The U.S. housing market has always been dynamic, but recent reports indicate a significant surge in home prices, hitting an all-time high, alongside a rise in mortgage rates. This combination is creating a challenging environment for potential homebuyers.

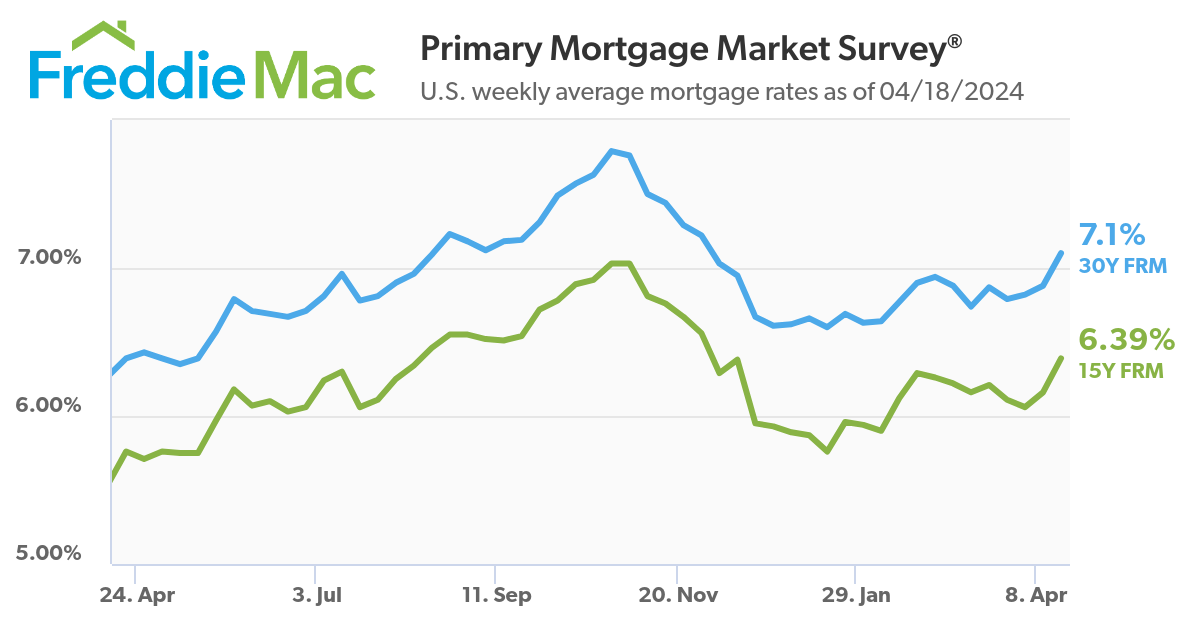

According to a recent report from Redfin, the median U.S. home-sale price reached a record $383,725 during the four weeks ending April 21, marking a 5.2% increase from the previous year. This is one of the most substantial jumps since October 2022, reflecting a robust and competitive market. Concurrently, the average weekly mortgage rate has climbed to 7.1%, the highest level since November 2023. This increase is partly due to the Federal Reserve's decision to maintain higher interest rates longer than initially expected.

The rise in both home prices and mortgage rates has driven the median monthly housing payment up to a record $2,843, a 13% increase year over year. Despite the increase in inventory, with new listings up by 10.2% compared to last year, the growth in listings may be losing momentum as high rates solidify the lock-in effect, where homeowners are disincentivized to move due to the higher costs of a new mortgage.

This situation is buoyed by the fact that, although there is more inventory than last year, overall inventory levels remain low. Demand is still relatively strong in the face of rates exceeding 7%, but some indicators suggest a potential slowdown. Redfin's Homebuyer Demand Index, which measures requests for tours and other buying services, is near its highest level in about eight months. However, mortgage-purchase applications have seen a slight decrease week over week.

For sellers, the current market conditions mean that pricing homes competitively is crucial. While sellers may receive top dollar now, setting a fair initial price can attract buyers quickly and avoid the need for price reductions later, especially as high mortgage rates impact buyers' budgets.

For buyers, especially those who are serious and can afford the current costs, the advice is to search for their dream home while accepting that finding a dream deal may not be possible this year. Price growth may cool slightly if mortgage rates remain high, but overall housing costs are likely to stay elevated for the foreseeable future.

The current financial landscape is impacting mortgage rates and the housing market in complex ways. In summary, navigating today's housing market requires a strategic approach, both for buyers and sellers. Understanding the factors at play, such as the Federal Reserve's policies, inventory levels, and demand indicators, can help all stakeholders make informed decisions.

Key Housing-Market Data

Redfin’s national metrics include data from 400+ U.S. metro areas and are based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision.

Four Weeks Ending April 21, 2024

Key Metrics:

- Median Sale Price: $383,725 (5.2% year-over-year change) – All-time high; biggest increase since Oct. 2022, with the exception of the 4 weeks ending Feb. 11, 2024 and the 4 weeks ending Feb. 18, 2024 (5.3% increases)

- Median Asking Price: $415,925 (6.7% year-over-year change) – All-time high; biggest increase since Sept. 2022

- Median Monthly Mortgage Payment: $2,843 at a 7.1% mortgage rate (12.6% year-over-year change) – All-time high

- Pending Sales: 86,786 (-3.8% year-over-year change) – Biggest decline in 6 weeks

- New Listings: 95,580 (10.2% year-over-year change)

- Active Listings: 840,411 (10.1% year-over-year change)

- Months of Supply: 3.2 months (+0.4 pts.) – 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions

- Share of Homes off Market in Two Weeks: 43.3% (Down from 46%)

- Median Days on Market: 35 (Unchanged)

- Share of Homes Sold Above List Price: 29.8% (Essentially unchanged)

- Share of Homes with a Price Drop: 6% (+1.7 pts.)

- Average Sale-to-List Price Ratio: 99.2% (+0.1 pt.)