In the current scenario, the Las Vegas housing market favors sellers, owing to high demand and limited inventory. With properties selling swiftly and sellers enjoying favorable terms, it's undeniably a seller's market. However, buyers can still find opportunities by acting decisively, leveraging pre-approval for financing, and collaborating with seasoned real estate professionals to navigate the market landscape effectively.

How is the Las Vegas housing market doing currently?

In February 2024, the market saw a surge in activity, with 1,896 single-family homes changing hands. This figure represents a significant 28.2% increase from January and a respectable 10.1% rise from the same period last year, according to the Southern Nevada report published by Summerlincommunities.com (Data by Las Vegas Realtors).

Moreover, the median sales price for previously owned single-family homes climbed from $445,000 to $460,000 in February, marking a noteworthy $15,000 increment from the previous month. This surge in prices reflects the robust demand prevailing in the market.

In the luxury segment, the story is equally compelling, with 131 homes fetching prices of $1 million and above in January. This represents a substantial increase compared to the 91 homes sold in January, signaling a 40 home increase.

Competitiveness of Las Vegas Housing Market

The Las Vegas housing market remains fiercely competitive, characterized by a delicate balance between supply and demand. Despite the increase in new listings – 2,544 in February, up 4.2% from January and 12.9% from the previous year – the number of single-family houses listed without offers decreased to 3,471, marking a 2.3% decline from the previous month and a 35.6% drop from the prior year. This discrepancy between supply and demand underscores the competitiveness of the market, with buyers facing stiff competition for a limited pool of available properties.

Meeting Buyer Demand with Limited Inventory

With only 1.8 months of inventory on the market in February, down 23.8% from January and 32.4% from the previous year, the housing supply in Southern Nevada continues to tighten. This shortage of inventory poses challenges for buyers, who must act swiftly in a market where properties are snapped up within days of listing. In February, 41.1% of closings occurred within 30 days of listing, highlighting the urgency for buyers to make prompt decisions.

Las Vegas Future Market Prospects

Despite headwinds such as rising interest rates and inflationary pressures, there are positive signs pointing towards a resilient housing market. Mortgage rates have stabilized, with a drop to 6.88% on the 30-year-fixed in recent months. Additionally, the Fed's contemplation of potential rate cuts later in the year, combined with increased seller activity and improving market conditions, augur well for the future outlook.

Las Vegas Housing Market Forecast 2024 and 2025

What are the Las Vegas real estate market predictions? The Las Vegas real estate market is one of the most dynamic and ever-changing markets in the United States. One factor contributing to this growth is the strong job market in Las Vegas. With major industries such as hospitality, gaming, and entertainment, Las Vegas has a strong job market that attracts many people to the city. This, in turn, increases the demand for housing in the area, which drives up home values.

Another factor contributing to the growth of the Las Vegas housing market is the city's reputation as a popular tourist destination. As more people visit Las Vegas and enjoy the city's amenities, they may be more inclined to purchase a home in the area, which can increase demand and home values.

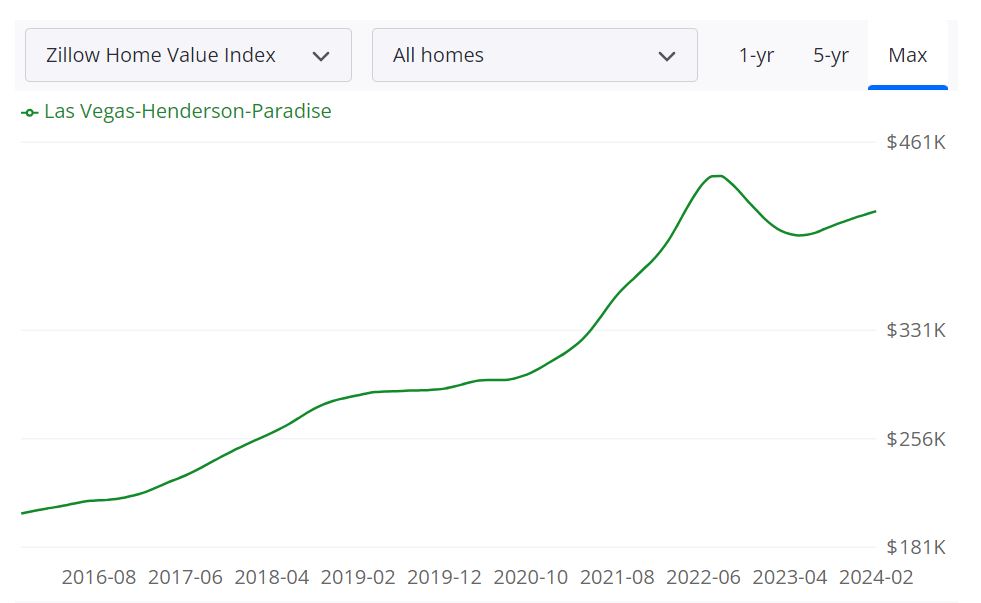

According to Zillow, the average home value in the Las Vegas-Henderson-Paradise area is currently $413,485, marking a 2.5% increase over the past year. Homes in this area typically go pending in approximately 25 days, showcasing the market's brisk pace.

