Are you considering buying a home in Myrtle Beach, SC? The housing market in this coastal city has experienced significant changes in recent times. Myrtle Beach has a diverse real estate market, with a range of properties available, including beachfront condos, townhouses, and single-family homes.

While current indicators point towards a buyer-friendly environment characterized by competitive pricing and ample inventory, ongoing economic developments and external factors will inevitably shape the market's evolution in the months ahead.

Current Myrtle Beach Housing Market Trends

According to the insights provided by realtor.com®, Myrtle Beach, SC, is currently a buyer's market as of February 2024. This implies that the supply of homes exceeds the demand, offering buyers a wider selection and potentially favorable negotiation terms. Sellers need to adapt their strategies to align with the prevailing market conditions, emphasizing factors such as competitive pricing and property presentation.

Median Listing and Sold Prices

In February 2024, the median listing home price in Myrtle Beach, SC stood at $299.9K, marking a downward trend of -11.5% year-over-year. Conversely, the median home sold price settled at $275.8K, highlighting the prevailing affordability within the market. This data underscores the importance of analyzing both listing and sold prices to gauge market health accurately.

Sale-to-List Price Ratio

The sale-to-list price ratio of 97.14% indicates a slight negotiation margin for buyers, with homes selling 2.86% below the asking price on average. This statistic underscores the importance of strategic pricing for sellers to attract potential buyers while ensuring a favorable return on investment.

Median Days on Market

One of the key indicators of market activity is the median days on market, which stood at 56 days in Myrtle Beach, SC, for February 2024. This statistic reflects the average duration it takes for a property to sell after being listed. The decreasing trend in median days on the market compared to the previous month suggests an uptick in buyer interest and accelerated sales pace.

Economic Landscape

The overall economic climate, including factors such as employment rates, wage growth, and consumer confidence, will play a pivotal role in shaping housing demand and affordability. Continued economic expansion and job creation can bolster buyer confidence and stimulate housing market activity.

Interest Rates

Fluctuations in mortgage interest rates can significantly impact home affordability and buyer purchasing power. While moderate rate increases can signal a healthy economy, excessively high rates may deter prospective buyers and slow market activity. Monitoring interest rate trends will be crucial for both buyers and sellers in navigating the market.

Supply and Demand Dynamics

The balance between housing supply and demand will continue to influence market conditions and pricing trends. Factors such as new construction activity, inventory levels, and population growth can shape supply dynamics, while demographic shifts and lifestyle preferences drive demand patterns.

Outlook for the Myrtle Beach Housing Market

- Prices: Prices are expected to remain stable or decline slightly in the coming months.

- Market Outlook: The market is expected to remain a buyer's market for the foreseeable future.

- Housing Inventory: The number of homes for sale is expected to continue to increase.

Myrtle Beach Housing Market Forecast for 2024 and 2025

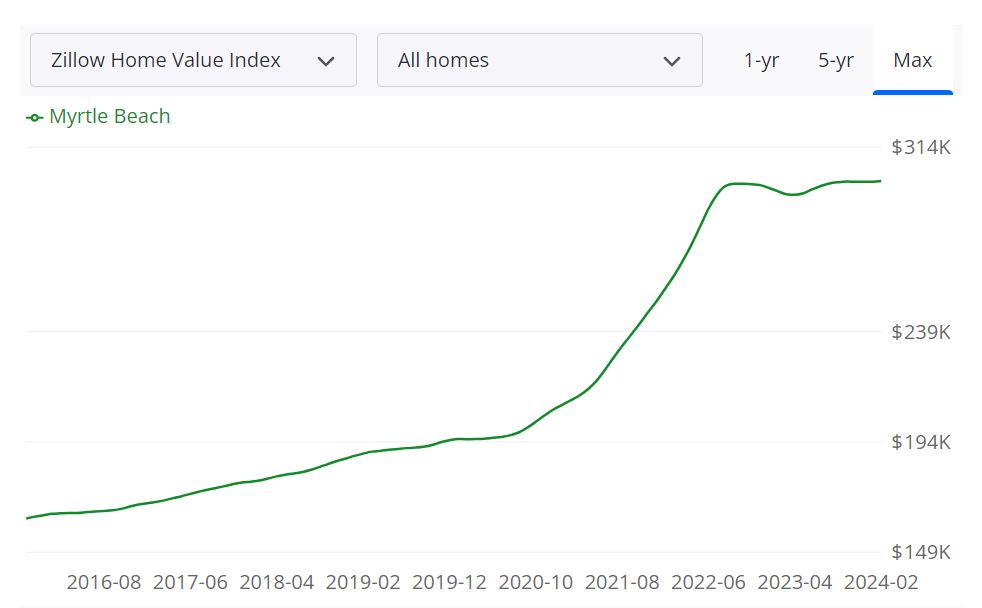

As of February 29, 2024, the Myrtle Beach housing market is demonstrating steady growth, with the average home value standing at $301,182, marking a modest 1.4% increase over the previous year. Homes in this area typically go pending in around 41 days. This data, sourced from Zillow, offers valuable insights into the current state of the housing market in Myrtle Beach.

Key Metrics Explained:

- For Sale Inventory: Currently, there are 2,182 homes listed for sale in Myrtle Beach as of February 29, 2024.

- New Listings: In February 2024, there were 584 new listings added to the market, indicating ongoing activity and interest.

- Median Sale to List Ratio: The median sale to list ratio as of January 31, 2024, stands at 0.968, reflecting the relationship between listing prices and actual sale prices.

