Unlike some South Carolina destinations, Myrtle Beach's housing market offers a more relaxed pace. This popular vacation spot attracts not only tourists but also those seeking a permanent residence along the beautiful coastline. While home values have risen in recent years, Myrtle Beach remains an attractive option compared to the national average.

This article explores everything you need to know about the Myrtle Beach housing market, including current trends, affordability factors, and valuable insights to help you navigate your buying journey.

Myrtle Beach Housing Market Report – April 2024

Myrtle Beach's housing market in 2024 is balanced, with prices down slightly and homes selling after 2 months on average. Let's delve into the key data points of the Myrtle Beach housing market in April 2024.

Affordability and Trends

The median listing price in Myrtle Beach sits at $299,900 (Realtor.com), reflecting a slight decrease of 11.8% compared to April 2023. This could indicate a softening market, potentially offering some negotiation space for buyers. While the price per square foot is $247, the median sold price is $327,300, suggesting some properties might be fetching above asking price.

Market Balance: A Sweet Spot for Buyers and Sellers

Good news for both buyers and sellers: Myrtle Beach boasts a balanced market. This means there's a healthy equilibrium between available homes and buyer demand. Sellers can expect to attract interest without an overabundance of listings, while buyers have options to choose from without facing fierce competition.

Time on the Market

The median number of days a home stays on the market before selling is 62 days. This has increased slightly compared to both the previous month and the same period last year. It's important to note that this is just a general timeframe, and the exact time will vary depending on factors like property type, location, and price point.

Neighborhood Nuances: Exploring Your Options

Myrtle Beach offers diverse neighborhoods catering to various lifestyles and budgets. The Dunes reigns supreme for luxury living with a staggering median listing price of $2 million. On the other hand, South Myrtle Beach offers a more affordable option, with a median listing price of $158,500. Researching different neighborhoods will help you find the perfect fit based on your priorities and budget.

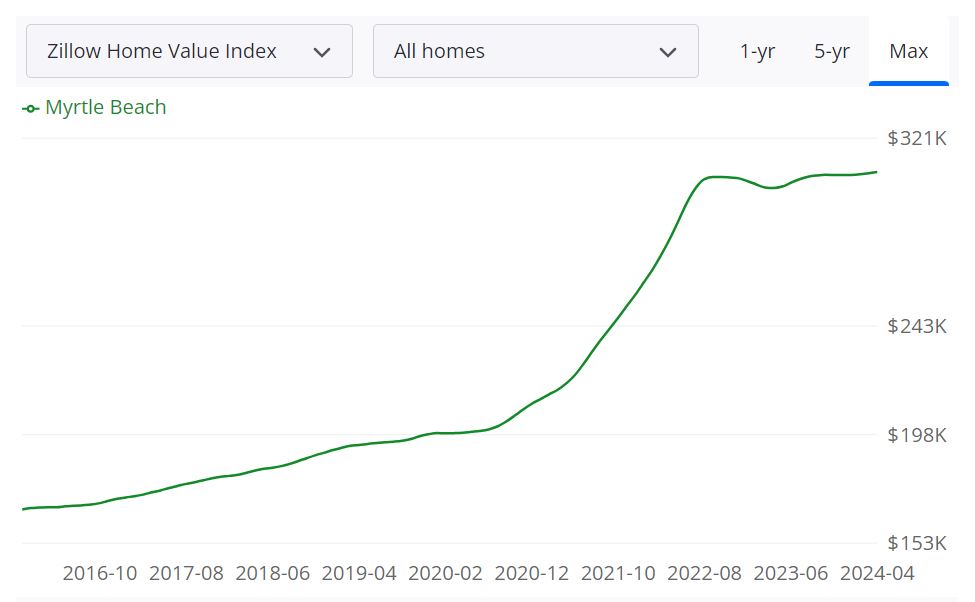

Myrtle Beach Real Estate Appreciation Over the Years

Thinking about buying a beach getaway or perhaps even a permanent residence in sunny Myrtle Beach? If so, you're probably curious about the area's real estate market, particularly when it comes to appreciation rates. Let's dive into the data and see how Myrtle Beach homes have performed over the years.

Good news for potential Myrtle Beach homeowners! Home values in the area have been on a steady climb for the past decade. Over this ten-year period, Myrtle Beach has seen a cumulative appreciation rate of a whopping 101.37%, placing it comfortably within the top 30% performers nationwide. That translates to an impressive annual average appreciation rate of 7.25%.

Now, let's zoom in and see how appreciation rates have unfolded over different timeframes. While the long-term trend is undeniably positive, it's important to consider shorter-term fluctuations as well.

- Latest Quarter: Looking at the most recent quarter (Q3 2023 to Q4 2023), appreciation came in at a modest 0.21%. However, it's important to remember that real estate is a long-term game, and short-term dips are a natural part of the cycle.

- Past Year: Over the past year (Q4 2022 to Q4 2023), appreciation reached a healthy 5.29%. This indicates a stable market with consistent growth.

- Past Two Years: Broadening the view to the past two years (Q4 2021 to Q4 2023), appreciation jumps to a significant 19.64%. This highlights the strong market performance in recent years.

- Past Five and Ten Years: The trend continues to impress when we look at the past five and ten years. Appreciation sits at a substantial 58.94% for the past five years (Q4 2018 to Q4 2023) and a remarkable 101.37% for the past ten years (Q4 2013 to Q4 2023).

