Buying a house in Denver in 2025 raises many questions for potential homeowners. With rising property prices and a competitive market, deciding to invest in a home requires extensive thought and analysis of the current housing situation. Denver has always been a desirable location, but is it still the right decision to buy here? This blog post examines key market trends, housing statistics, and personal insights to help you unravel the complexities of purchasing property in the Mile High City.

Buying a House in Denver in 2025 – Is It the Right Decision?

Denver Real Estate Market Insights

🏠 Competitive Market

Homes in Denver receive an average of 2 offers, reflecting a competitive market.

💵 Median Prices

The median sale price of a home has risen to $588,000 on Redfin, marking a 2.2% increase compared to last year.

⏳ Days on Market

Homes are selling in about 34 days, a 15% increase from last year, indicating a slight slowdown.

🌍 Migration Trends

Denver continues to attract residents from other major metros, particularly from Houston, New York, and Los Angeles.

📈 Price Growth vs. National Average

Denver's median sale price is 35% higher than the national average, reflecting strong demand for housing.

Current Denver Housing Market Overview

As of October 2024, the Denver housing market is notably competitive. The median sale price of $588,000 represents not only a consistent increase of 2.2% over the past year but also highlights how Denver has become increasingly attractive despite economic fluctuations. What strikes me as particularly interesting is how quickly homes are transitioning from listings to sales. Homes are, on average, selling in about 34 days, a 15% increase from last year.

Such a shift indicates that buyers are acting swiftly, alluding to a heightened demand in various neighborhoods. A deeper dive into the Denver market reveals crucial details: 831 homes were sold in October 2024, an increase compared to 752 sales from the previous year. This rise could hint at a potential decrease in competition due to growing inventory, causing home seekers to make slower decisions.

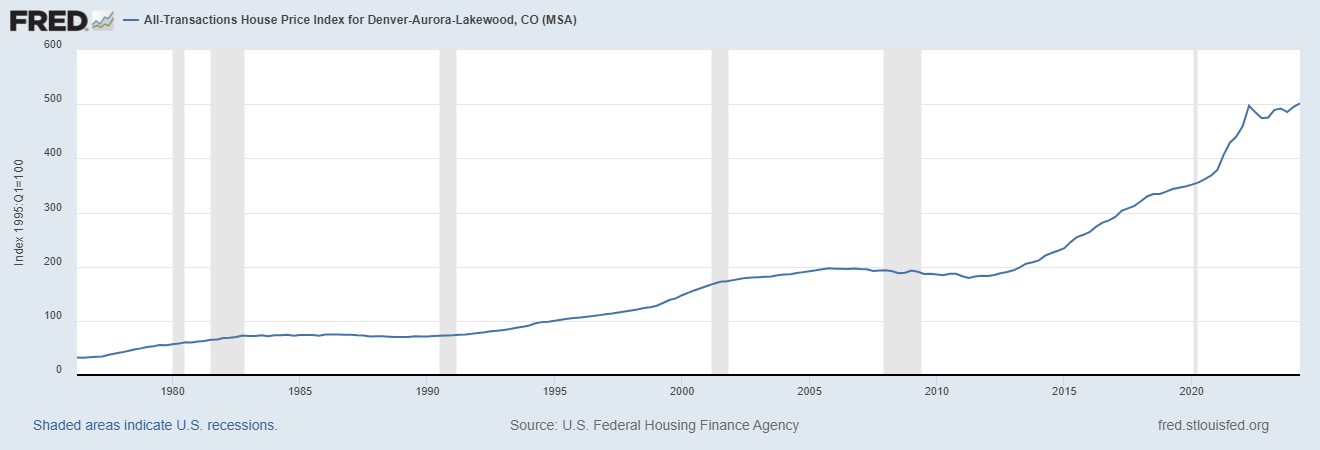

Broader Denver MSA House Price Index

Examining the All-Transactions House Price Index for the Denver-Aurora-Lakewood Metropolitan Statistical Area (MSA) provides insight into the broader price trends impacting the region. The data from the U.S. Federal Housing Finance Agency outlines the following index values:

- Q2 2024: 501.57

- Q1 2024: 495.08

- Q4 2023: 485.31

- Q3 2023: 492.04

- Q2 2023: 489.55

This upward trend reflects an increasing demand for housing across the MSA, indicating that home prices are continuing to appreciate. The index rise from 489.55 in Q2 2023 to 501.57 in Q2 2024 underscores a robust market, though it also begs the question of sustainability as buyers weigh their options. As someone who has observed market fluctuations over the years, it’s clear that prospective buyers need to consider both the potential for appreciation and the implications of such rapid price increases.

Pricing Dynamics in Denver's Real Estate Market

When debating the decision of buying a house in Denver in 2024, it's essential to consider pricing dynamics. While the median sale price reflects a rising trend, the median price per square foot has slightly dipped by 4.6%, now standing at $355. This drop could mean potential for savvy buyers willing to explore homes that may require some renovation or repositioning within the market. It’s a mixed signal; while prices may appear high, specific sectors of the market provide opportunities for investment and appreciation.

