New Home Sales, commonly referred to as “new residential sales,” is an economic indicator that tracks the sale of newly constructed residences. It is extensively watched by investors since it is seen as a lagging signal of real estate market demand and, thus, a factor influencing mortgage rates. Household income, unemployment, and interest rates are all variables that influence it.

The United States Census Bureau releases two versions of the New Home Sales metric: a seasonally adjusted figure and an unadjusted one. The adjusted value is shown as a yearly total, whereas the unadjusted figure is presented as a monthly total. These numbers are provided for several areas and the entire nation.

New home sales are completed when a sales contract or deposit is signed or accepted. In any stage of construction, the home might be: not yet started, in the process of being built or fully finished. About 10% of the US housing market is made up of new house sales. Preliminary numbers for new single-family home sales are subject to major changes because they are mostly based on data from construction permits.

Insights into Monthly New Residential Sales, February 2024

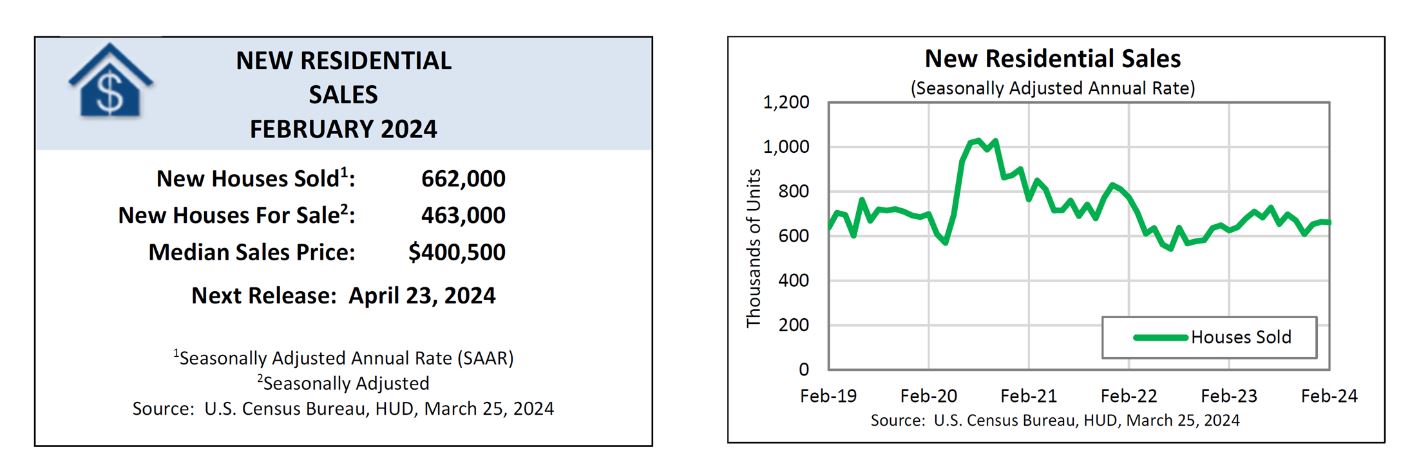

In February 2024, the landscape of new residential sales in the United States witnessed a slight downturn, surprising analysts who anticipated growth. This dip comes on the heels of a rise in mortgage rates during the month. However, despite this setback, the fundamental trend remains robust, underpinned by a persistent shortage of pre-owned homes available on the market.

New Home Sales Performance

According to the Commerce Department's Census Bureau, new home sales dipped by 0.3% to a seasonally adjusted annual rate of 662,000 units in February. While this figure is lower than January's revised rate of 664,000 units, it still represents a 5.9% increase compared to February 2023.

Economists had projected a rise in new home sales to reach a rate of 675,000 units. However, the actual figures fell short of these expectations, demonstrating the volatility inherent in month-to-month sales data.

Market Factors

The housing market's resilience amid a series of interest rate hikes by the Federal Reserve since March 2022 is noteworthy. This resilience is fueled by a scarcity of pre-owned homes for sale, prompting builders to escalate construction efforts. Builders have responded not only by increasing construction but also by introducing price cuts, incentives, and adjustments in floor sizes to enhance affordability.

Despite these efforts, the average rate for a 30-year fixed-rate mortgage surged to 6.94% in late February, before slightly retreating to just below 7.0% by mid-March. This increase likely deterred some prospective buyers from entering the market, contributing to the observed decline in new home sales.

Regional Variances

Regional disparities in new home sales were evident in February. While the Northeast experienced a significant decline of 31.5%, the Midwest also saw a 2.4% decrease. In contrast, the South, characterized by dense population centers, recorded a 3.7% increase, while the West witnessed a modest rise of 2.3%.

Price Trends

The median sales price for new houses in February 2024 was $400,500, marking a notable decrease from previous months and a 7.6% drop compared to the same period last year. This decline in median prices is a positive development for affordability, as elevated housing costs have been a barrier to homeownership for many.

Economists have welcomed this price adjustment, emphasizing its potential to mitigate inflationary pressures in the housing sector. Despite this moderation in new home prices, the overall housing market continues to experience upward price momentum due to supply constraints in the resale market.

Inventory Dynamics

At the end of February, the supply of new homes stood at 463,000 units, the highest level since November 2022. This increase in inventory, coupled with the extended time it would take to clear the existing supply, reflects the challenges posed by the current market conditions.

The composition of available inventory is also noteworthy, with houses under construction comprising the majority at 58.7%, followed by homes yet to be built at 22.9%, and completed houses at 18.4%.

Future Outlook

Despite the observed fluctuations and challenges, economists maintain an optimistic outlook for new home sales in the coming years. Factors such as continued construction efforts, favorable demographic trends, and anticipated adjustments in monetary policy contribute to this positive sentiment.

While February 2024 saw a slight decline in new residential sales, the underlying strength of the market persists, driven by ongoing demand and strategic responses from builders. As the housing sector continues to navigate evolving dynamics, stakeholders remain vigilant for opportunities and challenges on the horizon.

New Home Sales Trend [Previous Months]

Here's the region-wise tabular data for new home sales from February 2023 to February 2024. The units displayed are in thousands and are the seasonally adjusted annual rate. The data estimates only include new single-family residential structures. Sales of multi-family units are excluded from these statistics.

NORTHEAST: Connecticut, Maine, Massachusetts New Hampshire New Jersey New York Pennsylvania Rhode Island Vermont

MIDWEST: Illinois, Iowa, Indiana, Kansas, Michigan, Minnesota, Missouri, Nebraska North Dakota Wisconsin South Dakota Ohio

SOUTH: West Virginia, Virginia, Texas, Tennessee, South Carolina, Oklahoma, North Carolina, Mississippi, Maryland, Louisiana, Kentucky, Georgia, Florida, Alabama, Delaware, District of Columbia, Arkansas

WEST: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Sources

- https://www.census.gov/

- https://www.census.gov/construction/nrs/pdf/newressales.pdf

- https://www.mortgagenewsdaily.com/data/new-home-sales

- https://www.nahb.org/news-and-economics/housing-economics/national-statistics/new-and-existing-home-sales-reports