The new home construction market continues to face considerable headwinds from rising interest rates. The surge in new-home construction represents a significant shift in the real estate market, offering buyers a compelling alternative to the limitations of existing inventory. With sales incentives playing a pivotal role, builders are not only meeting but exceeding the expectations of house hunters in this market.

Housing Starts refer to the number of new residential construction projects that have begun during any particular month. Estimates of housing starts include units in structures being rebuilt on an existing foundation.

Building permits, on the other hand, are issued by local governments to allow builders to begin the construction of a new home or to make significant renovations to an existing home. Building permits are usually required for any new construction or remodeling that involves changes to the structural or mechanical systems of a home.

Housing construction refers to the actual building of the residential structure, which includes everything from laying the foundation to framing the walls, installing electrical and plumbing systems, and finishing the interior and exterior of the building.

The sequence of new housing construction events typically goes as follows:

A builder obtains a building permit from the local government, which allows them to start construction on a new housing unit.

Once construction begins, it is counted as a housing start. The construction process continues until the housing unit is completed and ready for occupancy, at which point it is considered part of the housing stock.

So, building permits come first, followed by housing starts, and then housing construction. However, it is important to note that not all permits lead to starts and not all starts to lead to completed construction. Some permits may expire before construction begins, and some starts may be delayed or canceled due to various reasons such as changes in market conditions or financing issues.

New-Home Construction in March Plunges Unexpectedly in Troubling Sign for Homebuyers

The landscape of real estate in March took an unexpected turn, casting a shadow over the hopes of eager homebuyers. The construction of new homes experienced a significant decline, marking a troubling trend for those already contending with a shortage of available properties.

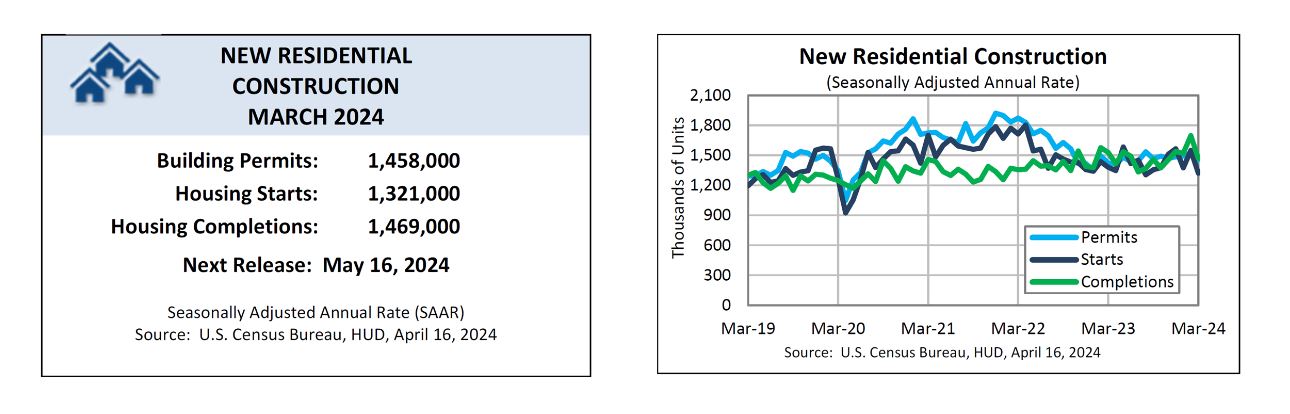

According to recent data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, housing starts plummeted by 14.7% in March compared to February, reaching a seasonally adjusted annual rate of 1.321 million. This decline, which also amounted to a 4.3% drop from the previous year, stands as the largest monthly percentage decrease since April 2020, during the onset of the COVID-19 pandemic. Additionally, March witnessed the lowest total of housing starts since August of the previous year.

The magnitude of this downturn surpassed economists' expectations, potentially signaling trouble ahead for prospective homebuyers. With the existing pool of homes for resale remaining tight, newly constructed homes have played a pivotal role in meeting the demand of buyers seeking shelter. However, this unforeseen decline in new construction raises concerns about the future availability of housing options.

Within the realm of total housing starts, single-family constructions experienced a notable setback, declining by 12.4% from February. Despite this downturn, there was a 21.2% increase in single-family starts compared to the previous year, offering a glimmer of hope amidst the gloom.