Market Metrics Demystified:

For Sale Inventory:

As of February 29, 2024, Las Vegas boasts a 7,383 inventory of homes available for sale. This figure underlines the diversity of options present within the market, catering to a wide range of preferences and budgets.

New Listings:

In February 2024 alone, Las Vegas witnessed the addition of 2,188 new listings, indicating a healthy influx of properties into the market. This surge in listings contributes to the market's vibrancy and potential for prospective buyers.

Median Sale to List Ratio:

The 0.989 median sale to list ratio, recorded in January 2024, reflects the equilibrium between listed prices and actual sale prices. This ratio serves as a barometer of market efficiency and negotiation dynamics.

Median Sale Price:

With a median sale price of $398,282 (January 31, 2024), Las Vegas offers housing options across a spectrum of price points, ensuring accessibility and diversity within its real estate landscape.

Median List Price:

The median list price, as of February 29, 2024, stands at $447,333, indicating the average listing price of properties available in the market. This figure guides both buyers and sellers in setting realistic expectations and making informed decisions.

Percentage of Sales Over/Under List Price:

In January 2024, 19.5% of sales were recorded above the list price, while 58.7% were transacted below the list price. These percentages offer insights into market competitiveness, buyer-seller dynamics, and negotiation trends.

Understanding the Las Vegas-Henderson-Paradise Market:

The Las Vegas-Henderson-Paradise metropolitan statistical area (MSA) encompasses a diverse array of communities and neighborhoods, spanning multiple counties including Clark County. Renowned for its vibrant entertainment scene, burgeoning economy, and favorable climate, Las Vegas attracts residents and investors alike.

The housing market in Las Vegas is sizable, reflecting the region's status as a major economic hub and tourist destination. Its robust infrastructure, coupled with a diverse housing stock, positions it as a sought-after destination for individuals and families seeking a dynamic living experience.

Is Las Vegas a Buyer's or Seller's Housing Market?

Determining whether the Las Vegas housing market favors buyers or sellers involves analyzing various factors such as inventory levels, pricing trends, and demand-supply dynamics. With a significant inventory of 7,383 homes for sale as of February 29, 2024, coupled with a median sale price of $398,282 (January 31, 2024), the market appears to offer a balance between supply and demand.

However, with 19.5% of sales recorded above the list price and 58.7% below the list price in January 2024, it suggests a competitive environment, tilting slightly towards sellers. Prospective buyers may find opportunities amidst this equilibrium, but should be prepared to act swiftly in competitive situations.

Are Home Prices Dropping in Las Vegas?

As of the latest available data, home prices in the Las Vegas housing market have shown resilience, with a 2.5% increase over the past year, bringing the average home value to $413,485. While fluctuations may occur in specific segments or neighborhoods, overall trends indicate stability and modest appreciation. Factors such as demand from investors, population growth, and economic indicators contribute to the market's resilience against significant price declines.

Will the Las Vegas Housing Market Crash?

Speculating on the possibility of a housing market crash involves considering numerous variables, including economic conditions, regulatory policies, and market sentiment. While no market is immune to downturns, the Las Vegas housing market exhibits signs of stability and resilience, supported by steady demand, diverse economic drivers, and proactive regulatory measures. However, external factors such as economic recessions or unforeseen events could impact market dynamics. Continuous monitoring of market indicators and prudent risk management strategies can mitigate potential risks for investors and homeowners.

Is Now a Good Time to Buy a House in Las Vegas?

Assessing whether it's an opportune time to buy a house in Las Vegas depends on individual circumstances, financial readiness, and long-term goals. With favorable mortgage rates, a diverse inventory of properties, and a relatively stable market outlook, now may present an attractive window for prospective buyers. However, it's essential for buyers to conduct thorough due diligence, assess affordability, and align their purchase with their financial objectives.

Las Vegas Real Estate Market: Is It A Good Place For Investment?

Las Vegas, renowned for its entertainment and tourism, is also emerging as an attractive destination for real estate investment. In this section, we'll delve into the current state of the Las Vegas housing market and explore why it might be the right place for you to invest.

Current Market Trends

The Las Vegas real estate market has been on a remarkable journey, but in 2023, we see some notable shifts:

The Las Vegas housing market is showing signs of cooling down. Sales activity decreased in 2023, and there was a significant drop in new listings. The increased months of supply also indicate a more balanced market, suggesting a cooling trend compared to previous months.

The reduction in home prices also presents opportunities for buyers looking for more affordable housing options. However, while prices may have eased slightly, finding a home in Las Vegas remains a challenge due to low inventory. This means that competition among buyers, especially for properties in desirable locations and price ranges, remains fierce.

