With limited inventory and sustained buyer demand, the Illinois housing market predominantly favors sellers. The scarcity of available homes has intensified competition among buyers, resulting in swift sales and upward pressure on prices. Sellers, therefore, hold a distinct advantage in this market, with well-priced properties often garnering multiple offers and commanding premium prices.

Illinois Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In February 2024, the Illinois housing market witnessed a slight dip in year-over-year home sales, marking a 1.2 percent decrease compared to the same period in 2023. Data from Illinois REALTORS® revealed that a total of 7,576 homes, including both single-family residences and condominiums, were sold statewide. Notably, this decline coincided with a significant reduction in available inventory, reaching its lowest level since 2008. Only 15,502 homes were listed for sale across the state in February 2024, reflecting a 14.4 percent drop from the previous year.

The median home price in February 2024 stood at $265,500, marking a substantial increase of 10.6 percent compared to the previous year. This median price indicates a balanced midpoint where half of the homes sold for more and the other half for less. Despite the slight decrease in sales volume, the notable surge in median price underscores a continued trend of robust appreciation in the Illinois housing market.

How Competitive is the Illinois Housing Market?

The housing market in Illinois, particularly in the nine-county Chicago Metro Area, remains fiercely competitive. In February 2024, home sales within the Chicago Metro Area totaled 5,071, experiencing only a marginal decline of 0.3 percent from the previous year. However, this modest decrease occurred against the backdrop of a substantial reduction in available housing inventory. With only 10,166 homes listed for sale, the Chicago Metro Area witnessed a notable 19.1 percent decrease compared to February 2023.

Furthermore, within the city of Chicago itself, the market exhibited heightened competitiveness. Home sales surged by 6.7 percent year-over-year, reaching 1,321 sales in February 2024. However, the number of homes available for sale dwindled significantly, plummeting by 20.3 percent compared to the previous year. This scarcity of inventory has fueled an environment where competitively priced homes are in high demand, often resulting in multiple offer scenarios.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the persistent demand from buyers, the Illinois housing market is grappling with a shortage of available homes for sale. This scarcity is particularly evident in the Chicago Metro Area, where the number of homes on the market has dwindled significantly. The decrease in inventory levels, coupled with sustained buyer demand, has created a scenario where homes, especially those priced competitively, are swiftly absorbed by the market.

In the city of Chicago, the imbalance between supply and demand is further exacerbated, with a substantial year-over-year decrease in available housing inventory. As a result, buyers are faced with limited options, compelling them to act swiftly in securing desirable properties. This imbalance between supply and demand underscores the challenges faced by prospective homebuyers in navigating the competitive Illinois housing market.

What is the Future Market Outlook for Illinois?

Looking ahead, experts anticipate a rebound in the Illinois housing market, particularly with the onset of spring. Dr. Daniel McMillen, a professor of real estate at the University of Illinois-Chicago College of Business Administration, predicts that lower inflation rates, interest rates, and unemployment rates will likely stimulate increased activity in the housing market, starting as early as April. This optimistic outlook suggests that despite current challenges, the Illinois housing market is poised for a resurgence in the coming months.

Illinois Housing Market Forecast for 2024

The annual housing market forecast for Illinois for 2024 provides valuable insights into the upcoming months. These forecasts have been presented to Illinois Realtors® by the UIC Stuart Handler Department of Real Estate.

Median Price Projections

One key aspect of the forecast revolves around the median prices, anticipated to exhibit a more restrained growth pattern compared to the previous year. On a year-over-year basis, the projected gains are expected to fall within the range of 3.8% to 9.6% for the entire state of Illinois and 2.0% to 8.3% specifically for the Chicago PMSA (Primary Metropolitan Statistical Area).

By the culmination of December 2024, the median home price in Illinois is anticipated to reach $272,800, reflecting a substantial 8.4% increase from the corresponding month in 2023. Similarly, the Chicago PMSA is forecasted to experience a surge, with the median price projected to climb to $324,200, marking an impressive 12.0% escalation from the previous December.

Sales Outlook

Contrary to the positive trajectory of median prices, the sales market is predicted to face challenges in terms of growth rates throughout 2024. Both Illinois and the Chicago PMSA are expected to witness a decline in overall sales, with annual growth in monthly sales projected to range from -19.8% to 6.2% for Illinois and -24.6% to 3.1% for the Chicago PMSA. Negative growth is anticipated to dominate most months.