Meanwhile, multifamily starts took a considerable hit, dropping by 20.8% in March compared to the prior month. This downward trajectory reflects an ongoing trend of diminishing multifamily construction over the past year. Factors such as moderating rents and an abundance of existing and forthcoming projects have contributed to a waning interest among developers in pursuing new condominiums, cooperatives, and rental properties.

Interestingly, while housing starts dwindled across the board in the Northeast, Midwest, and South, there was a notable exception in the West, where construction activity surged by 7.1% on a monthly basis and soared by an impressive 48.1% year over year. This surge in new construction offers a ray of hope for prospective homebuyers in the western region, who have long grappled with soaring prices and limited housing inventory.

However, amidst these developments, homebuilders find themselves grappling with financing constraints on construction projects, exacerbated by rising interest rates. The increasing cost of borrowing, both for builders and potential buyers, poses a significant challenge to the affordability of housing.

The resurgence of mortgage rates, inching closer to 7% following March's inflation uptick of 3.5%, has dashed hopes of an imminent reduction in interest rates by the U.S. Federal Reserve. Last week, the average rate on a 30-year fixed mortgage stood at 6.88%, according to Freddie Mac. This surge in rates has contributed to the decline in single-family starts, while tighter financing conditions have further dampened multifamily production.

“Single-family starts were down in March as interest rates increased and multifamily production fell as builders faced tighter financing conditions,” said Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis. “And with single-family permits also down in March, single-family production will likely decline again in April.”

As single-family permits also witnessed a decline in March, the trajectory for single-family production in the coming months appears bleak. The confluence of rising interest rates and financing challenges portends a challenging road ahead for both builders and aspiring homeowners alike. As the real estate landscape continues to evolve, it remains imperative for stakeholders to closely monitor these developments and adapt strategies accordingly to navigate the complexities of the market.

New-Home Construction Forecast for 2024

As the real estate landscape continues to evolve, the forecast for new-home construction in 2024 is brimming with optimism. Home buyers, frustrated by the scarcity of existing inventory, are turning to builders for solutions. The data reveals a surge in construction activities, with builders employing innovative sales incentives to attract house hunters.

The Rise of New-Home Market

The new-home market is emerging as a dominant player, set to shape the real estate landscape in 2024. According to Ali Wolf, Chief Economist at housing research firm Zonda, the trend is expected to continue gaining momentum. Speaking at the International Builders' Show in Las Vegas, Wolf emphasized the increasing role of new-home sales, which traditionally constituted 10% to 12% of the market for single-family homes but now account for over 30%.

Addressing Affordability Concerns

With existing-home prices soaring to record highs, home builders are proactively addressing buyers' affordability concerns. The shortage of existing homes for sale has created an opportunity for new-home construction to cater to a broader audience. Danielle Hale, Chief Economist at realtor.com®, notes that 40% of home buyers consider buying new homes to “avoid renovations or problems,” highlighting the appeal of turnkey solutions.

Buyers' Motivations and Incentives

Zonda's research indicates that 40% of home buyers opt for new homes to avoid the hassles of renovations, while 25% are driven by the scarcity of existing inventory. Additionally, 25% appreciate the ability to choose and customize their home's design. In response to these preferences, builders are introducing enticing sales incentives.

The most popular incentive, according to Wolf, has been mortgage buydowns. To ease buyers' fears and boost confidence in the market, builders are offering financial incentives such as funds towards closing costs, with some reaching up to $20,000. Moreover, “flex dollars” are becoming a sought-after perk, allowing buyers to invest in home upgrades according to their preferences.

New-Home Construction Outlook for 2024

The momentum in new-home construction is poised to shape the real estate landscape throughout 2024. As buyers seek alternatives to the challenges posed by existing inventory, builders are stepping up their efforts to provide turnkey solutions and attractive incentives. The forecast indicates a positive trajectory for the new-home market, with affordability and customization driving the preferences of home buyers.

Builders' Positive Outlook and Challenges Ahead

Builders are approaching 2024 with a bullish outlook, fueled by a forecast that anticipates a 4.7% increase in single-family housing starts nationwide this year. The momentum is expected to continue into 2025, with an additional 4.2% growth, reaching an impressive pace of 1.3 million units, as reported by the National Association of Home Builders (NAHB).

Meeting the Housing Deficit Challenge

However, economists are urging builders to do more to address the nation's housing deficit. According to Robert Dietz, Chief Economist of NAHB, building over 1.15 million single-family homes annually is crucial to reducing the housing deficit. Despite the ambitious goal, builders are facing formidable challenges that hinder their capacity to build at the required pace.

