Naples is a beautiful coastal city located in the southwestern part of Florida. The Naples housing market has been experiencing some interesting trends in recent times. The current Naples housing market leans towards being a seller's market, evident in the increased median prices and the relatively short time properties spend on the market. Buyers may need to act decisively, considering the competitive nature of the market, multiple offers, and the trend of some homes selling above the list price.

Naples Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In February 2024, Naples saw a 4.7% decrease in home prices compared to the previous year, with the median price standing at $829,000, according to Redfin. While this may indicate a slight dip, it's essential to note that market conditions can vary over time. On average, homes in Naples are spending 61 days on the market before being sold, slightly longer than the 54 days recorded the previous year. Despite these fluctuations, 163 homes were sold in February 2024, showing continued activity in the market.

How Competitive is the Naples Housing Market?

The Naples real estate market can be described as somewhat competitive, with homes typically selling in 53 days. Some properties even receive multiple offers, reflecting the interest and demand from buyers. It's worth noting that the average home sells for about 5% below list price and goes pending in approximately 53 days. However, hot homes can defy these averages, selling for around list price and going pending in a mere 17 days.

Examining the sale-to-list price ratio, we observe a 95.4% ratio, showing a slight increase of 0.1 percentage points year-over-year. Additionally, 4.9% of homes were sold above list price, indicating a 4.3 percentage point decrease compared to the previous year. Meanwhile, 36.4% of homes experienced price drops, marking a 7.2 percentage point increase year-over-year.

Are There Enough Homes for Sale to Meet Buyer Demand?

Understanding the migration and relocation trends in Naples provides insight into the balance between supply and demand. From December 2023 to February 2024, 38% of homebuyers in Naples searched to move out of the area, while 62% looked to stay within the metropolitan region. Interestingly, only 1% of homebuyers nationwide searched to move into Naples from outside metros.

Among the cities contributing to inbound migration, Miami stands out, with homebuyers from this metro showing the most interest in relocating to Naples. This trend is followed by interest from buyers in Chicago and New York, highlighting the diverse origins of potential residents.

What is the Future Market Outlook for Naples?

While the current state of the Naples housing market presents both challenges and opportunities, it's essential to consider the future outlook. Factors such as economic conditions, interest rates, and regional developments can influence market dynamics.

Despite the fluctuations observed, Naples continues to attract interest from both local and national buyers. As the market evolves, staying informed about emerging trends and adapting strategies accordingly will be key for navigating the real estate landscape effectively.

Naples Housing Market Forecast 2024 and 2025

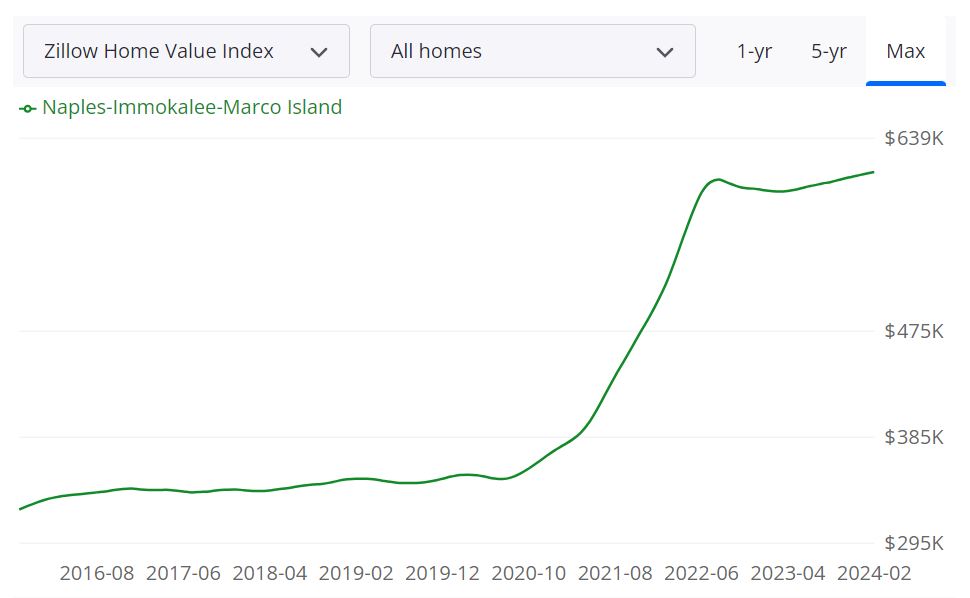

Naples, along with its neighboring areas of Immokalee and Marco Island, forms the Naples-Immokalee-Marco Island Metropolitan Statistical Area (MSA). It encompasses Collier County and parts of Lee County. The housing market in Naples-Immokalee-Marco Island is substantial, with diverse offerings and a robust economy driving its growth. Investors and residents alike find opportunities and stability in this thriving real estate landscape. Let us take a closer look at the current state of the market and its forecast for the near future leveraging data from Zillow.

