout 2024.

However, it's essential to recognize that rates are subject to fluctuation, and unforeseen global events can quickly disrupt economic stability, potentially leading to a rise in rates. As such, homebuyers and investors should remain vigilant and monitor market trends closely to make informed decisions regarding their mortgage plans in the next 90 days.

Mortgage rate predictions for 2024

As of April 11, the 30-year fixed-rate mortgage stood at 6.88%, according to data from Freddie Mac. However, projections from various housing authorities suggest that the average for the second quarter of 2024 will drop below this figure. All five major housing authorities surveyed anticipate that the average for Q2 2024 will be lower than 6.88%.

- Fannie Mae: Positioned at the lower end of the spectrum, Fannie Mae foresees the average 30-year fixed interest rate to settle at 6.3% for the second quarter.

- Mortgage Bankers Association (MBA), National Association of Realtors (NAR), and Wells Fargo: These organizations have a more optimistic outlook, projecting a slightly higher average of 6.6% for the same period.

These forecasts indicate a potential decline in mortgage interest rates compared to the recent 6.88% figure, providing potential relief for homebuyers and refinancers in the coming months.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q2 2024) |

| Mortgage Bankers Association | 6.60% |

| National Association of Realtors | 6.60% |

| National Association of Home Builders | 6.61% |

| Wells Fargo | 6.65% |

| Fannie Mae | 6.70% |

| Average Prediction | 6.63% |

References:

- https://www.hsh.com/2month4cast.html

- https://www.noradarealestate.com/blog/mortgage-interest-rates-forecast/

- https://www.noradarealestate.com/blog/mortgage-rate-predictions-next-week/

- https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

- https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

A big part of my job is helping our clients project the most likely scenarios for the housing market. Now that we know who will be President, my job just got easier because we have four years of experience with Obama and a divided Congress, so we know what we are getting.

A big part of my job is helping our clients project the most likely scenarios for the housing market. Now that we know who will be President, my job just got easier because we have four years of experience with Obama and a divided Congress, so we know what we are getting.