Obstacles in the Path of Builders

Builders are grappling with multiple challenges, including higher prices, shortages of lumber, lots, and labor. These factors are stifling their ability to meet the growing demand for new homes. Dietz highlighted the impact of rising regulatory costs, which account for nearly 24% of the final sales price—or a significant $93,870—for a new single-family home. This underscores the complexity and cost implications of complying with building codes and zoning regulations.

Optimism Despite Challenges

Despite these headwinds, builders remain remarkably optimistic, buoyed by the surge in consumer demand. According to Ali Wolf, Chief Economist at Zonda, 80% of builders anticipate initiating more home starts in the current year. Furthermore, a substantial 51% of builders expect starts to increase by more than 10% compared to the previous year, showcasing a strong belief in the resilience of the market.

The Path Forward: Strategies for Success

As builders navigate the challenges posed by higher prices, material shortages, and regulatory hurdles, strategic planning becomes imperative. Finding innovative solutions to streamline the construction process, exploring alternative materials, and advocating for regulatory reforms are essential components of overcoming these obstacles. The commitment to meeting the nation's housing deficit while ensuring affordability remains a shared goal among builders.

The Townhouse Boom: A Shift in Housing Trends

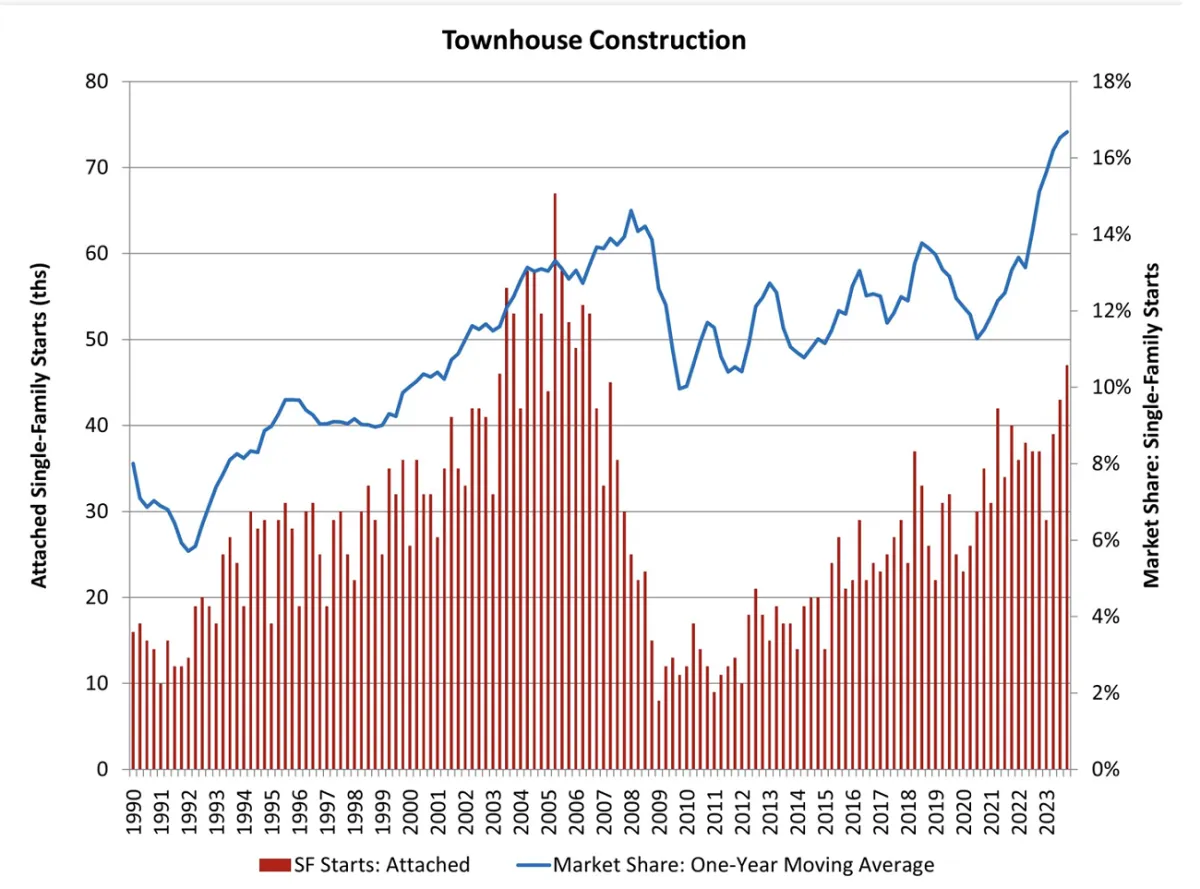

As builders adapt to the challenges of affordability and lot shortages, the real estate landscape is witnessing a notable shift with the rise of townhome construction. Townhouses have experienced a surge, reaching their highest rate in over 17 years, according to an analysis of Census data by the National Association of Home Builders (NAHB).