Current Housing Metrics

- Home Value: The average Naples-Immokalee-Marco Island home value stands at $611,107, reflecting a 2.7% increase over the past year. Homes typically go pending in approximately 44 days.

- For Sale Inventory: As of February 29, 2024, there are 5,930 properties listed for sale in the Naples area.

- New Listings: In February 2024, 1,581 new listings were added to the market, indicating ongoing activity.

- Median Sale to List Ratio: This ratio, calculated as of January 31, 2024, stands at 0.963, implying a balanced market where sale prices closely align with listing prices.

- Median Sale Price: The median sale price, recorded as of January 31, 2024, is $583,333.

- Median List Price: As of February 29, 2024, the median list price for homes in Naples is $783,300.

- Percent of Sales Over/Under List Price: In January 2024, 5.1% of sales were over list price, while 84.3% were under list price, indicating variability in pricing dynamics within the market.

Market Forecast

Looking ahead, the Naples housing market is poised for continued stability and moderate growth. With favorable economic conditions and ongoing demand for properties in desirable locations, experts project a 3.2% increase in home values over the next year, as indicated by the Zillow forecast issued on February 28, 2024.

Are Home Prices Dropping in Naples?

Despite the competitive nature of the market, home prices in Naples have shown resilience, with no significant signs of dropping. The steady increase in home values over the past year, coupled with sustained demand, indicates a stable pricing environment. However, localized fluctuations may occur based on factors such as property type and location.

The current state of the Naples housing market leans towards being a seller's market. With a limited inventory of homes for sale and strong demand from buyers, sellers have the upper hand in negotiations. Multiple offers and bidding wars are common, driving prices up and creating a competitive environment for buyers.

Will the Naples Housing Market Crash?

While predicting market crashes is inherently challenging, the current fundamentals of the Naples housing market do not suggest an imminent crash. Factors such as strong demand, limited inventory, and a diverse economy contribute to its stability. However, external economic shocks or unforeseen events could impact market dynamics, emphasizing the importance of monitoring trends closely.

Is Now a Good Time to Buy a House in Naples?

For buyers considering entering the Naples housing market, timing is a critical consideration. While the market favors sellers, opportunities still exist for buyers, especially those who are well-prepared and flexible. Working with a knowledgeable real estate agent and securing financing in advance can enhance the chances of success. Additionally, assessing personal financial circumstances and long-term housing goals is essential in determining whether now is a favorable time to buy.

Naples Real Estate Investment Overview

Naples, Florida, is a popular real estate investment destination due to its location, thriving economy, and desirable quality of life. The city has been experiencing steady growth in population and housing demand, making it an attractive market for real estate investors. In this section, we will discuss Naples real estate investment overview and seven reasons why investors should consider investing in this market.

Naples Real Estate Investment Overview

Naples is known for its upscale homes, beachfront properties, and high-end condominiums. The city offers a unique combination of natural beauty, excellent climate, and world-class amenities, making it an ideal place for people looking to invest in a vacation home or rental property. The city's real estate market has been growing steadily over the past few years, with prices continuing to rise due to strong demand and limited inventory.

In recent years, the Naples real estate market has experienced steady appreciation in property values, making it an attractive investment opportunity for both local and international investors. The city's high-end real estate market has been particularly strong, with luxury homes and condos selling at a premium. Additionally, Naples has a thriving vacation rental market, with many tourists flocking to the city's beaches and attractions throughout the year.

Top Reasons to Invest in Naples Real Estate:

- Strong Rental Market: Naples is a popular vacation destination, which translates into a high demand for rental properties. Investors can enjoy high occupancy rates and attractive rental yields by investing in vacation homes or rental properties.

- Growing Population: Naples has been experiencing steady population growth, making it an attractive market for real estate investors. As more people move to the city, demand for housing continues to rise, which can translate into higher property values.