It's worth emphasizing that Denver's pricing is about 35% higher than the national average. This stark contrast raises questions about long-term affordability and the impacts on future buyers. As someone who has watched the housing sector for years, this considerable premium makes me wonder if these prices reflect sustainable growth or inflated speculation.

Demographic Trends and Migration Patterns

A noteworthy trend is how migration shapes Denver's real estate market. Over the last few months, 70% of prospective buyers have shown a preference to remain within the metropolitan area, while 30% are looking to relocate out. The influx of buyers mainly originates from places like Houston, New York, and Los Angeles. The statistics surrounding migration trends are fascinating:

- Houston, TX: 588 people relocating to Denver.

- New York, NY: 139 individuals looking to move.

- Los Angeles, CA: 532 seeking Denver's appeal.

- Conversely, major exits were to Breckenridge, Fort Collins, and Phoenix.

This migration is yet another piece of the puzzle when considering whether buying a house in Denver in 2024 is the right decision. The city's reputation for lifestyle, outdoor activities, and career opportunities continues to attract newcomers, feeding into the rising home prices and overall demand.

Housing Market Competitiveness

The competitiveness of the Denver housing market is palpable. A Compete Score™ of 64 indicates a somewhat competitive landscape, where homes are receiving multiple offers. Approximately 21.5% of homes sold are above the list price, albeit a decline compared to previous years, suggesting that while buyers are ready to place offers, the overall demand may be moderating. Nonetheless, it reflects a buyer's willingness to engage when they find a suitable property.

Moreover, recent statistics indicate that 43.7% of homes have experienced price drops compared to last year. This duality of high competition and rising price drops can create challenges for buyers. It becomes increasingly necessary for prospective purchasers to act quickly, weighing the pros and cons of making an offer in a market that could shift on a dime.

Impacts of Climate on Real Estate Decisions

While the economics of buying a house are paramount, the environmental factors can also shape one’s decision. Denver faces various natural hazards such as wildfires and moderate flooding risks. For instance, about 71% of properties are at moderate risk of wildfires over the next three decades. As someone who prioritizes sustainability and safety, this factor is something every potential homeowner should scrutinize carefully.

The upcoming housing decisions cannot solely rest on price points and market competitiveness; buyers need to consider their safety and long-term security in relation to climate factors.

Transportation and Lifestyle in Denver

Lastly, as an attractive city for young professionals and families alike, Denver's transportation options significantly impact its housing market. With a Walk Score of 61 and a Bike Score of 72, Denver is relatively accessible, promoting a healthy lifestyle that many residents cherish. The availability of public transportation, combined with bike lanes and pedestrian-friendly areas, makes it an inviting option for those looking to settle in urban centers without sacrificing environmental concerns.

Frequently Asked Questions

Is it a good time to buy a house in Denver?

Buying in 2024 depends on personal circumstances and readiness, but current trends indicate a competitive market.

Is Denver a buyer or seller market?

Currently, Denver leans more towards a seller's market due to high demand and quick sales.

Is the Denver housing market slowing down?

While there are indications of slight price drops and more homes available, overall demand remains strong, suggesting a slowdown is relative.

Are Denver rents dropping?

Rental prices experienced fluctuations, but overall trends indicate a persistent demand for rentals, sustaining higher rents.

Are housing prices expected to drop in Colorado?

Predictions vary; while some analysts suggest potential stabilization or declines due to economic factors, others foresee continued growth.

What is the cheapest place to live in Colorado?

Areas like Pueblo or Alamosa can offer more affordable living compared to Denver, but they may not provide the same amenities or job opportunities.

Does Denver have a housing shortage?

Yes, Denver is experiencing a housing shortage, driven by high demand and limited inventory.

How much do you need to make to live in Denver?

General estimates suggest that a salary of at least $70,000 to $80,000 may be necessary to afford a comfortable living in Denver.

What is Denver's housing market ranked?

Denver often ranks among the top U.S. cities for housing due to its growth and opportunities, but specific rankings can vary year by year.

What is the average price of a house in Denver in 2024?

As of mid-2024, the average price of a house in Denver is around $590,000.

What salary do you need to buy a house in Denver?

To buy a home at the median price of $590,000, it's generally suggested that a household income of $110,000 or more is needed.

Why is Denver so expensive?

Factors contributing to Denver's high prices include its booming job market, desirable lifestyle amenities, and limited housing supply.

Is it better to rent or buy in Denver, CO?

This decision typically depends on individual circumstances, including financial readiness, job stability, and lifestyle preferences.

In summary, buying a house in Denver in 2024 entails navigating a complex web of factors, including competitive markets, rising prices, and demographic changes. It’s vital for potential homebuyers to weigh personal priorities against the backdrop of ongoing events shaping these market dynamics. Facing these realities requires a reflective approach; it’s about finding a balance between aspirations and reality in the current housing landscape.

Recommended Read:

- Colorado housing market forecast & trends

- Denver Housing Market Forecast 2025-2026: What to Expect

- Denver Housing Market: Prices, Trends, Forecast 2024-2025

- Denver Housing Market Trends: Sellers Still Have the Upper Hand

- Denver Housing Market Heats Up Again: Can You Afford?

- Top 10 Priciest States to Buy a House by 2030: Expert Predictions

- 10 Best Real Estate Markets for Investors in 2025