The current Milwaukee housing market conditions heavily favor sellers, with limited inventory and heightened competition driving up prices. Buyers are facing significant challenges in finding suitable homes amidst the scarcity of listings. In February, the seasonally adjusted inventory level stood at 2.2 months. This means that at the current pace of sales, it would take 2.2 months to deplete the available inventory of homes for sale.

With 3,014 current listings providing 2.2 months of inventory, the market would require an additional 5,110 units to reach a balanced inventory level of six months. As a result, sellers have the upper hand in negotiations, leveraging the tight market to their advantage.

Milwaukee Housing Market Trends in 2024

How is the Housing Market Doing Currently?

February Home Sales Up 11.2%: According to data provided by The Greater Milwaukee Association of REALTORS®, the Metropolitan Milwaukee housing market witnessed a notable uptick in home sales in February. This marks the first time in recent history that there has been a two-month streak in sales since 2022. Despite this positive momentum, it's important to note that February 2023 experienced unusually low sales, making the recent increase somewhat tempered.

Listings Up for 7th Month in a Row: Another encouraging trend is the consistent rise in listings, which have increased for the seventh consecutive month. This streak is the longest in a decade, indicating a potential shift in the market dynamics.

Prices Down 2.2%: Despite the surge in sales and listings, home prices experienced a slight decrease of 2.2% in February. This shift could be attributed to various factors influencing market dynamics.

How Competitive is the Milwaukee Housing Market?

Inventory and Seller Advantage: The current inventory stands at 2.2 months, well below the balanced market threshold of 6 months. Additionally, when factoring in listings with an offer, the rate falls to a mere 1.0 months, indicating a highly competitive market skewed in favor of sellers. This scarcity of inventory is contributing to heightened competition among buyers.

Are There Enough Homes for Sale to Meet Buyer Demand?

Shortage of Homes: While the increase in listings is a positive sign, the market still falls short in meeting buyer demand. Despite the positive trend, the market is hundreds of listings behind what is required to adequately satisfy buyer needs. This shortage of homes is a significant factor driving the current competitiveness in the market.

New Construction: The data also highlights an increase in new home construction permits, with a solid 48% increase compared to the previous year. However, this surge is still insufficient to address the underlying shortage of housing units needed to reach market equilibrium. The lack of new construction, especially in single-family houses and condominiums, exacerbates the existing imbalance.

What is the Future Market Outlook for Milwaukee?

Continued Tight Market: Despite the positive indicators, it appears unlikely that the market will achieve balance in the near future. The region would require thousands of additional housing units to reach a balanced market, which seems unattainable given the current pace of construction.

Challenges Ahead: The systemic issue lies in the inadequate supply of new construction units, coupled with a growing demographic of Millennial and Gen Z buyers. Without addressing this bottleneck, the market is poised to remain historically tight, posing challenges for prospective homeowners.

While the Milwaukee housing market is witnessing positive trends in sales and listings, challenges remain in addressing the shortage of homes and achieving market balance. Prospective buyers should navigate the competitive landscape with caution, while sellers can capitalize on the favorable conditions to maximize their returns.

Milwaukee-Area Housing Market Forecast 2024

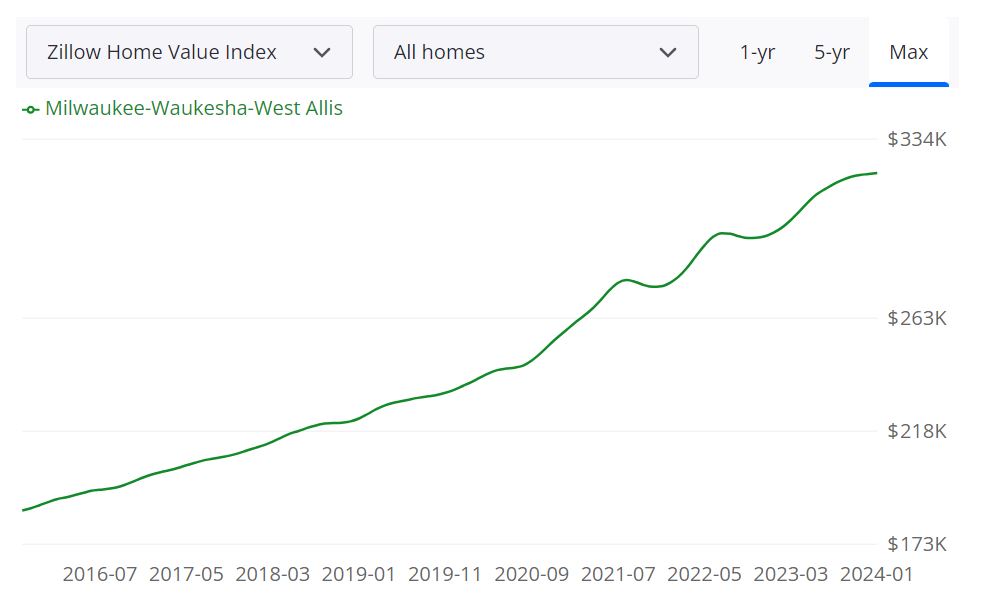

According to Zillow, the average home value in the Milwaukee-Waukesha-West Allis area is currently $321,037, reflecting an impressive 8.0% increase over the past year. Homes in this region typically go pending within an average of 31 days, providing a glimpse into the market's vitality. This data is accurate as of January 31, 2024.