Top Reasons to Invest in the Las Vegas Real Estate

Here are several compelling reasons why you should consider investing in Las Vegas real estate for the long term:

1. Strong Economy and Population Growth

The Las Vegas metro area is one of the fastest-growing regions in the United States, with approximately 19,000 new residents from the summer of 2020 to 2021, as reported by the U.S. Census Bureau. The city's diverse economy, driven by sectors like tourism, entertainment, gaming, technology, healthcare, and education, provides a stable income source for residents.

2. Rental Income and Appreciation Potential

Las Vegas has a strong rental market, with a significant portion of its population choosing to rent rather than buy. This creates opportunities for long-term investors to generate steady rental income, especially in desirable neighborhoods and near employment centers.

Rental properties in Las Vegas are always in high demand. In September 2023, the median rent for single-family homes increased by 16.7% compared to the previous year, reaching $2,100. The city's rental vacancy rate, at 4.8%, is lower than the national average of 6.2%, ensuring high occupancy rates and cash flow for landlords.

The demand for rental properties in Las Vegas often results in low vacancy rates. Long-term investors can benefit from a stable stream of rental income and less downtime between tenants, increasing overall profitability.

3. Resilience and Adaptability

Lifetime periods of economic downturns, Las Vegas has proven to be resilient. After the challenges of the Great Recession of 2008-2009 and the COVID-19 pandemic in 2020-2021, the city has bounced back with robust growth and development. New projects and initiatives are continually revitalizing the city.

4. Infrastructure Development

Las Vegas has ongoing infrastructure development projects, including new roads, public transportation, and community amenities. These investments can enhance the quality of life and property values, making it an appealing choice for long-term real estate investors.

Several significant projects are shaping Las Vegas's future:

- The Resorts World Las Vegas: A $4.3 billion mega-resort opened in June 2023, offering over 3,500 rooms, a casino, a theater, and more.

- The MSG Sphere at The Venetian: A $1.8 billion entertainment venue expected to open in late 2023 or early 2024, featuring a spherical shape and state-of-the-art technology.

- The Las Vegas Convention Center Expansion: A $980 million project added 1.4 million square feet of space, enhancing the city's event capabilities.

- The Allegiant Stadium: A $1.9 billion stadium that opened in July 2020 as the home of the NFL's Las Vegas Raiders and host for events and concerts.

- The Boring Company's Loop System: A $52 million underground transportation system connects various locations in Las Vegas using autonomous electric vehicles.

5. Strong Population Growth

Las Vegas has been experiencing consistent population growth due to its economic opportunities, affordable cost of living, and desirable lifestyle. A growing population creates sustained demand for housing, making it an attractive option for long-term investors.

Las Vegas is a shining beacon in the desert for those fleeing California or simply hoping to make it big. Many others simply come to earn a living serving the many tourists who visit here each year or work at the firms relocating to this tax haven. All of this gives the Las Vegas real estate market a bright future.

According to PwC's annual real estate report, the Las Vegas housing market will enjoy a population growth rate that is well above the national growth rate. This is a continuing trend as data from the US Census Bureau shows a net migration of 6.46% from 2012-2016.

6. Economic Diversification

Las Vegas has diversified its economy beyond the entertainment and tourism sectors. The city now boasts thriving industries in technology, healthcare, and manufacturing. Economic diversification contributes to stability and long-term growth potential in the real estate market.

7. Appreciation Potential

The Las Vegas real estate market has historically shown the potential for property appreciation. As the city continues to grow and evolve, property values may increase over time, providing long-term investors with capital gains opportunities.

8. Low Property Taxes

Nevada is known for its favorable tax climate. The state has no personal income tax, and property taxes are relatively low. This can translate into better returns for real estate investors, making long-term ownership more attractive.

9. Tourism and Hospitality

Las Vegas remains a global tourist destination, and the hospitality industry continues to thrive. This ensures a steady flow of short-term rental and vacation rental opportunities, which can be a lucrative segment for long-term investors, especially in the right locations.

10. Education and Workforce

The city has been making investments in education and workforce development. A well-educated and skilled workforce can attract businesses and professionals, leading to increased demand for housing and real estate investment potential in the long term.

11. Wealth of Investment Options

Las Vegas offers a wide range of real estate investment options, from single-family homes to multi-unit properties and commercial real estate. Diversifying your portfolio with different types of properties can provide a solid foundation for long-term financial growth.

Before investing in Las Vegas real estate for the long term, it's crucial to conduct thorough research, understand market conditions, and consult with local real estate experts to make well-informed investment decisions. Long-term real estate investment can be a promising path to building wealth and financial security in this dynamic and growing city.

References:

- https://www.lasvegasrealtor.com/housing-market-statistics

- https://summerlincommunities.com/

- https://www.zillow.com/las-vegas-nv/home-values

- https://www.neighborhoodscout.com/nv/las-vegas/real-estate#description

- https://www.realtor.com/realestateandhomes-search/Las-Vegas_NV/overview