When foreclosed sales are excluded from the equation, the focus shifts to regular sales, revealing a growth range of -8.9% to 41.9% for the Chicago PMSA. This underscores the impact of foreclosed properties on the overall sales landscape.

Expert Insights

Daniel McMillen, the Head of the Stuart Handler Department of Real Estate at the University of Illinois Chicago, provides valuable insights into the market dynamics. He notes that sales remained low throughout 2023 while prices continued their upward trajectory. McMillen acknowledges the challenges posed by uncertainty surrounding interest rates and inflation rates, making the market difficult to predict. Despite these challenges, the forecast suggests a continuation of the trends, with prices experiencing growth while the number of sales faces limitations in its expansion.

As we navigate the intricate landscape of Illinois' housing market in 2024, these projections serve as a compass, guiding stakeholders through the twists and turns of a dynamic real estate environment.

Illinois Home Values Predictions 2024 & 2025

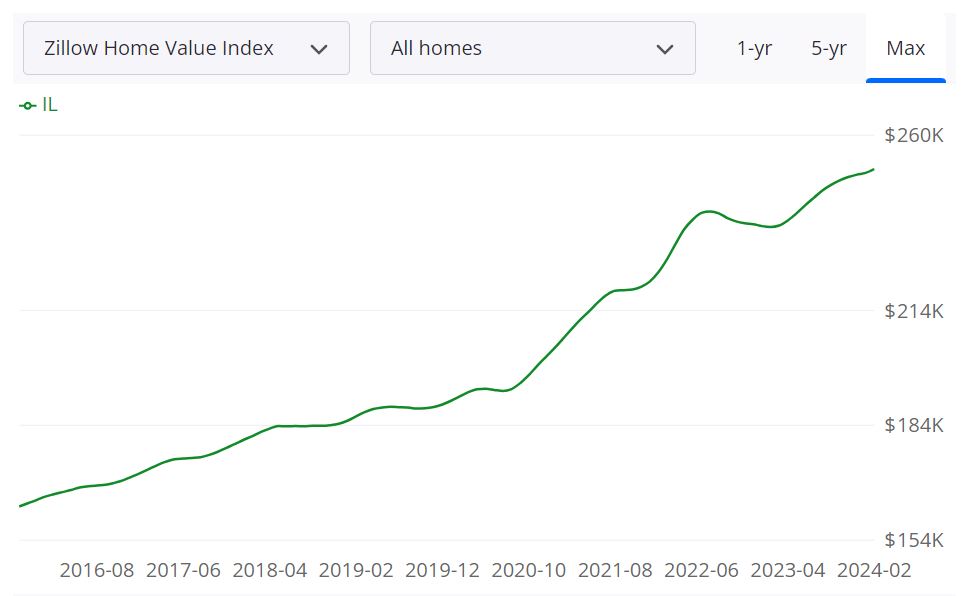

According to Zillow, the average home value in Illinois stands at $251,267, reflecting a 6.4% increase over the past year, with properties typically pending in approximately 16 days.

For Sale Inventory

The Illinois housing market boasts a For Sale Inventory of 24,793 listings as of February 29, 2024. This metric highlights the number of properties available for purchase within the state at any given time.

New Listings

As of February 29, 2024, Illinois witnessed 8,046 New Listings. This figure indicates the influx of newly available properties entering the market, potentially influencing supply and demand dynamics.

Median Sale to List Ratio

The Median Sale to List Ratio in Illinois as of January 31, 2024, stands at 0.991. This ratio provides insight into the relationship between the final sale price of a property and its initial list price, offering indications of market competitiveness.

Median Sale Price

As of January 31, 2024, the Median Sale Price for homes in Illinois is recorded at $234,667. This figure represents the midpoint value of all properties sold within the specified timeframe.

Median List Price

Illinois exhibits a Median List Price of $268,332 as of February 29, 2024. This figure signifies the midpoint value of all properties listed for sale within the state, offering insights into market pricing trends.

Percent of Sales Over/Under List Price

As of January 31, 2024, 32.1% of Illinois home sales were over the List Price, while 53.4% were under the List Price. These percentages indicate the prevalence of competitive bidding scenarios within the market.

Top Areas in Illinois Poised for Home Price Growth

When considering home price growth potential in Illinois for 2024, specific regions stand out as promising. Analyzing data provided by Zillow, the following areas demonstrate notable projections:

- Rockford, IL: This metropolitan statistical area (MSA) in Illinois, as of February 29, 2024, shows a growth projection of 0.8% by March 31, 2024, increasing further to 2% by May 31, 2024, and reaching 2.6% by February 28, 2025.

