Currently, the Austin housing market is experiencing increased activity, with a surge in new listings providing more options for buyers. The market is competitive, especially in the more affordable segment. While there's a growing inventory, it's still a seller's market in many areas due to high demand. Looking ahead, the future market outlook remains positive, with continued opportunities for both buyers and sellers.

A report from Realtor.com has stirred the conversation by making bold predictions about the Austin housing market for 2024. The national forecast for home prices in the U.S. suggests a modest dip of 1.7% in 2024. However, what captures attention is the specific prediction for the Austin area—a substantial 12.2% drop in home prices next year.

This projection has sparked discussions among real estate experts and residents, prompting varied opinions and analyses. Contrary to the above-mentioned forecast, there could be a slight increase in Austin home prices for the upcoming year despite higher interest rates. Here is the latest market report.

Austin Housing Market Trends in 2024

In the vibrant city of Austin, Texas, the real estate landscape is buzzing with optimism as we step into 2024. According to the latest Central Texas Housing Market Report released by Unlock MLS, the data paints a promising picture.

How is the Austin Housing Market Doing Today?

According to the February 2024 Central Texas Housing Market Report, the region is witnessing increased prospects, particularly for first-time homebuyers. One of the key highlights of the February data is the surge in new listings, which soared by 44.9% compared to the same period last year.

This spike in listings has contributed to a total of 3 months' worth of inventory for the region, offering buyers a broader array of choices. Notably, this increase in housing options is predominantly observed in the more affordable segment of the market, with homes priced under $400,000 witnessing significant growth in availability.

Clare Losey, Ph.D., housing economist for Unlock MLS and the Austin Board of REALTORS®, emphasized the significance of this development, especially for aspiring homeowners. The rise in inventory comes as a breath of fresh air for those challenged by rising home prices and mortgage rates in recent years, opening doors for individuals looking to step into homeownership.

Kent Redding, president of Unlock MLS and ABoR, sheds further light on the current market conditions, particularly as the spring homebuying season unfolds. With over 35% of annual sales typically occurring between March and June, buyers are increasingly motivated to capitalize on the current landscape before the fall season approaches. Redding emphasizes the importance of leveraging expert local market knowledge, coupled with accurate data, to make informed decisions tailored to individual budgets and housing needs.

Housing Market Performance Metrics

Examining the performance metrics across various segments within the Austin-Round Rock-Georgetown Metropolitan Statistical Area (MSA) provides a comprehensive understanding of the prevailing trends:

- Austin-Round Rock-Georgetown MSA: The region witnessed a 1.3% increase in residential home sales compared to February 2023, with a median price of $443,065. New home listings surged by 44.9%, indicating growing market activity.

- City of Austin: Despite a slight decrease in median home price compared to the previous year, the city experienced a 3.0% rise in residential home sales. New listings also saw a significant uptick of 41.7%.

- Travis County: Residential home sales in Travis County increased by 1.1%, with a median price of $500,000. New listings surged by 42.8%, contributing to a dynamic market environment.

- Williamson County: The county observed a 2.0% increase in residential home sales, accompanied by a median price growth of 1.9%. New home listings rose by 41.7%, indicating heightened buyer interest.

- Hays County: While residential home sales declined by 6.5%, Hays County remained an active market with a median price of $385,000. New home listings spiked by 56.4%, offering increased options for buyers.

- Bastrop County: Despite a slight increase in residential home sales, the county experienced a decrease in median home price. However, new listings surged by 32.2%, indicating a growing inventory.

- Caldwell County: Caldwell County witnessed a significant surge in residential home sales, accompanied by a decrease in median home price. New home listings increased by 137.5%, highlighting growing market activity.

Despite fluctuations in median home prices and sales volumes across different counties, one consistent trend is the rise in new home listings, indicative of a dynamic and evolving market landscape. As buyers navigate through the multitude of options available, the expertise of a seasoned REALTOR® becomes invaluable in making informed decisions.

