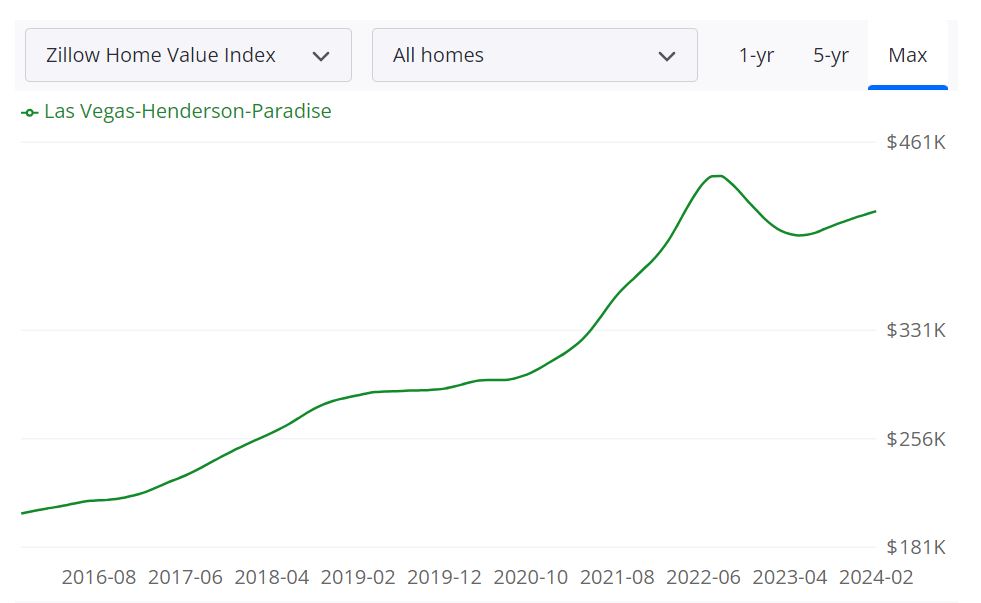

The Las Vegas housing market has been a topic of much discussion and speculation about home price declines. As we look towards the rest of 2024, potential buyers and sellers are keen to understand the trajectory of housing prices. As of early 2024, the Las Vegas housing market has been favoring sellers due to high demand and limited inventory.

Properties have been selling quickly, with sellers enjoying favorable terms. In February 2024, the market experienced a surge in activity, with single-family homes' median sales price climbing to $460,000, a significant increase from the previous month.

The luxury segment of the market has also seen substantial activity, with an increase in homes selling for $1 million and above. This indicates a robust demand in the higher-end market as well.

The market remains fiercely competitive, with a delicate balance between supply and demand. The number of single-family houses listed without offers has decreased, highlighting the competitiveness buyers face in securing a property.

With only 1.8 months of inventory available in February, down from the previous year, the housing supply in Southern Nevada continues to tighten. This shortage poses challenges for buyers, who must act swiftly in a market where properties are quickly taken off the market.

Las Vegas Future Market Predictions

Despite the challenges posed by rising interest rates and inflationary pressures, there are positive signs pointing towards a resilient housing market. Mortgage rates have stabilized, and there's speculation about potential rate cuts later in the year. Increased seller activity and improving market conditions could bode well for the future outlook.

Forecasts suggest that home prices may end the year up by 2.8% and could rise by another 1.5% by the end of 2024. Home sales are also projected to increase, which could make homeownership a good investment.

However, it's important to note that some forecasts predict a 1 percent drop in home prices but an increase in sales from the previous year, which was the worst on record since 2008.

Top Neighborhoods for Buyers in Las Vegas Real Estate 2024

Las Vegas, known for its dazzling lights and vibrant lifestyle, is also a city with a diverse and dynamic real estate market. Based on recent data and trends, here are some of the top neighborhoods in Las Vegas that stand out for real estate investment.

Summerlin: A Master-Planned Community

Summerlin is one of the most sought-after master-planned communities in Las Vegas. It offers a variety of housing options, from luxury estates to more affordable single-family homes. With over 250 parks, numerous golf courses, and a strong sense of community, Summerlin continues to attract families and professionals alike. The area has seen consistent growth in property values, making it a solid choice for long-term investment.

Henderson: Suburban Living with City Amenities

Henderson, located on the southeastern edge of Las Vegas, combines suburban tranquility with city amenities. It's known for its excellent schools, parks, and recreational facilities. The area has a high demand for housing, driven by its quality of life and proximity to the Las Vegas Strip. Henderson‘s real estate market has been robust, with a healthy appreciation rate that appeals to investors.

Skye Canyon: The Newcomer with Potential

Skye Canyon is a newer development in the northwest part of Las Vegas. It's quickly gaining popularity due to its outdoor-focused lifestyle, offering hiking and biking trails, as well as community parks. As a growing neighborhood, Skye Canyon presents an opportunity for investors to get in early and benefit from the area's development and appreciation.

Boulder City: A Historic Town with Charm

Boulder City, known for its historic charm and proximity to the Hoover Dam, offers a unique investment opportunity. It's one of the few places in Nevada without gaming, which attracts residents looking for a quieter lifestyle. The real estate market in Boulder City is stable, with a steady demand for homes that retain their value over time.

Lake Las Vegas: Resort-Style Living

Lake Las Vegas is a resort-style community centered around a man-made lake. It offers luxury homes and condominiums with amenities such as golf courses, spas, and dining options. The area caters to those seeking a vacation-like lifestyle and has a mix of primary residences and second homes. The exclusivity and unique setting of Lake Las Vegas make it an attractive niche market for investors.

Southern Highlands: An Upscale Enclave

Southern Highlands is an upscale community located in the southern part of Las Vegas. It features high-end homes, a prestigious golf club, and top-rated schools. The neighborhood is well-maintained and offers a luxurious lifestyle, which keeps the demand for homes high. Southern Highlands is a prime location for investors looking for premium properties with the potential for significant returns.

Las Vegas is a city with a real estate market as diverse as its entertainment options. From the family-friendly atmosphere of Summerlin to the luxury of Southern Highlands, there's a neighborhood to fit various investment strategies and goals. With careful research and consideration of market trends, investing in Las Vegas can be a fruitful endeavor.

The Las Vegas housing market in 2024 is dynamic and evolving. While current trends suggest a seller's market with rising prices, the future holds various possibilities influenced by economic factors and market dynamics. As always, working with a knowledgeable real estate professional can provide valuable insights and guidance in making the right investment choices. Happy investing!