- Freeport, IL: Similarly, Freeport, another MSA in Illinois, exhibits a growth trajectory with projections of 0.7% by March 31, 2024, 1.8% by May 31, 2024, and 2.5% by February 28, 2025.

- Bloomington, IL: This Illinois MSA indicates a growth trend, albeit with fluctuations. From a projected 0.4% increase by March 31, 2024, it rises to 1.3% by May 31, 2024, then experiences a slight decline to 0.3% by February 28, 2025.

- Sterling, IL: Sterling, part of the Illinois MSA, follows a similar pattern, showing growth potential of 0.7% by March 31, 2024, 1% by May 31, 2024, and 0.3% by February 28, 2025.

Top Areas in Illinois Poised for Home Price Decline

While many areas in Illinois are projected to experience growth in home prices in 2024, there are also regions where a decline is anticipated. According to data from Zillow, the following areas are expected to see highest decreases:

- Quincy, IL: This MSA in Illinois, starting from a base date of February 29, 2024, shows a decline of -0.6% by March 31, 2024, worsening to -1.1% by May 31, 2024, and reaching -3.5% by February 28, 2025.

- Lincoln, IL: Another Illinois MSA, Lincoln, follows a similar pattern, with a projected decrease of 0.2% by March 31, 2024, further declining to -0.2% by May 31, 2024, and -3.3% by February 28, 2025.

- Galesburg, IL: Galesburg shows a declining trend, starting with 0.5% by March 31, 2024, remaining stable at 0.5% by May 31, 2024, and then decreasing to -3.2% by February 28, 2025.

- Jacksonville, IL: This Illinois MSA displays a decrease of 0.7% by March 31, 2024, maintaining the same rate by May 31, 2024, and decreasing further to -2.8% by February 28, 2025.

- Carbondale, IL: Carbondale also indicates a downward trend, with a projected decrease of 0.4% by March 31, 2024, declining to 0.1% by May 31, 2024, and reaching -2.4% by February 28, 2025.

- Danville, IL: Danville, part of the Illinois MSA, shows a decrease of 0.3% by March 31, 2024, further declining to 0.1% by May 31, 2024, and reaching -2.3% by February 28, 2025.

- Macomb, IL: Macomb demonstrates a similar pattern, with a projected decrease of 0.6% by March 31, 2024, increasing slightly to 0.7% by May 31, 2024, and then decreasing to -2.1% by February 28, 2025.

- Springfield, IL: The Illinois MSA of Springfield indicates a downward trend, with a projected decrease of 0.3% by March 31, 2024, rising slightly to 0.5% by May 31, 2024, and reaching -2% by February 28, 2025.

- Mount Vernon, IL: Mount Vernon follows suit, with a projected decrease of 0.9% by March 31, 2024, declining to 0.6% by May 31, 2024, and reaching -1.6% by February 28, 2025.

- Davenport, IA: Although located in Iowa, Davenport is included here due to its proximity and relevance to the Illinois market. It shows a decrease of 0.5% by March 31, 2024, increasing to 1% by May 31, 2024, and ultimately declining to -1.4% by February 28, 2025.

Is Illinois a Buyer's or Seller's Housing Market?

Assessing whether the current housing market in Illinois favors buyers or sellers involves considering several factors, including inventory levels, demand, and pricing trends. With the average home value in Illinois experiencing a 6.4% increase over the past year, coupled with a median sale price of $234,667 (as of January 31, 2024), sellers may have the upper hand in negotiations. However, the presence of regions poised for price declines suggests potential opportunities for buyers to secure deals in certain areas.

Are Home Prices Dropping in Illinois?

While overall home prices in Illinois have shown an upward trajectory, data indicating price declines in specific regions suggests a nuanced market scenario. Factors such as local economic conditions, population trends, and housing supply dynamics contribute to fluctuations in home prices. While some areas may experience declines, others may continue to see appreciation, emphasizing the importance of localized analysis when assessing housing market trends.

Will the Illinois Housing Market Crash?

The possibility of a housing market crash depends on various macroeconomic factors, including interest rates, unemployment rates, and overall economic stability. While localized price declines in certain areas may raise concerns, it's essential to consider the broader economic context. Historically, housing market crashes have been precipitated by systemic economic issues rather than localized fluctuations. However, ongoing monitoring of market indicators is prudent to identify any emerging risks.