The Austin housing market in 2024 presents a wealth of opportunities for both buyers and sellers alike. With increased inventory levels and favorable market conditions, first-time homebuyers, in particular, stand to benefit from the evolving dynamics. As the spring homebuying season unfolds, individuals seeking to enter the housing market or make strategic investments are encouraged to leverage expert guidance and comprehensive market insights to navigate the landscape effectively.

Austin Housing Market Forecast 2024 and 2025

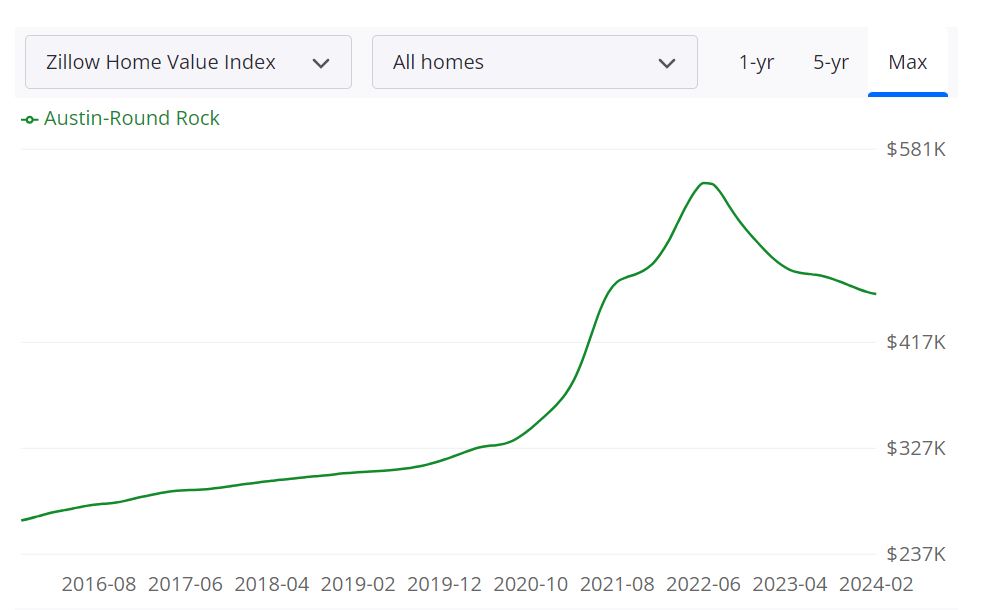

According to Zillow, the average home value in the Austin-Round Rock area stands at $458,179, reflecting a 6.3% decline over the past year. Homes typically go pending in approximately 60 days. Let's dissect the various housing metrics to gain a deeper understanding of the market:

For Sale Inventory and New Listings

- For sale inventory: As of February 29, 2024, the Austin market boasts 9,069 homes for sale, indicating the level of housing supply available to prospective buyers.

- New listings: In February 2024, 2,022 new properties were listed for sale, suggesting ongoing activity within the housing market.

Median Sale to List Ratio and Sale Prices

- Median sale to list ratio: With a ratio of 0.972 as of January 31, 2024, this metric highlights the relationship between the listing price and the eventual sale price of properties in the Austin area.

- Median sale price: The median sale price, recorded at $439,583 as of January 31, 2024, gives insight into the prevailing pricing trends within the market.

- Median list price: As of February 29, 2024, the median list price in Austin is $509,250, providing a benchmark for sellers and buyers alike.

Percent of Sales Over and Under List Price

- Percent of sales over list price: In January 2024, 10.8% of sales were transacted above the listed price, indicating instances of competitive bidding and demand exceeding supply.

- Percent of sales under list price: Conversely, 73.1% of sales occurred under the list price, showcasing negotiation opportunities for buyers in the market.

Austin-Round Rock Metropolitan Statistical Area (MSA) encompasses several counties, including Travis, Williamson, Hays, and Bastrop. With its diverse geography and robust economy, Austin's housing market is sizable and continually evolving.