- Strong Economy: Naples has a thriving economy, with a diverse range of industries, including tourism, healthcare, and construction. The city's economy is expected to continue to grow, which can translate into higher property values over time.

- Desirable Location: Naples is located in Southwest Florida, offering easy access to some of the state's most popular attractions, including the Everglades, Sanibel Island, and Marco Island. The city's desirable location makes it an attractive place to live, work, and vacation.

- High-Quality Lifestyle: Naples is known for its high-quality lifestyle, with world-class amenities, including top-rated restaurants, shopping centers, and cultural attractions. The city's desirable lifestyle is a significant draw for both local and international real estate investors.

- Limited Inventory: The Naples real estate market has limited inventory, particularly in the luxury home and condo segments. Limited inventory can translate into higher property values over time.

- Stable Real Estate Market: Naples has a stable real estate market, with steady appreciation in property values over the past few years. The city's real estate market has been relatively resilient to economic downturns, making it an attractive investment opportunity for long-term investors.

While there are many advantages to investing in Naples real estate, there are also a few drawbacks to consider. One of the most significant drawbacks is the high cost of entry, particularly in the luxury home and condo segments. Additionally, property taxes and insurance rates in Naples can be relatively high compared to other Florida cities. Finally, investing in vacation rental properties can be challenging, particularly given the city's strict zoning laws and regulations.

In conclusion, the Naples real estate market offers many opportunities for investors looking to capitalize on the city's growing population, strong economy, and high-quality lifestyle. While there are some drawbacks to consider, the overall market conditions and long-term appreciation potential make Naples an attractive investment destination. Investors should conduct their due diligence and work with experienced real estate professionals to navigate the local market successfully.

Florida is a great place to invest in real estate with several affordable and growing markets. While there are investment opportunities in the Florida housing market, major metros are some of the most popular choices, like Jacksonville, Orlando, Miami, St. Petersburg, and Tampa. Another market that we suggest is the housing market in Lakeland, Florida. The Lakeland housing market presents the perfect balance of currently affordable real estate for buyers and future growth. We can expect the population of the area to grow rapidly, and the renting population will grow even faster. The time to buy real estate in Lakeland is now.

While the Lakeland FL real estate market is cheaper than Orlando and Tampa, it is not a good overall value given the lower average wages of its residents. That explains why U.S. News and World Report gave the city an index score of 5.5 out of ten. This is due to the average resident earning around $23,000 a year, several thousand less than the U.S. average. Median household incomes are no better.

You can also invest in another hot market in Ocala, Florida. Ocala is an affordable real estate market for investors who can still reap a decent return on investment. The area has recovered from the Great Recession, and several factors will insulate it from a future downturn. The Ocala housing market is buoyed by several near-recession-proof industries.

It is quite affordable for investors compared to the rest of Florida markets like Tampa where the median home value is $221,500. The median home price in Ocala in 2018 was around $150,000. You can buy several homes in the Ocala FL real estate market for the price you would of one mid-market condo in the Miami real estate market.

The Tampa real estate market has been seeing constant development for the last two years, a trend that does not seem to be stopping any time soon. The real estate in Tampa Florida has been estimated to grow rapidly during 2020. Investors are recommended to buy properties now and hold on to them until good price appreciation for maximum return on investment.

Tampa has the headquarters of four Fortune 500 companies which makes it a moderately attractive city for work and economic growth. In addition to this, many entrepreneurs and small businesses are also making their way to Tampa in search of better prospects and lesser expenses for running their start-ups. Acquiring residential spaces is one of the earliest priorities for such professionals when they move here.

Tampa, FL has a very diverse economy with financial services, STEM, health care, research, education, tourism, beaches, and military bases all making significant contributions to jobs and growth. These factors make the Tampa housing market a hot destination for real estate investors in 2019.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Naples.

Consult with one of the investment counselors who can help build you a custom portfolio of Naples turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Naples.

Not just limited to Naples or Florida but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Let us know which real estate markets in the United States you consider best for real estate investing!

Sources:

- https://www.zillow.com/naples-fl/home-values

- https://www.redfin.com/city/12171/FL/Naples/housing-market

- https://www.neighborhoodscout.com/fl/naples/real-estate

- https://www.realtor.com/realestateandhomes-search/Naples_FL/overview