Is Now a Good Time to Buy a House in Illinois?

Assessing whether now is a good time to buy a house in Illinois depends on individual circumstances and market conditions. Factors such as personal finances, long-term housing goals, and local market trends should be considered. While some areas may present opportunities for buyers due to projected price declines, others may still favor sellers. Engaging with a real estate professional and conducting thorough research can help prospective buyers make informed decisions tailored to their specific needs.

Top 10 Areas in Illinois Expected to See the Highest Increases in Home Prices

Delving into the localized real estate dynamics of Illinois, certain regions are projected to witness substantial increases in home prices throughout 2024. These forecasts, based on data provided by Zillow, highlight the evolving nature of the housing market in specific areas.

1. Rockford, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.6%

- Projected Increase by April 30, 2024: 2.3%

- Anticipated Growth by January 31, 2025: 6.1%

This metro is poised for a steady rise in home prices, with a gradual acceleration expected over the coming months. This forecast underscores the attractiveness of the Rockford MSA housing market for potential buyers and investors.

2. Freeport, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.3%

- Projected Increase by April 30, 2024: 1.8%

- Anticipated Growth by January 31, 2025: 5.6%

In Freeport, the real estate landscape is poised for incremental growth, with a noticeable uptick expected in the coming months. This suggests a favorable environment for those considering real estate transactions in Freeport.

3. Sterling, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.5%

- Projected Increase by April 30, 2024: 1.7%

- Anticipated Growth by January 31, 2025: 4.0%

Sterling, with its moderate yet consistent growth projections, presents an interesting landscape for prospective homebuyers and investors. The MSA's real estate market is expected to show resilience and stability in the coming year.

4. Decatur, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.6%

- Projected Increase by April 30, 2024: 2.4%

- Anticipated Growth by January 31, 2025: 3.6%

Decatur is positioned for a notable surge in home prices, with projections indicating a favorable market for both buyers and sellers. This upward trajectory suggests a positive outlook for the city's real estate landscape.

5. Bloomington, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.2%

- Projected Increase by April 30, 2024: 1.4%

- Anticipated Growth by January 31, 2025: 3.4%

Bloomington, while showing more modest growth compared to other regions, remains a steady player in the real estate scene. The MSA forecast suggests a gradual increase in home prices, indicating a stable and resilient market.

6. Pontiac, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.2%

- Projected Increase by April 30, 2024: 1.1%

- Anticipated Growth by January 31, 2025: 3.4%

Pontiac emerges as a region with steady growth, offering a real estate landscape that is anticipated to attract buyers and investors. The projections hint at a favorable market for those considering transactions in Pontiac.

7. Chicago, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.4%

- Projected Increase by April 30, 2024: 1.6%

- Anticipated Growth by January 31, 2025: 3.1%

As a major metropolitan area, Chicago continues to be a key player in the real estate scene. The forecast suggests a moderate yet consistent rise in home prices, indicating a stable and evolving market in the city.

8. Peoria, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.4%

- Projected Increase by April 30, 2024: 1.4%

- Anticipated Growth by January 31, 2025: 2.8%

Peoria showcases a real estate market with measured growth, providing potential buyers and sellers with a balanced environment. The projections indicate an attractive landscape for those looking for stable and gradual appreciation.

9. Rochelle, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 0.5%

- Projected Increase by April 30, 2024: 1.4%

- Anticipated Growth by January 31, 2025: 2.8%

Rochelle, with its anticipated growth, presents an intriguing option for those seeking a balance between appreciation and stability in the real estate market. The projections suggest a positive outlook for the metro's housing landscape.

10. Taylorville, IL

- Base Date: January 31, 2024

- Expected Increase by February 29, 2024: 1.1%

- Projected Increase by April 30, 2024: 2.3%

- Anticipated Growth by January 31, 2025: 2.8%

Taylorville emerges as a region with significant growth potential, indicating a thriving real estate market. The projections highlight the metro's attractiveness for those seeking a robust appreciation in home values.

Sources:

-

- https://www.illinoisrealtors.org/marketstats/

- https://fred.stlouisfed.org/series/ILSTHPI#

- https://www.zillow.com/il/home-values/

- https://www.neighborhoodscout.com/il/real-estate

- https://fred.stlouisfed.org/series/ACTLISCOUIL#

- https://ides.illinois.gov/