Is Austin a Buyer's or Seller's Housing Market?

Assessing whether the current state of the Austin housing market favors buyers or sellers requires a nuanced analysis of various factors. Despite a 6.3% decrease in average home values over the past year, the market remains relatively balanced. With 9,069 homes for sale and 2,022 new listings, there's a notable inventory available for prospective buyers. However, the 10.8% of sales occurring over list price suggests competition among buyers, indicating a slightly seller-friendly market. Overall, while buyers have options, they may encounter competition for desirable properties.

Are Home Prices Dropping in Austin?

With the average home value in the Austin-Round Rock area experiencing a 6.3% decline over the past year, there's a perception that home prices are dropping. However, it's essential to contextualize this decline within broader market dynamics. Factors such as inventory levels, demand-supply dynamics, and economic conditions influence pricing trends. While the decrease in average home values indicates a shift, it doesn't necessarily imply a widespread plummet in prices. Rather, it reflects a recalibration of the market in response to changing conditions.

Will the Austin Housing Market Crash?

The question of whether the Austin housing market will experience a crash is one that elicits concern and speculation. While market fluctuations and economic uncertainties are inherent, predicting a crash with certainty is challenging. Several mitigating factors, including robust economic fundamentals, population growth, and diverse industry sectors, contribute to the market's resilience. Additionally, regulatory measures and industry safeguards are in place to prevent excessive speculation and instability. While market corrections may occur, the likelihood of a catastrophic crash is mitigated by the region's overall stability and growth trajectory.

Is Now a Good Time to Buy a House in Austin?

For prospective buyers contemplating whether now is an opportune time to enter the Austin housing market, several considerations come into play. With home values experiencing a slight decline and a healthy inventory available, there are favorable conditions for buyers seeking affordability and choice.

However, factors such as personal financial readiness, long-term housing goals, and market conditions should inform the decision-making process. Consulting with real estate professionals and financial advisors can provide valuable insights tailored to individual circumstances. Ultimately, while market conditions may fluctuate, making an informed decision aligned with one's needs and circumstances is paramount.

Is the Austin Housing Market Overpriced?

The question of whether the Austin housing market is overpriced is a subjective one and can depend on several factors. Firstly, it is important to note that the Austin housing market has been experiencing an unprecedented level of demand over the past few years. This demand has been driven by a combination of factors, including a strong local economy, a growing population, and an influx of out-of-state buyers. This increase in demand has resulted in a significant rise in the median home price.

Recent research suggests that homes in Austin continue to be among the most overvalued in the United States. The study conducted by researchers from Florida Atlantic University and Florida International University reveals that homebuyers in Austin are still paying almost 51% more than what is expected for homes. Only Boise, Idaho, has a higher premium, with homebuyers paying an exorbitant 81% more.

However, it is equally essential to compare the affordability of homes in Austin to other major cities. Although the median home price in Austin is high compared to historical norms, it is still lower than in cities like San Francisco, New York, or Los Angeles. Additionally, Austin's cost of living is generally lower than other major cities, which can make it more feasible for some buyers to own a home.

Another aspect to consider is the potential growth of the Austin housing market. While it is impossible to predict the future, many experts believe that Austin's robust economy and growing population make it a worthwhile long-term investment for homebuyers. Furthermore, the city has a diverse economy, making it less vulnerable to economic shocks.

Ultimately, whether or not the Austin housing market is overpriced is subjective. While some buyers may find the high prices unaffordable, others may see it as a sound investment in a thriving city. It is crucial for prospective buyers to assess their financial situation and goals before deciding to purchase a home in Austin or any other market.

Is Austin a Good Place for Real Estate Investment?

Austin's rapidly expanding economic industry is driving more people into the city which is increasing the housing demand. A number of reasons have affected the present situation of the Austin housing market, one of which is the high migration of firms and persons relocating to the city from Texas and out-of-state, which has led to a robust and varied economy that attracts people seeking opportunity.