For comparison, it's worth noting that South Carolina and the national average haven't quite matched Myrtle Beach's performance. Over the past ten years, South Carolina's appreciation rate averaged 3.6%, and the national average came in at 3.6%.

While past performance is a valuable indicator, it's not a crystal ball. The real estate market is constantly evolving, influenced by various factors like economic conditions, interest rates, and local demographics. However, Myrtle Beach's consistent growth over an extended period suggests a strong and resilient market with positive long-term prospects.

Thinking of buying in Myrtle Beach?

The data paints a compelling picture for Myrtle Beach real estate. However, remember, this is just one piece of the puzzle. Before making any decisions, it's crucial to consult with a qualified real estate professional who can provide specific guidance tailored to your individual needs and goals. They can help you navigate the market, understand current trends, and find the perfect property that fits your budget and lifestyle.

Myrtle Beach Housing Market Predictions

The Myrtle Beach housing market continues to show signs of stability with a healthy pace of growth. Let's dive into the data and see what experts predict for the future.

Current Market Snapshot (as of April 30th, 2024):

- Average Home Value: $307,680 (up 2.2% year-over-year)

- Days to Pending: 31 days (indicating strong buyer interest)

- Median Sale-to-List Ratio: 0.97 (suggests a balanced market with room for negotiation)

- Median Sale Price: $257,667

- Median List Price: $280,750

- Sales Over List Price: 5.8%

- Sales Under List Price: 83.0%

Looking Ahead: MSA Forecast

The Myrtle Beach Metropolitan Statistical Area (MSA) forecast paints a picture of gradual growth. Here's a breakdown of the predicted changes:

- May 31st, 2024: A modest increase of 0.2% is expected.

- July 31st, 2024: The growth is projected to pick up slightly to 0.3%.

- April 30th, 2025: By next year, a more significant rise of 1% is anticipated.

This indicates a stable market that's likely to experience continued appreciation without any dramatic booms or crashes.

Will it Crash or Boom?

Experts predict neither a crash nor a boom for the Myrtle Beach housing market. The market is expected to see continued growth, but at a moderate pace. This is due to several factors:

- Healthy Tourism Industry: Myrtle Beach's thriving tourism industry helps maintain consistent demand for housing, both for primary residences and vacation rentals.

- Increasing Interest Rates: Rising interest rates may cool down the market slightly, preventing a rapid price surge. This could be a positive sign for potential buyers, offering more negotiation power.

- Limited Inventory: The inventory of available homes remains somewhat low, which could put some upward pressure on prices. However, the increase is likely to be gradual.

Overall, the Myrtle Beach housing market appears to be in a good position for those considering buying or selling. While there may not be explosive growth, the market is expected to remain stable with a healthy appreciation rate.

Should You Invest in the Myrtle Beach Real Estate Market?

Investing in real estate can be a smart decision, especially when you consider the long-term potential for appreciation and the potential for passive income through rental properties. Here are some top reasons to consider investing in the Myrtle Beach real estate market:

- Strong Economy: Myrtle Beach is a popular tourist destination, which means there is a strong economy supported by the tourism industry. Its economy has benefited from population and tourism growth, which has led to job creation, infrastructure development, and investments. Last year, US News and World Reports named Myrtle Beach the fastest-growing city in the United States for the third year in a row. The site attributes this growth to the area's milder climate and relatively low cost of living, which appeal to young professionals and families. This translates into a steady stream of visitors and a demand for rental properties.

- Rental Population: Myrtle Beach has a significant population of renters, with nearly 50% of the population renting rather than owning their homes. This creates a strong demand for rental properties and potential for steady rental income.

- Tax Environment: South Carolina is known for its favorable tax environment, with no estate tax, low property taxes, and no state inheritance tax. This can make it an attractive place to invest in real estate and potentially generate higher returns.

- Affordable Market: Compared to other popular vacation destinations, the Myrtle Beach real estate market is relatively affordable, which means investors can potentially acquire properties at lower prices and generate higher returns on their investment.

- Potential for Appreciation: Myrtle Beach has been experiencing steady growth in the real estate market over the past several years, with home values increasing steadily since 2015. This trend is likely to continue as the area continues to attract new residents and tourists.

However, there are also some potential drawbacks to investing in the Myrtle Beach real estate market:

- Seasonal Market: While Myrtle Beach is a popular tourist destination, the real estate market can be seasonal. Demand for rental properties and home sales may slow down during the off-season, which could impact cash flow for investors.

- Property Management: If you plan to invest in rental properties, you will need to manage them or hire a property manager to do so. This can be time-consuming and costly, and there is always a risk of tenant turnover and other issues that could impact cash flow.

- Competition: While the Myrtle Beach real estate market may be affordable compared to other vacation destinations, it is still a competitive market. Investors may need to act quickly to acquire properties and may face stiff competition from other buyers and investors.

- Hurricane Risk: As a coastal city, Myrtle Beach is at risk for hurricanes and other natural disasters. This risk could impact property values and create additional costs for investors in terms of insurance and maintenance.

In conclusion, the Myrtle Beach real estate market offers a number of potential benefits for investors, including a strong economy, rental population, favorable tax environment, affordability, and potential for appreciation. However, investors should also be aware of the potential drawbacks, including a seasonal market, property management challenges, competition, and hurricane risk. By carefully weighing these factors, investors can make an informed decision about whether the Myrtle Beach real estate market is right for them.