Responding to Affordability and Lot Woes

Builders are diversifying their product offerings to address affordability concerns and lot shortages. Townhome construction, characterized by single-family attached housing, has become an attractive option for both builders and home buyers. This housing style often comes with a lower price tag, making it a viable solution in the current real estate landscape.

Impressive Growth in Townhouse Starts

The fourth quarter of 2023 saw a remarkable 27% increase in single-family attached starts compared to the same period in 2022. Townhouses, overall, accounted for nearly 20% of the total housing starts in the final quarter of 2023. This surge signifies a growing preference for townhomes among home buyers, offering a more affordable and accessible housing option.

Bright Spots in the New-Home Sector

Robert Dietz, Chief Economist of NAHB, identifies townhouse markets as one of the bright spots in the new-home sector. He expresses optimism about this segment continuing to outperform, pointing to a shift in preferences among home buyers. Both young and old demographics are increasingly seeking medium-density residential neighborhoods, such as urban villages, that provide walkable environments and a range of amenities.

Meeting the Demand for Walkable Environments

The appeal of townhouses extends beyond affordability, with an increasing number of home buyers valuing walkable environments and communal amenities. Urban villages, characterized by medium-density residential developments, are gaining popularity as they offer a lifestyle that aligns with the preferences of modern home buyers.

Builder Sentiment Holds Steady in April Amid Economic Uncertainties

The sentiment among builders in the real estate market remained unchanged in April, maintaining a flat trajectory as mortgage rates hovered close to 7% throughout the past month. Coupled with this, the latest inflation figures failed to demonstrate improvement during the first quarter of 2024, contributing to a cautious atmosphere among potential homebuyers.

Builder Confidence Remains Stable

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released recently, builder confidence in the market for newly built single-family homes stood at 51 in April, mirroring the figures from March. This steadiness breaks a four-month streak of gains for the index, although it still holds above the pivotal breakeven point of 50.

“With many frustrated buyers back on the fence waiting for interest rates to fall, policymakers can help ease affordability challenges by reducing inefficient regulatory rules that raise housing costs and limit supply,” remarked NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan.

NAHB Chief Economist Robert Dietz noted, “April’s flat reading suggests potential for demand growth is there, but buyers are hesitating until they can better gauge where interest rates are headed. With the markets now adjusting to rates being somewhat higher due to recent inflation readings, we still anticipate the Federal Reserve will announce future rate cuts later this year, and that mortgage rates will moderate in the second half of 2024.”

Market Dynamics and Trends

The April HMI survey also unveiled interesting insights into market trends. It revealed that 22% of builders reduced home prices this month, a slight decrease from 24% in March and 36% in December 2023. However, the average price reduction in April remained constant at 6% for the 10th consecutive month. Moreover, the utilization of sales incentives dipped to 57% in April from 60% in March, indicating a subtle shift in builder strategies.

The NAHB/Wells Fargo HMI, derived from a longstanding monthly survey spanning over 35 years, assesses builder perceptions of current single-family home sales and sales expectations for the next six months. The survey also evaluates the traffic of prospective buyers, categorizing it as “high to very high,” “average,” or “low to very low.” Scores for each component are utilized to compute a seasonally adjusted index, where any figure above 50 indicates a positive outlook among builders.

In terms of regional performance, the Northeast witnessed a four-point surge to 63 in the three-month moving averages for HMI scores. Similarly, the Midwest recorded a five-point increase to 46, while the South observed a modest one-point uptick to 51. The West also saw improvement, registering a four-point gain to 47.

The stability in builder sentiment amid economic uncertainties underscores the cautious optimism prevailing in the real estate market. While challenges such as mortgage rates and inflation persist, builders remain hopeful for potential demand growth in the coming months, anticipating adjustments in interest rates to alleviate affordability concerns. As the market continues to evolve, stakeholders are closely monitoring developments and adapting strategies to navigate the ever-changing landscape of the real estate sector.

Sources

- https://www.census.gov/

- https://www.nahb.org/news-and-economics/nahb-pressroom