A surge of people moving in, combined with rapid population growth and low mortgage interest rates, has turned Austin and its surrounding area into a sellers' market. Austin’s engine of job and population growth is not projected to slow down anytime soon—the biggest drivers of residential real estate demand. Its economy has diversified and strengthened over the past two decades.

Companies like Google and Tesla are moving operations to Austin. The software giant Oracle has also relocated its headquarters here. As more companies move here, that means more people looking for homes, and the city is also attractive to outside investors. With a steady influx of job creation in the pipeline, the housing market will continue to post strong numbers. Big companies moving here will also play into what happens to the housing market.

If you're considering real estate investment, Austin, Texas, is a city that should be on your radar. Known for its vibrant culture, strong economy, and population growth, Austin offers numerous opportunities for real estate investors. Let's explore in detail why Austin is a promising destination for real estate investment.

Population Growth and Trends

Population Growth:

- Austin has been experiencing consistent and substantial population growth for many years. The city's population has been steadily increasing, making it one of the fastest-growing metropolitan areas in the United States.

- The city's appeal to newcomers is driven by factors like its vibrant tech scene, cultural attractions, and overall quality of life.

Trends:

- The population growth trend in Austin is expected to continue, with projections indicating a significant increase in residents over the coming years.

- As the city's population expands, the demand for housing, both rental and owned, is likely to rise, creating opportunities for real estate investors.

Economy and Jobs

Economic Strength:

- Austin's economy is robust and diverse, with a thriving technology sector, a burgeoning startup scene, and a strong presence of major corporations.

- The city consistently ranks high in terms of job creation and economic growth, making it an attractive destination for professionals seeking employment opportunities.

Job Market:

- The city's job market is diverse and dynamic, with a focus on technology, healthcare, education, and entertainment.

- Employment opportunities continue to draw individuals to Austin, contributing to the population growth and housing demand.

Livability and Other Factors

Livability:

- Austin consistently receives high marks for its quality of life. The city offers a vibrant cultural scene, excellent healthcare facilities, and access to outdoor activities.

- It's known for its music and arts culture, making it a desirable place to live for professionals and creatives.

Education:

- Austin is home to top-tier educational institutions, including the University of Texas at Austin. This draws students, academics, and their families to the city, further boosting the demand for housing.

Infrastructure:

- The city has invested in infrastructure and transportation improvements to accommodate its growing population, making it more accessible and commuter-friendly.

Austin Rental Property Market Size and Growth

Rental Market:

- Austin's rental property market is substantial and continues to grow. The city offers a wide range of rental properties, from apartments to single-family homes, catering to a diverse tenant population.

- The city's dynamic job market attracts young professionals, making it an ideal location for rental property investment.