One-Year Market Forecast:

Looking ahead, Zillow's forecast indicates a positive trajectory with a projected growth of +3.6% as of January 31, 2024. This optimistic outlook suggests a continued upward trend in the Milwaukee housing market.

Breaking Down Key Metrics:

For Sale Inventory:

The market currently boasts 3,119 homes available for sale as of January 31, 2024. This figure is essential for prospective buyers to gauge the level of housing supply.

New Listings:

Over the same period, 815 new listings have been added to the market, indicating ongoing activity and a dynamic real estate landscape in Milwaukee.

Median Sale to List Ratio:

As of December 31, 2023, the median sale to list ratio stands at 0.996, underlining the efficiency and competitiveness of the market. This ratio reflects the percentage of the listing price that a home ultimately sells for.

Median Sale Price:

The median sale price for homes in the Milwaukee area, as of December 31, 2023, is $274,967, providing a benchmark for both buyers and sellers.

Median List Price:

As of January 31, 2024, the median list price for homes in Milwaukee is $267,917. This figure represents the midpoint of all listed home prices, giving an indication of the market's pricing trends.

Percent of Sales Over/Under List Price:

Examining sales data from December 31, 2023, we observe that 40.6% of sales were above the list price, while 45.9% were below. These percentages provide valuable insights into market dynamics, indicating areas of demand and negotiation trends.

Understanding the Market Size:

The Milwaukee housing market encompasses the Milwaukee-Waukesha-West Allis Metropolitan Statistical Area (MSA). This MSA is comprised of multiple counties, contributing to a diverse and expansive real estate landscape. The robust housing market, as indicated by the aforementioned metrics, underscores Milwaukee's significance as a regional economic hub with a thriving real estate sector.

Are Home Prices Dropping in Milwaukee?

Contrary to a drop, the Milwaukee housing market has experienced a notable 8.0% increase in average home value over the past year. This upward trajectory signals a robust and appreciating market, making it less likely for home prices to exhibit a significant decline in the near future.

The current state of the Milwaukee housing market leans towards being a seller's market. With an 8.0% increase in average home value over the past year and a relatively low inventory of 3,119 homes for sale, sellers hold an advantageous position. This scenario often leads to higher prices and potentially quicker sales, making it essential for buyers to act strategically in a competitive environment.

Will the Milwaukee Housing Market Crash?

Based on the current data and positive one-year market forecast of +3.6%, there are no imminent signs of a housing market crash in Milwaukee. The steady growth and demand for homes contribute to a stable market environment. However, it's essential to monitor economic factors and external influences that could impact the real estate landscape.

Is Now a Good Time to Buy a House in Milwaukee?

For prospective buyers, the decision to purchase a home in Milwaukee depends on individual circumstances and long-term goals. While the market is currently favoring sellers, the projected growth of +3.6% suggests potential future appreciation. Timing is crucial, and buyers should carefully consider factors such as personal financial stability, interest rates, and housing needs before making a decision.

Milwaukee Real Estate Investment Overview

Milwaukee's real estate market seems to be doing well, with steady growth in husing prices over the past year. The typical home value in Milwaukee-Waukesha-West Allis is $321,037, which represents an increase of 8% over the past year. However, it is important to note that the typical home value can vary depending on the neighborhood and housing type.

The Milwaukee real estate market seems to be a good option for affordable housing development, with Bear Real Estate Group receiving $20.6 million in financing for the construction of Michigan Street Commons, a 99-unit fully affordable housing development in Milwaukee.

Milwaukee's foreclosure rate is expected to be lower than ever before, accounting for less than 1% of all mortgages, less than half the average historical rate of 2.5%. However, the GDP growth rate is predicted to be 1.3%, indicating a significant slowdown. It is unclear how this will impact the real estate market in Milwaukee.

Real estate investment is active in Milwaukee, with Kyle Mack, owner of Mackximus LLC, a real estate investment company in Milwaukee, discussing his business in a video interview. Additionally, PIMCO, an investment management firm, manages assets for individual investors around the world.

Milwaukee is investing in its infrastructure, proposing to create the Vel R. Phillips Plaza, situated south of Wisconsin Avenue between North Fifth Street and North Vel R. Phillips Avenue. The city is prepared to move forward on the project which will add to the positive.

There seem to be various ways to invest in the Milwaukee real estate market, such as buying homes to renovate and resell, investing in real estate courses to gain knowledge about the industry, and investing in property management companies that help landlords maximize their investment properties in Milwaukee.