- Median Sale Price: As of January 31, 2024, the median sale price for homes in Myrtle Beach is $244,917.

- Median List Price: The median list price for homes in Myrtle Beach as of February 29, 2024, is $287,965.

- Percent of Sales Over/Under List Price: In January 2024, 4.1% of sales were recorded above list price, while 85.6% were below list price, indicating varying market conditions and negotiation dynamics.

These metrics collectively provide a comprehensive overview of the Myrtle Beach housing market, shedding light on aspects such as inventory levels, pricing trends, and buyer-seller dynamics.

Myrtle Beach MSA Housing Market Forecast:

The Myrtle Beach Metropolitan Statistical Area (MSA) encompasses a region of significant economic and residential activity within South Carolina. With a forecasted growth rate of 0.2% by March 31, 2024, followed by 0.6% by May 31, 2024, and 2.4% by February 28, 2025, this indicates a positive trajectory for the housing market in the area.

MSA, or Metropolitan Statistical Area, refers to a geographical region defined by the United States Office of Management and Budget (OMB) for use by federal agencies in collecting, tabulating, and publishing federal statistics. In the case of Myrtle Beach, the MSA encompasses the city itself along with surrounding areas, providing a comprehensive view of the regional housing market.

The Myrtle Beach housing market, buoyed by its vibrant tourism industry, is sizable in scope, attracting both homebuyers and investors seeking opportunities in a coastal setting. With its diverse range of properties, from beachfront condos to suburban homes, the market caters to various preferences and budgets, contributing to its resilience and appeal.

Is Myrtle Beach a Buyer's or Seller's Housing Market?

In the current Myrtle Beach housing market, conditions lean slightly towards sellers. With a median sale price higher than the median list price and a relatively low inventory level, sellers may have an advantage in negotiations. However, factors such as the median sale to list ratio and the percentage of sales under list price indicate some room for negotiation, suggesting a balanced market overall.

Are Home Prices Dropping in Myrtle Beach?

As of the latest data available, there is no indication of a significant drop in home prices in Myrtle Beach. While market conditions may fluctuate due to various factors, including economic trends and seasonal changes, the consistent growth in median sale prices over the past year suggests a stable and resilient market.

Will the Myrtle Beach Housing Market Crash?

As with any market, predicting a housing market crash with certainty is challenging. While there may be fluctuations and localized corrections, Myrtle Beach's housing market benefits from diverse demand drivers, including tourism and retirement migration. Additionally, proactive measures by stakeholders and regulatory bodies often mitigate the risk of a widespread crash.

Is Now a Good Time to Buy a House in Myrtle Beach?

For prospective homebuyers considering Myrtle Beach, the current market presents opportunities and challenges. While favorable interest rates and a diverse inventory provide options, buyers should carefully assess their financial situation and long-term goals. Consulting with real estate professionals and considering factors such as affordability, market trends, and personal preferences can help individuals determine if now is the right time to make a purchase.

How is Real Estate Investing in Myrtle Beach?

Investing in real estate can be a smart decision, especially when you consider the long-term potential for appreciation and the potential for passive income through rental properties. Here are some top reasons to consider investing in the Myrtle Beach real estate market:

- Strong Economy: Myrtle Beach is a popular tourist destination, which means there is a strong economy supported by the tourism industry. This translates into a steady stream of visitors and a demand for rental properties.

- Rental Population: Myrtle Beach has a significant population of renters, with nearly 50% of the population renting rather than owning their homes. This creates a strong demand for rental properties and potential for steady rental income.

- Tax Environment: South Carolina is known for its favorable tax environment, with no estate tax, low property taxes, and no state inheritance tax. This can make it an attractive place to invest in real estate and potentially generate higher returns.

- Affordable Market: Compared to other popular vacation destinations, the Myrtle Beach real estate market is relatively affordable, which means investors can potentially acquire properties at lower prices and generate higher returns on their investment.

- Potential for Appreciation: Myrtle Beach has been experiencing steady growth in the real estate market over the past several years, with home values increasing steadily since 2015. This trend is likely to continue as the area continues to attract new residents and tourists.

However, there are also some potential drawbacks to investing in the Myrtle Beach real estate market:

- Seasonal Market: While Myrtle Beach is a popular tourist destination, the real estate market can be seasonal. Demand for rental properties and home sales may slow down during the off-season, which could impact cash flow for investors.

- Property Management: If you plan to invest in rental properties, you will need to manage them or hire a property manager to do so. This can be time-consuming and costly, and there is always a risk of tenant turnover and other issues that could impact cash flow.

- Competition: While the Myrtle Beach real estate market may be affordable compared to other vacation destinations, it is still a competitive market. Investors may need to act quickly to acquire properties and may face stiff competition from other buyers and investors.

- Hurricane Risk: As a coastal city, Myrtle Beach is at risk for hurricanes and other natural disasters. This risk could impact property values and create additional costs for investors in terms of insurance and maintenance.

In conclusion, the Myrtle Beach real estate market offers a number of potential benefits for investors, including a strong economy, rental population, favorable tax environment, affordability, and potential for appreciation. However, investors should also be aware of the potential drawbacks, including a seasonal market, property management challenges, competition, and hurricane risk. By carefully weighing these factors, investors can make an informed decision about whether the Myrtle Beach real estate market is right for them.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Sources:

- https://www.zillow.com/home-values/46666/myrtle-beach-sc/

- https://www.redfin.com/city/12572/SC/Myrtle-Beach/housing-market

- https://www.realtor.com/realestateandhomes-search/Myrtle-Beach_SC/overview