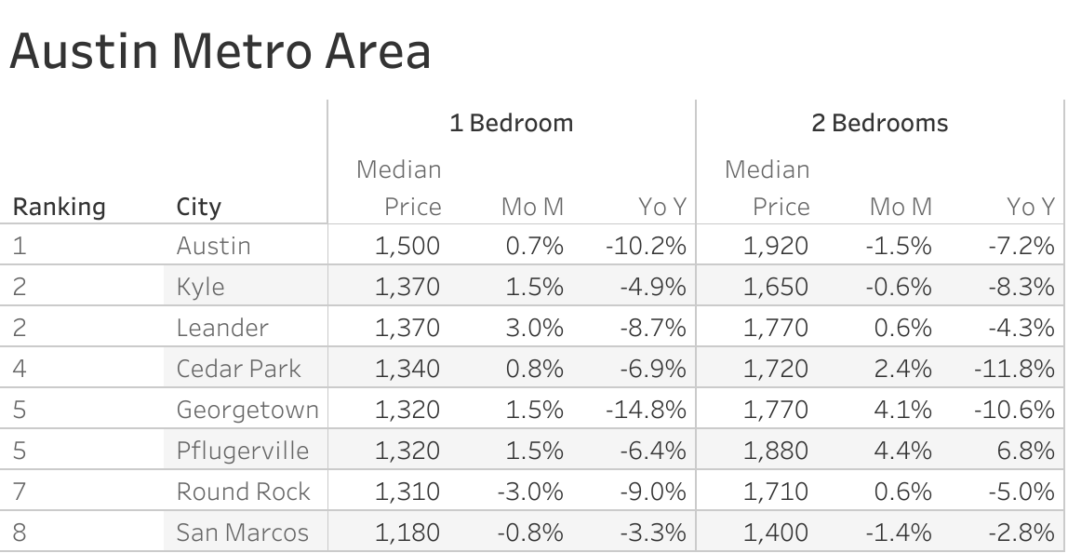

The latest Zumper Austin Metro Area Report delved into the dynamics of rental listings across various cities in the metropolitan area, shedding light on both the most and least expensive locales as well as those experiencing the fastest growing rents. According to the report, the median rent for a one-bedroom apartment in Texas stood at $1,132 last month.

The best place to buy rental property is about finding growing markets. Cities like Round Rock, Cedar Park, and Pflugerville are good for investors looking to get started with rental property ownership at an affordable price. These cities look good for rental property investment this year as rents are growing over there. These trends provide a macro look at the growing rental demand. Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present their own opportunities for investors.

The Most Expensive Cities

- Austin: Topping the list as the most expensive city, with one-bedroom apartments commanding $1,500.

- Kyle & Leander: Sharing the second spot, both cities recorded rents of $1,370.

- Cedar Park: Following closely, Cedar Park boasted a median rent of $1,340.

The Least Expensive Cities

- San Marcos: Emerged as the most affordable city, with one-bedroom units priced at $1,180.

- Round Rock: Securing the second position, Round Rock offered rents at $1,310.

- Pflugerville & Georgetown: Jointly occupying the third spot, both cities recorded a median rent of $1,320.

Largest Declines in Rent (Year over Year Percentage)

- Georgetown: Witnessed the most significant decline, experiencing a 14.8% drop compared to the same period last year.

- Austin: Followed closely, with rents decreasing by 10.2%.

- Round Rock: Ranked third in terms of decline, with a 9% decrease in rent.

These insights provide valuable data for both renters and investors navigating the dynamic Austin Metro Area rental market.

Growth Potential:

- The city's population growth and job market strength contribute to the growth potential of the rental property market. As more people move to Austin, the demand for rental units is expected to rise.

- Investors can explore various rental strategies, including long-term leases, short-term rentals, and vacation rentals, to diversify their real estate portfolio.

Other Factors Related to Real Estate Investing

Investor-Friendly Environment:

- Austin's business-friendly environment extends to real estate investment. The city offers attractive incentives and a favorable legal framework for real estate investors.

- Real estate investors benefit from a strong property rights regime and a well-regulated market.

Tax Benefits:

- Texas does not have a state income tax, which can be advantageous for investors looking to maximize their returns.

- Investors should explore the tax implications of specific investment strategies, including property taxes and capital gains.

Market Resilience:

- Austin's real estate market has shown resilience during economic downturns, and it is considered one of the more stable markets in the country.

- Investors appreciate the market's ability to weather economic fluctuations and maintain its growth trajectory.

Diversification:

- Investors can diversify their portfolios by exploring various types of real estate, from residential properties to commercial and mixed-use developments, taking advantage of Austin's growing and diverse market.

As a real estate investor, Austin's population growth, strong economy, livability, rental property market size, and other investor-friendly factors make it a compelling choice. However, it's essential to conduct thorough market research, consult with local real estate experts, and tailor your investment strategy to your specific goals and risk tolerance. Austin's real estate market offers exciting opportunities, but informed decision-making is key to success.

References:

- https://www.abor.com/new-center/market-stats

- https://www.zillow.com/austin-tx/home-values

- https://www.realtor.com/realestateandhomes-search/Austin_TX/overview