In terms of commercial real estate, Milwaukee's downtown office market has its strengths, highlighted by Fiserv's pending headquarters move from Brookfield to HUB640 by the end of 2023, and Northwestern. However, more Milwaukee office buildings may become apartments in the future.

Overall, Milwaukee's real estate market appears to be doing well, with steady growth in housing prices and various opportunities for investment in the residential and commercial sectors.

Top Reasons to Invest in Milwaukee Real Estate Market

Milwaukee is a city in Wisconsin that offers real estate investors a lot of opportunities. With a population of over 590,000 people, it is the largest city in the state and offers a diverse range of neighborhoods, property types, and investment opportunities. Here are some of the top reasons to consider investing in Milwaukee's real estate market:

- Affordability: Compared to other major metropolitan areas in the United States, Milwaukee offers relatively affordable real estate prices. This means that investors can find deals on both residential and commercial properties that are priced lower than similar properties in other cities.

- Strong rental demand: Milwaukee has a strong rental market, with a high percentage of residents who rent their homes. According to data from the U.S. Census Bureau, over 50% of Milwaukee's residents are renters. This creates a significant demand for rental properties, particularly in areas that are close to downtown, universities, or other major employers. As of February 2024, the median rent for all bedroom counts and property types in Milwaukee, WI is $1,250. This is -35% lower than the national average. Rent prices for all bedroom counts and property types in Milwaukee, WI have decreased by 5% in the last month and have increased by 14% in the last year.

- Growing economy: Milwaukee has a diverse economy that is experiencing steady growth. The city is home to a range of industries, including manufacturing, healthcare, finance, and education. According to the Milwaukee Economic Development Corporation, the city has seen a 13.5% increase in employment since 2010, and the unemployment rate has dropped from 9.5% in 2010 to 3.5% in 2022. A growing economy typically translates to increased demand for real estate, both from businesses and from residents.

- Low vacancy rates: With strong demand for rental properties, it's not surprising that Milwaukee has a relatively low vacancy rate. According to data from RentCafe, the overall vacancy rate in Milwaukee was 5.5% in 2021, which is lower than the national average of 6.8%.

- Urban revitalization: Milwaukee's downtown and surrounding neighborhoods have undergone a significant revitalization in recent years, with new development projects and investments in public spaces. The city has also seen an increase in younger residents who are attracted to urban living. This has led to an increase in demand for properties in walkable neighborhoods that offer amenities like restaurants, bars, and shopping.

- Favorable landlord-tenant laws: Wisconsin has landlord-friendly laws that make it easier for property owners to manage their rental properties. For example, landlords can evict tenants for non-payment of rent with just a five-day notice, and there are no limits on the amount that landlords can charge for security deposits. This can make investing in rental properties less risky for investors.

- Availability of financing: Like many other cities, Milwaukee has a range of financing options available for real estate investors. Local banks and credit unions offer commercial real estate loans, and the city has a range of public-private partnerships that provide funding for development projects. Additionally, there are a variety of federal and state programs that offer to finance affordable housing projects and other real estate development initiatives.

Therefore, Milwaukee's real estate market offers several compelling reasons to invest. The city has a strong economy, affordable prices, a growing rental market, and a diverse population. These factors, combined with tax incentives and a robust infrastructure, make Milwaukee an attractive location for real estate investors. However, like any investment, there are risks involved, and investors should carefully consider their options before investing.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Another market to go for diversifying your investments is the Dallas housing market. Dallas, TX is a great market because it has a strong economy and constant population growth and will make your pockets bigger. As rents go up smart investors should invest in Dallas.

Similarly, Houston is another great market for investing in real estate for your early retirement. Houston housing market is becoming a hotbed of buyer activity that could be beneficial for real estate investors; just ask the multitude of overseas investors who are choosing Houston as the city of choice to invest in for the foreseeable future.

Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you may fill-up the form given here. One of our investment specialists will get in touch with you to discuss all facets of searching for, buying, and owning a turnkey investment property.

References

- https://www.gmar.com/resources/research-statistics/2024-housing-statistics

- https://www.redfin.com/city/35759/WI/Milwaukee/housing-market

- https://www.zumper.com/rent-research/milwaukee-wi

- https://www.zillow.com/milwaukee-waukesha-west-allis-wi/home-values/

- https://www.realtor.com/realestateandhomes-search/Milwaukee_WI/overview

- https://www.neighborhoodscout.com/wi/milwaukee/real-estate

- https://www.multihousingnews.com/bear-real-estate-lands-21m-for-milwaukee-affordable-project/

- https://www.bizjournals.com/milwaukee/video/6082058683001

- https://www.expertise.com/wi/milwaukee/property-management

- https://www.milwaukeemag.com/milwaukee-mayor-proposes-investing-15-million-to-create-vel-r-philips-plaza/

- https://www.jsonline.com/story/money/real-estate/commercial/2023/03/09/more-milwaukee-office-buildings-will-likely-become-apartments/69963549007/